Spotlights

Honeywell (HON): Industrial Excellence & Quantum Computing

Securities.io maintains rigorous editorial standards and may receive compensation from reviewed links. We are not a registered investment adviser and this is not investment advice. Please view our affiliate disclosure.

Honeywell’s Role as a Technology Enabler

Some technology companies specialize in one type of technology or a specific market, becoming well-known brands for customers around the world, like Boeing (BA +0%), Apple (AAPL -0.48%), or Tesla (TSLA +4.6%).

Other companies are more enablers of technology, providing the figurative bolts and screws that other companies will use to produce customer products.

Honeywell is one such company, producing a wide array of specialty chemicals, sensors, cybersecurity software, safety systems, avionics, automation solutions, etc.

These will be used in some capacity by most of the factories and research centers of the world, forming an invisible support structure for industrial civilization.

Besides these activities, Honeywell has also been the backer of one of the leading quantum computing firms, Quantinuum, which is quickly moving to become a serious contender in the emerging field of quantum AI.

Honeywell International Inc. (HON -0.4%)

Founding & Evolution: Honeywell History

Honeywell was founded in 1906 to manufacture and market the mercury seal generator, a water-heating device. Through a series of acquisitions, the company quickly grew and became an industrial leader in early automation and scientific instruments.

The company started to produce electronic components and sensors for the military in World War II, notably periscopes, camera stabilizers, and autopilots used in the atomic bombing of Japan.

This activity for the US military expanded during the Cold War, with Honeywell improving aircraft autopilot systems, missile guidance, cluster bombs, napalm, and mines.

The activity in sensors created a strong presence in industrial equipment and industrial controls, benefiting from the technical expertise and reputation of the company built in military and aerospace equipment.

Meanwhile, the company was active in computing as early as 1955, although it was not extremely successful in competing with IBM (IBM +0.8%), and it exited the sector in 1991.

The company was almost absorbed by GE in 2000, but the European Commission ultimately blocked the merger. Today, is it a major conglomerate in industrial equipment, although it seems that it is headed for a split between activities, initiating the recent break of the GE conglomerate into GE Aerospace (GE +0.13%), GE Healthcare , and GE Vernova (GEV +1.27%).

Honeywell by the Numbers: Revenue & Workforce

With 102,000+ employees and $38B in sales in 2024, Honeywell is a major global corporation. It is divided into 3 segments: automation, aviation, and energy transition.

Of these segments, automation and aviation/aerospace represent the bulk of sales and profit.

Source: Honeywell

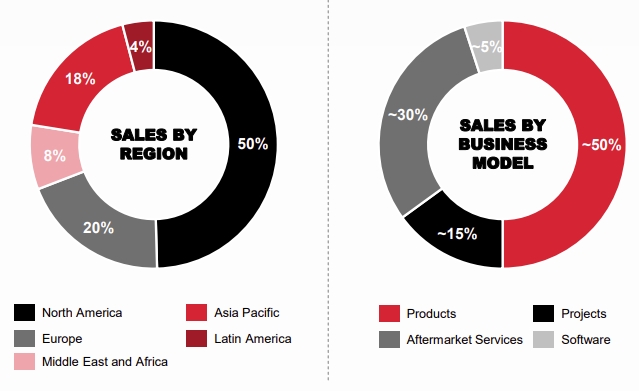

While truly global, the company is still having a much stronger presence in North America, where it does half of its sales (the USA is 45% of sales). Contrary to many other B2B industrial companies, Honeywell mostly makes money from selling products directly, more than from selling consumables and aftermarket services.

Source: Honeywell

Aftermarket sales of aerospace technologies and the defense & space segments are by far the largest individual activities, followed by building automation and advanced materials.

Source: Honeywell

Why Honeywell Is Splitting Into Three Companies

Current investors in Honeywell should be aware that the conglomerate plans to split into three separate entities by the end of 2026.

The resulting companies would be Automation, Aerospace, and Advanced Materials.

