Biotech

Top 10 Pharmaceutical Stocks For Healthcare Innovation (May 2024)

Securities.io is not an investment adviser, and this does not constitute investment advice, financial advice, or trading advice. Securities.io does not recommend that any security should be bought, sold, or held by you. Conduct your own due diligence and consult a financial adviser before making any investment decisions.

Pharmaceutical Innovation At The Core Of Healthcare

The pharmaceutical industry has been built on the back of scientific innovation. The first innovators a century ago have turned into large pharmaceutical companies regularly re-inventing themselves.

This is because life sciences and medicine have evolved equally fast in the last few generations. In addition, patent protection often expires less than 10-15 years after the commercialization of a new therapy, forcing pharmaceutical companies to invent new products constantly.

Thanks to this pressure to constantly innovate, even large companies kept the incentives to stay able to invent regularly life-changing medicine.

In this article, we will see some of the best healthcare innovators in all arrays of medicine, from cancer treatments to vaccines, rare diseases, neurosciences, or metabolic therapies.

Top 10 Pharmaceutical Stocks for Healthcare Innovation

(These stocks are organized by market capitalization at the time of writing of this article)

1. Johnson & Johnson

The largest pharmaceutical company by revenues in 2022, with $94B. The company operates as a conglomerate of 3 sub-businesses: pharmaceuticals, medical devices, and consumer healthcare (by importance order).

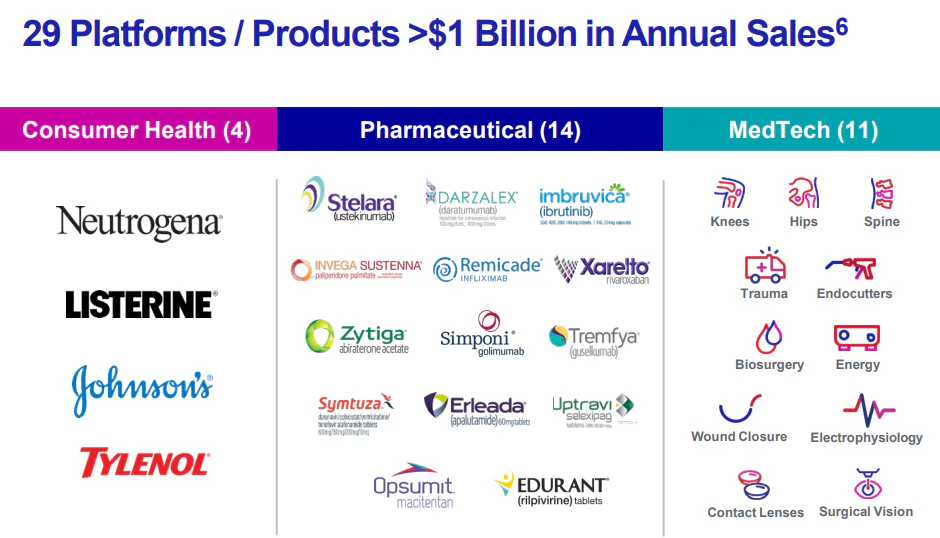

Source: J&J

It operates no less than 29 products or platforms with more than $1B in annual sales. Non-medical professionals might be more familiar with some of the consumer health products like Listerine, Neutrogena, or Tylenol. Still, more than half of its revenues are from pharmaceuticals, with a focus on 6 therapeutic areas:

- Immunology.

- Infectious diseases.

- Neurosciences

- Oncology

- Cardiovascular & metabolism.

- Pulmonary hypertension.

J&J was the second largest pharmaceutical company by R&D investment in 2022 and boasts an impressive lineup:

- 6 new products were approved in 2022.

- 20 large MedTech pipeline programs.

- 81 innovation deals.

- 20 new equity investments in 2022.

- 8 licensing agreements in 2022.

With its highly diversified activities in consumer health, pharmaceuticals, and medical devices, J&J is a good pick for investors looking to bet on pharmaceutical innovation with as little volatility as possible.

(You can read more about J&J's innovation strategy from this transcript of a speech given at Sanford C Bernstein Strategic Decisions Conference)

2. Bristol-Myers Squibb Company

BMS is a pharmaceutical company with a strong presence in cancer, hematology, immunology, and cardiology.

The company is targeting its risk-adjusted sales to grow from $10B-$13B in 2025 to $25+B in 2030, with the growth coming from both currently commercialized blockbuster drugs increasing their market and new therapies. The new therapies are growing very quickly, having more than doubled revenues between 2022 and 2023.

BMS also has more than 50 therapies in the early stage of clinical trials, of which half are in oncology.

With half of the 2020-2025 revenues expected to come from the new product portfolio, BMS has already achieved remarkable innovations and should strongly increase its operating margins.

