Market News

Linqto Collapse: What It Means for Pre-IPO Investors

Securities.io maintains rigorous editorial standards and may receive compensation from reviewed links. We are not a registered investment adviser and this is not investment advice. Please view our affiliate disclosure.

Linqto On The Brink

Linqto, an investment platform that lets users access shares of privately held companies, filed for bankruptcy on July 8, 2025.

This could put in danger the money of investors that had used Linqto to access shares of private companies, notably the cryptocurrency company Ripple.

The major concern stems from the bankruptcy filing, as well as the declaration by Dan Siciliano, Linqto’s CEO:

“Linqto had discovered serious defects in the corporate formation, structure, and operation of the business that raise questions about what customers actually own. The company faces “potentially insurmountable operating challenges.”

To understand what happened, we first need to discuss Linqto’s business model and what they seem not to have done as advertised.

Linqto Explained

Private Versus Public Shares

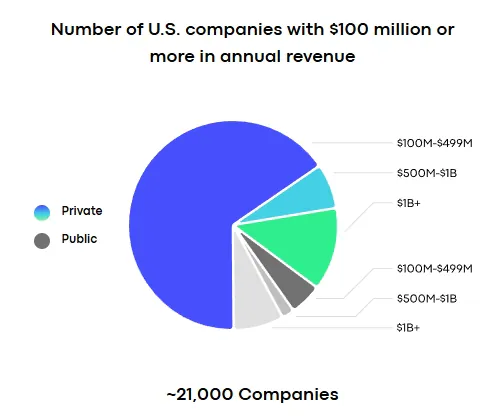

Privately held companies are generally not accessible to most investors. This is because participating in the fundraising for these types of companies is limited to “accredited investors”, a term strictly defined by the SEC (Securities and Exchange Commission).

Accredited investors must have either a very high income, typically exceeding $200,000/year (with the additional criterion that this income be stable), or a high net worth exceeding $1 million (excluding their primary residence).

Private companies’ shares are generally accessible either through participation in funding rounds (an activity often done by private equity firms) or in “secondary markets”, where early investors, founders, or employees can sell some of the shares they own before a public listing.

Source: Linqto

This can open access to otherwise uninvestable companies, including Open AI, SpaceX, Kraken, Shield AI, or Ripple, for example. Linqto is one of such secondary marketplaces for private shares.

Linqto’s Business Model

Linqto promised its users 3 main features: instant ownership, direct economic interest in the company associated with the share, and segregation of assets, with the users’ assets held in a separate account from Linqto’s own assets.

Source: Linqto

Linqto aims to invest in mid-to-late-stage companies that it believes will go public or be acquired within the next five years.

So for most investors, the way to “cash-in” from their investment in private companies would be to liquidate their Linqto position after the lockup period following an IPO or acquisition expires, receiving either the cash into their bank account, or the shares in a brokerage account.

Among Linqto’s advantages was a very low initial minimum ($1,000), one of the industry’s lowest.

The way Linqto made money was not through fees, as it had no carry, legal, administrative, or profit fees. It instead made money with a purchase premium, reselling the share of private companies it owned at a “reasonable” premium (the actual percentage was undisclosed).

As it turns out now, some of these premiums were rather large, with reports of a 60% markup on Ripple shares, and maybe even higher (anything above 10% is generally flagged as potentially fraudulent by the SEC).

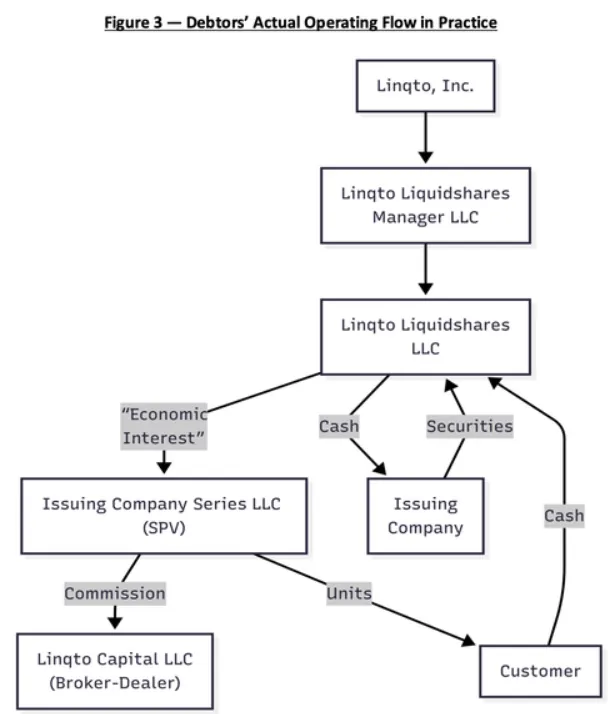

Linqto’s model requires it to deploy special purpose vehicles (SPVs), which are a separate company that is bankruptcy remote, allowing users extra protection against a potential Linqto’s financial distress.

