The Best Of...

Top 5 Technology ETFs to Watch as AI and Innovation Surge (2026)

Securities.io maintains rigorous editorial standards and may receive compensation from reviewed links. We are not a registered investment adviser and this is not investment advice. Please view our affiliate disclosure.

Technology Takeover

Technology has been the sector to be in for investors to maximize return, with extraordinary outperformance compared to the “old economy” businesses in sectors like energy, materials, utilities, or brick-and-mortar retail.

In large part, this is due to the sector’s continuous growth and higher margins, justifying ever-increasing valuation. This growth often came at the expense of older business models, for example, Amazon putting countless retail shops out of business, or smartphones replacing at once radio, cameras, phone booths, etc.

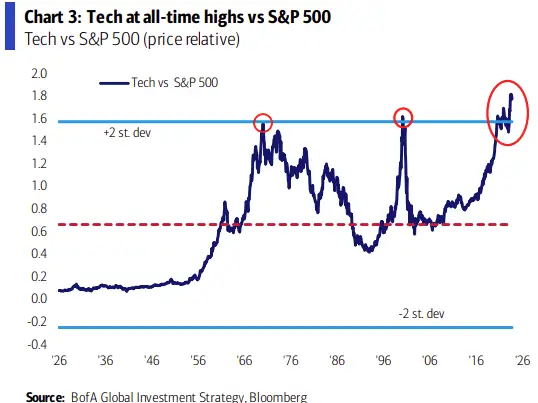

For a while, there were concerns that this was just another Internet Bubble like in 1999, doomed to burst when the promise of endless growth came crashing into the reality of a much slower tech takeover than expected, especially as valuations in the tech sector remain elevated relative to historical market averages.

Source: Market Insiders

And this might still happen. But overall, with AI rising as a new tailwind to the sector, threatening to disrupt even more industries, this might not be the case.

AIs like LLMs and AI agents could replace large segments of the videogame and movie industry, school and universities, research & development, customer services, translation and news services, legal and consulting firms, etc.

If this is the case, then tech companies and their stock prices are likely to keep rising, as they become an even larger part of the overall economy, to the point where “tech” might become a less and less relevant category and become the economy, the way “industry” has progressively become most of the economy in the 19th century during the transition from agrarian economies.

Picking The Right Stocks

The rise in tech stock versus the rest of the market nevertheless hides the difficulty of picking the right stock. For every ultra-successful and dominant Amazon or Apple, there is a failing or more stagnant competitor that failed, like eBay or Blackberry.

So diversification is most likely a good choice for most investors, as it is unclear which technology company or business model will become the king of the AI era.

A good way to do so is ETFs (Exchange Traded Funds), which allow investors to invest at once, for low fees, in dozens or even hundreds of different stocks.

As the financial industry released more specialized ETFs, this offered a way to create a “passive-active” portfolio, where investors do not pick individual stocks but can fine-tune their exposure to different sectors and geographies.

Best Tech ETFs: Invest in AI, Software, and Chips

1. Invesco QQQ Trust Series I

Invesco QQQ ETF tracks the Nasdaq-100 Index, a US financial exchange specializing in tech stocks.

This is the 2nd-most traded ETF in the US, providing plenty of liquidity for investors looking to not just invest but also trade the sector.

It is also the best-performing large-cap growth fund based on total return over the past 15 years, illustrating the last decade’s strong performance of US tech stocks.

Its top holdings include the world’s largest companies like Microsoft (MSFT -0.52%), Apple (AAPL -0.03%), and Nvidia (NVDA +1.21%), as well telecom companies like Cisco (CSCO -3.11%), and T-Mobile (TMUS -1%).

Source: VettaFi

As a result of its focus on the largest NASDAQ-listed companies, this is an ETF solely focused on large companies, which might impact its growth potential compared to smaller but riskier companies.

Source: VettaFi

2. VanEck Semiconductor ETF

VanEck Semiconductor ETF (SMH +1.64%)

Another option to bet on the rise of AI and the tech sector is to assume that a lot more computing power will be needed. As a result, more data centers, memory bars, CPU, and GPUs will need to be produced.

This would boost the performance of the semiconductor industry further, even when considering the recent boom in profit for AI/GPU-focused companies like Nvidia. The core concept would be to invest in semiconductor foundries like TSMC (TSM +1.09%) and other chip designers like AMD (AMD +2.25%).

