Sustainability

Solar After 2025: Costs, Storage & Grid Impacts

Securities.io maintains rigorous editorial standards and may receive compensation from reviewed links. We are not a registered investment adviser and this is not investment advice. Please view our affiliate disclosure.

Visualizing The Solar Age

Solar energy has been the most significant trend in renewable and low-carbon energy in the past decade. Thanks to a collapse in the price of solar panels, it is quickly becoming the cheapest energy source, especially in countries with favorable weather conditions and high levels of solar radiation.

As such, a new “Solar Age – A Bright Future To Mankind” was already discussed in our corresponding article in 2024.

A new study by researchers at the University of Surrey (UK), Ehsan Rezaee and S. Ravi P. Silva, shows us how much progress has been made and discusses how energy storage will be an equally important part of the discussion around solar energy moving forward.

They published their findings in the scientific journal Energy & Environmental Materials, under the title “Solar Energy in 2025: Global Deployment, Cost Trends, and the Role of Energy Storage in Enabling a Resilient Smart Energy Infrastructure”.

Solar Success Story

Declining Levelized Cost Of Electricity (LCOE)

The renewable energy industry commonly uses LCOE, defined as the average net present cost to generate one unit of electricity over a power plant’s lifetime. This metric takes into account not only the operating costs but also the durability of a system and its capital costs, giving a more accurate picture of total costs.

LCOE for utility-scale solar PV projects fell by over 80% between 2010 and 2023, reaching as low as $0.03 per kilowatt-hour in sun-rich regions, and $0.05-0.08 per kWh average in other areas.

The total installed cost of solar PV systems has declined from $5,310/kW in 2010 to an estimated $620/kW in 2025, reflecting a nearly 90% reduction.

This decline in costs was the result of the conjunction of several factors:

- Technological progress is making new solar panels more efficient, cheaper, and more durable.

- Increasing production volume allows for scaling up, and the cost per unit is declining, especially for Chinese solar panels.

- Change in policy to favor low-carbon energy projects, such as competitive procurement mechanisms, enhancing market transparency, and driving efficiency among developers.

As a result, solar PV is now the cheapest source of new electricity generation in most parts of the world, outcompeting coal, gas, and even wind in some markets.

This economic advantage has shifted the narrative from “why renewables?” to “how fast can we deploy them?”

The authors also point out that the decline in solar costs is especially beneficial to underdeveloped regions like sub-Saharan Africa and South Asia. As grid infrastructure in these regions is overall insufficient, decentralized solar power can have the largest impact, having already provided electricity access to more than 100 million people globally.

Exploding Solar Volumes

According to the International Renewable Energy Agency (IRENA), the global installed solar capacity exceeded 1.5 terawatts (TW) in 2024, more than doubling from just 760 gigawatts (GW) in 2020.

This is not only impressive but represents one of the fastest technological adoptions in energy history.

While other renewables like wind power can play an essential role in supplementing solar power, especially in winter, they are overall more expensive than the more recent solar installations.

Source: Energy & Environmental Material

This is true for almost all energy sources at this point:

- Offshore wind reaching up to $0.13 per kWh and coal up to $0.12 per kWh.

- Natural gas falls in the mid-range, with LCOE values between $0.05 and $0.11 per kWh.

- Nuclear energy shows a broader cost range from approximately $0.07 to $0.14 per kWh.

So, except for the questions of availability and reliability, or for tasks hard to electrify away from fossil fuels, all energy should ideally come from photovoltaic solar panels at this point.

Grid Challenges at High Solar Penetration (Curtailment, Stability, Flexibility)

Intermittent Production

If solar has been instrumental in shifting developed economies towards renewables and addressing the power grid deficiencies in developing countries, the full integration of solar energy as the primary energy supply could pose challenges for maintaining stable energy grids.

The key issue is that solar power generation is highly dependent on the weather conditions, not only the general conditions (winter-summer, sunny or not, day-night), but also can be highly variable in a given location from one minute to another, depending on cloud cover.

