Transportation

2025: The Year Self-Driving Cars Go Mainstream?

Securities.io maintains rigorous editorial standards and may receive compensation from reviewed links. We are not a registered investment adviser and this is not investment advice. Please view our affiliate disclosure.

When Will Self-Driving Cars Arrive?

When it comes to disruptive technologies that seem just around the corner, few appear as impactful for the economy and society at large as autonomous or ‘self-driving’, except, of course, maybe AGI (Artificial General Intelligence).

This is due to the tremendous number of jobs and tasks that require humans to drive vehicles. This starts with the driving jobs, such as taxi drivers, delivery services, truck drivers, etc. But more fundamentally, most of the world’s population is performing that task unpaid, often wasting hours of their day, every day, behind the wheel.

This represents a massive loss of productivity that weighs on the economy, our daily life, and culture. This is why, already in 2023, robotaxis were projected to generate up to four trillion dollars in revenues.

However, developing truly autonomous vehicles is hard, and so far, fully automated transportation has yet to hit the roads. How close are we to large-scale deployment of self-driving vehicles?

Self-Driving Massive Potential

Back in 2023, the ARK Invest “Big Ideas” report projected massive potential revenues for robotaxis, with revenues as high as $9T projected by 2030.

Behind the idea is the core economic fact that robotaxis could reduce the need for owning a car, as long as the rides are cheap enough.

This can create a positive feedback loop, where cheap fares increase demand, which increases the utilization of the robotaxis, amortizing the capital costs further, reducing prices, which increases demand further, etc.

It notes that if service providers can lower this to $0.25 per mile, autonomous taxi services will “be more cost effective than 95% of short-haul journeys.”

The economics of self-driving are even more straightforward if it can address freight like trucks and ships. Here, the drivers and crews are just costs to be removed from the business structure if the autonomous systems are reliable enough to replace them.

Source: ARK Invest

So overall, there is no question that self-driving vehicles would be massive money makers, which is also why so many tech companies have been pouring tens of billions into developing this technology. But it appears that it is a tough puzzle to solve.

Building The Self-Driving Tech Stack

Supporting Techs

Before discussing the core of autonomous vehicles, the AI that directs them, we can briefly discuss why the past decade has made self-driving cars, but also drones and other items, economically viable.

One reason is the collapsing costs of sensors and computing power. It is easy to forget that the first iPhone was only released in 2007, and that a phone with a good camera and working like a mini-computer was a revolution at the time, less than 20 years ago.

Since then, optics, sensors, chips, and other electronics components have only become cheaper, more powerful, and more reliable.

The rise of EVs since the first Tesla Roadster in 2008 has also changed how vehicles function. The new electric car can provide a massive amount of electric power from its massive battery and drive train, making the power supply of the self-driving chips and its sensors an almost trivial matter.

Electric cars are also a lot more reliable mechanically, able to drive much longer distances with lower wear and tear, and their fuel is overall a lot cheaper per mile, making them the perfect “robotaxis” driving all day long for many users. In comparison, self-driving technology would have much poorer economics if it had to rely on ICE (Internal Combustion Engine) cars.

Overall, today’s cars are already pretty much a computer on wheels, with 300-1,000 chips per car, and some EVs have up to 3,000 chips per car. It just misses the “brain” to drive itself.

Source: Polar Semi

Understanding Roads

For the most basic functions, like identifying the road to take from point A to point B, most self-driving AI are perfectly able to perform the task for more than a decade, especially since the mass adoption of GPS and “Maps” apps providing the required data.

The tricky part is for the car to understand what is changing on the road: weather conditions, other cars, pedestrians, bicycles, animals, etc.

Here, too, the general case proved relatively quick to be solved, with systems allowing for “assisted driving” on highways, a much less challenging environment, already on offer in most high-end cars.

But more complex situations, like construction zones, downtown areas, the presence of pedestrians, and traffic accidents, are more difficult to deal with.

Generally, self-driving systems are ranked along a spectrum, from mere assistance to keep speed stable and park, to the idealized perfect self-driving vehicle. The last level, L5, or full automation not requiring a driver, is still elusive.

Source: MobileEye

Usually, failure to achieve the L5 level of autonomy comes from rare cases that confuse the AI. For example, a computer might struggle to understand the situation of a car in a multi-level parking lot:

“The vehicle thought the cars parked in the parking garage were blocking the road. It thought, ‘Car stopped, go around the curb.’