This investment idea should ideally also cover adjacent sectors to semiconductor production, like networking systems and the manufacturers of machines used by the semiconductor foundries. For example, ASML (ASML +2.84%) and its monopoly on EUV (Extreme UltraViolet) technology, or Broadcom (AVGO +4.37%)

As a result, this ETF is a perfect choice to invest in the “picks and shovels” of the tech industry, without having to consider who will be the winner of the best design of AI.

Source: VanEck

This ETF is very US-centric, with Taiwan and the Netherlands next due to TSMC and ASML.

Source: VanEck

With low management fees of 0.35%, it can be a good long-term holding to bet on the rising demand for semiconductors and the tools to produce them.

3. iShares Expanded Tech-Software Sector ETF

iShares Expanded Tech-Software Sector ETF (IGV -0.87%)

Instead of betting on the hardware, investors interested in the tech sector can instead look at the software side of the industry. This can be a good idea as historically, the software segment has been able to capture a large part of the industry added value.

It is also traditionally a high-margin sector, as software tends to become more profitable as it scales up, with each new user bringing more revenues, but not much more costs.

Software is also a segment where the push for more AI will likely be the more visible, as many enterprises software or digital tools could benefit from more user friendly interface and specialized AI assistant to boost productivity further.

For example, the Photoshop suite from Adobe (ADBE -0.89%) is now offering AI to speed up graphic design jobs, or Oracle (ORCL -2.29%) databases provide AI analysis of a company’s key metrics.

Source: VettaFi

This ETF also includes important cybersecurity tools like Palo Alto Networks (PANW +0.05%) and Crowdstrike (CRWD +1.14%), which are increasingly central to companies’ operations as they digitalize.

4. KWEB KraneShares CSI China Internet ETF

KraneShares CSI China Internet ETF (KWEB +1.53%)

While the US tech sector has been the world’s largest for decades, it is now seeing serious competition coming from overseas, especially from China. Recently, this was made abundantly clear by the sudden and unexpected catch-up of the Chinese tech sector on AI tech.

Not only a previously unknown hedge fund called High Flyer created record-breaking DeepSeek with a fraction of the resources of US-based AI companies, but the AIs of China’s own tech giants like Alibaba (BABA +0.46%), TikTok creator ByteDance or Baidu (BIDU +2.25%) are also performing well against the AIs of Meta, Microsoft, or Google.

So this ETF can provide a hedge against the risk of Chinese tech companies competing successfully against American ones, especially in non-US markets like the EU or the rest of Asia.

Source: KraneShares

It also provides exposure to China’s domestic tech market and online retail, which is now much bigger than the US. For example, Chinese retail web sales totaled $2.1T in 2023, compared to “just” $1.1T in the United States, despite a still lower Internet penetration rate (77% versus 93% in the US).

Due to the US-China rising tensions under the Trump administration and the associated trade war and tariffs, the listing of Chinese companies in the US market has been under threat. This could temporarily affect KWEB and should be a risk investors take into account, although only a third of the ETF is invested in US-listed stocks, with the rest invested in Hong Kong-listed stocks.

Source: KraneShares

5. ARK Innovation ETF

ARK Innovation ETF (ARKK +0.69%)

Most tech ETFs focus on the largest companies, as they are both the most popular and well-known and also the most likely to have the capital and resources to develop ultra-advanced AI and other technologies.

However, most of the growth might be in smaller niches or newer sectors that are only starting to emerge, the same way that the most growth in the 2000s tech industry was not in telecom infrastructure that had boomed in the previous decade (Cisco), but in e-commerce (Amazon), new devices like smartphones (Apple) and new concepts like social networks (Meta).

This is the idea behind ARK Innovation ETF, with holdings in unconventional tech ideas, such as:

- Cryptocurrencies: Coinbase (COIN -0.02%)

- Online Trading: Robinhood (HOOD +0.48%)

- Electric flying taxis: Archer Aviation (ACHR +0.4%)

- Biotech data and AI: Recursion Pharmaceuticals (RXRX -0.98%)

- AI healthcare and cancer detection: Tempus AI (TEM -2.22%)

It is more present in companies developing “tech” but in other sectors than software and computer hardware, like healthcare, finance, retail, etc.

Source: VettiFi

This means that this ETF is a lot more exposed to mid-size and small companies, with both much higher risks and more growth potential.

Source: VettiFi

So this is more an ETF to invest in human ingenuity and overall technological progress, with a tilt towards VC-style investing, rather than the traditional “tech” industry, as illustrated by the breakdown of the underlying innovations of the ETF’s holdings.

Source: VettiFi