In high-penetration markets like California, Germany, and Australia, these dynamics have led to curtailment and grid stability concerns.

So far, several strategies have been implemented to deal with the problem, like strategic use of hydropower generation, implementing demand-side management to align consumption with solar availability, and modernizing grids with digital infrastructure and smart inverters.

Still, it seems that when solar passes the 10-15% of total energy supply mark, like in California (17%), Australia (15%), or Spain & Italy (10%), grid issues can become more important than solar’s LCOE alone.

Source: Energy & Environmental Material

In 2024 alone, California curtailed over 2.5 terawatt-hours of solar energy due to limited storage and transmission infrastructure.

Wasting potentially generated power (curtailment) is only one part of the issue. The higher demand for power in the evenings and winter, when solar production is at its lowest or even non-existent, is another problem.

New solutions must be implemented to maintain the rising solar percentage of total production and prevent curtailments or insufficient production at key times from hindering further solar growth.

Swipe to scroll →

| Technology | Global LCOE Range (US$/kWh) |

|---|---|

| Utility-scale Solar PV | 0.038–0.078 (US, 2025) |

| Onshore Wind | 0.044–0.123 (US, 2025) |

| Offshore Wind | ~0.08–0.13 (global) |

| Gas CCGT | 0.048–0.109 (US, 2025) |

| Coal | 0.071–0.173 (US, 2025) |

| Nuclear (new build) | ~0.136–0.251 (US/EU) |

Utility-Scale Batteries

Battery Costs: From $350/kWh (2015) to $115/kWh (2024)

These innovations are helping transition solar energy from an intermittent source into a dispatchable one, capable of ensuring grid stability and emergency power supply.

The key part here is large batteries able to handle at the very least several hours’ worth of consumption in a given section of the grid.

A strong support for this switch is the decline in the cost of lithium-ion battery packs from $350/kWh to $115/kWh between 2015 and 2024.

Because solar is intermittent, and a true utilization of solar power is only possible with battery volume to solve it, the honest “true” cost of solar should likely be the cost of solar+batteries rather than the LCOE of solar alone.

Luckily, as the cost of both is falling, this might not significantly change the potential for mass adoption of solar energy. Installation costs are also expected to decline with larger deployments, as more experience and modular solutions become available.

Source: Energy & Environmental Material

Are Lithium-Ion the Right Choice for Utility-Scale Storage?

Another factor to take into account is that lithium-ion batteries might not be the right technology for utility-scale batteries.

In “The Future Of Energy Storage – Utility-Scale Batteries Tech” we discussed the many possible candidates, including “exotic” options like batteries using redox-flow, iron-air, sea-salt, molten metal, sodium-sulfur, polymer, CO2, heat batteries with sand or molten salts, etc.

These alternative battery chemistries are good candidates to replace lithium when support to the power grid is a concern, as the requirements are quite different from EVs:

- No weight limit, as the utility-scale batteries are expected to be immobile next to a large transformer.

- No significant space limit, with containers on each or large buildings available in the vicinity of power plant sites.

- A premium will be given to ultra-durable batteries, more fitting the business model of utilities used to amortize investment over a multi-decade period.

- (We previously described in further detail the different technologies that could make batteries last 30+ years in our article “Ultra-Durable Batteries: Why Next-Gen Tech Will Last Decades, Not Just Years“.)

V2G & EV Fleets as Flexible Storage

Between 2015 and 2025, global EV and hybrid car sales surged from 0.5 million to 17 million units, while petrol and diesel car sales fell from 70 million to 60 million units.

Declining battery costs, mirroring the drop in solar panel prices, have driven the shift to EVs and been fueled by EV adoption, which has spurred technological innovation and production scaling, resulting in a similar price decline.

It is likely that if utility-scale battery parks start to be installed en masse, the scale in cash flow to the battery manufacturers and to production volumes will be similar in magnitude to the switch from small electronics to EVs, decreasing battery prices further.

Already, even EVs are slowly moving toward either denser solid-state batteries or cheaper, less critical-material-hungry sodium-ion batteries.

