Energy

5 Best Solar Companies for (2026): Leaders & Risks

Securities.io maintains rigorous editorial standards and may receive compensation from reviewed links. We are not a registered investment adviser and this is not investment advice. Please view our affiliate disclosure.

2024 was a landmark year for solar power. Global solar installations climbed to almost 600 GW, an increase of 33% over the previous year. It is performing even better this year, with the world having already installed 380 GW of new solar capacity in the first six months of 2025, 64% higher than during the same period in 2024.

Solar also accounts for a whopping 81% of all new renewable energy capacity added worldwide in 2024. Among all the power generation technologies, it also had the fastest growth in terms of electricity output. It was three times that of wind power, which had the second-fastest growth.

As for solar’s share of the overall electricity generation, it remains small at 7% in 2024, though it has almost doubled in three years. Overall, global installed solar capacity is now above 2 TW as of 2024. Impressively, it took as many as 68 years to reach the first terawatt but a mere two years to double it.

This remarkable progress has been driven by rapid technological advancements that have significantly reduced costs, helping solar power become the driving force of the global energy transition.

According to the International Energy Agency (IEA) forecast, coal will be topped by renewable energy as the world’s main source of electricity “by 2026 at the latest,” with solar photovoltaic (PV) and wind central to this change.

A renewable, sustainable, and clean source of energy, solar energy is critical in reducing our reliance on finite fossil fuels, thereby mitigating climate change by cutting greenhouse gas (GHG) emissions.

It is also present in abundance, with the sun providing a massive amount of energy, far more than what is used by human activities globally.

Solar energy is a virtually inexhaustible resource, though the intermittency of sunlight requires storage solutions. In order to harness this radiant energy from the Sun in the first place, technologies like solar panels and thermal collectors are required to convert sunlight into electricity or heat.

Once installed, solar energy offers long-term cost savings. It also allows individuals, communities, and governments to achieve energy independence and maintain greater stability. Moreover, the solar industry supports jobs in research, manufacturing, installation, maintenance, and other sectors, fostering economic growth.

Against this bullish backdrop, now, let’s take a look at the best solar companies that are well-positioned to leverage this rapid expansion of renewable energy adoption and accelerate the global transition away from fossil fuels.

html{scroll-behavior:smooth}

Swipe to scroll →

| Company | Core Focus | 2025 Highlights (Q2) | Key 2025–2026 Catalysts | Primary Risks |

|---|---|---|---|---|

| First Solar (FSLR) | CdTe thin-film modules; utility-scale | $1.1B net sales; backlog ~64 GW; $3.18 EPS (diluted) | New US capacity; efficiency gains; bookings through 2028 | Policy shifts; competition; interconnection delays |

| NextEra Energy (NEE) | Largest US utility + renewables/storage developer | Adj. EPS $1.05; +3.2 GW backlog adds; Point Beach license +20 yrs | AI data-center load; FL grid/storage buildout | Rate/regulatory risk; nuclear O&M; higher rates |

| SolarEdge (SEDG) | Inverters; home energy systems & batteries | Revenue ~$289M; GAAP GM 11.1%; GAAP net loss ~$125M | Nexis all-in-one platform; US mfg ramp; channel normalization | Residential demand softness; pricing; tariff/trade |

| Sunrun (RUN) | Residential solar-as-a-service + storage/VPPs | 941,701 subscribers; 392 MWh storage installed; positive cash flow | VPP expansion; Tesla Electric partnership; new pilots | Capital costs; policy shifts; acquisition costs |

| Enphase (ENPH) | Microinverters; home energy storage; app | Revenue $363.2M; non-GAAP GM 48.6% incl. IRA / 37.2% ex-IRA | US mfg ramp; flexibility revenues via partnerships | Tariffs/supply chain; residential slowdown; policy |

1. First Solar (FSLR +1.85%): Thin-Film Leader with Utility-Scale Moat

First Solar is America’s leading photovoltaic (PV) solar technology and manufacturing company. The company provides solar panels, PV power plants, and related services.

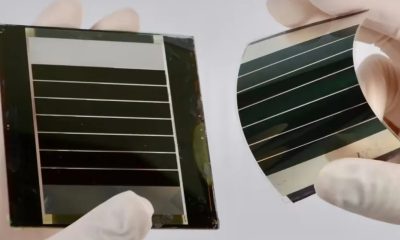

It is mainly focused on enabling the world’s power generation needs through thin-film PV technology.

