Energía

General Fusion saldrá a bolsa en un acuerdo SPAC de fusión de 1 millones de dólares

Securities.io mantiene rigurosos estándares editoriales y podría recibir una compensación por los enlaces revisados. No somos asesores de inversiones registrados y esto no constituye asesoramiento de inversión. Consulte nuestra divulgación de afiliados.

General Fusion anuncia planes para salir a bolsa

General Fusion, a leader in fusion reactor development, anunció the signing of a business combination agreement with Spring Valley Acquisition Corp. III (SVAC -0.82%) on January 22, 2026. This deal would effectively create a post-merger valuation of approximately $1 billion for the firm and position it to remain a major force in the fusion sector for the foreseeable future. Here is what you need to know.

Demanda de energía

This deal could help bring energy-efficient fusion technology to the masses, providing a cleaner and more effective solution to today’s growing energy demands. International energy demand has increased steadily over the last decade, and the power sector, in particular, has seen accelerating growth.

Recent IEA reporting showed global energy demand grew by about 2.2% in 2024, with electricity demand rising even faster—driven by electrification, industrial load growth, and the expansion of data centers supporting emerging technologies like artificial intelligence.

Globally, fossil fuels still account for roughly 80% of total primary energy consumption, while renewables contribute closer to 15% and nuclear power approximately 4–5%. While renewables have grown rapidly in electricity generation, their share of total energy supply remains constrained by intermittency and storage requirements.

For firm, 24/7 generation, nuclear plants can deliver high capacity factors (often above 90% in mature fleets) and do not depend on weather conditions like solar or wind. These factors have led many scientists and policymakers to turn toward fusion technology as a potential next-generation solution for meeting global electrical demand.

Why Magnetized Target Fusion Matters

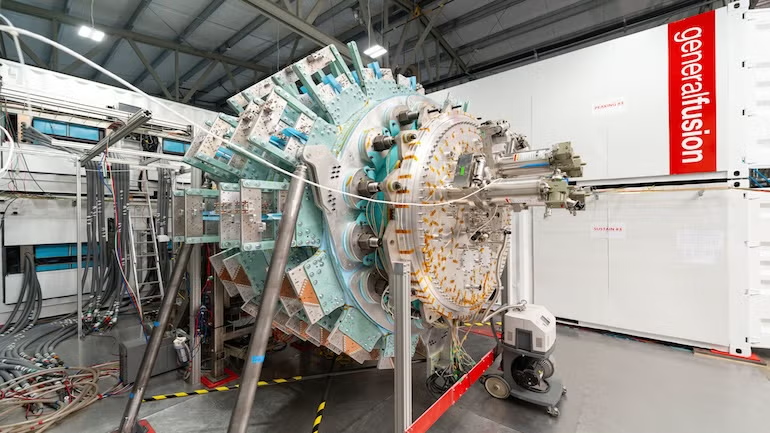

Notably, General Fusion has been instrumental in driving the adoption of fusion energy production technology. Now, the firm will join forces with Spring Valley Acquisition Corp. III to commercialize and scale up its Magnetized Target Fusion (MTF) reactors, including the Lawson Machine 26.

Lawson Machine 26

The Lawson Machine 26 (“LM26”) is General Fusion’s MTF demonstration machine. It utilizes a proprietary hybrid fusion approach that leverages magnetic confinement of the plasma fuel and inertial compression. This approach differs from tokamak-style systems and laser-based inertial confinement because it is designed around rapid pulse compression rather than relying solely on large superconducting magnets or high-powered lasers.

Fuente - Fusión general

The Lawson Machine 26 supports the broader goal of progressing toward the Lawson criterion, a core set of conditions involving plasma temperature, density, and confinement time required for a fusion reaction to produce more energy than it loses. In practical terms, the path from demonstration hardware to grid-scale plants requires extensive engineering validation beyond laboratory physics.

Detalles de la transacción

The SPAC merger with Spring Valley Acquisition Corp. III (SVAC) creates a combined entity with an estimated ~$1 billion pro-forma equity value. The deal assumes zero redemptions from SVAC’s ~$230M trust and participation from a committed and oversubscribed PIPE (Private Investment in Public Equity).

The proposal was unanimously approved by both companies’ boards of directors, with executives predicting the combination will complete in mid-2026 (subject to regulatory and shareholder approval). As part of the agreement, the companies have communicated an ambition to make MTF fusion technology commercially available around the mid-2030s.

In a recent announcement, the firms confirmed the agreement’s details and stated they are moving forward to seek regulatory and shareholder approval. They also shared that the new entity would be called General Fusion and would be listed on the Nasdaq under the GFUZ ticker.

