Spotlights

Salesforce (CRM): The World’s Dominant Sales Tool

Securities.io maintains rigorous editorial standards and may receive compensation from reviewed links. We are not a registered investment adviser and this is not investment advice. Please view our affiliate disclosure.

Why SaaS is the Tech Industry’s Growth Engine

The tech industry has been the leading force behind stock markets in the past few decades, especially since 2000. This was achieved through the combination of growth, increased efficiency, and the absorption of many older industries into “tech”: paper, news & advertising, photography, retail stores, design, etc.

A segment of the tech industry with even more remarkable returns for investors than the overall sector is SaaS (Software as a Service) and cloud-based software.

This type of business offers software that can boost the productivity of a company’s employees, and sometimes replace some jobs entirely with a software offering.

The power of this business model is that while software development is initially expensive, it can then be deployed at low cost again and again, spreading the development costs among more and more clients as the company grows.

So while it might take a while to start generating profit, SaaS companies tend to enjoy very high profit margins once they reach a certain scale, making them highly profitable for their shareholders.

And once a software tool has been developed for a specific case or industry, adapting it to new markets tends to be a lot cheaper as well, giving these companies a very large total addressable market.

One of the original SaaS, and today still one of the largest ones in the world, is Salesforce. By boosting sales, it made an immediate contribution to the companies’ revenues that adopted it, making its added value obvious, and building its reputation at a time when SaaS was a new and exotic idea for most management teams.

Today, Salesforce software is present in most major corporations and represents a gold mine of sales data now usable by new AI systems.

Salesforce, Inc. (CRM -0.59%)

Salesforce Overview

Salesforce is the producer of the software of the same name, one of the first cloud CRM to be created (Customer Relationship Management). The company is also behind the popular work chat app Slack, acquired in 2021.

Its products are used by 90% of the Fortune 500 companies. The company handles daily 3.1 million e-commerce orders, 5.8 billion marketing messages sent, 145 billion records in its data cloud, and handles 655 million e-commerce page views.

Salesforce has around 76,000 employees, and is still growing at a rapid pace.

Salesforce is by far the dominant actor in a very fragmented CRM market, with 20.7% market share, more than the combined 4 following largest CRM softwares from Microsoft (MSFT +0.14%), Oracle (ORCL -14.45%), Adobe (ADBE +0.5%), and SAP.

Source: Salesforce

The company was founded in 1999 by former Oracle executive Marc Benioff.

Source: WEF

Only partially affected by the dot-com bubble popping, it grew its sales from $5.4 million in 2000 to $22.4 million in 2001.

Salesforce IPOed in 2004 and passed the $1B in revenues in 2009.

In 2020, it joined the Dow Jones Industrial Average, replacing energy giant ExxonMobil (XOM -0.2%).

In 2025, the company generated $37.9B in revenues, $13.1B in operating cash flow, thanks to a 33% operating margin.