With its cadmium telluride (CdTe) thin-film solar modules, the company has built a strong technological moat. These modules are cheaper to manufacture than crystalline silicon, while maintaining strong efficiency and performance in hot climates.

It is because of the lower cost, better scalability, and a higher efficiency limit that First Solar selected CdTe PV tech over conventional crystalline silicon (c-Si). Over time, the company invested $2 billion in its R&D to further harness other advantages that are unique to the semiconductor.

According to First Solar, the modules offer superior energy yield advantages, such as retaining over 89% of original performance after three decades, delivering about 4% more annual energy in hot climates and another 4% in high humidity conditions, less sensitivity to power loss in shaded conditions, and no power loss from cell-cracking and LeTID mechanisms.

The product also boasts as much as four times lower carbon and water footprint than c-Si panels, while global recycling services can recover over 90% of its materials for reuse.

CdTe has enabled First Solar to have a fully vertically integrated, continuous manufacturing model. Despite all this, the company believes the full potential of thin-film CdTe technology is yet to be fully realized, forecasting pathways to 28% cell efficiency by 2030.

Equipped with this solid product, First Solar secured $1.1 billion in net sales in the second quarter of 2025. Its sales jumped by $0.3 billion from the prior quarter due to an increase in the volume of modules sold to third parties, which includes utilities, system developers, independent power producers, and commercial and industrial companies.

First Solar, Inc. (FSLR +1.85%)

The company’s net income per diluted share was $3.18, and its net cash balance was $0.6 billion. It booked 2.1 GW in July 2025 while its expected sales backlog is 64 GW, extending through 2030, supporting First Solar’s long-term revenue visibility and module shipment.

Now, if we look at the FSLR’s market performance, its stocks are currently trading at $232, up 31.7% YTD. But according to a recent report from Jefferies, they may go higher with the investment firm raising its price target for the stocks to $260.

Jefferies pointed to a “solid setup” for $24.8 bln market cap solar panel maker, noting stocks getting into “price discovery mode” as First Solar’s US production capacity gets fully booked through 2028.

FSLR has an EPS (TTM) of 11.69 and a P/E (TTM) of 19.85.

“On a fundamental basis, with its cost-competitive energy and faster time to power profile, the case for utility-scale solar generation is compelling. First Solar, a utility-scale leader, in a position of strength.”

– CEO Mark Widmar

2. NextEra Energy (NEE +1.49%): Clean-Energy Utility + Storage at Scale

NextEra Energy is the largest clean-energy developer in the US with a market capitalization of $161 billion.

At the time of writing this, NEE shares are trading at $78.45, up more than 9% YTD. Over the last few years, the stock prices have experienced volatility, though they remain not far from the nearly $94 peak hit in 2021 following a decade-long uptrend.

NextEra Energy, Inc. (NEE +1.49%)

With that, the company delivers an EPS (TTM) of 2.67 and a P/E ratio (TTM) of 29.24 while paying a decent dividend yield of 2.90%. It actually plans to increase the dividend by nearly 10% annually, having been increasing its payments for about three decades.

A big reason for sustaining such price levels is diversified utility with solar-heavy growth plans. The company describes itself as the “world’s largest producer of wind and solar energy,” with its clean energy focus covering natural gas pipelines, renewable fuels, and battery storage.

The pairing of solar and wind energy with battery storage allows NextEra to store surplus renewable energy and then deliver it during peak times, thus reducing fluctuations and improving efficiency and grid stability.

The company plans to generate more energy from clean sources through systematic investments, outlining approximately $120 billion in a clean energy investment pipeline through 2029, with the majority directed toward solar and storage.

Currently, NextEra boasts 72 GW in total generating capacity across nuclear, natural gas, wind, solar, and battery storage.

Recently, the company secured a major regulatory win as the US Nuclear Regulatory Commission approved the Point Beach Nuclear Plant in Wisconsin to continue operating for another two decades. The plant currently provides nearly 14% of Wisconsin’s total electrical supply, running almost a million households.

A major component working in NextEra’s favor is its regulated Florida utility that provides its defensive earnings. NextEra is the parent company of Florida Power & Light (FPL), the country’s largest electric utility company and its energy resources arm.

For Q2 of 2025, FPL reported net income of $1.275 billion, or $0.62 per share. Meanwhile, its capital expenditures were $2 billion for the quarter. FPL serves its customers with a diversified energy mix, invested in a gas-fired fleet along with four nuclear units, besides solar and storage.