So EVs might contribute to the declining cost of utility-scale batteries, even if these are not based on lithium-ion technology.

Another role EVs could contribute, especially if their batteries become more long-lasting than the rest of the car, is a form of additional optional battery storage, with the EV taking in surplus power during some period, and powering houses and the grid in the evenings.

Here, the use of AI to optimize the role of EVs’ batteries will be important to balance seamlessly the mobility versus the grid requirements.

Policy Tailwinds & Trade Headwinds

Green policies globally, while often interrupted by changes in political situations, like with the Trump administration disrupting Biden’s Inflation Reduction Act (IRA), are expected to keep pushing for more renewables and low-carbon energy sources.

For example:

- The EU’s initiatives of the Green Deal and REPower.

- India’s PLI scheme is to bolster domestic solar manufacturing & the PM-KUSUM (Pradhan Mantri Kisan Urja Suraksha evam Utthaan Mahabhiyan) program to promote decentralised solar for agriculture and rural electrification.

- Brazil, Vietnam, and South Africa are also scaling solar adoption through feed-in tariffs, competitive auctions, and concessional finance.

Other green policies could boost solar as well.

The European Hydrogen Backbone (follow the link for a detailed explanation of this megaproject), looking to soak up surplus renewable energy and turn it into hydrogen, could help absorb surplus solar and turn it into shipping and industrial fuel, helping indirectly solar energy to displace natural gas.

Similar forms of energy storage, such as hydrogen, synthetic fuels, or ammonia, could also help improve solar profitability by utilizing surplus daytime and summer production.

Future Technologies

Tandem Perovskites: Record 34.85% Efficiency

While past progress in monosilicon and polysilicon solar panels has led to the current decline in price and rise in solar energy production, a different generation of photovoltaics is emerging.

This could radically change how solar energy is produced, with concerns over excessive land usage likely compensated by growing efficiency in the sun-to-power yield.

Tandem perovskite-silicon solar cells have now achieved record efficiencies of up to 34.85%, significantly exceeding the theoretical limit of single-junction cells.

An increase in solar module efficiency from circa 22% power conversion efficiency to ~34%, which is likely by 2030, would provide a momentous step in decreasing the surface land requirement by 50%.

Recycling

As solar panels are becoming one of the main sources of energy of humankind, or maybe THE main energy source, managing solar panels properly at their end of life will be essential.

This is especially important as photovoltaic solar panels contain a lot of important minerals, including silver (follow the link for an investment report on this metal) and potentially polluting heavy metals.

Already, new recycling processes are recovering over 90% of materials from used-up solar panels. Further progress in recycling technology and strict regulation should avoid resource depletion and promote a true solar circular economy.

New Deployment Methods

Bifacial solar panels allow for solar panels to produce energy from both sides and for vertical installation, unlocking the possibility of maximizing production in mornings and evenings (facing East and West).

Agrivoltaics and other integration of farming activities to solar fields can also reduce the land footprint of solar power.

Solar’s Future

The emergence of curtailments, the need for recycling of the exploding volume of aging solar panels, and the growing discussion about the durability of centralizing solar panel production in China are just some of the cracks that have appeared in the solar industry over the last few years.

It should not be forgotten that these issues mostly arose due to the explosive growth of the industry, leading, for example, to solar energy production outpacing the electric grid’s capacity to handle it.

Behind the quicker-than-expected growth of solar energy is the collapsing LCOE, leading to solar becoming the cheapest form of energy on Earth, and that’s before further progress from technology like perovskite solar cells.

As batteries are becoming increasingly cheaper by the day, the issue of intermittency and production-demand mismatch can be solved with a lot more storage added to the electric grids.

Similarly, recycling or building local supply chains are mostly policy issues that can be solved now that the problems are identified.

Conclusion

Solar is now cheaper than all other alternatives, and still has a long way to go to get even cheaper by further scaling up and innovation.

So even if batteries were not getting cheaper (a very unlikely possibility), the additional costs of storage should be more of a bump in the road to solar’s dominance than a true limit.

