Energy

Top 10 Renewable Energy Infrastructure Stocks (June 2025)

Securities.io maintains rigorous editorial standards and may receive compensation from reviewed links. We are not a registered investment adviser and this is not investment advice. Please view our affiliate disclosure.

Energy Is Life

Energy is the lifeblood of the economy and civilization. It was initially really scarce, only provided by animals (horses, oxen) or limited natural extraction (wood, peat, primitive windmills).

The discovery of fossil fuels led to the industrial age, with coal at first and later oil and gas. But it came with various issues, like pollution and climate change. And it is non-renewable, with fossil fuels now having to be extracted from shale deposits or ultra-deep deposits.

We are now on the verge of a new energy revolution, with the switch to renewables, especially solar, wind, geothermal, and hydropower.

So, investors should pay attention to this trend and look for the companies that are most likely to benefit from it.

Top 10 Renewable Energy Infrastructure Stocks

This article gives a wide and diversified view of the sector and uses a subjective assessment of technologies, asset quality, geography, and financial metrics.

The stocks are ordered by market capitalization at the time of writing this article.

1. NextEra Energy, Inc.

NextEra Energy, Inc. (NEE -0.14%)

NextEra Energy, Inc. (NEE -0.14%)

This massive renewable utility company, focusing on Florida, has 45.5 GW of net generating capacity.

The company plans to expand even more, with already 2 GW of new renewable and storage added in 2023. In the long run, it plans to add 27.6 GW to 35 GW of renewable capacity by 2026, relying on Florida's sunny and tropical weather and growing population.

This should ensure a steady growth of 6%-8% for NextEra earnings per share until 2026.

Source: NextEra

Thanks to its almost ideal geographical location, NextEra could be a clear winner in the push for switching to renewable energy and “decarbonizing America” and in making Florida a very “green” state. The company also provides an above 2% dividend yield in addition to the expected growth.

2. Iberdrola, S.A.

Iberdrola is one of the world leaders in green energy generation, with 40 GW of renewable capacity (out of 60.7 GW of total capacity) and aiming for 52 GW of renewable capacity by 2025.

The 2025 Strategic plan includes €17B in renewable power production and €27B in electric networks. Iberdrola also plans €3.4B in green energy projects like hydrogen and green methanol production, industrial heat, micro-hydroelectric, electric vehicle charging stations, etc…

Iberdrola operates mostly in Spain, with operations in the rest of Europe, North America, and Brazil.

Source: Iberdrola

Iberdrola's recent dividends are very small, but the new policy states that “shareholder remuneration shall be between 65 % and 75 % of the net profit attributed to the Company”.

3. China Yangtze Power Co., Ltd.

China Yangtze Power fully owns 110 hydropower generation assets in China, including the Three Gorges Dam and 5 of the 12 largest hydropower dams in the world.

Source: China Yangtze Power

It is the largest electric power company in China and the largest hydropower company in the world, with 71.7 GW of total capacity installed.

The company also has hydropower businesses in Brazil, Sudan, Pakistan, and Malaysia and wind power generation in Germany.

Thanks to its reliance on hydropower, China Yangtze Power is able to produce green energy with a high level of reactivity to grid and market demand, with only seasonable fluctuation in rainfall able to limit its ability to generate power on demand. This makes it a highly reliable producer and one unlikely to have to make massive investments in energy storage or electric transmission to deal with intermittent production like for solar and wind.

So, investors looking for the highest level of safety and little growth might be the most interested in China's Yangtze Power.

The quality of the company's assets is somewhat tempered by the geopolitical tensions between the West and China, which could affect the stock price without changing the business case.

4. Ørsted A/S

The Danish energy producer has undergone a massive transformation, from 2006, with 83% of the energy produced from fossil fuels, to 2022, with only 8% still from fossil fuels, and on track to reach 99% renewable production by 2025.

Source: Ørsted

It was the first company to create an offshore wind farm in 1991 and is currently operating the world's largest wind farm.

Orsted has an installed renewable capacity of 15.4 GW, with 4.9 GW more under construction and a grand total of 30.6 GW installed and in projects.

Half of this power generation is from offshore wind farms, and the onshore generation is roughly equally split between solar and onshore wind farms. Most of the planned growth is in offshore wind generation.

Orsted has wind farms in Denmark, the UK, Germany, the US, Taiwan, and Vietnam. It is also building a 50,000 tpa e-methanol plant in Sweden, which should open in 2025, and is exploring the possibility of green hydrogen production.

Thanks to its pioneering role in wind power and still leading the way, Orsted is a good way for investors to gain exposure to the wind power market, with a very high level of geographical diversification.

