ETFs

Best Nasdaq ETFs: Top 5 to Diversify Tech Bets (2025)

Securities.io maintains rigorous editorial standards and may receive compensation from reviewed links. We are not a registered investment adviser and this is not investment advice. Please view our affiliate disclosure.

Nasdaq 101

The Nasdaq, or National Association of Securities Dealers Automated Quotations, is one of the USA’s (and the world’s) most important stock exchanges. It is the country’s most active stock trading venue in the U.S. by volume and one of the world’s largest by market capitalization of the companies listed on it.

Maybe more importantly, it has slowly become synonymous with technology stocks. Notably among the founders of this exchange were companies like chip maker Intel (INTL +0.52%), telecom company Comcast (CMCSA +0.51%), and semiconductor manufacturing machines Applied Materials (AMAT +0.5%).

It was an early adopter of technology at its founding in 1971, being the world’s first fully electronic stock market. In 1998, it became the first stock market in the United States to trade online, using the slogan “the stock market for the next hundred years”.

Nasdaq has also historically been a stock exchange that was cheaper to list on than competitors like the NYSE, making it a favorite of startups and companies not yet profitable.

For more than 50 years, Nasdaq has been at the forefront of our industry. We pioneered technologies that enhanced the performance of the financial system, improved accessibility, and championed economic progress.

The exchange platform is owned by Nasdaq, Inc. (NDAQ +0.19%).

The exchange’s main index is the NASDAQ Composite, which has grown astonishingly from 280 in 1985 to today’s 20,500 levels, or x100 for the general index in 40 years, much higher than the dot-com bubble peak at 4,700 levels in 2000.

Source: Yahoo Finance

The Nasdaq has listed 142 IPOs in 2025, raising a total of $19.2B, with also 11 companies transferring their corporate listings to Nasdaq.

Notably, Nasdaq’s first half listings have showcased the most exciting trends in the market – with AI company CoreWeave, cybersecurity leader SailPoint, Fintech heavyweight Chime, and crypto innovators Galaxy Digital and eToro joining the Nasdaq family.

To invest in the Nasdaq and Nasdaq-listed companies, it is often easier to do so with ETFs, which offer a high level of diversification while keeping transaction fees low.

5 Best Nasdaq ETFs to Invest In

Below is a quick side-by-side comparison of these top Nasdaq ETFs to help you choose the right fit:

| ETF | Tracks | Main Feature |

|---|---|---|

| Invesco QQQ (QQQ) | Nasdaq-100 | Top-heavy, blue-chip tech exposure |

| Direxion QQQE | Nasdaq-100 Equal Weight | Balanced weight for less volatility |

| Invesco QQQJ | Nasdaq Next Gen 100 | Exposure to emerging tech stocks |

| Fidelity ONEQ | Nasdaq Composite | Broad exposure to entire Nasdaq |

| iShares BTEE | Nasdaq US Biotech | Focused on biotech innovation |

1. Invesco QQQ Trust

Invesco QQQ Trust (QQQ +1.04%)

This ETF tracks the Nasdaq-100, an index representing the 100 largest non-financial companies on the Nasdaq.

Since its launch in 1999, this index has outperformed the S&P 500 by 379%. An investment of $10,000 in QQQ ten years ago would be worth $55,650 today.

QQQ is one of the oldest ETFs and is the second most traded ETF in the USA, based on average daily volume.

