Stellar Investor

Stellar Vs. XRP – What’s the Difference?

Securities.io is committed to rigorous editorial standards. We may receive compensation when you click on links to products we review. Please view our affiliate disclosure. Trading involves risk which may result in the loss of capital.

Table Of Contents

Understanding the differences between XRP and Stellar Lumens (XLM) is a crucial step in familiarizing yourself with the blockchain sector. Both of these projects have a strong community following and other characteristics they share in common. That being said, there are still many differences between the platforms that make each uniquely suited for their specific purposes.

What is XRP?

People often use the term Ripple to describe XRP. However, this is incorrect as Ripple is a private company and the XRP ledger is an open, public, decentralized network that anyone can use. The XRP Ledger community consists of a number of companies that use XRP and the XRP Ledger for a variety of use cases, including cross-border payments, Coil for Web Monetization, and Forte for gaming.

Ripple also runs a separate private network called RippleNet. RippleNet is designed to connect banks and financial institutions efficiently. RippleNet can access liquidity on the XRP Ledger using Ripple’s ODL (On Demand Liquidity) product. Lastly, you have the XRP Ledger Foundation. This is a non-profit foundation that fosters development and encourages the adoption of the XRP Ledger.

What makes Ripple different, and why it has always been a bit of a black sheep among early crypto projects, is the fact that it’s designed to serve the central banking community. Ripple functions as global payments network specifically designed to streamline international financial transactions between Ripple Net participants. This group is comprised mostly of banks but there are some other notable financial institutions, such as Money Gram, that have joined the team to leverage Ripple’s real-time gross settlement system, currency exchange, and remittance network.

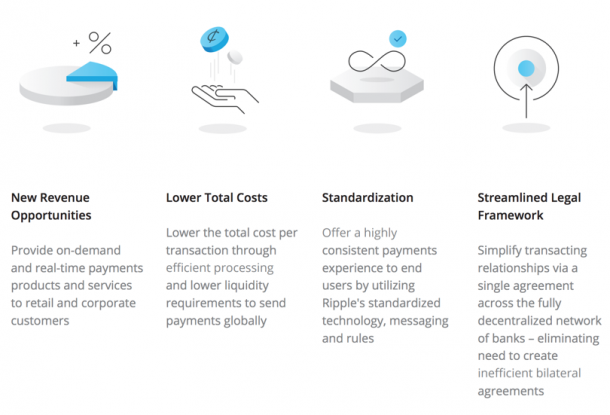

RippleNet Benefits

What is Stellar Lumens?

Stellar Lumens (XLM) is a cryptocurrency designed to facilitate the same style of cross-border transactions as Ripple, albeit to a slightly different crowd. Stellar Lumens is geared primarily to enterprise clientele, although it also works with banks and financial institutions. The project is backed by a non-profit called the Stellar Development Foundation (SDF). This group focuses on expanding the Stellar Lumens’ ecosystem and securing new strategic partnerships.

A Shared History

The similarities in these two projects are not some random occurrence. Many are surprised to learn that the projects share a developer, Jeb McCaleb. Here's how the Ripple concept helped spawn one of its biggest competitors, Stellar Lumens, into existence.

XRP vs Stellar Lumens (XLM) Company Histories

Ripple (XRP) officially launched in 2012 to moderate market hype. This was the early days of the market as Bitcoin was only three years old. Notably, XRP was the first bank-focused cryptocurrency. As such, it was seen by many long-time crypto users as a bit of a sell-out during those early years. Remember, Bitcoin was developed to free people from the same system that Ripple was designed to serve.

XRP Chart CoinMarketCap – Ripple (XRP) vs Stellar Lumens (XLM)

However, Ripple was anything but a sellout. If anything, it was ahead of the curve. The reality is the project has helped spur blockchain adoption in many ways. Currently, the platform supports tokens representing fiat currencies, cryptocurrencies, commodities, and more.

Notably, Ripple is a privately owned for-profit firm. The platform's developments are decided on by the members of the Ripple Foundation and its development team. Interestingly, during Ripple's launch, 1 billion XRP were pre-mined. These tokens have been slowly released into the network via a few major investors.

Ripple Founders

Ripple was founded by a group of long-time blockchain developers. Specifically, the concept was conceived by Ryan Fugger and led by Jed McCaleb and Chris Larsen. All have a long vibrant history in the sector. McCaleb has been a pioneering force in the market since its early days. He is best known for starting the now-defunct Mt.Gox cryptocurrency exchange.