Source: Salesforce

Salesforce Platform Overview

CRMs

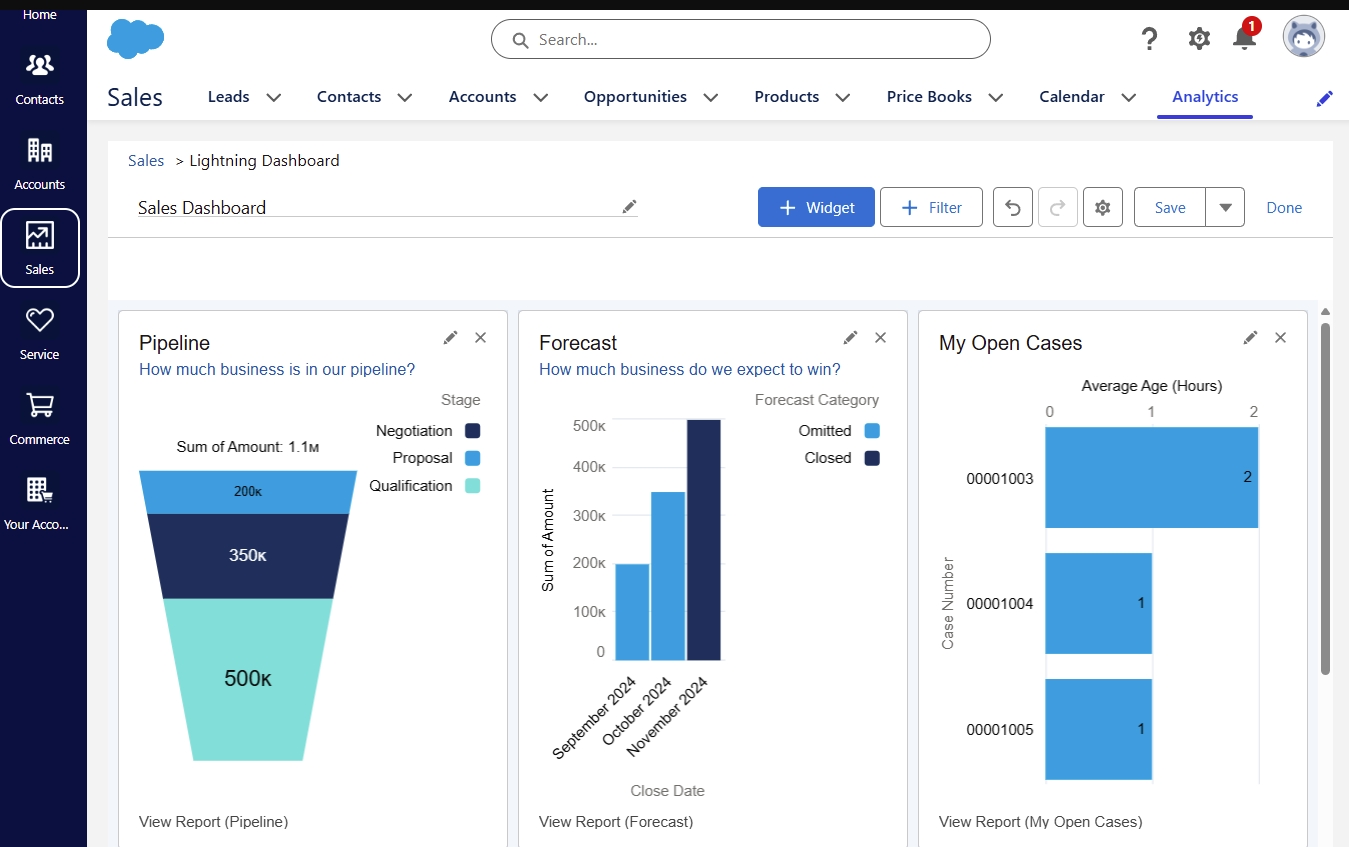

The core of the company is still today the Salesforce platform. It is used to coordinate all sales activity, from the listing of potential prospects, ongoing negotiations, and past and future deals.

Management teams can also use it to monitor sales activities, manage sales teams’ work, measure key sales metrics, etc.

Source: Tech.co

No matter your industry, or even if you’re a nonprofit, if you communicate with customers — and your employees rely on information about those customers — a CRM system can help.

By recording and making the customer information immediately available to all authorized personnel (and only them), a CRM ensures a smooth process and reduces the risk of depending on a specific employee for handling the interaction with a given customer.

Contrary to the previous generation of CRMs, cloud CRMs like Salesforce keep all the data available at all times, from any office or site in a company, updated in real time.

Whether customers have previously reached out via phone, chat, email, or social media, a single source of truth ensures everyone at your company can provide the expected level of service.

This information can be invaluable, especially since 70% of customers expect every representative they contact to know their purchase and issue history.