When a system encounters something and doesn’t know what to do about it, in many cases, the car simply stops moving.”

Neural Networks Hardware

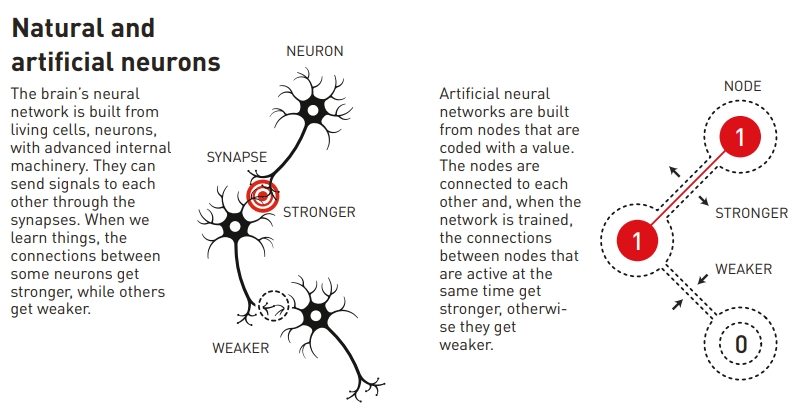

Most of the recent progress made in AI has been built based on neural network technology, which won the 2024 Nobel Prize in Physics. Contrary to ordinary computing, which requires a rigid set of commands for every situation, neural networks can adapt to their training conditions to provide the appropriate response.

Source: Nobel Prize

This makes them inherently better at handling “messy” situations, where the inputs are highly variable, and the data is always somewhat confusing for a computer (“noisy”).

For a long time, neural networks have been trained and run on GPUs, repurposing computer graphics cards into AI hardware. More recently, hardware dedicated to AI and neural networks is being developed.

Among other AI hardware (which we discussed in further detail in a dedicated report), Neural Network Processors (NNPs) are especially relevant for self-driving AI. Also called Neural Processing Units (NPUs) or neuromorphic chips, they can complete an operation with just one calculation instead of several thousand with generalist hardware.

Because of this energy efficiency, NPUs are popular for so-called “edge computing”, where the calculations are done on-site instead of in the cloud.

As self-driving needs to be reliable, very quickly reactive, and not depend on a connection, it mostly relies on edge computing running a neural network locally, even if the training of the AI was done in the cloud before.

Picking The Right Tech

Geofencing Vs Free Driving

Why Geofencing

A major choice in terms of technology and business strategy for future self-driving car companies has been the decision of using geofencing or not.

Geofencing is when a self-driving system is specifically trained to perform only in a limited geographic area, setting a virtual border for where the autonomous driving system can operate.

The idea is that by limiting the area, the AI system can learn well enough these roads in particular to be trusted to drive safely in them.

“Limiting the area to more ‘private’ locations, or even sidewalks versus roads, can significantly reduce the type of interactions the vehicle will have with other objects, such as cars, trucks, cyclists and pedestrians.”

Robert Day – Director of automotive partnerships for Arm’s Automotive and IoT.

By reducing the number of cases the AI needs to deal with, as well as the road and possible paths, it greatly reduces the computation required, which impacts the required hardware as well.

“The limits provided by geofencing have a profound effect on the capabilities that an autonomous vehicle requires, which impacts the hardware required to power the autonomous systems.”

Robert Day – Director of automotive partnerships for Arm’s Automotive and IoT.

However, this severely limits the deployment possibilities of autonomous vehicles. It means that every new city requires the self-driving company to create a custom set of training data, usually by manually driving cars in the areas for several years before launch.

It makes the approach rather costly.

It also makes self-driving cars only attractive to robotaxi companies, with individual people likely to still need their own cars, as they are going to want to occasionally drive out of the geofenced areas, which are usually limited to downtown or just one city.

If the industry stays stuck in this paradigm, most of the gains expected from the mass adoption of robotaxis will just not happen.

Legal & Business Implications Of Geofencing

At the same time, opting for a direct-to-full self-driving without any limitation can be self-defeating.

It can delay deployment of autonomous services, as it needs to be perfect everywhere first, instead of being deployed in a limited list of cities first, where it could already reach millions of users.

Another problem is the rules and laws around self-driving systems. Regulators have been reluctant but willing to accept the slow deployment of geofenced solutions, especially when safety in a given zone has been demonstrated.