The success is the commercialized new product portfolio is very encouraging, and BMS might be on the verge of a decade of explosive growth driven by its new product portfolio and its strong performance in all of its 4 core segments.

Investors will want to pay close attention to phase 3 of clinical trials and the continuing new product sales growth.

3. Novo Nordisk

Novo Nordisk's innovation has traditionally been razor-focused on diabetes, the core segment for the company. This is still true, with 10 clinical trials ongoing in the field.

Source: Novo Nordisk

However, the major innovation of Novo Nordisk is in the obesity market, with its newly launched Wegovy, an injectable medicine for weight loss initially used for diabetes.

The drug is showing strong medical results and has been regularly sold out, even with Novo Nordisk increasing production capacity several times. The drug is proving so popular that a TikTok-induced mania even increased the shortage.

The company is also working on growth hormones and acquiring the connected medical device BIOCORP.

While its diabetes business is likely stable for the next decade, innovative treatment could slowly endanger this market, especially for type-1 diabetes.

So, the expansion in the obesity market is likely to represent the long-term prospect for growth for Novo Nordisk. We discussed This market in more detail in our article “Top Companies In Obesity Treatments.”

4. Merck & Co.

Merck has changed since its 2021 spin-off of women's health and biosimilar products in Organon. The company is currently most active in infectious diseases, vaccines, oncology, and cardiovascular & metabolic disorders.

At its core, Merck is a technology company that goes beyond just pharmaceuticals. For example, it has a semiconductor offer (equally useful for many biotech equipment like DNA readers). It also controls Sigma Aldrich, a leading supplier of laboratory and testing materials and consumables, which is part of the broader life science offering, which relies on 59 manufacturing sites and proposes 300,000 products.

The company has an ambitious R&D roadmap, with 1 new pharmaceutical launch every 1.5 years. This includes the potential of a new therapeutic method for cancer, relying on targeted DNA disruption.

Source: Merck

Merck combines steady cash flow from its industrial capacities (semiconductors and life sciences) with the potential of new blockbuster drugs in cancer and neurology.

With Merck's flagship drug, Keytruda, losing its patent protection in 2028, these innovations will be needed to keep the company's income growing.

So, investors in Merck will want to keep an eye on the R&D portfolio to see if the company has been able to reinvent itself after that date.

5. Pfizer

Already a large company, Pfizer made it big with the Covid-19 vaccine. It generated no less than $37B in 2021, for example, almost half of the company's revenues. The pandemic also boosted the sale of the antiviral pill Paxlovid by another $20B.

Pfizer sees the pandemic windfall profits as leverage to expand with new products and to “allow us to pursue new business development opportunities going forward that could add at least $25 billion of risk-adjusted revenue to our 2030 top-line expectation.”

Among these opportunities for the next 2 years are 4 vaccines, of which 3 are mRNA, one treatment for growth hormone deficiency, and two for inflammatory diseases. It also covers 7 new indications for existing drugs and 4 business development deals.

Source: Pfizer

In the longer term, a lot more potential launches could also work in a large variety of applications. This includes a potential competitor on obesity to Novo Nordisk's Wegovy, new vaccines, hemophilia therapies, and cancer treatments.

Pfizer is a company that has demonstrated with the pandemic its ability to cash in on innovation and taken a strong lead in the vaccine sector. Combined with its previously well-established lines of business in oncology and inflammatory disease, this should reassure investors of Pfizer's ability to keep bringing new therapies to the market.

6. Bayer

Bayer is equal parts an agriculture company and a pharmaceutical company.

After its merger with Monsanto, it is one of the world's largest biotech and seed companies. It controls most of the traditional GMO seed market and is also working on using CRISPR for the next generation of seeds for corn, soybeans, wheat, etc…

The pharmaceutical activity, under prescription and over-the-counter (OTC), is roughly half of the company’s revenues, with the other half made of the agricultural business. It covers a large spectrum of therapeutic areas, with a third of its sales in the cardiovascular segment.

Source: Bayer Presentation

Bayer’s focus on innovation is on

- Eye treatments, in partnership with Regeneron (Eylea is the second best-selling drug of Bayer)

- Stem cell treatments for Parkinson’s disease and heart attacks, in partnership with BlueRock Therapeutics.

- Gene therapies, in partnership with AskBio.

- Oncology (cancer treatments): 2 drugs in clinical trials in phase III, 2 in phase II, and 8 in phase I

Far from a distraction, the agricultural segment of the company shares many R&D capacities and human resources with the pharmaceutical segment.

However, Bayer's stock valuation has been hammered down due to legal risk from its Monsanto acquisition and court case on the potential of the pesticide RoundUp to cause cancer.

So investors will want to assess if the pharmaceutical segment is at a deep discount due to these legal issues or if the risk is too high despite Bayer's other IPs and R&D pipeline quality.

