Computing

What Is The NTSC? Investing In US Chip Manufacturing

Securities.io maintains rigorous editorial standards and may receive compensation from reviewed links. We are not a registered investment adviser and this is not investment advice. Please view our affiliate disclosure.

Rebuilding US Chip Manufacturing

Computer chips and other semiconductor components have become as essential to modern industries as basic materials made abundant by the industrial revolution, like steel, concrete, or aluminum.

This makes the production of chips not only a matter of economic prosperity for a given nation but also a vital strategic concern. Despite most chip design and chip-making technology having initially been invented in the West and Japan, chip-making is now highly concentrated in other regions, especially in Taiwan, South Korea, and increasingly in China.

Because China considers Taiwan a “breakaway province” that should be reunited with China’s mainland, a conflict over Taiwan between China and the USA could sever crucial chip supply to Western economies.

In response to this risk, in 2024 the USA has launched the National Semiconductor Technology Center (NTSC). It is a public-private consortium dedicated to “advancing U.S.-led innovation, economic competitiveness, and national security.”

US Chip Manufacturing: Industry Overview

Global Semiconductor Supply Imbalance

Chip manufacturing is an industry with a strong tendency toward concentration into a few major players. This is because it requires an extreme level of quality control and precision to produce ever smaller chips, where scale and experience tend to be very important.

It has led the industry to become dominated by one company in particular: TSMC (Taiwan Semiconductor Manufacturing Company (TSM -1.44%)).

Source: Eric Flaningam

We covered this company in detail in “TSMC (TSM) Spotlight: The Foundry Of 21st Century Gold”.

Among the other major players in chip foundries are Taiwanese United Microelectronics Corporation (UMC -0.4%), Korean Samsung Electronics (005930.KS), and Chinese SMIC (0981.HK).

Not only are these companies almost exclusively in Asia, but the US manufactures absolutely none of the most advanced chips domestically, the type of chips essential for AI data centers, the newest smartphone models, or self-driving cars.

“An average car contains 1,400 chips and electric vehicles use more than 3,000.”

Rick McCormick – Sandia’s senior scientist for semiconductor technology strategy

Current State of US Chip Manufacturing

None of the largest semiconductors foundry companies are based in the US today, even if the country was instrumental in building in inventing these technologies, from the early days of the Bell Lab to today’s Silicon Valley.

So even if American companies capture almost 50% of the $527B of revenues from the global semiconductor industries, mostly through design work and intellectual properties, the USA has very little control over the actual production.

This is what the NTSC is looking to change. It will be part of a wider effort including:

- The NSTC Consortium

- The National Center for the Advancement of Semiconductor Technology (Natcast)

- The CHIPS R&D Program Office

In June 2025, Sandia National Laboratories became the first national lab to join the NSTC.

“We have pioneered the way for other labs to join.

The CHIPS Act has brought the band back together, you could say. By including the national labs, U.S. companies, and academia, it’s really a force multiplier.”

Mary Monson – Sandia’s senior manager of Technology Partnerships and Business Development.

Sandia joins an already very impressive roster of 134 NSTC members, including Google, AMD, Apple, Nvidia, IBM, Intel, Nokia, RTX, Samsung, Siemens, Texas Instruments, TSMC, MIT, Princeton University, Stanford University, etc.

CHIPS Act Funding and Resources

The NSTC is part of the larger CHIPS act, an initiative launched by the Biden administration to catch up on chip manufacturing.

Contrary to previous similar programs that mostly focused on tax rebates and other financial incentives, the approach is this time much more directed and represents the US moving toward more intentional industrial policies.

“More than $12 billion in research and development spending is planned under CHIPS, including a $3 billion program to create an ecosystem for packaging assemblies of chiplets.

These chiplets communicate at low energy and high speed as if they were a large expensive chip.”

Rick McCormick – Sandia’s senior scientist for semiconductor technology strategy

NTSC Multi-Stage Strategy 2025–2027

The NSTC’s strategic plan for 2025-2027 details three main goals for the program, building a coherent industrial policy that has been missing for years and even decades, a key factor is the relative decline of US semiconductor manufacturing to Asia.