The rationale is that the move is following the general trend of breaking up conglomerates formed in the past decades, which have accumulated too much bureaucracy and organizational inertia, as illustrated recently by a similar move at GE.

In addition, the different segments ultimately had little synergies with each other, each working with its own integrated supply chain and technology base.

Another factor is that the market dynamics of each of these segments are rather different, with different capital intensity, industry cycle duration, etc. Once separated, each entity will be able to handle these differences with a customized strategy.

Source: Honeywell

Overall, this would not necessarily change much for current Honeywell shareholders, as the separation is expected to be completely tax-free, and each of the resulting companies’ shares will be distributed to Honeywell shareholders.

At most, it might create some volatility in the short term, as some shareholders might want to focus on only some parts of the company after its split-up.

As a result, each of these segments can already be analyzed as a separate company, with their effective separation to occur later.

Segment Deep Dive: Honeywell Automation

Industrial IoT & AI-Driven Factory Solutions

This segment was separated into building automation and industrial automation, but will stay together in the future split-up company.

This is because while the applications and markets are very different, the technologies behind both forms of IoT (Internet of Things) are relatively similar.

In the case of industrial automation, the merging with AI technology is already well on its way, and the automated production line needs as many sensors and data points as possible.

This allows for the deployment of advanced solutions like a factory digital twin, remotely operated workstations, or the concept of “HIVE”: Highly Integrated Virtual Environment.

Source: Honeywell

In this space, the vertical integration of Honeywell can be a strong advantage, as the AI solution it offers can be fine-tuned to the sensors and data collected.

And of course, the decades of experience in working with industrial clients in virtually every sector of the economy is an advantage in both identifying the customers’ needs and already having a well-established working relationship to boost sales.

This sector should benefit from the trend of re-industrialization of Western countries, especially the USA, with digitalization and automation the most likely solution to compensate for higher labor costs.

Smart Building Management & Safety Systems

This segment covers an array of different solutions, from fire safety to cybersecurity and building management systems, as well as airports’ landing systems and software.

It can help monitor the situation in countless types of buildings, from airports to schools, hospitals, commercial real estate, stadiums, etc.

What is being monitored is equally diverse, ranging from air quality to energy consumed, gunshot detection, fire detection, and control, etc.

Source: Honeywell

In terms of building management, this can cover nurse calls, guestroom management, visitor and contractor passes, remote management, etc.

Segment Deep Dive: Honeywell Aerospace

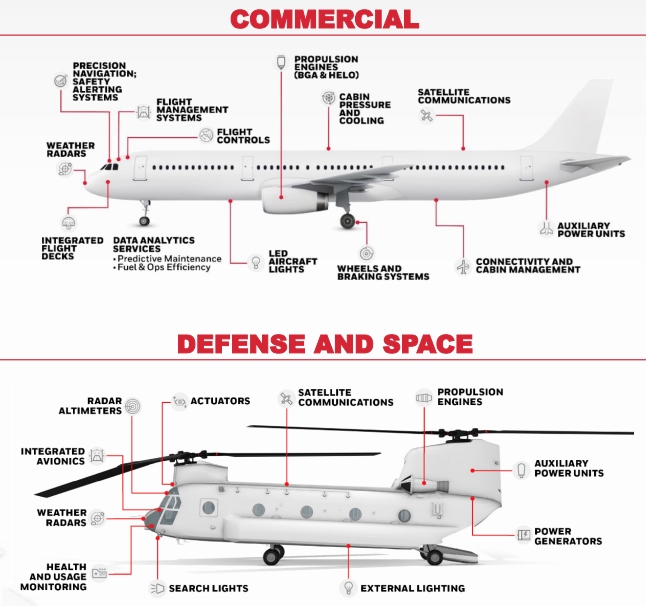

Currently, the business is focused on electronics, engines, and mechanical systems. This covers parts like weather radars, wheels, braking systems, avionic electronics, sensors, etc. It also includes engines able to burn Sustainable Aviation Fuel (SAF), which reduces carbon emissions by 80% compared to jet fuel.

