Disruptive Tech

The 8 Biggest Tech Breakthroughs of 2025 (With Stocks)

Securities.io maintains rigorous editorial standards and may receive compensation from reviewed links. We are not a registered investment adviser and this is not investment advice. Please view our affiliate disclosure.

2025’s Innovations To Change The World

2025 delivered technological breakthroughs that will have a long-term impact not only on science and investors but also on our daily lives and the overall progress of humankind.

Unsurprisingly, the common threads are computing and energy.

More computing power has the potential to radically change how science, business, and daily tasks are executed. Consequently, new computing paradigms, such as quantum computing, and software applications like AI Agents, became the major trends of the year.

To fuel this computing and AI boom, the world requires more energy. This demand stems not only from the computation itself but also from the extraction of copper, aluminum, silver, rare earths, and other minerals needed to build the associated data centers.

Lastly, climate change continues to drive the mass electrification of energy systems previously dominated by fossil fuels. Better electricity storage is being deployed rapidly, not just for EVs, but for power grids that cannot rely solely on the intermittent production of renewables.

Summary

- AI and new forms of computing like quantum computing are the largest innovation stories of 2025, dominating both headlines and stock markets.

- This boom requires significantly more energy generation, leading to a strong push for innovation in the sector, including new forms of nuclear fission and a push for nuclear fusion.

- As the digital world becomes more critical, new ways of ensuring trust through blockchain are going mainstream, with cryptocurrencies increasingly adopted by traditional financial firms.

- Meanwhile, the electrification of transportation and industry requires superior electricity storage solutions, addressed by 2025’s breakthrough in solid-state batteries.

Public Companies Exposed to 2025’s Biggest Innovations

Swipe to scroll →

| Company (Ticker) | Business Activity | 2025’s Innovation | Key Risk |

|---|---|---|---|

| Alibaba (NASDAQ: BABA) | E-commerce / Cloud / AI | AI agent and advanced LLMs | China-USA trade war |

| Tesla (NASDAQ: TSLA) | EV / Robotics / Solar | Self Driving Robotaxis | Regulatory delays |

| BWX Technology (NASDAQ: BWXT) | Nuclear Energy & Fuels | SMR & naval nuclear reactors | Slow approval of SMR and new ship designs |

| QuantumScape (NASDAQ: QS) | Batteries | Solid-State batteries | Production scale-up |

| IBM (NASDAQ: IBM) | Computing equipment | Modular quantum computer | Intense competition from other tech firms |

| Trump Media & Technology Group (NASDAQ: DJT) | Media / Nuclear Fusion | Nuclear fusion (merger with TAE Technologies) | Profitability of experimental fusion reactor |

| Rocket Lab (NASDAQ: RKLB) | Orbital launchers & satellites | Large Reusable Rocket | Intense competition |

| Gemini Space Station (NASDAQ: GEMI) | Cryptocurrency exchange | Prediction Markets | Regulatory risks |

8 Most Impactful Innovations In 2025

1. AI Agents

If 2024 was the year AI went mainstream with the popularization of LLMs (Large Language Models), 2025 is when it began deploying applications to the real world.

This is happening through “AI Agents”: The core idea of AI agents is to create AIs that can operate independently in a given environment.

This gives them very different practical roles than generative AIs like LLMs or image generators, which mostly react to human-created prompts.

In this context, “environment” can mean specific situations in the real world—like a car on the road utilizing AI for self-driving functions—or a fully virtual place, like specific software or digital interfaces.

Because the AI agent acts autonomously, it does not require constant intervention via prompting. It can take action by itself, without needing confirmation or supervision.

In practice, most AI agents have built-in conditions and rules where they ask for feedback from a human supervisor at key steps.

Source: DevRevAI

This makes AI especially relevant for highly repetitive tasks, ranging from walking a customer through a troubleshooting algorithm to driving trucks on a highway. Contrary to humans, such AI works 24/7 and does not require a salary or health insurance.

Source: Cobus Greyling

In addition to being more reliable and task-specific, AI agents demand less computing power, as they rely on a smaller, more specialized knowledge and reasoning dataset.

Overall, we should expect AI agents’ deployment across many industries to be a dominant part of the economic story in the coming years:

- Customer services.

- Scientific research.

- Websites & Marketing.

- Translation and Law.

- Arts.

- Healthcare.

- Security.

- Logistics and transportation.

- Finance.

- Manufacturing.

(You can read more about AI agents in our article dedicated to the topic)

AI Agent Company – Alibaba

Alibaba Group Holding Limited (BABA -3.45%)

Better known in the West for its e-commerce platform and as a supplier of cheap materials and consumer goods, Alibaba is also a massive tech company in China, leading in AI and cloud computing.