5. Companhia Paranaense de Energia – COPEL

Companhia Paranaense de Energia - COPEL (ELP -1.33%)

Companhia Paranaense de Energia - COPEL (ELP -1.33%)

Copel is one of the largest Brazilian power producers, operating 30 power plants with an installed capacity of 5.6 GW. Its flagship assets are the three hydropower dams in the Brazilian state of Parana, responsible for 95% of the company's total production.

The company plans to add 2 GW of renewable power generation by 2030 through hydropower and wind farms. It also handles large assets in power distribution and transmission.

Source: Copel

Copel has little competition to deal with as a quasi-monopoly in its region. The region's only other major electricity producer is the Itapúa Dam, the second largest in the world after the 3 Gorges Dam in China.

Copel is majority state-owned, which can be viewed as a good or bad thing, depending on your perspective.

On one hand, this makes the company likely to keep distributing a generous dividend that fuels the government budget. On the other hand, this makes it very exposed to Brazilian politics, which can be somewhat unstable, as recently illustrated by the election of socialist president Lula and riots of his opponent's supporters at multiple government centers.

Such instability has damaged Brazil's reputation with investors and has especially hurt the state-owned companies' stocks, like Copel and Petrobras.

So Copel is more a dividend stock with rather high yields, attractive to investors willing to deal with some level of overseas political risks.

6. Brookfield Renewable Partners L.P.

Brookfield Renewable Partners L.P. (BEP -0.08%)

Brookfield Renewable Partners L.P. (BEP -0.08%)

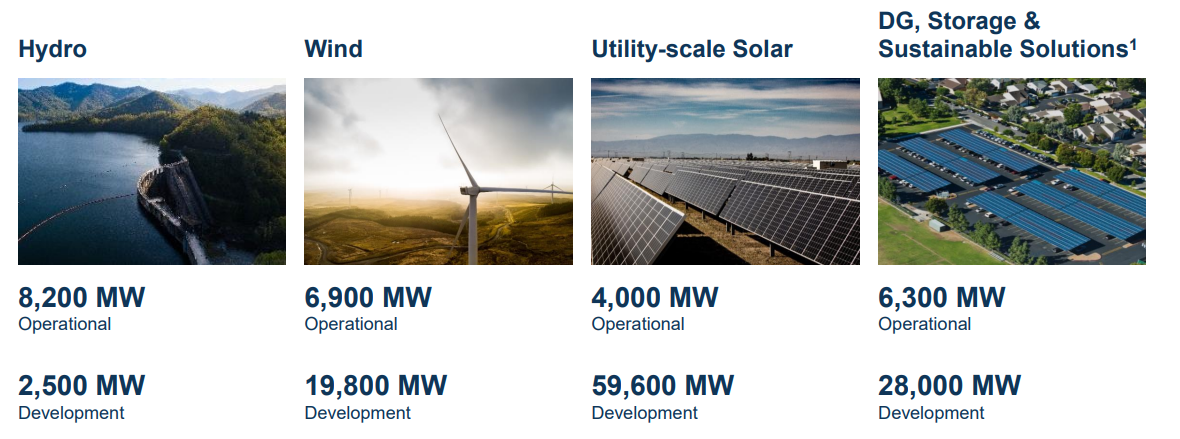

Brookfield Renewable Partners, or BEP, is part of the massive asset management firm Brookfield, handling $625B in assets, which owns 48% of BEP.

The company manages 25 GW of power generation and has a staggering 110 GW in its construction pipeline. Most of this growth will be in North America, with 71.2GW planned, mostly in the USA.

The current assets are a mix of hydropower, wind, and solar, with the bulk of the future production growth planned to be in solar, followed by energy storage and wind. For the next 5 years, BEP plans to deploy $6-7B in new energy infrastructures.

Source: BEP

Another important development for BEP in 2023 is the closing of the acquisition of Westinghouse, the leading nuclear plant builder in North America. Westinghouse is an OEM (Original Equipment Manufacturer) for half of the world's nuclear reactor fleet and the immense majority of non-Russian, non-Chinese nuclear power plants.

Done together with the world's second-largest uranium miner, Cameco, this 7.9B acquisition will increase the role of nuclear in BEP's revenue stream, even if more in the form of construction contracts than power plants and electricity sold.

While nuclear is not technically renewable, this shows the growing role of low-carbon nuclear in the energy transition and reflects positively on BEP's management's ability to follow business trends instead of strict adherence to dogmas on energy policies.