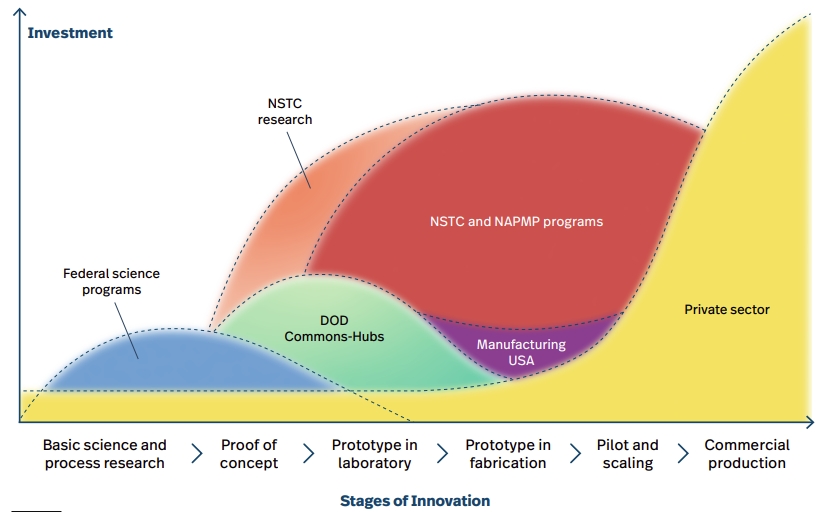

Extending U.S. technology leadership

This would help ideas achieve a proof-of-concept or validation point and move from labs to foundries.

Here, the NSTC would bridge the gap between theoretical sciences and the private sector taking over innovations into commercial realities.

Source: Natcast

Among the topics tackled by the program are energy efficiency for AI, sustainability in chip manufacturing, and security and provenance of material and equipment.

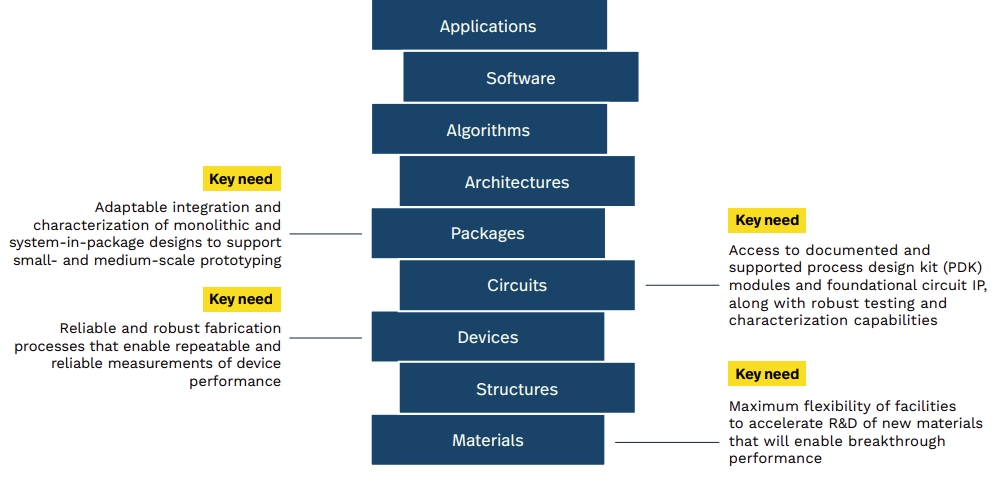

Reducing Prototyping Time and Costs

A portfolio of physical and digital assets and services is created and given access to the members of the NSTC to test innovative designs.

The focus will be put on the development of new materials, free access to process design kit (PDK) modules and foundational circuit IP, and reliable and robust fabrication processes.

Source: Natcast

Building a Robust US Semiconductor Workforce

This will be done through the NSTC Workforce Center of Excellence (WCoE), supported by a $250M investment.

“There is a potential crisis looming. The Semiconductor Industry Association anticipates that the U.S. will need 60,000 to 70,000 more workers, so we need to help engage the STEM workforce.”

Rick McCormick – Sandia’s senior scientist for semiconductor technology strategy

This is a goal where the active participation of dozens of top-level universities in the NSTC in the US will be essential.

Another crucial aspect will be the closer interaction brought by the NSTC between training institutions and private companies, helping the freshly trained workers to access internships and immediately get jobs in their specialty.

NTSC and the Post-Moore’s Law Era

In the background of the CHIPS act and the foundation of the NSTC is the fact that chips and computing technology are heading for a revolution.

For decades, Moore’s Law, which stipulated that chips increase in density and capacity regularly, is coming to an end as the scale of engraving of the latest silicon chips is slowly moving toward transistors made of barely a few atoms.

Full ecosystem convening is required to collaboratively advance “whole stack” innovations that are required in the Post Moore Era, including government, industry, labor, customers, suppliers, educational institutions, and investors.

This is why the focus on new technology and faster lab-to-fab processes is important, as the next stage of computing technology might not be with silicon at all, but with other semiconductive materials, neuromorphic chips, quantum computing, or photonics.