But a global, unlimited authorization of self-driving cars will require not just local approval, but national-level laws and regulations that are yet to be created.

As law often moves much more slowly than technology, this could prove a serious problem for the unlimited deployment of the L5 level of autonomy, even if all technical issues are already solved.

LIDAR Vs Cameras-Only

Another debate in the industry is the use of LIDAR (light detection and ranging, or “laser radar”). LIDAR uses laser beams to detect nearby objects, creating a real-time 3D model of its environment.

Source: Autoweek

LIDAR systems are usually placed on top of the self-driving cars, making for a rather bulky addition to them.

An advantage of LIDAR is that it can see more than cameras, and excels at evaluating distances, making it especially useful to avoid accidents at high speeds. It can also operate perfectly in the dark or low-light conditions.

Source: Forbes

Often, LIDAR is used in conjunction with radar to detect objects even in difficult conditions, like fog, for example.

Most self-driving technology relies on LIDAR in order to increase safety, with the exception of Tesla (TSLA -2.17%), but it comes with a few drawbacks.

The first one is cost. As most high-end LIDAR systems cost around $70,000-$80,000, this makes self-driving cars rather expensive. This might not be true forever, as there are signs that LIDAR has become a lot cheaper recently, especially for low-end LIDARs, maybe making them more commercially viable.

“It’s about both volume and technology itself. The automotive industry relies on scale to reduce costs. When application volume increases, costs come down.

A LiDAR unit, for instance, used to cost 30,000 yuan (about $4,100), but now it costs only around 1,000 yuan (about $138) — a dramatic decrease.”

LIDAR is a rather complex technology with a lot of moving parts (rotating mini-mirrors), which is one reason for the high cost, and can make maintenance and reliability a hassle.

Lastly, any AI trained with LIDAR data will likely forever need them to perform well, as this requirement will be embedded deep into the neural network. So any company going with LIDAR for training its self-driving system might just be stuck with it moving forward.

How Safe Must Self-Driving Cars Be?

A key question for both regulators and users is how safe a self-driving car needs to be. In theory, if self-driving cars are 5x safer than a human driver, they should be quickly adopted and welcomed as a progress.

However, in practice, people are very reluctant to trust a machine that is only marginally safer than the error-prone humans. Humans also tend to overestimate their driving capacity.

So even when self-driving systems have been much safer than human-driven cars for years (as illustrated by Tesla data in 2023 already), the perception of any crash being a “failure” of the AI persists.

The recording of every crash by the car’s cameras, and the reactions of the mainstream and social media, don’t help either.

Source: ARK Invest

As a result, it is likely that the very high bar of 10x-100x safer than a human driver will be required for authorization of fully unrestricted L5-level self-driving to be let loose on all roads.

Self-Driving Companies

Swipe to scroll →

| Company | Core Market | Tech Approach | Deployment Status |

|---|---|---|---|

| Waymo | Robotaxi | Geofenced, LIDAR + radar | ~250k paid rides/week in select US cities |

| Tesla | Consumer EV + Robotaxi | Cameras only | Texas pilot; safety driver onboard |

| Baidu | Robotaxi | Multi-sensor (incl. LIDAR) | Driverless ops in China; Uber partnership |

| Zoox | Custom robotaxi | No wheel/pedals, LIDAR | NHTSA exemption; testing in multiple US cities |

| Aurora Innovation | Freight trucks | Highway autonomy | First fully driverless run (May 2025) |

| WeRide | Robotaxi | Multi-sensor fusion incl. high-line LIDAR | 24/7 pilot in Beijing; UAE expansion |

| Mobileye | ADAS & autonomous stack | Camera-first, REM HD mapping | Broad OEM footprint; evolving autonomy |

Waymo

Alphabet Inc. (GOOGL -0.54%)

When it comes to actual robotaxis deployed, a clear leader is emerging: Google-linked Waymo. In April 2025, Waymo was already reporting 250,000 paid robotaxis rides per week in the USA, mostly in Austin, Phoenix, and the San Francisco Bay Area, with a million miles driven monthly.

Waymo’s success stems from an early start (the company was launched in 2010, with technology tracing back to 2005), and a very cautious approach: its robotaxis are geofenced and heavily rely on high-end LIDAR systems, winning the race to safe autonomous ride, even if limited to a few areas so far.