Source: Bondoro

What Went Wrong?

| Promise | Reality |

|---|---|

| SPV Structure for Asset Protection | No SPVs Created; Assets Pooled |

| Low Purchase Premiums | Markups of 30%–150% Reported |

| Segregation of Customer Assets | No Legal Segregation Found |

Because of the bankruptcy filing, quite a bit of information has been made public.

It appears that Linqto holds $500M worth of shares in 111 companies on behalf of its customers. Some of the most prominent firms that were accessible through Linqto were Stripe, Zipline, Scale AI, Ripple, Patreon, Kraken, and Acorns.

The main issue is that court documents indicate that Linqto never formalized its promised special-purpose vehicle (SPV) structure, did not establish series LLCs, or keep proper records.

Source: Bondoro

So, contrary to the very clear promise made of segregation of assets, still displayed in Linqto’s front page, the platform pooled assets with no legal segregation or individual title, according to Thomas Braziel, an attorney who shared his analysis of the case on X.

So this seems to be a clear case of fraud, at least in the sense that the promises made were not delivered upon.

However, as explained by John E Deaton, also an attorney, there was no significant fraud in the purchase of shares with users’ money. So the money does not appear to have been stolen, but the corporate structure was never as advertised.

Deaton is a Massachusetts attorney and Linqto customer representative, who himself invested nearly half a million dollars into private companies through the platform.

“The other GREAT news is that ALL the shares of companies people invested in (Circle, Ripple, Uphold, Kraken. SpaceX, etc) are present and accounted for. The only caveat to that is that 3% of the shares of Ripple that should be there were sold without people’s knowledge – but the funds related to that sale are there. ”

The legal issues seem to be multiple:

- No SPV setup, contrary to the promise made.

- Excessive markup on some stock and transactions.

- Linqto might have allowed some individuals who were not accredited investors to participate in private share sales, in violation of federal securities regulations.

Who Is To Blame?

The initial blame seems to fall to the company’s founders, husband and wife Bill and Vicki Sarris, as the decision not to create the SPV structure properly was likely made by them.

Linqto saw a new CEO appointed in March 2025, Daniel Siciliano, who now blames the previous management of the company. With him, the entire executive team was changed, including the Chief Executive Officer of Linqto Capital, the General Counsel of Linqto Capital, the Chief Operating Officer, and the Chief Administrative Officer.

Daniel Siciliano’s statement at his appointment indicates he knew some problems were brewing.

“I am excited to be joining Linqto at this inflection moment in the Company’s history.

Despite the urgent need to reset our approach to regulatory compliance, all of us on the new executive leadership team believe that Linqto has the promise to unlock real value.

Most of the new management team hail from Nikkl, a company that has now stopped its operation. It was also active in the private capital market.

Overall, it seems that the company board either knew or recently realized there was a big problem and decided to come clean to the regulator before getting investigated at a point in the future.

“The regulatory issues left unresolved by prior management are critical to address immediately. When we do, we are confident we can deliver on our original mission in a manner that fully complies with all laws and regulations.”

Mike Huskins – Linqto Capital’s newly appointed General Counsel.

The position of the new management, as discussed in the Wall Street Journal, is that they are discovering the issue, which is yet to be clear how true such a statement is, and court proceedings will likely clarify who knew what.

“An internal investigation had uncovered serious securities law violations and practices far beyond minor compliance issues.

Much of what we discovered about the prior business practices at Linqto is disturbing.”

Dan Siciliano – Linqto’s new CEO

What’s Next For Linqto Users?

Most likely, a lengthy legal battle will ensue, with the new management trying to save the company, the old management denying any wrongdoing, and the court having to figure out if the company’s board was truly blindsided or actively decided to look the other way.

