Aerospace

Top 5 Space Companies Shaping the New Space Economy

Securities.io maintains rigorous editorial standards and may receive compensation from reviewed links. We are not a registered investment adviser and this is not investment advice. Please view our affiliate disclosure.

From Public Agencies to a Private Space Economy

For now, space technology and exploration are primarily driven by scientific research, national prestige, and the ambitions of billionaires like Elon Musk and Jeff Bezos.

While this will still be true in the future, a new space-based economy is emerging, with space technologies having matured enough to make space exploration profitable.

We previously discussed in “The Future Space-Based Economy” how space tourism, satellite constellations, orbital manufacturing, space-based solar energy, and eventually asteroid mining or space colonization will form the economic base for humankind’s expansion into the void.

A few companies are now leading the charge, moving space activities away from the model where NASA and other national agencies were the primary inventors of space technologies.

Swipe to scroll →

| Company | Core Business | Flagship Vehicle/Asset | Key Spec | Milestone (2025) | Investability |

|---|---|---|---|---|---|

| SpaceX | Launch + LEO broadband | Starship / Starlink | Starlink 7M+ subs (Aug ’25) | Starship Flight-10 splashdowns & payload deploy | Private; indirect via GOOGL |

| Relativity Space | Launch | Terran R (1st stage reusable) | ~23,500 kg to LEO (target) | First launch targeted end-2026 (LC-16) | Private |

| Rocket Lab (RKLB) | Launch + Space systems | Electron / Neutron | Neutron ~13,000 kg to LEO | 70th Electron mission (Aug ’25) | Public (NASDAQ: RKLB) |

| Virgin Galactic (SPCE) | Suborbital tourism & research | Delta-class spaceplane | ~8 flights/month per vehicle (target) | Service start aimed at fall 2026 | Public (NYSE: SPCE) |

| Planet Labs (PL) | Earth-imaging data | ~200 satellites, hyperspectral | >90% recurring ACV; Q2 FY26 $73.4M | Second straight positive FCF quarter | Public (NYSE: PL) |

1. SpaceX (Private)

Elon Musk’s SpaceX is single-handedly the trigger that created a new space race and the renewed enthusiasm for the sector.

This is because the company is the first one to have created truly reusable rockets, with the Falcon rocket series, causing the cost of reaching orbit to collapse in less than a decade.

Source: ARK Invest

The company is now aiming to replicate this feat with Starship, the heaviest rocket ever created, which, in theory, is capable of lifting an astonishing 200 tons of material into orbit in a single flight in its final form.

SpaceX has also created the first large-scale constellation of Internet satellites, Starlink, and is alone responsible for the USA to have sent more objects into orbit in the past years than the rest of the world combined.

Starlink passed the 7 million customers mark in August 2025, adding 1 million new customers in just 79 days.

Source: Our World In Data

The move from prototype to functional rocket of Starship has not been without issues, with many of the early tests ending in “rapid unscheduled disassembly”, a tongue-in-cheek way for the company to say “unexpected catastrophic explosion”.

This might be improving, after Flight 10, which took off on August 26, saw the Super Heavy booster and Starship upper stage both landing in their planned areas mostly intact.

Starship is essential to make Starlink actually profitable, as the Falcon launches are still too small to keep the constellation alive. It is also essential to NASA’s Artemis missions, which will determine if the USA is able to keep up with China in the new space race to the Moon and Mars.

SpaceX remains privately held (not publicly traded). Indirect exposure is possible via Alphabet (GOOGL), which invested in SpaceX and reported a significant unrealized gain on that stake in 2025.

You can also follow our guide on how to invest in SpaceX shares through pre-IPO marketplaces for secondary shares, as well as other potential methods.

2. Relativity Space (Private)

While SpaceX invented the reusable rocket, it mostly produced them through traditional manufacturing methods, tried and tested by the space industry before, but did so more efficiently.

Relativity Space is even more ambitious, having used 3D-printed technology since inception for its Terran 1 (LEO payload of 1.25 tons) and the Aeon R engine powering the upcoming reusable Terran R.

Terran R is expected to carry 23.5 tons to low-Earth orbit (LEO), or even up to 33.5 tons in its largest version.