Notably, Alibaba controls 36% of the cloud market in China, well ahead of all competitors.

Source: Jeff Townson

Perhaps most importantly, it already offers six new DeepSeek AI models, the open-source AI that rocked the world by suddenly outperforming most American AI models for a tiny fraction of the costs in both development and on a per-use basis.

Alibaba also has its own AI model, Qwen, and claims Qwen 2.5 is even better than DeepSeek V3.

“Qwen 2.5-Max outperforms … almost across the board GPT-4o, DeepSeek-V3 and Llama-3.1-405B,”

Alibaba’s Cloud Unit

Beyond its growth in cloud and AI, Alibaba remains a giant of e-commerce in China, with Taobao & Tmall only slightly down from their 29% share of global online sales in 2019.

Recent AI progress has shifted how Alibaba is perceived. From a legacy e-commerce position under pressure, it has pivoted back to leading China’s tech innovation.

Quark, a comprehensive AI agent powered by Qwen, is the new weapon Alibaba is deploying to capture the Chinese AI assistant market, having prepared the ground by deploying it as an AI search engine first and gathering 200 million users.

Considering its relatively low stock price—triggered by years of tech crackdown and concerns about investing in China—Alibaba could be an opportunity for investors willing to bet on China taking the lead in the AI race.

(You can also read our dedicated report focused on Alibaba for more details.)

2. Self-Driving & Edge Computing

While self-driving AIs can be seen as a subset of AI agents, their potential is so transformative that they deserve their own mention in the hall of fame of 2025’s innovations, as we explained in “2025: The Year Self-Driving Cars Go Mainstream?“.

Back in 2023, the ARK Invest “Big Ideas” report projected massive potential revenues for robotaxis, with revenues as high as $9T projected by 2030.

Behind the idea is the core economic fact that robotaxis could reduce the need for owning a car, provided rides are cheap enough.

This creates a positive feedback loop: cheap fares increase demand, which increases the utilization of robotaxis, amortizing capital costs, reducing prices further, and increasing demand again.

Currently, the industry is moving away from the consensus solution of LIDAR (“laser radar”) + cameras, to camera-only. This allows for the removal of the dependency on expensive LIDARs and mimics how a human driver analyzes the road.

This shift is driven largely by the extremely quick rate of improvement in AI reasoning and so-called “edge computing”: calculating a safe driving path directly using the car’s hardware, without extra connection to an outside server.

Self-Driving Company – Tesla

Tesla, Inc. (TSLA -2.62%)

This direction greatly benefits Tesla, which has long been the sole advocate of this strategy.

As the company collected an order of magnitude more data from its fleet, it may be the first to achieve “true” autonomous driving, beyond the “geofenced” limits imposed on solutions like Waymo (part of Google/Alphabet (GOOGL -0.63%)).

Source: ARK Invest

Until 2025, Tesla’s release of Full Self-Driving (FSD) was a perpetually “soon” then delayed announcement, stemming from unfulfilled 2018 expectations and leading to harsh criticisms.

However, this changed when Texas granted Tesla Robotaxi a permit to run a ride-hailing service in August 2025, following a test run in Austin since June. For now, a Tesla employee remains on board as a safety monitor.

(You can read more about Tesla in its dedicated investment report.)

3. Thorium Nuclear Energy

Nuclear power plants use the fission of uranium atoms to create heat, which is then turned into electricity. Uranium was originally chosen because its use created plutonium—useful for nuclear weapons—which was a strategic advantage during the Cold War.

Today, the need for low-carbon energy combined with concerns over nuclear proliferation makes non-weaponizable fissile materials more attractive.

This makes thorium the best alternative to uranium. It is 4x more abundant and more equally distributed across the planet.

Thorium mining is far less impactful on the environment, and thorium nuclear energy generates significantly less nuclear waste, with that waste having a shorter half-life than that produced by conventional reactors.

Source: Energy From Thorium

Lastly, thorium reactors are safer due to the way the material generates energy—at least for molten salt reactors—as they do not need an external cooling system and cannot experience a runaway chain reaction (the cause of meltdowns at Chernobyl and Fukushima).

2025 saw China manage not just to refuel its experimental thorium reactor without interruption, but also the first conversion of thorium and uranium nuclear fuel.

“This milestone breakthrough provides core technological support and feasible solutions for the large-scale development and utilization of thorium resources in China and the development of fourth-generation advanced nuclear energy systems.”