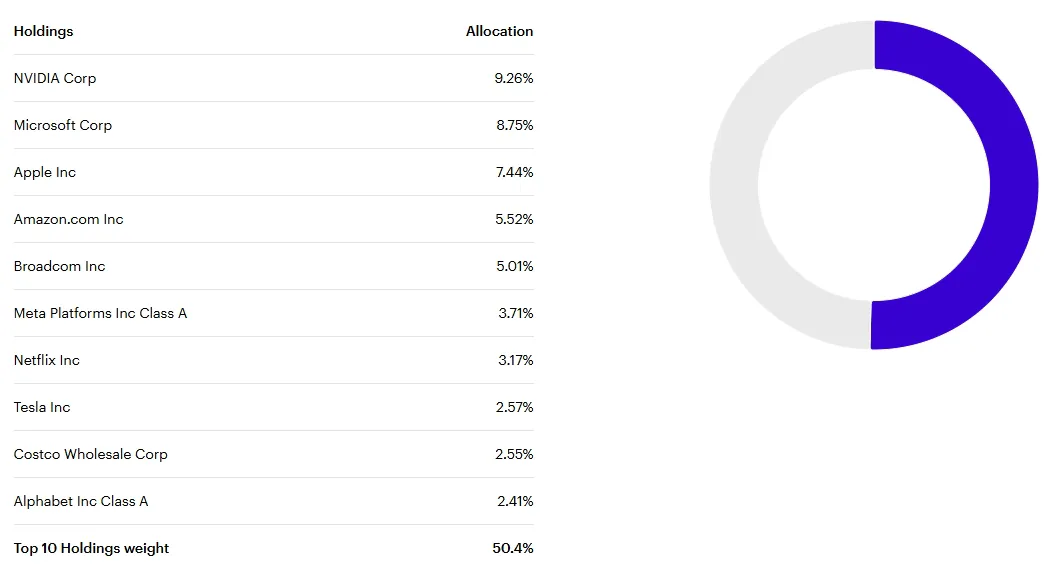

This is a rather “top-heavy” ETF, with the top 10 holdings making up more than half of the index, including household names and some of the world’s largest companies like Nvidia, Microsoft, Apple, Amazon, Meta, Netflix, Tesla, etc.

Source: Invesco

Overall, QQQ is an index to get a broad exposure to the largest US tech stock, and a good presence in the tech industry through its leaders.

Due to the size of the companies making the bulk of the index, it is possible that past performance might not be representative of future results.

Investors should remember that most of the Nasdaq historical returns have been built on growth and digitalization of society, trends which are still strong but also maybe reaching a point of diminishing returns for the largest stocks of the sector.

2. Direxion Nasdaq-100 Equal Weighted Index Shares

Direxion NASDAQ-100 Equal Weighted Index Shares (QQQE +0.84%)

This ETF is also replicating the Nasdaq-100, but not the same way as QQQ.

QQQ tries to replicate the relative weight of each stock, meaning that if a company is a bigger part of the Nasdaq-100, it will also be larger in the holdings of the ETF.

In contrast, QQQE puts all the stock at an equal weight of 1% of the portfolio, rebalancing all holdings to 1% on a quarterly basis.

This method means that the top stocks, which are also the largest and most mature companies, are a lot less represented than in QQQ. Ultimately, it is aiming at reducing volatility and risks, as not one single stock in the ETF can significantly impact the value of the whole.

The downside is that it can also somewhat “miss” success stories, as a stock part of the index that is rising in price will constantly be sold every quarter, instead of being bought more. The same holds true for a struggling stock, which will be bought more when it gets cheaper.

So this ETF is for investors interested in the Nasdaq-100 and its tech-heavy exposure, but not in the wilder volatility that often comes with it.

It can also be appealing to value investors wary of piling up on “overpriced” stocks, and preferring more exposure to companies whose stock is selling “at a discount”.

3. Invesco Nasdaq Next Gen 100 ETF

Invesco NASDAQ Next Gen 100 ETF (QQQJ +1.08%)

If the sheer size of the top 100 companies listed on the Nasdaq is a concern, this index is there to be the answer.

The Fund invests at least 90% of its total assets in the securities that comprise the Index by investing in the 101st to the 200th largest companies on the NASDAQ.

This way, it still provides exposure to important tech companies that are already successful, but none of the largest ones either.