Source: Relativity Space

While it will be much smaller than Starship, it compares somewhat to SpaceX’s current functional rocket, the Falcon Heavy, and its 50 tons of LEO payload.

The first launch of Terran R is expected for the end of 2026 from Launch Complex 16 (LC-16) at Cape Canaveral Space Force Station.

The company uses vertically integrated, proven smart manufacturing methods across Terran R to optimize for cost, scalability, and speed, and enable high-frequency launch. This approach allowed Relativity Space to achieve rapid iteration cycles for components that benefit from rigorous hardware testing, as well as progress well into flight production of primary structures and systems for Terran R.

Relativity notably uses the NASA-developed Glenn Research Copper, or GRCop, a combination of copper, chromium, and niobium.

GRCop is optimized for high strength, high thermal conductivity, high creep resistance – which allows more stress and strain in high temperature applications – and good low cycle – which prevents material failures –above 900 degrees Fahrenheit.

Larger pieces, like the panels of the rocket’s body, are still manufactured the traditional way.

This hybrid approach optimizes for rapid development and scalability, ensuring we can bring Terran R to market quickly for our customers.

For now, Relativity Space is also still private and backed by VC firms.

As one of the highest-profile rocket companies, it is expected to IPO in a few years, most likely after several successful launches of the Terran R, which confirmed the success of the technical approach of the company.

3. Rocket Lab USA (RKLB)

Rocket Lab USA, Inc. (RKLB +5.1%)

Rocket Lab is the largest publicly traded rocket company (since 2021) and one of the most serious contenders to SpaceX in the reusable rocket market.

The company has initially focused on small rockets, with the Electron launch system (320 kg of payload), which is progressively being turned into a partially reusable rocket. So far, Electron has deployed 224 satellites in 70 launches.

Later on, Rocket Lab is developing Neutron, a medium-lift reusable rocket now specced at 13,000 kg to LEO and ~1,500 kg to Mars/Venus, positioning it squarely against Falcon 9 for mid-class missions.

Source: Rocket Lab

The Neutron will be powered by a methane-burning rocket engine (like Starship), which seems to be the trend for the next generation of rockets.

It will use the newly opened Launch Complex 3, as well as a custom-built landing pad at sea constructed by Bollinger Shipyards, the largest privately owned new construction and repair shipbuilder in the United States.

Source: Rocket Lab

The company is also remarkable for its fully vertically integrated satellite manufacturing process, allowing it to optimize costs and design speed.

This resulted in multiple contracts with NASA & the US government, including a $515M military satellite contract. And a civilian $143m contract for Globalstar.

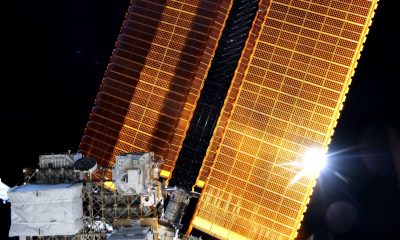

Rocket Lab is also a major manufacturer of solar panels for satellites after its 2022 acquisitions of SolAero Technologies, with 1000+ satellites powered by these panels, and 4MW solar cells manufactured in total.

Source: Rocket Lab

For now, its launch system is reliant on outside suppliers for parts, but a series of strategic acquisitions is changing that, replicating for launch systems the vertical integration strategy already achieved in satellite design and manufacturing.

The company is also looking at the possibility of a telecom LEO constellation to generate recurring revenues. It is also contributing to research for in-space manufacturing with Varda Space Industries and orbital debris inspection.

While SpaceX had Elon Musk’s business talent (and money) to develop its technology from scratch, Rocket Lab used a mix of R&D and acquisitions to vertically integrate the technology required.

It has proven very successful in satellite manufacturing, and they are now looking to replicate this strategy for reusable rockets. Considering the existing cash flow from satellite production & the Electron successes, Rocket Lab is a good candidate to catch up with SpaceX’s head start.

(You can read more about the company in our dedicated investment report on Rocket Lab.)

4. Virgin Galactic (SPCE)

Virgin Galactic Holdings, Inc. (SPCE +5.57%)

The idea of travelling to space without having to qualify as an astronaut after years of hard training and ultra-selective qualification is appealing to many people.