Larsen was the founder of a number of successful FinTech startups including E-Loan, which he later sold to Banco Popular. The group also recruited Arthur Britto and David Schwartz to assist in building the project. Interestingly, Ripple (XRP) originally entered the market under the name OpenCoin on April 11, 2013. In September of the same year, the group officially rebranded to Ripple Labs.

Ripples Turn to Waves

As Ripple began to expand its network, a rift began to become evident among some of its core developers. Specifically, McCaleb began to express concerns about the project's overall direction. According to inside sources, there were multiple instances where his concepts and ideas were shot down by the rest of the Ripple development team.

Stellar Lumens (XLM) is Born

These concerns led to McCaleb splitting for Ripple in 2014 and launching his own international payments network called Stellar Lumens. Notably, the split wasn't amicable as McCaleb began to dump his billions of XRP. This decision led to Ripple filing a lawsuit to block him from tanking the market value of the coin.

Jed McCaleb via WorldStockMarket

Stellar Lumens officially entered the market in 2014. The project was co-founded by McCaleb and former lawyer, Joyce Kim. Stellar Lumen's main functionalities are very similar to Ripple, with a few changes. XLM, the platform's utility token, was built to provide an easy way for enterprise clientele to create, send, and trade digital representations of all forms of money.

A Well-Funded Launch

Stellar Lumens received major market support during its early funding stages. The network secured funding from Stripe CEO, Patrick Collison, WordPress Founder, Matt Mullenweg, and AngelList Founder, Naval. Notably, Stripe received 2 billion XLM for its seed funding of the project.

Ripple (XRP) vs. Stellar Lumens (XLM) Mechanics

When you look at the technical structure of these networks it’s easier to see all the differences. For one, XLM has a cap of 50,001,806,812, whereas, XRP is set at 100,000,000,000. Notably, the majority of Ripple is held by its development team and early investors at this time. The firm releases these coins at a rate of 1 billion a month. Notably, only around 10%-30% enter service with the majority going into an escrow account. Users can track these issuances via the xrpL.

XRP vs. Stellar Lumens (XLM) Consensus Mechanisms

The Ripple Consensus mechanism relies on six components. There are servers running Ripple Server software, a distributed ledger, a last-closed, ledger, and an open ledger. The ledger holds the value of all user’s accounts. The last closed ledger is the most recent version of the ledger and the open ledger is the ledger's current operating status.

There is also a Unique Node List (UNL). This is a set of other server queries used during validation. Lastly, a Proposer is any server broadcasting transactions to be included in the consensus process. The Ripple Protocol Consensus Algorithm (RPCA) is applied every few seconds by all nodes, in order to maintain the correctness and agreement of the network.

The main advantage of Ripple's DLT is that it’s extremely scalable. The platform can handle around 1,500 transactions per second (tps) currently. This scalability also improves transaction fees. The network's standard transaction fee averages out to 0.00001 XRP per transaction.

Stellar Consensus Protocol (SCP)

The Stellar Consensus Protocol was first published in 2015 by David Mazières. The document laid out how the SCP could secure a decentralized network in an efficient manner without sacrificing performance. The SCP relies on a combination of digital signatures and hash families to validate the state of the network. Unlike Ripple's closed network, anyone can become a validator, archiver node, or horizon server on Stellar Lumens’ blockchain.

Stellar Lumens (XLM) – CoinMarketCap

The SCP provides extremely low latency. The network has been stress tested to +1000 tps. This test was conducted with 1 billion accounts operating on the ledger. In this way, Stellar Lumens provides enterprise clientele with a reliable and secure means to conduct international transactions.

Regulatory Concerns

Ripple is currently in the midst of an SEC court battle. The SEC has alleged Ripple unlawfully sold securities during its XRP ICO. According to the most recent reports, the firm is prepared to argue “The Fair Notice” defense. This strategy argues the firm had no reasonable fair notice from the SEC on whether selling XRP would constitute an illegal securities offering.

Why the Ripple Case is Pivotal

If Ripple (XRP) is successful in its argument, the effects would have a “ripple” effect throughout the industry. Moving forward, the SEC would have to prove they warned ICOs that their efforts could be considered illegal to impose harsh fines. Speaking on the company’s future plans, Ripple’s CEO, Brad Garlighaus has stated that his firm intends to consider going public following the resolution of the SEC lawsuit.