Overall, electronics and engines make up the bulk of this activity’s revenues (64%).

Source: Honeywell

Historically, Honeywell has produced many of the auxiliary systems in aircraft, both civilian and military, which are not necessarily the most complex individually but very important as a whole.

Source: Honeywell

It is now moving into new emerging technologies, notably electric flight, also called aerial mobility, with giant drones becoming the first viable “flying cars” vehicles now in sight.

Further innovations, like more advanced cockpit controls, space-based altitude controls, and improved thermal management, are integral to new aircraft, including very advanced ones like the F-35.

Source: Honeywell

This segment should benefit greatly from a series of underlying trends:

- The growing importance of drones and autonomous weapon systems.

- Electrification of aeronautic systems.

- Progress in precision navigation guided by GPD or laser.

- Rising budget defense in the context of ever-escalating international tensions.

Segment Deep Dive: Honeywell Advanced Materials

Currently the smallest segment of the company, it is also one with large growth potential, as it is tightly linked to electrification and renewable energies.

One part of this business is specialty materials, with IP-protected chemicals (10,000+ active patents) used for refrigeration, special fibers for armor (Spectra®), gas adsorbent, petrochemical catalysts, diverse research chemicals, fluorescent tags, fluorides compounds against corrosion, industrial plastic films, waxes, adhesives, paints, etc.

The company’s materials and chemicals can also be used for batteries and energy storage, carbon capture, and LNG processing.

Source: Honeywell

Sustainable aviation fuel (SAF) and hydrogen are also a part of this business, with SAF for now being the most developed. Enabling the production of sustainable diesel for trucks and tractors could also be a growing part of the business moving forward.

Quantinuum: Honeywell’s Quantum Computing Spin-Off

Qunatinuum is a quantum computing company, based on trapped-ion technology. It is the result of the merger of Honeywell Quantum Solutions and Cambridge Quantum, a partner of Microsoft in quantum cloud computing.

This is a segment of the business often never mentioned by Honeywell management during its presentations, as it is for now mostly a prospective technology will little revenue yet.

However, this could change soon, as the race for building the first quantum computers for use in real life is heating up.

The industry has been in a situation where two technologies compete: trapped-ion, with low qubit count, but very high result reliability, versus superconducting quantum computers, the favored approach of most tech giants, from Microsoft (MSFT +1.5%) with Majorana to Google (GOOGL +1.53%) and IBM (IBM +0.8%).

The reason the tech giants, with deep enough pockets to develop slowly superconducting quantum computing for 10-20 years, prefer this option is that it is the one with the most likelihood to scale up one day to tens of thousands of qubits.

For a long time, it was thought to be the only way to reach the computing power required for real-life applications.

Quantinuum IPO

This might not be true, as a series of innovations could change how quantum computers are being built in the near future, and with trapped-ion tech taking the lead:

- Increase the possibility of networking smaller quantum computers together, thanks to single photon teleportation, quantum operating system QNodeOS, and high-efficiency daisy-chaining of quantum computers.

- The first real-life use case of quantum computing solving a problem better than normal computers. And it was for training AI neural networks, a notoriously compute-hungry task that is also exploding in demand.

Quantinuum is now actively pursuing this target of “Generative Quantum AI” with a string of related news around the meeting point of AI, photonics, and trapped-ion quantum computers.

It should lead to an IPO for the company owned at 52% by Honeywell, after a fundraising round valuing it at $5B. Founder Ilyas Khan is reported to own approximately 20% of the company. Other shareholders include JSR Corporation, Mitsui, Amgen, IBM, and JP Morgan.

A potential IPO of Quantinuum in the future, following the broader Honeywell restructuring and spin-offs, is estimated to be worth as much as $20B (1/7th of Honeywell’s total value) and might occur between 2026 to 2027.

Financial Performance & Shareholder Returns

Sales, EPS, And Cash Flows

Honeywell sales are still growing solidly, up $3.4B since 2022, and free cash flow is up $600M in the same period.