Li Qingnuan – Shanghai Institute of Applied Physics Deputy Director

Thorium & Nuclear Stock – BWX Technologies

BWX Technologies, Inc. (BWXT -0.81%)

Today, thorium reactors are most advanced in China, and most private companies developing thorium reactors in the West are privately listed, such as Copenhagen Atomics, Terrestrial Energy, or TerraPower.

However, any growth in nuclear energy—be it SMR (Small Modular Reactor), 4th generation uranium reactors, or thorium reactors—will need nuclear-rated components, fuel, and access to the existing nuclear supply chain.

BWX Technology is a major provider of nuclear parts and components, as well as the builder of nuclear reactors for the US Navy. The company has delivered 400+ reactors for naval nuclear power in its 60+ year history, as well as 315 steam generators for nuclear power plants.

The company is also the only one accredited to produce high-quality uranium at 20%+. This fuel type is needed for so-called micro-reactors, which are even smaller than SMRs. These can power applications like space systems for NASA and remote military locations.

BWXT is also entering the nuclear medicine field, hoping to capture some of the sector’s $500M annual revenues.

As the US Navy looks to restart building massive 35,000-ton battleships, all nuclear-powered, this should provide further opportunity for BWX Technology, on top of continuous orders for submarines and carriers.

Finally, BWXT is working on an SMR design with GE Energy, as GE is a main contender in the nascent global SMR market, with contracts already agreed with Estonia and Canada.

4. Solid-State Batteries

As EVs attempt to replace internal combustion engine (ICE) cars completely, ever-denser batteries are required to compete directly with fossil fuels.

A large segment of consumers remains doubtful of the range and recharging speeds of most EV models. The risk of fire from traditional lithium-ion batteries is also a concern.

The solution is solid-state batteries. These replace the liquid electrolyte in lithium-ion with a solid electrolyte, eliminating fire risks and massively increasing energy density.

Source: QuantumScape

2025 was the year the solid-state battery finally moved from promising prototype to mass production and integration into commercial vehicles. This was primarily the achievement of QuantumScape and its partnership with Volkswagen.

Solid State Battery Company – QuantumScape

QuantumScape Corporation (QS -11.96%)

In 2025, QuantumScape saw the debut of its battery in the electric motorcycle Ducati V21L.

Source: QuantumScape

QuantumScape’s design is significantly superior to lithium-ion batteries in almost all metrics:

- It can charge in just 15 minutes (10-80% at 45 ºC).

- The separator replacing the liquid electrolyte is nonflammable and noncombustible.

- Its battery cells’ energy density is 844 Wh/L and 301 Wh/kg.

- For reference, Tesla’s 4680 cells stand at 643 Wh/L and 241 Wh/kg, and BYD’s blade cells at ~375 Wh/l and 160 Wh/kg.

Volkswagen’s battery department, PowerCo, will provide QuantumScape up to $131 million in new payments over the next two years upon achieving certain milestones, demonstrating the group’s commitment to solid-state technology.

(You can read more about QuantumScape in our dedicated investment report.)

5. Quantum Computing

Quantum computing involves using quantum physics to perform calculations, differing fundamentally from semiconductor-based methods.

Instead of generating 0s and 1s (no current or current), it uses “quantum bits,” or qubits, where particle data can be 0 AND 1 simultaneously.

This is a game-changer for complex calculations like climate modeling, cryptography, or the 3D configuration of complex molecules like proteins.

Source: IonQ

When mature, this technology could represent a $500B market, with individual applications representing >$10B markets each.

Source: IBM

From early proofs-of-concept, several milestones were achieved in 2025, alongside pioneering steps in new computing methods:

- Quantum teleportation of data through ordinary optical fiber.

- New magnetic superconductor materials to create quantum logic gates.

- 2D superconducting material to create low-loss superconducting qubits.

- Photon sifter for creating all-optical quantum computers.

All these advancements prove that quantum computing is getting much closer to commercial use.