Meanwhile, NextEra Energy Resources reported GAAP net income of $983 million, or $0.48 per share, and earnings of just over $1 billion, or $0.53 per share. During the quarter, it added 3.2 GW to its backlog, which includes 1 GW to hyperscalers, bringing its total backlog to 30 GW.

For NextEra Energy, the growing need for electricity from AI data centers, which are rapidly expanding, offers a major tailwind, but at the same time, the company is facing headwinds like financial risks from the operation and maintenance of its nuclear generation facilities. High interest rates are also a major concern for the capital-intensive industry.

3. SolarEdge Technologies (SEDG -0.03%): Inverters + Whole-Home Energy Systems

Surging more than 179% this year, SEDG stock has had a strong 2025, but despite this performance, it is still far from the all-time high (ATH) of almost $390, which was reached in 2021.

The peak was recorded during a period when there was massive liquidity in the market due to low rates. By slashing rates to virtually zero, the Federal Reserve injected huge liquidity into the markets, which boosted company valuations. At the time, the markets at large were bouncing hard after the pandemic crash in early 2020, and with risk appetite high, investors chose to pile into clean energy stocks like SEDG, which surged 450% in less than a year.

Combined with speculative momentum, green energy hype, and favorable government policies, stock prices surged skyward.

But those conditions are no more. Higher rates, overvaluation, supply chain pressures, and the Donald Trump administration cracking down on renewables have stocks like SEDG now struggling. Currently, it has an EPS (TTM) of -30.40 and the P/E (TTM) of -1.25.

SolarEdge is a smart energy technology company that provides an inverter solution for a solar PV system. The DC optimized inverter aims to maximize power generation while reducing the cost of energy produced by the PV system.

The company is constantly innovating its whole-home and integrated battery systems while ramping up US manufacturing to strengthen its position in residential and commercial markets.

When it comes to financials, SolarEdge reported a revenue of $289.41 million for Q2, which increased 32% from the previous quarter. GAAP gross margin increased 2.9% to 11.1% and non-GAAP gross margin increased by 5.3% to 13.1%. GAAP net loss was $124.71 million, or $2.131.

SolarEdge Technologies, Inc. (SEDG -0.03%)

Free cash flow during this period was $9.1 million, down significantly from the prior quarter when it was $19.8 million. As of June 30, 2025, SolarEdge had $131.8 million in its cash and investments portfolio.

In Q2, the company shipped 1,194 MW (AC) of inverters and 247 MWh of batteries for PV applications.

“I’m proud of the steady progress we made in turning SolarEdge around this quarter. This was our second consecutive quarter of year-over-year and sequential revenue growth, along with margin expansion. We are staying laser-focused on elevating our execution and advancing our strategic priorities, positioning SolarEdge for the opportunities we see ahead.”

– CEO Shuki Nir

Most recently, the company unveiled its new Nexis all-in-one residential solar and modular battery system designed to integrate an inverter with stackable modular batteries. It offers a scalability of up to 19.6 kWh to support both backup and self-consumption. It is projected to be available in the market next year.

With this product launch, SolarEdge is building on its recent developments, including expanding shipments from its US manufacturing facilities to locations worldwide. It has already shipped residential solar technology to Australia, with plans to expand into other markets this quarter.

SolarEdge has also expanded its partnership with automotive and industrial supplier Schaeffler from powering its rooftops using solar tech to installing EV charging hardware and software throughout Europe.

4. Sunrun (RUN +1.22%): Residential Solar-as-a-Service + Batteries

Sunrun is a residential rooftop solar leader that also provides flexible financing.

The company is engaged in the development, installation, and maintenance of solar energy systems in the US. It also offers battery storage in select markets. Meanwhile, through its third-party ownership model with solar-as-a-service offerings, Sunrun removes upfront costs for customers, thereby accelerating adoption. The company is currently serving over a million customers.

Over the last 18 years, Sunrun solar energy systems have produced about 40 billion kilowatt-hours of clean energy, in turn, avoiding an estimated 21.6 million metric tons of CO2e from entering the atmosphere.

Last month, Sunrun noted that it has activated the nation’s first residential vehicle-to-grid distributed power plant in partnership with Baltimore Gas, Maryland’s largest utility, and Exelon Corporation’s subsidiary Electric Company (BGE). The pilot program dispatches energy from customers’ own all-electric Ford F-150 Lightning trucks to the grid during periods of high demand.