This is not to say that it does not contain well known companies, like for example hard drive company Seagate(STX +3.76%) or VoiP company Zoom (ZM +2.17%), but also plenty of more “obscure” software and tech companies creating new markets and still in their expansion phase.

This way, investors can hope to catch the “next X”: the next Facebook, the next Intel, the next Tesla, etc.

The ETF is spread between multiple sectors, notably software (33%), healthcare (21%%), consumer discretionary goods (13%), and industrials (13%) for the largest ones, with small exposure to telecommunication, consumer staples, utilities, financials, energy, real estate, etc.

4. Fidelity Nasdaq Composite Index ETF

Fidelity Nasdaq Composite Index ETF (ONEQ +1.15%)

This ETF does not follow the Nasdaq 100, but the Nasdaq composite, which covers almost all of Nasdaq Nasdaq-listed companies.

By doing so, it provides a much wider exposure to the tech industry, as well as other innovative segments like biotech, telecommunication, consumer goods, industrials, etc.

Source: Fidelity

This is a very diversified ETF (except for its focus on “tech”) as it holds more than 1000 stocks.

It has however still some heavy exposure to some of the largest companies in the sector as well, with notably Apple, Microsoft, Nvidia, Amazon, and Meta in the top 5 of the holdings.

5. iShares Nasdaq US Biotechnology UCITS ETF

In the past decades, the most impressive technological successes have been semiconductors, software, and IT in general; nothing says it will be the case going into the 2030s.

Another technology segment with great potential is biotechnology. The goal of this ETF is to provide investors with a diversified exposure to U.S. biotechnology and pharmaceutical companies listed on the NASDAQ.

Biotech is currently carried by the aging of the population and the associated growing need for medical care, as well as multiple technological revolutions:

- A flood of new data thanks to so-called “multiomics”, measuring living cells not only through DNA (genomics), but also RNA, proteins.

- AI helping finding hidden patterns and making sense of all the generated data, speeding up the discovery times.

- Personalized medicine and telemedicine boosting the efficiency of therapies for a given individual while lowering costs.

- CRISPR gene editing technology allowing for the first time realistic correction of genetic problems in patients or treating cancer through modification of the cells’ DNA.

The ETF has large part of its holdings (up to 6-7% of total into an individual stock) into already successful and cash positive biotech companies like Vertex Pharmaceuticals (VRTX +0.45%), Amgen (AMGN +0.15%), Gilead Sciences (GILD -0.52%), or Regeneron (REGN +0.77%).

It also has exposure to “big pharma” companies with significant biotech activities like AstraZeneca (AZN -0.34%).

An investor who believes the editing genetic code is going to be as much, or maybe more important than binary computer code, will want to be positioned in these companies.

Biotech is a very high-risk sector, with most drugs taking more than a billion dollars of R&D costs before being commercialized.

So it makes sense to look for the most diversified exposure to the sector, in order to spread out risks and take a chance in many of the competing technologies to cure rare diseases, cancer, metabolic problems, aging, or maybe even one day improving our performances and appearances through genetic modifications.

Conclusion

Nasdaq ETFs are a good way to get exposure to the US tech sector while also getting a reasonable level of diversification.

Some are more top-heavy, like QQQ, and will be influenced strongly by the fortunes of the largest tech companies in the world, or the so-called Magnificent 7 (Alphabet, Amazon, Apple, Broadcom, Meta Platforms, Microsoft, and Nvidia).

Other Nasdaq ETFs will look to provide exposure to a more specific situation or investing need:

- Lower exposure to the largest companies with QQQE.

- Investing in up-and-coming stocks not yet among the top 100 of Nasdaq listings, but well on their way to it, with QQQJ.

- Broad exposure to the whole of Nasdaq with ONEQ.

- Narrow down on the biotech sector instead of ICT with BTEE.

In any case, for the majority of investors, these ETFs should likely be mixed with non-Nasdaq, non-tech ETFs to create an even more diversified portfolio for reducing risks and volatility.