This means that in the long run, it is likely going to be the dominant form of energy production, with equally low-carbon hydro, wind, and nuclear energy likely going to play a supporting role, notably in compensating for lower winter solar production.

Other future options, like orbital solar plants providing stable solar energy 24/7, could also help alleviate some of the last weather-related limits of solar power.

Ultimately, this leads us to the conclusion that the true question about solar energy is not “how much”, but “when”, with the end goal now in sight of a society mostly powered by solar energy, with grid balance and niche applications powered by other low-carbon applications.

Investing in Solar Innovation

First Solar

First Solar, Inc. (FSLR +1.85%)

First Solar is the largest solar panel manufacturer in the USA and in the whole Western hemisphere, with manufacturing sites in the US, Malaysia, and Vietnam.

The company is not using the classic crystalline silicon technology and instead uses its proprietary thin-film photovoltaics.

Based on cadmium-telluride, they are more efficient, are produced at a lower cost, and can easily be mass-manufactured.

Source: Department Of Energy

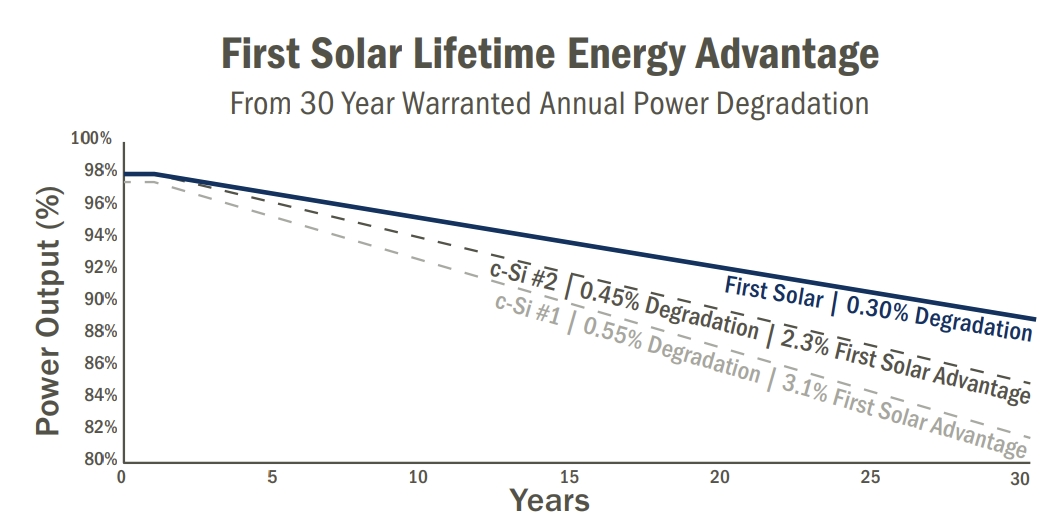

Cadmium telluride thin-film solar panels are also more durable, retaining 89% of the original performance after 30 years.

Source: First Solar

The company’s focus on thin-film semiconductor technology allows it to be fully vertically integrated, making it radically different from the silicon-based solar panel industry.

Unlike traditional factories, where each actor specializes in a single segment, such as polysilicon purification, and solar cells take many days to produce, First Solar can transform raw materials into finished products in under 4 hours.

Source: First Solar

First Solar has spent a cumulative $2B in R&D since its inception. R&D teams at First Solar forecast a thin film CdTe of 25% cell efficiency and pathways to 28% cell efficiency by 2030.

In the long run, First Solar is looking to integrate its experience with cadmium telluride thin film to perovskite technology, making the resulting solar panels even more efficient.

Source: First Solar

Overall, First Solar is a technology leader that stands to benefit from tariffs on Chinese imports, something likely to compensate for the negative effect on the solar industry from Trump’s reelection.

While mostly focused on thin-film solar using cadmium telluride for now, its expertise in non-silicon solar panel manufacturing could give it a significant head start with perovskite.

(You can also read more information about First Solar in the investment report dedicated to the company)