7. Amgen

Amgen is maybe the poster child of success in biotechnology, both for its technological achievement and from an investing point of view. It went from a price of $0.11/share in 1984 to a recent price in the $225-$285/share range in 2022.

Its first achievement was creating the first recombinant human erythropoetin in 1989. It would follow with treatments for rheumatoid arthritis in 1998 and osteoporosis and cancer in 2010, among other protein and biological-based therapeutics.

It currently has a total of 27 approved treatments, treating 11 million patients. Its most quickly growing products (9 products worth $ 10.5B in sales) have grown their sales volume by 16% in 2022.

It has 39 potential drugs in its pipeline, of which 18 are already in clinical trials phase 3, with a strong predominance of inflammation and oncology for these most advanced clinical trials.

Another innovation is AMG 133, an obesity treatment that is hoped to be more powerful than the existing therapies. AMG 133’s unique advantage would also be a long half-life, with a dosage every 4 weeks instead of the required weekly treatment of Wegovy.

Because it is only entering phase 2 of clinical trials and because the company focuses on a wide array of therapies, AMG 133 is less central to the investment thesis for Amgen. Still, a potential 5-20 billion dollar blockbuster drug could seriously boost the company's bottom line. So, with Wegovy showing the market is larger than expected, this is something investors in Amgen will want to keep an eye on.

The company also has a biosimilar department (the equivalent of generic drugs for biotech treatments), with 5 approved drugs and 3 drugs in the R&D pipeline.

Amgen has historically been one of the most innovative pharmaceutical companies ever made, almost single-handedly creating the biotech sector. Its impressive R&D pipeline shows Amgen is determined to keep that reputation intact, including by venturing into new segments like the obesity market.

8. Gilead Sciences

Gilead is the other big biotech success story of the last 30 years. Where Amgen focuses on unique proteins, Gilead is centered around specific therapeutic areas, with a predilection for untreated diseases, mostly in virology at first and then in oncology.

An emerging focus is also inflammation, the root cause of many other hard-to-treat diseases. Still, HIV represents by far the bulk of Gilead's current income.

Source: Gilead

It currently has 30 approved drugs, most of them for HIV, Hepatitis, and cancer. Its R&D pipeline contains 59 clinical trial programs, of which 19 are in phase 3.

The R&D programs are overwhelmingly dominated by infectious diseases and oncology clinical trials, deepening Gilead's specialization, especially with 13 HIV-related clinical trials.

Gilead is a surprisingly “niche” biotech for its market cap, very focused on HIV and, to some extent, oncology. Investors in Gilead might want to understand the dynamic of the HIV drug market as most of the company's ongoing cash flow is tied to it.

9. BioNTech

The company behind the Covid mRNA vaccine sold by Pfizer is now using the money made during the pandemic to expand its offer widely.

It is now developing mRNA vaccines for shingles, tuberculosis, malaria, HIV, and the herpes virus. This makes it a leading company in the field of mRNA vaccines, with only its competitor Moderna (MRNA) developing more mRNA vaccines than BioNTech. You can read more about the future of mRNA technology in our article “The Next Application for mRNA Technology: Cancer Therapies.”

BioNTech is also working on various other therapeutic methods, including cell and gene therapies, antibodies, and chemical drugs.

As the great winner of true transformation innovation with the arrival of mRNA during the pandemic, BioNTech has a spotless image with investors, even if the current stock price cooled down from the pandemic highs.

The company's future will depend on expanding mRNA to replace many older vaccines and on mRNA capacity to be used for other applications, of which cancer is the most promising financially.

10. Moderna

The other big winner of the pandemic and the mRNA vaccine technology, Moderna, is doubling down on the vaccine application of mRNA. It has no less than 32 clinical trials for mRNA vaccines, covering 14 pathogens like the RSV, Zika, HIV, Epstein-Barr virus, or cytomegalovirus.

Despite the focus on vaccine application, Moderna also has some research programs regarding cancer application, cardiac regeneration, and rare diseases, including cystic fibrosis in partnership with the leader in this sector, Vertex.

This R&D frenzy is fueled by the revenues from the COVID-19 vaccine and represents a tripling of R&D spending in 2023 compared to 2020.

Source: Moderna

Moderna is also looking to use its available cash, $16.4B in Q1 2023, to acquire licenses from smaller biotech or directly acquire these companies. The focus seems to be on technology platforms, which include synthetic genome company OriCiro, metagenomics and AI gene discovery Metagenomi, and macrophage therapies Carisma Therapeutics.

Moderna is, for now, a mRNA company with strong prospects in infectious diseases and rare genetic diseases. In the long run, its collaboration with startups working on new biotech technologies could yield out-sized results, similar to how mRNA used to be just a theoretical concept for decades.