BEP has grown its distribution to shareholders by 6% per year since 1999. Together with the stock price rising, BEP has generated annualized returns of 16% for its shareholders since 1999.

With its balanced mix of hydropower, wind, solar, and now even nuclear, BEP is a solid stock to bet on the de-carbonization of the energy grid. It also has an excellent track record and distributes a rather generous dividend.

7. Clearway Energy, Inc.

Clearway Energy, Inc. (CWEN +0.09%)

Clearway Energy, Inc. (CWEN +0.09%)

Clearway Energy owns 8 GW of power generation assets, of which 5.5GW is renewable, 1/3rd solar, and 2/3rd wind (the rest is 2.5 GW of high-efficiency natural gas power plants). The company assets are mostly located in the USA, and it plans to focus on North America.

The company is also working on the USA's 4th largest energy storage facility, the 450 MW Daggett Solar Power Facility – Battery Energy Storage System, which should be commissioned in 2024.

Due to its relatively large ownership in both gas power plants and renewable, Clearway Energy can be seen as a bet on the energy transition relying on gas as a “bridge fuel” before reaching a fully renewable or renewable + nuclear energy mix. Low gas prices in North America, thanks to shale gas, could support this view.

Clearway is giving a rather generous dividend and plans to keep it growing annually at 5%-8% through 2026.

8. Algonquin Power & Utilities Corp.

Algonquin Power & Utilities Corp. (AQN +0.17%)

Algonquin Power & Utilities Corp. (AQN +0.17%)

Algonquin is a Canadian power company with water and power assets in North America. 80% of the business is in regulated utilities, of which 72% is electric generation, 13% water, and 15% gas. The other 20% of the business is renewable power production, standing at 4.1 GW.

Source: Algonquin Power

https://s25.q4cdn.com/253745149/files/doc_presentations/2021/12/2021-Investor-Day-Dec-14-2021.pdf

The company is actively turning toward renewable, with $1B planned in capital expenditure in 2023. This comes on top of a $2.3B acquisition of Kentucky Power. This acquisition was preceded by the purchase in 2019 & 2020 of a water distribution utility in New York, a Chilean water and sewage company, and a Bermuda electric company.

Until 2025, Algonquin plans to spend $9.4B, including building and/or acquiring a 3.4 GW extra renewables capacity. Which is almost twice as much as its early 2023 market cap.

Thanks to its diverse utilities, including water and gas, Algonquin is a highly diversified utility stock, entering only now at a very large scale the renewable energy segment. So, this stock will appeal more to investors looking for exposure to the sector and the green transition but are also happy with a slightly lagging green strategy compared to more renewable-focused utilities.

9. Enefit Green AS

Enefit is an Estonian company that IPOed in 2021, aiming to become the largest renewable energy producer in the Baltic region and a large producer in Poland.

Source: Enefit

The region has recently suffered from an acute energy crisis due to the interruption of Russian gas supplies. This created a favorable environment for alternative supplies and a lot of state support of the local governments for “fuel-free” energy production. Especially considering the potential for wind power in the Baltic countries has been mostly left untapped until recently.

The company plans to rapidly expand its production in 2023 from 1,053 MW to to1,542 MW, thanks to multiple wind farm projects being finished, with a target of 1,900 MW by 2026.

Enefit is a utility for investors looking for relatively high yield and growth in a region just beginning to grow its renewable production. The tensions with Russia and the invasion of Ukraine are accelerating the energy transition and overcharging local power prices, but this also means a significant geopolitical risk in case the conflict escalates.

10. Vulcan Energy Resources Limited

Vulcan is a German company targeting geothermal energy production in the Rhine Valley while also extracting lithium from the geothermal brine.

The project targets the production of renewable heat for 1 million people, enough lithium for 1 million EVs per year, and 1 million tons of CO2 emission avoided per year. The heat production matches well the local market, with Germany rich in district heating systems currently relying on coal or gas.

Source: Vulcan Energy

The company has yet to produce lithium but has already secured off-take agreements with Stellantis, Volkswagen, LG, Umicore, and Renault. The lithium resource is expected to decline very slowly, with less than 50% dilution even by 2055. Production should start at the end of 2025.

Phase one of the project should result in 4.2 MW in power capacity, with a final goal of 33 MW of power and 30 MW of heat generation.

Vulcan is a more speculative project, with no significant cash flow expected before 2026. Still, the prospect of lithium production going hand-in-hand with geothermal power generation is intriguing.

This could also reduce the carbon footprint for EU-made EVs, as currently, most lithium is extracted using fossil-fuel-powered engines and facilities running at least partially on fossil fuels.