CRM software also helps monitor and record every action, which is both useful to understand if something went wrong, but maybe more importantly, what went right as well. This gives management the potential insights on how to optimize their sales process in the future, for example, identify a sub-segment of prospects turning into clients at a higher rate, or a type of offer yielding better results.

The larger the team and company, the less manual decisions, interpersonal relations, and paper trail are necessary to keep track of sales. Instead, the digital & centralized database of a CRM ensures that growth does not result in excessive loss of efficiency.

On average, companies adopting a CRM like Salesforce see their sales revenue increase by 30%, a 32% increase in return on investment of their marketing efforts, 32% higher customer satisfaction, and 28% higher online revenues.

An Integrated Platform

While the CRM core is still the main offering, it has progressively expanded to integrate additional tools for marketing, e-commerce, internal communication (Slack), as well as industry-specific modules and offers.

Source: Salesforce

The software is sold as a subscription, ranging from $25 to $350 per user, with higher tiers giving access to increasingly advanced options for larger companies.

This model makes the adoption of the software less difficult than a major purchase, and helps onboarding companies when they are still small and do not need all the most complex tools available.

Source: Tech.co

Overall, Salesforce is much more expensive than its competitors, with the average CRM starting price at around $15 per user.

However, it is one of the most complete and one that offers the most potential in scaling up later, a concern for growing companies. It also offers a 30-day free trial for testing the product.

So overall, it is more of a product-focused one for enterprise clients and quickly growing smaller companies, leaving the less dynamic segment of the economy to cheaper, less powerful CRM solutions.

Add-Ons

In addition to its core offering, Salesforce has a massive library of potential add-ons, many of which will cost extra, like, for example, Salesforce Contracts that cost $70 per user, per month.

These add-on modules and external software can interface with the data already inside the core Salesforce software, allowing for easy integration and utilization of this data for other purposes, like accounting, billing, maintenance, HR, etc.

So one key strength of Salesforce is its extensive integration with virtually every other work-related app, with no less than 2,600 pre-built integrations.

Salesforce Customers

Over the years, Salesforce has expanded its custom offering to virtually every industry, having specialized modules and layouts for economic sectors as diverse as manufacturing, financial services, healthcare, public sector, retail, education, and energy.

Source: Salesforce

In total, 150,000 companies worldwide use Salesforce’s software.

Thanks to the level of integration and overview over a business’s sales data, the software allows companies to integrate different elements and optimize their operation. For example, FedEx used it to grow revenue from inactive customers.

To encourage shipments, FedEx’s sales reps needed to reach out to inactive customers across hundreds of accounts manually. But identifying these accounts took IT three or more weeks across up to ten separate systems.

FedEx chose Data Cloud to bridge opportunity data in Sales Cloud, web browsing data in Marketing Cloud, and shipping data in Databricks. Now, a unified view of all customer data allows FedEx to pinpoint inactive customers in a matter of hours, not weeks, and efficiently re-engage them.