This has helped Waymo lock valuable alliances like a strategic partnership with Toyota, the world’s largest automaker by unit sold (>10 million per year).

Toyota and Waymo aim to combine their respective strengths to develop a new autonomous vehicle platform. In parallel, the companies will explore how to leverage Waymo’s autonomous technology and Toyota’s vehicle expertise to enhance next-generation personally owned vehicles (POVs).

Toyota is committed to realizing a society with zero traffic accidents and becoming a mobility company that delivers mobility for all.

Hiroki Nakajima – Executive Vice President of Toyota Motor Corporation

(You can read more about Toyota in its dedicated investment report)

Tesla

Tesla, Inc. (TSLA -2.17%)

The other major contender in the race to self-driving cars and robotaxis is Tesla.

The company has had a major advantage in the fact that all its sold vehicles are equipped with cameras that the company expects to be enough to train its AI, without requiring LIDAR, or even radars.

This means that Tesla gets millions of miles of training data “for free”, provided by buyers of Teslas driving in real-world conditions. In contrast, almost all other self-driving companies need to pay drivers to drive real streets for years in each geofenced area, greatly increasing costs.

Source: ARK Invest

However, the release of Full Self-Driving (FSD) by Tesla has been a perpetually “soon” and then delayed announcement for several years (from expectations of autonomous cars available in 2018), leading to some harsh criticisms about setting unrealistic expectations.

However, this might finally be changing, with Texas granting Tesla Robotaxi a permit to run a ride-hailing service in August 2025, after a test run in Austin since June 2025. For now, a Tesla employee is still on board as a safety monitor.

So Tesla is, as always, controversial, with some seeing the Texas approval as the first step to large-scale deployment of FSD, and the human safety monitor as a temporary issue, while others believe Tesla will never release truly autonomous robotaxis.

The truth is probably somewhere in between.

In theory, if humans can use only their eyes to drive a car, so can an AI, so using only cameras should not be an issue forever. At the same time, this ambitious strategy, which might be correct in the long term, has clearly hindered Tesla’s short-term deployment, no matter how positive Elon Musk wants to be about it.

(You can read more about Tesla in its dedicated investment report)

Baidu

Baidu, China’s leading search engine, is following in the tracks of Google with Apollo Go, its own self-driving cars.

Baidu has transitioned to fully driverless operations in several Chinese cities, removing safety drivers from their vehicles.

Baidu made a deal with Uber in July 2025 to bring its driverless cars to the world outside of the USA and China.

The two companies said the multi-year partnership will see ‘thousands’ of Baidu’s Apollo Go autonomous vehicles on Uber globally.

Baidu already provided 899,000 rides in the second quarter of 2024. In 2025, pilot zones will have expanded to 20 cities.

In 2024, Baidu open-sourced its autonomous driving technology, confirming a trend of Chinese AI tech toward open source, as illustrated by a similar move by the generalist AI sensation DeepSeek.

For the USA market, Baidu is unlikely to make much progress in the context of trade tensions and concerns about users’ data, but it might be a serious contender to Waymo and Tesla overseas, especially with the support of Uber.

Zoox

Amazon.com, Inc. (AMZN -4.42%)

Zoox, a subsidiary of Amazon, is easy to identify for its unique design, building its robotaxi as dedicated vehicles away from the normal features of a regular car.

Source: TechCrunch

The company just secured an exemption from the National Highway Traffic Safety Administration’s expanded Automated Vehicle Exemption Program, allowing it to demonstrate its custom-built robotaxis on public roads. This is an important step as Zoox robotaxis lack essential features of normal cars, like a steering wheel and pedals.

Zoox launched in June 2025 its first production line for its vehicles, aiming to produce more than 10,000 robotaxis annually. This follows the tests made in several US cities and expanding to more: Las Vegas, San Francisco Bay Area, Seattle, Austin, Miami, Los Angeles, and Atlanta.

Zoox now plans to roll out commercial robotaxi riding offers in Las Vegas, San Francisco, and then in Austin and Miami in the next few years.

(You can read more about Amazon in its dedicated investment report)

WeRide

WeRide Inc. (WRD +3.52%)

WeRide is a company established in Silicon Valley in 2017 and is headquartered in China. The company has made many tests around the world, notably in the UAE, an area where it is now expanding thanks to a partnership with Uber. It is also now deploying a 24/7 robotaxi in Beijing.