A month ago from that, an analysis reported Sunrun’s fleet of home batteries across California delivered an average of 535 MW to the grid, becoming the largest contributor to a historic distributed power plant dispatch event.

This year, Sunrun also introduced a new home energy plan, for which it has partnered with Tesla (TSLA +1.89%) Electric. Together, they will offer customers abundant solar production, seamless battery management, and advanced outage protection.

This isn’t all, though. Sunrun is even considering using its residential batteries to power data centers, which can open up massive growth avenues for the company.

If we look at Sunrun’s market performance, it has experienced a massive drawdown since topping at above $100 in 2021. This year, so far, RUN shares have rallied over 107% to now trade at $19.50. Analysts at Jefferies have also upgraded Sunrun to ‘Buy’ on anticipated cash generation this year and strong growth prospects next year.

Sunrun Inc. (RUN +1.22%)

With that, the $4.5 billion market cap company has delivered an EPS (TTM) of -11.75 and a P/E (TTM) of -1.66.

As for financials, in Q2, Sunrun’s unrestricted cash balance grew by $131 million, and its net earning assets increased by $2.4 billion. Cash generation during the quarter was $27 million, marking the fifth straight quarter of positive cash flow.

The company’s subscribers climbed to 941,701, and storage capacity installed reached 392 megawatt hours.

5. Enphase Energy (ENPH -0.1%): Microinverters + Home Energy Platform

The top player in microinverters and residential energy management, Enphase Energy enables people to harness the sun’s energy to create, save, and sell their own power and control it through a smart app. It provides solar solutions to both homes and businesses in over 160 countries.

Enphase has shipped over 83 million microinverters, while over 4.9 million Enphase-based systems have been deployed worldwide.

Powered by batteries, microinverters, an EV charger, and the app, the Enphase Energy System offers an integrated solar energy storage and management solution. There’s also a predictive software platform, powered by the AI Optimization profile, for simplifying the cleantech service landscape.

The global energy technology company brings a networked approach to solar generation plus energy storage by leveraging its design expertise across semiconductors, power electronics, and cloud-based software technologies.

When it comes to Enphase’s market performance, its stock prices are currently trading at $37.91, down 45% so far this year. The stocks are currently far off their $336 peak that was hit in late 2022.

Enphase Energy, Inc. (ENPH -0.1%)

This weak market performance is due to homeowners pulling back on installing solar systems, mainly due to higher rates and the rising cost of financing such products. This drop in demand is hurting Enphase’s core business.

Tariffs haven’t been kind to Enphase either. They have actually been major headwinds for company shares because of their reliance on China for battery cell components, though Enphase is working on remedying that. Not only is the tariff burden putting pressure on Enphase’s margins, but legislation and executive orders to cut government incentives are further adding significant stress to not just Enphase but also other solar companies.

To address the softening demand and compressing margins, the company laid off about 17% of its workforce last year and consolidated its operations.

Enphase’s $5 billion market cap has an EPS (TTM) of 1.04 and a P/E (TTM) of 36.44.

For the second quarter of 2025, the company reported a revenue of $363.2 million. Revenue in the US increased by 3% from Q1, with seasonality partially offset by lower safe harbor revenue, while revenue in Europe spiked by 11%.

Its non-GAAP gross margin was 48.6% with net IRA benefit and 37.2% excluding it.

During this period, GAAP diluted earnings per share were $0.28 and non-GAAP diluted earnings per share were $0.69. Free cash flow was $18.4 million.

Most recently, Enphase Energy formed a strategic partnership with Essent to offer its customers an opportunity to boost their systems by integrating IQ Batteries. The collaboration also enables participants to join Essent’s Smart Steering initiative, maximizing solar energy self-consumption and reducing electricity expenses by receiving a consistent monthly compensation.

Is Solar Still a Buy in 2025? Key Risks & Catalysts

These companies showcase the various ways solar energy momentum is being captured. They are leveraging technological innovation, large-scale clean energy infrastructure, and integrated smart energy solutions to facilitate the solar industry’s transformation into a dominant force in global electricity generation.

While challenges like supply chain constraints, high interest rates, and regulatory uncertainty remain, the long-term outlook for solar remains bright, given falling costs and improving efficiency of solar energy tech as solar leads the clean and sustainable energy revolution towards a healthier planet.

Click here to learn how the quest for sustainable energy leads to unconventional discoveries.