Desliza para desplazarte →

| Empresa | Nuevo enfoque | Core Hardware Concept | Estado | Commercialization Target (Publicly Communicated) | Relevancia del inversor |

|---|---|---|---|---|---|

| Fusión general | Fusión de objetivo magnetizado (MTF) | Magnetized plasma + mechanical/electromagnetic compression | Going public via SVAC SPAC | Mid-2030s (first-of-a-kind plant goal) | Pure-play fusion exposure (GFUZ proposed) |

| Sistemas de fusión de la Commonwealth | Tokamak (high-field) | Compact tokamak + high-temperature superconducting magnets | Privado | Early-to-mid 2030s (varies by program) | Benchmark private leader; not directly investable |

| Helion | Pulsed magneto-inertial / FRC-based | Pulsed plasma compression in a linear device | Privado | Early 2030s (company-targeted timelines) | High-profile private play; timelines debated |

| Tecnologías TAE | FRC-based / advanced beam-driven concepts | Field-reversed configuration plasma stabilization | Privado | Mid-2030s+ (program dependent) | Long-running private developer; not directly investable |

| Energía Zap | Sheared-flow Z-pinch | Linear pinch with flow shear stabilization | Privado | Mid-2030s+ (program dependent) | Non-tokamak pathway; high technical uncertainty |

| Primera fusión ligera | Inertial fusion (non-laser impact concept) | Projectile/impact-driven compression concepts | Privado | Mid-2030s+ (program dependent) | Alternate inertial path; not directly investable |

What the Funding Will Go Towards

There are several projects that the funding will help push, including commercialization work and the continued development of Magnetized Target Fusion technology. The broader goal is to advance fusion systems toward commercial-scale deployment, which aligns with long-range decarbonization objectives pursued by many governments and institutions.

Commercializing Fusion at Grid Scale

Discussing the schedule, General Fusion CEO Greg Twinney spoke on how the timing could not be better. He touched on how fusion energy could help address the world’s power constraints and how the company plans to pursue commercialization via MTF reactors.

How Lawson Machine 26 Tech Can Change the World

If successful, fusion technology could revolutionize energy production by delivering dense, always-on power with no carbon emissions at the point of generation. Frequently cited comparisons note that fusion reactions can produce about four times more energy per unit mass of fuel than nuclear fission and millions of times more than chemical energy sources such as coal, oil, or gas.

Fusión general

General Fusion launched in 2002 with the goal of pushing MTF technology to new heights. The company’s founder, Dr. Michel Laberge, is recognized as an expert in the field alongside Twinney, who has over two decades of experience in the market and has been involved in bringing multiple projects to public markets.

General Fusion has continually pushed innovation in the sector, securing hundreds of patents along its journey. This drive, alongside a focused strategy, helped the firm become one of a small group of private fusion companies that have published peer-reviewed results related to their fusion research.

Apoyo a los inversores

General Fusion continues to receive strong investor support from both institutional and venture capital sources. The company has raised roughly $440M since its launch. This funding comes from a mix of industry partners, VCs, investors, and government grants, including support from Canada’s Strategic Innovation Fund.

Spring Valley Acquisition Corp. III

Spring Valley Acquisition Corp. III is a special purpose acquisition company formed to pursue business combinations in the energy and decarbonization sectors. While General Fusion is headquartered in Richmond, British Columbia, Spring Valley Acquisition Corp. III operates as a U.S.-listed SPAC.

Chairman and CEO of SVAC, Chris Sorrells, spoke on how this merger will help address growing energy demand globally. He described a future where fusion becomes a core form of energy production before discussing how this deal could help accelerate commercialization and infrastructure readiness.

News of the deal has helped bolster Spring Valley Acquisition Corp. III shares. Investors eager to gain exposure have already begun to purchase SVAC, which provides pre-merger exposure ahead of the newly formed entity and proposed ticker GFUZ.

Spring Valley Acquisition Corp. III Class A Ordinary Shares (SVAC -0.82%)

Latest Spring Valley Acquisition Corp. III News and Performance

Starboard Value Takes a Hefty 8% Stake in Bill Holdings: Should Investors Buy Too?

Starboard slashes stake in Kohl's after seeking to buy it in January

Is Starboard's $9B Offer a Fair Valuation of Kohl's?

Starboard Value Acquisition Corp. Announces Stockholder Approval of Business Combination with Cyxtera Technologies, Inc.; Record Date Announcement for Warrant Distribution

3 Celebrity Investors Who Broke Buffett's Investing Tenets — And Scored

Why Aren't More Companies Using SPACs for Their IPOs?

General Fusion – Meeting Global Demand with Next Gen Technology

General Fusion and Spring Valley Acquisition Corp. III will now work together to take MTF fusion technology from the lab toward commercialization. If successful, the result could be a cleaner, denser, and more reliable energy supply—at a time when grid constraints and electricity demand are becoming central economic bottlenecks.

Learn about other interesting stock developments aquí.