To address potential visibility issues at night, WeRide’s robotaxi is equipped with more than 20 sensors, including high-precision, high-dynamic cameras and high-line lidars across the vehicle.

Combined with its multi-sensor fusion algorithm and high-performance computing platform, the system achieves 360° blind-spot-free coverage in a detection range of up to 200m.

Mobileye

Intel Corporation (INTC -0.74%)

Mobileye is an Israel-headquartered company, acquired by Intel in 2017, and re-IPOed in 2022.

While with promising technologies, troubles might be brewing at the company, with news in July 2025 that Intel is planning layoffs and to sell 8% of its holding in the company.

It is possible this instead reflects more general issues at Intel, with the company laying off employees in other activities as well.

This could, however, still be an issue for Mobileye, as it would reduce the amount of funds and backing it can expect from its parent company, putting it at a disadvantage compared to Waymo or Zoox, for example.

(You can read more about Intel in its dedicated investment report)

Aurora Innovation

The company is more focused on driverless trucks, with a focus on highway driving, which makes up the immense majority of mileage driven by trucks.

In May 2025, Aurora pulled its first truly driverless run, after having recorded three million autonomous miles, hauling more than 10,000 customer loads.

The company was founded by Chris Urmson, an early leader at Google’s self-driving car project, now well known under the Waymo brand.

“I’m cruising down the highway at 65 miles per hour, not behind the wheel, but in the rear seat, watching the scenery unfold as a truckload of pastries are driven by the technology I helped create,”

Aurora plans to expand its driverless service to El Paso, Texas, and Phoenix, Arizona, by the end of 2025.

The Ones That Gave Up

As the successful companies now make it look like it is just a matter of perseverance to win the self-driving race, it is worth remembering the projects that died along the way:

- General Motors gave up on Cruise in December 2024.

- Apple gave up its own self-driving plans in April 2024.

- Uber sold its driverless car segment to Aurora Technologies in 2020.

Non-Car Self-driving

There are a lot of companies working on self-driving, but focusing on systems other than cars.

For example, small delivery robots, technically self-driving vehicles, are small enough to escape regulation aimed at cars. For now, the leaders in rolling robots are Estonian Starship Technologies, launched by Skype co-founders, and Chinese e-commerce giant Alibaba ; both have adopted a small and harmless design not dissimilar to Star Wars’ droids.

Source: Starship

Due to regulatory reasons and the sheer impact of any accident with heavy vehicles, autonomous trucks are still relying on human input, with companies like Kodiak, Gatik, and Pony.ai following the lead of Aurora Innovation.

Another idea is to rely on flying drones for performing the delivery of small and light enough items. So far, the leader is clearly Zipline, followed by Wing and Meituan (3690.HK). This could be a true revolution, but it faces even more regulatory hurdles than self-driving delivery trucks, so it might be slower to be deployed at scale.

Source: ARK Invest

Conclusion

After years of slow movement despite “imminent” full self-driving cars hoped for by Elon Musk and other leaders in the field, 2025 is a clear acceleration point for self-driving technology.

Many cities that have taken a chance early are now having robotaxis routinely driving on their streets, driving down the price of ride-hailing.

So far, it seems that the USA and China are the two countries ahead globally, both in terms of companies leading the field, and in terms of more flexible regulations, with the positive feedback loop between innovation and a welcoming regulatory framework a likely valuable case study for economists in the future.

For now, the vision of limited, geofenced, and slowly deploying robotaxis with a full set of cameras, LIDAR, radars, and other sensors seems to have been the winning combination to fully not need drivers.

This has greatly benefited Waymo with its chosen cautious approach, with Zoox and many other companies at its heels and catching up quickly.

Meanwhile, Tesla is still pursuing its dreams of a general “full self-driving” technology that could drive any road and rely solely on cameras, ideally done with a simple software upgrade on all existing Tesla cars. This is a risky bet, but also an interesting idea that seems the only one likely to deliver unlimited self-driving anytime soon.

Geofenced tech will likely only deploy very slowly globally, bit by bit, and will be limited to competing with traditional taxi services in big cities. This leaves on the table much of the potential multi-trillion-dollar prize from “true” robotaxis able to replace car ownership by ultra-cheap, 24/7 ubiquitous EV rides.

So true to its company culture, Tesla might be the ultimate winner and create an entirely new massive market and revolutionize what a car means, once again, but only if it can solve a seemingly insurmountable technical challenge.