Stellar (XLM) – A Smooth Ride

Of course, the experience and insight gained by McCaleb during his stint at Ripple paid off greatly in terms of regulatory concerns. To date, Stellar has managed to remain out of the SEC's crosshairs. Notably, the platform even received regulatory approval from the New York Department of Financial Services to be listed.

Stellar Goes Hyper

This month, Stellar Lumens raised eyebrows across the market when it announced that it had partnered with VISA, Tala, and Circle, one of the companies behind USDC, to create a new decentralized ecosystem. The team will create a new stablecoin and wallet that will enable users to make cross-border transactions and access fiat to crypto services.

For its part, VISA intends to issue cards that are directly linked to the wallets. These cards will enable users to spend their crypto anywhere that accepts VISA. Currently, VISA’s network consists of +70 million merchants globally.

How to Buy Stellar (XLM) and Ripple (XRP)

These are two of the most popular cryptocurrencies in the world. The exchanges below enable the purchase of both of these digital assets.

Uphold – This is one of the top exchanges for United States & UK residents that offers a wide range of cryptocurrencies. Germany & Netherlands are prohibited.

Uphold Disclaimer: Terms Apply. Cryptoassets are highly volatile. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

Kraken – Founded in 2011, Kraken is one of the most trusted names in the industry with over 9,000,000 users, and over $207 billion in quarterly trading volume.

The Kraken exchange offers trading access to over 190 countries including Australia, Canada, Europe, and is a top exchange for USA residents. (Excluding New York & Washington state).

Ripple (XRP) and Stellar Lumens (XLM) – Depends on Your Goals

In terms of what project is a better investment, there’s no one-size-fits-all answer. Both firms have managed to secure some impressive strategic partnerships and both projects have a lot of pilot programs currently underway. For these reasons, both networks could be considered long-term investments.

To learn more, make sure to visit our Investing in Ripple and Investing in Stellar guides.

*July 14, 2023 UPDATE*

After a multi-year court battle, Judge Torres, who was presiding over the case, announced a split decision surrounding the charges laid against Ripple Labs by the SEC.

“For the foregoing reasons, te SEC's motion for summary judgment is GRANTED as to the Institutional Sales, and otherwise DENIED. Defendants' motion for summary judgment is GRANTED as to the Programmatic Sales, the Other Distributions, and Larsen's and Garlinghouse's sales, and DENIED as to the Institutional Sales.”

Simply put, Ripple was found guilty of selling unregistered securities directly to institutions, as these were clearly viewed as investment contracts. Outside of this point, which is in favor of the SEC, it is widely viewed that Ripple ‘won' the case. It was found that both programmatic sales of XRP and those made by Larsen & Garlinghouse did not constitute the sale of unregistered securities.

This decision was made due to the following distinction.

“…the vast majority of individuals who purchased XRP from digital asset exchanges did not invest their money in Ripple at all. An Institutional Buer knowingly purchased XRP directly from Ripple pursuant to a contract, but the economic reality is that a Programmatic Buyer stood in the same shoes as a secondary market purchaser who did not know to whom or what it was paying its money…Therefore, having considered the economic reality and totality of circumstances, the Court concludes that Ripple's Programmatic Sales of XRP did not constitute the offer and sale of investment contracts.”

These rulings are significant, as many of the circumstances of the case and points made echo those of other digital assets on the market. While each and every case is unique, a modest level of clarity has now been provided for the status of altcoins.

While the ruling may be challenged by the SEC, digital asset exchanges have already begun relisting the asset now that the fear of regulatory violation has diminished. Moving forward, a trial will decide whether Larson and Garlinghouse knowingly aided in the illegalities that the company did take part in.

David Hamilton is a full-time journalist and a long-time bitcoinist. He specializes in writing articles on the blockchain. His articles have been published in multiple bitcoin publications including Bitcoinlightning.com

You may like

Investing in Stellar Lumens (XLM) – Everything You Need to Know

Investing in Ripple (XRP) – Everything You Need to Know

Investing In Bitcoin (BTC) – Everything You Need to Know

Investing in Litecoin (LTC) – Everything You Need to Know

Bitcoin Vs. Litecoin – What’s the Difference?

Ripple Vs. Cardano – What’s the Difference?