Experiencing weightlessness, seeing Earth from orbit, or even later traveling and staying for an extended period of time on the Moon or Mars has a built-in demand that just begs to be satisfied and will likely be a pillar of the future space-based economy.

Unfortunately, this is yet to fully happen, with only a handful of ultra-rich space tourists having pioneered this idea, for example, Katy Perry with Blue Origin in April 2025, or an all-amateur 4-person space crew with SpaceX in 2021.

Building a regular stream of space tourism opportunities is the goal of Virgin Galactic, initially created by billionaire and media personality Richard Branson.

The tickets are priced between $250,000 and $450,000, with a long waiting list. The first customers seem to be ecstatic with their experience:

“This has been the best day of my life, the most sensational day of my life. And you can’t get any better than that. It exceeded my wildest dreams.”

Virgin Galactic has been working on improving its unit economics, with a new launch system, the “Delta”, able to carry 6 passengers instead of 4, and to perform 8 flights/month instead of just one.

Together, these 2 improved metrics should boost revenue per unit by 12x, with a payback time of less than 6 months for each Delta shuttle.

Source: Virgin Galactic

The Delta flight test was expected in mid-2025, before being rescheduled for the fall of 2026.

“The company ran into a problem with the production of the first carbon composite skins for the vehicle’s fuselage.

The material had different densities based on the compressive forces it was designed to handle, which caused problems when the composites were placed in an autoclave.”

Michael Colglazier – Chief executive of Virgin Galactic

This delay might put the company in a tight spot, with a rather low share price and the need to turn to positive cash flow as soon as possible.

At the same time, the previous customers’ satisfaction, a clear plan for a profitable design (Delta shuttles), and a long waiting list of potential clients show that the company might still be viable even without raising much more funds.

So a lot will rely on the success of developing, manufacturing, and operating the Delta shuttle.

(It should be noted that Virgin Galactic is different from Virgin Orbit. Virgin Orbit filed for bankruptcy in April 2023, and provided launch services for small satellites, with Rocket Lab acquiring the company’s Long Beach facility, manufacturing, and tooling assets.)

So this is a highly speculative investment with a previously rocky start, but it offers investors direct exposure to consumer-facing space travel, and remains one of the only public ways to play the emerging space tourism market.

5. Planet Labs (PL)

Planet Labs PBC (PL +1.41%)

The space and satellite industry is experiencing a revolution with companies like Rocket Lab entering the market aggressively.

This does not mean that established players in this space are not still important or able to keep up.

One of them is Planet Labs, with a focus on Earth-observation satellites. The company owns a fleet of approximately 200 Earth imaging satellites, the largest in history, imaging the whole Earth’s land mass daily.

These images are high-resolution and include hyperspectral data (visible + infrared and UV light), making them useful for geodesy, agriculture, insurance, finance, and governments (including military applications).

They can be used for monitoring, disaster response (wildfire, tornadoes, etc.), defense & intelligence, mapping infrastructures, detecting methane emissions, etc.

Source: Planet Labs

The company offers transparent pricing, with different subscriptions depending on the regions of the world covered and the number of square kilometers of surface demanded.

90% of revenue is recurring and from annual or multi-year contracts.

Source: Planet Labs

Planet Labs recorded $245 million in revenues in the 2025 fiscal year, doubling from $122 million in 2022, with record revenues in Q1 2026 and an adjusted EBITDA turning positive for the first time in Q4 2025.

The largest source of revenues is the North American region (45%), and the defense and intelligence segment represents more than half of revenues.

Source: Planet Labs

As a trusted provider of data, Planet Labs could benefit from a few trends, irrespective of where the space industry goes:

- It can license out the images to AI companies, or use them itself to train its own AIs, both for better real-time monitoring and novel insights.

- It will benefit from the price war between launch providers like SpaceX, Relativity Space,and Rocket Labs, making the maintenance and replacement of its satellite fleet cheaper.

- It will benefit from the economies of scale in satellite manufacturing, making new, more capable models cheaper, as it demonstrated with the recent addition of hyperspectral data to its offerings.

- Larger launch vehicles should enable the conception of larger, more capable satellites, with potentially much longer lifespans, as this is mostly determined by the volume of fuel that the satellite can contain and use to maintain a stable orbit.