Source: Salesforce

Swipe to scroll →

| Company | Market Share (2025) | 2025 Revenue (B) | Key Strength |

|---|---|---|---|

| Salesforce | 20.7% | $37.9 | AI & integration ecosystem |

| Microsoft Dynamics | 5.9% | $15.5 | Microsoft 365 integration |

| Oracle | 5.4% | $12.3 | Enterprise databases |

| SAP | 3.8% | $9.1 | ERP integration |

| Adobe | 2.7% | $8.5 | Marketing analytics |

Salesforce AI Integration: Einstein & Agentforce

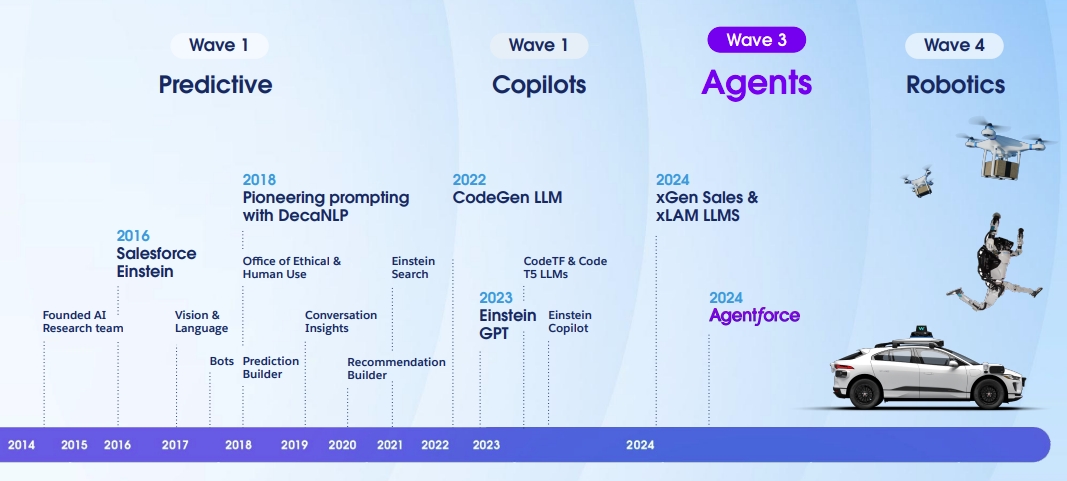

Like most tech companies, Salesforce is acutely aware of the importance of AI in its future business. However, the company was remarkably early, having launched in 2016 “Einstein”, its AI for predictive insights and personalized recommendations, using the already available sales data in the system.

It was used to increase sales efficiency, help write emails, provide an AI sales assistant, Chat-GPT for services, etc.

Contrary to uncontrolled use of AI by employees, Einstein provides a “trust layer” with data masking and zero data retention, allowing users to securely use confidential sales data. This can also be used by Salesforce’s customers to create private AI models.

Source: Salesforce

In 2024, the company leveraged the progress in AI technology to release Agentforce, an AI agent platform using a series of agentic tools to automate more of the sales process.

Source: Salesforce

The platform is already used by companies like General Mills, Dell, Goodyear, Pfizer, Indeed, Heathrow Airport, Panasonic, Fujitsu, and many others.

Source: Salesforce

“The combination of AI, data, and CRM allows us to help busy parents solve the ‘what’s for dinner’ dilemma with personalized recipe recommendations their family will love.”

Heather Conneran – Director of Brand Experience Platforms at General Mills

Salesforce was also early in leveraging AI to create no-code solutions for managers looking to develop automation without being programmers themselves. The integration with Slack and Chat-GPT allows for efficient chatbots directly connected to Salesforce data about previous interactions with a client or a prospect.

Source: Salesforce

The use of agents allows for more customization of the AI, with specific models developed for each industry. For example, fraud risk in financial services, patient inquiries in healthcare, or customer outreach in retail.

In practice, the Agent Builder uses such templates to create customized agents for each of a specific company’s use cases.

Overall, the AI offering, and Agentforce in particular, come on top of the rest of the offering, providing additional tools to manage sales beyond manual contact with both existing and potential customers. While keeping the company’s data safe, it is integrating well into the pre-existing sales process previously handled by humans alone.

Conclusion

A pioneer in cloud-based CRM, Salesforce has been at the top of SaaS innovation since its inception. It is still so today, with its early integration of AI tools, and a deep understanding of enterprise needs and concerns regarding letting AI handle a part of business as essential as sales.

Thanks to its ongoing dominance over the CRM market, it is likely to have the most valuable pool of data and customers to prepare for the transition of SaaS to Agentic AI.

That puts the company well ahead in deploying useful and money-making producing AI agents, having a major advantage in the natural integration of its agents with the sales data collected over more than 2 decades, and the experience of integrating Salesforce with thousands of other enterprise tools.

These trends should persist and support the company’s double-digit growth levels for the foreseeable future, especially as the CRM market is still very fragmented.