Source: Honeywell

Overall, the company’s return on capital invested has been hovering around 15%-19% since 2017, and the R&D and capex spending of 8%-10% should help maintain the company’s competitive position.

Returns To Shareholders Policy

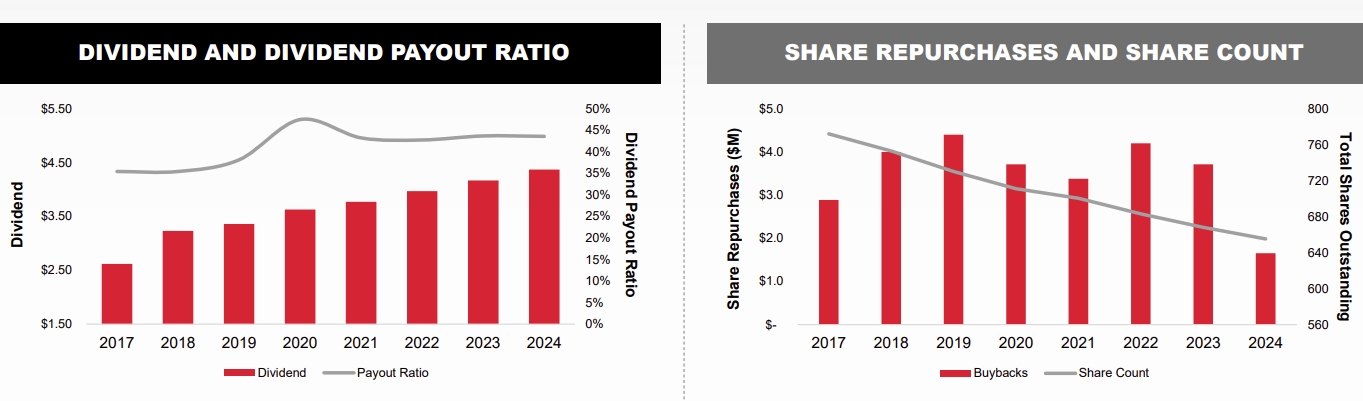

The company’s management and strategy are very focused on shareholders’ returns. This is done through share repurchases, with $ 13B+ committed in 2023-2025, and dividends, with $9B committed in 2023-2025. There were at least 15 dividend increases since 2010.

Source: Honeywell

The share count is down from around 760 million in 2017 to 650 million in 2024.

Both repurchases and dividends are driven by consistently growing earnings per share, having compounded at 10% annually since 2004.

Source: Honeywell

Latest Honeywell (HON) Stock News and Developments

Can Honeywell International (HON) Keep the Earnings Surprise Streak Alive?

2 Overlooked Dividend Stocks With Upside

These 2 Blue Chip Stocks Just Declared Dividend Raises. Should You Buy 1 or Both?

October Dogs Of The Dow Flash One Ideal 'Safer' Dividend Buy

Honeywell Benefits From Business Strength Amid Headwinds

All You Need to Know About Honeywell International (HON) Rating Upgrade to Buy

Conclusion: Is Honeywell a Buy in 2025?

Honeywell is an industrial giant whose products are empowering countless other industries, especially the aerospace and manufacturing sector, but also biotech, data centers, oil & gas, utilities, etc.

It is an important defense contractor, producing key sensors, propulsion, communication, autopilot, avionics, and radar. With drones and smaller electrical aerial mobility growing in importance, the company has a field of potential expansion in an area where it could compete head-to-head with other larger aerospace companies.

In parallel, the valuable IP on key chemicals in refrigerant, ultra-strong textile, and energy-related products form a valuable and stable income stream.

For a long time, Honeywell was a conglomerate with several parts not really connected to each other. It will soon be possible for its shareholders to decide what they prefer in the company, thanks to the upcoming reorganization/split-up in 2026.

As a cherry on the cake, Honeywell is also a way to acquire parts of Quantinuum, a quantum computing company that has recently made impressive progress in finding the first use case for quantum computers, just as AI training models are getting in dire need of more efficient and less energy-hungry computing power.