In theory, this initiative should reduce a lot of the barriers that have so far made all effort to bring back semiconductor manufacturing to the USA.

Source: Natcast

In practice, the timeline proposed might be more than a little enthusiastic and mostly driven by political targets, as it will realistically take years if not decades to train enough workers and move foundries to the US.

Chips Made in America: Domestic Foundries

The process of re-localizing chip-making in the USA was already underway even without the CHIPS Act.

For example, the Arizona facility of TSMC has been in construction for several years by now, and high-volume production started at the end of 2024. The factory is starting to produce advanced 4-5nm chips and is aiming to produce future best-in-class chips of 3nm and even 2nm.

The CHIPS act is also not the only financial incentive given to chip manufacturers, for example, multiple loans and grants were given to important companies in the sector:

- GlobalFoundries ($1.5 billion in grants and $1.6 billion in loans)

- Intel ($8.5 billion in grants and $11 billion in loans)

- TSMC ($6.6 billion in grants and $5 billion in loans)

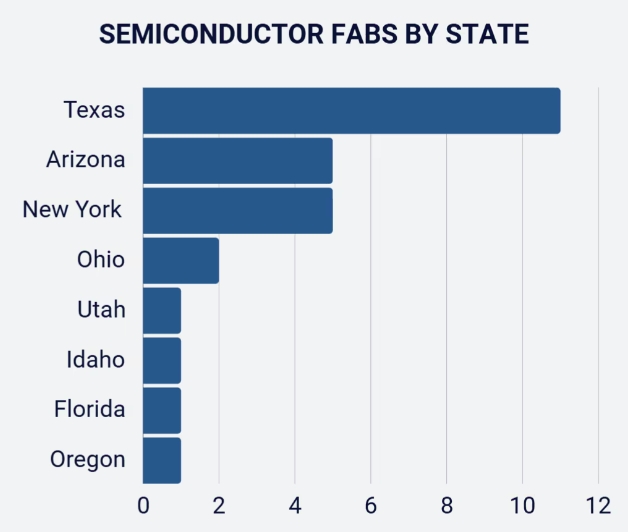

So far Texas, Arizona, and New York are the states to benefit the most from the industrial activity in semiconductors. With more fabs in construction in Arizona by TSMC and Intel, the state might even take the lead.

Source: Z2Data

This build-up of industrial capacity is expected to accelerate further, with Taiwanese chipmakers having announced in April 2025 plans for $100B of investment in US-based capacity over 5 new factories. A lot of this is tied to TSMC, which agreed to expand its planned U.S. investment by $25 billion to $65 billion and to add a third Arizona factory by 2030.

Investing in US Semiconductors and Foundries

Intel

Intel Corporation (INTC +8.87%)

While foreign companies like Samsung and TSMC are ramping up their presence in the USA, respectively mostly in Arizona and Texas, they are yet to catch up with the existing domestic champion, Intel.

Intel has for a long time lagged behind its Asian competitors on the global semiconductor markets and missed 2 technological innovations in the chip-making sector:

- EUV (Extreme UltraViolet) lithography, a technique to engrave ultra-dense chips, which despite being mostly invented by Intel, is now solely commercialized by the Dutch company ASML (ASML +0.28%)

- Chiplets, smaller modular chips that can be assembled to boost performance at a lower cost, a market today dominated by ARM (ARM -2.53%) and AMD (AMD +0.24%).

This relative inertia of Intel can likely be blamed on a too strong and too “comfortable” position in its proprietary x86 core architecture, which was from inception in 1980 and still is today one of the world’s most widely used processor architectures.

Intel is now catching up, with EUV production ramping up first in its Irish fab since 2023, and likely later on in the US. And contrary to TSMC, which has struggled to adapt its Taiwanese work culture to American workers, Intel already knows how to produce at scale in America.

Source: Intel

Lastly, Intel has been very active in building up a new treasure trove of IP in new computing technologies, especially quantum computing, with the Intel Quantum SDK a popular option for programmers in the field.

Source: Intel

Overall, Intel is a classic story of a leading company becoming a little complacent due to stable cash flow from past innovations.

It has however reinvented itself in the past few years, catching up on EUV (for <4nm chips), chiplets, innovated in quantum computing, and benefitted from its pre-existing American industrial base.

In the case of an escalation of tensions with China in the upcoming years, Intel will also benefit greatly, while it is likely that TSMC would struggle to relocate key foundries and personnel in time.

So Intel is still for now, and likely up to the 2030s, going to be the prominent advanced chip manufacturer in the USA, progressively sharing this spot with TSMC.

(You can also read a more in-depth analysis about Intel in our dedicated article from September 2024)