The bankruptcy itself might be in legal limbo, as Linqto shareholders (the owner of the company, not the users) are apparently looking to fight the bankruptcy proceeding.

A core question is what will happen to the assets and money of the users.

One possibility is that the assets will have to be liquidated, which is probably the worst-case scenario. This is because these shares are very illiquid, as they are not being publicly listed.

So, a forced sale of a bulk of private shares could tank their value, and a court-ordered fire sale would likely not realize the true value of the assets.

A better option would be for the company to restructure, clean its practice during the bankruptcy proceeding, and then re-emerge from bankruptcy. If this is possible and authorized by the courts, it will likely be a way for the private investment of the users without creating unwanted financial losses.

Overall, it seems that Linqto did purchase the shares it said it would, although at an excessive markup, and many of these companies have since grown significantly, meaning that some of the assets might actually be worth a lot more than they appear on the balance sheet.

So there is still a possibility for Linqto users to get their money back, or even make a profit on their investments, depending on how the bankruptcy proceeds and the costs from legal fees.

Where Else To Access Private Shares?

Naturally, the collapse of Linqto brought in the spotlight the risks of investing in private equity markets. Overall, this is a segment that is less transparent, less regulated, and more prone to fraud than the much more scrutinized public markets.

However, this should not deter experienced investors from considering the idea.

First, the situation proves that the sector is actually well-regulated, and potential fraud is being brought to light.

Secondly, the risks should ideally be managed by spreading their investment across multiple platforms, and with the private equity investment making up only a part of the whole investment portfolio.

If you meet the requirements and are comfortable with the risks, several platforms offer access to pre-IPO opportunities:

Forge Global: One of the largest private stock marketplaces, offering shares in late-stage startups like SpaceX, Stripe, and Databricks. Minimums typically start around $100,000.

EquityZen: A popular platform allowing accredited investors to buy into private companies with minimums as low as $5,000. Past offerings include companies like Discord and UiPath.

Rainmaker Securities: A full-service broker that helps source and negotiate private share sales, including opportunities in companies like OpenAI, Stripe, and Palantir.

Hiive: A newer platform with live bid/ask pricing for hundreds of private companies. Transparent and low-fee, with minimums starting around $25,000.

MicroVentures: Offers pooled access to late-stage companies through special purpose vehicles (SPVs), including past investments in SpaceX and Instacart.

EquityBee: Allows investors to fund employee stock option exercises at startups, often at discounted valuations, with minimums of around $10,000.

Augment: A digital-first marketplace showing real-time pricing for pre-IPO shares, targeting tech-savvy investors and offering lower transaction fees.

StartEngine Private: Launched in late 2023, this platform offers accredited investors access to Regulation D offerings in later-stage, venture-backed companies. In its first nine months, it generated $16.5 million in revenue, with average investments around $32,000

Are Pre-IPO Investments at Risk After Linqto?

The situation with Linqto should not directly affect the company whose shares it owns for the moment.

At worst, it could cause a temporary excess of supply in the secondary private market, and only if the court were to order an instant and total liquidation of all Linqto assets, irrespective of the price that could be obtained for them.

The reputational damage should also be limited, with the most exposed firms like Ripple already taking preventive actions.

“Understandably, there have been many questions from those who believed they were buying Ripple shares from Linqto, and what happens next.

What we know from our records is Linqto owns 4.7 million shares of Ripple, solely purchased on the secondary market from other Ripple shareholders (never directly from Ripple).”

Brad Garlinghouse reiterated that the firm itself never sold shares to Linqto or had any formal business relationship with the platform.

Conclusion

Linqto’s situation is rather unfortunate, and hopefully, it should not cause a loss of money for its users who trusted the platform.

This however should not change how the overall, much larger field of private equity investing is perceived. At least not more than past scandals in public markets (Enron, subprimes) have affected the long-term investability of public markets.

Investing is an inherently risky activity. A more illiquid market, like private equity, is even more so. This is nevertheless an increasingly attractive sector, as the world’s leading companies like OpenAI or SpaceX are delaying IPO much more today than equivalent companies in past decades.

With a lot of money flowing into the sector, the temptation for bad actors to misrepresent their actions and defraud investors grows. This is why going for platforms that are well established and well audited is maybe preferable, as well as not using only one platform.

Investors should also pay attention to the transparency of the business model, with well-understood fees sometimes preferable to more opaque no-fees approaches.