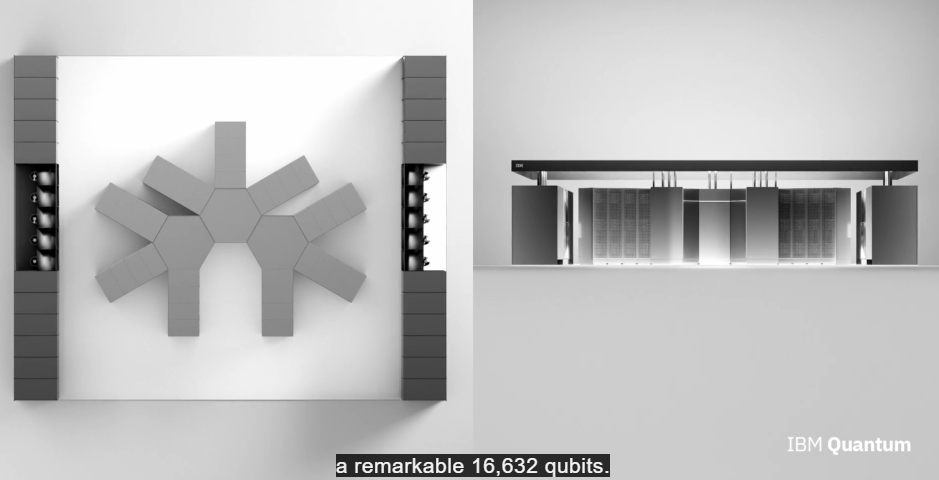

Quantum Computing Company – IBM

International Business Machines Corporation (IBM -4.87%)

IBM is at the forefront of quantum computer development. It developed its 127-qubit “Eagle” computer, followed by the 433-qubit “Osprey” and the “Condor”, a 1,121 superconducting qubit processor.

The goal is ‘IBM Quantum System Two’, a modular system capable of supporting up to 16,632 qubits by combining up to 3 quantum units.

Source: IBM

Finally, IBM released Qiskit 1.0 in February 2024, the most popular quantum computing SDK. It offers improvements in circuit construction, compilation times, and memory consumption.

In early 2025, IBM reached $1B in quantum computing sales, having deployed 75+ systems since 2016.

IBM currently offers access to 100-qubit QPUs (Quantum Processing Units) through several plans paid on a per-minute basis.

The service is already in use, with case studies from electric grid company E.ON, Boeing, Mitsubishi Chemical, and CERN.

IBM’s strength has historically been in ultra-powerful supercomputers, a segment overshadowed by consumer electronics. The emergence of quantum computing is an occasion for IBM to shine again and become a leader in scientific and corporate computing, with an extensive roadmap planned through 2033.

Source: IBM

6. Nuclear Fusion

If nuclear fission is a promising low-carbon energy method, nuclear fusion would be a superior option to all other forms of energy generation:

- No carbon emissions or pollution.

- Unlimited fuel (hydrogen is the most abundant resource in the Universe).

- Dependable, stable baseload energy generation.

(You can read more about nuclear fusion technology in our report on the topic, as well as the international collaboration project ITER.)

Achieving commercially viable fusion is difficult, requiring plasma heated to millions of degrees, maintained for hours, with energy extracted efficiently.

However, this is likely changing soon. Many private companies moved toward their first commercial prototypes in 2025, including Proxima Fusion and Commonwealth Fusion Systems.

But the move grabbing the most attention in 2025 is the $6B merger of the US President’s company, Trump Media & Technology Group, with TAE Technologies, aiming to build the world’s first utility-scale fusion power plant next year.

Fusion Reactor Company – Trump Media & Technology Group

Trump Media & Technology Group Corp. (DJT -1.54%)

The merger of a media company with a nuclear fusion firm came as a surprise.

It implies that TAE has managed specific milestones on the path to fusion commercialization that were previously undisclosed. It also suggests the US President intends to speed up the deployment of this technology in the USA.

In 2026, the combined company plans to site and begin construction on the world’s first utility-scale fusion power plant (50 MWe), subject to required approvals. Additional fusion power plants are planned and expected to be 350 – 500 MWe.

This could trigger questions about conflicts of interest regarding regulatory approval. Nevertheless, this endorsement from the highest level is a clear sign that fusion is no longer “20 years in the future,” but arriving fast. 2025 was clearly the inflection point.

With the infusion of TMTG’s significant capital, TAE is on the precipice of scaling its leading technology to usher in a new era of energy abundance. The world needs energy, and fusion is the clear answer.”

Michael B. Schwab – Founder and Managing Director of Big Sky Partners

7. Reusable Rockets and the Falling Cost of Orbit

During the 2020s, access to space was transformed by reliable reusable rockets, largely thanks to SpaceX. This collapsed the cost of reaching orbit by more than 10x.

Source: ARK Research

But to form a true space-based economy, even cheaper and larger rockets are needed.

2025 was the year SpaceX turned its largest-ever rocket, Starship, from an often exploding prototype to a workable solution. Starship managed several mid-air catches by the “Mechazilla” landing tower. Test 11 succeeded in recovering the booster stage, deploying its payload, and splashing down the upper stage.

SpaceX is one of many private companies progressing quickly in reusable rockets. While most remain private (although a SpaceX IPO is rumored for 2026), one major player is publicly listed: Rocket Lab.

Reusable Rocket Company – Rocket Lab

Rocket Lab USA, Inc. (RKLB -5.19%)

Rocket Lab was founded in 2006, 4 years after SpaceX. It became a public company via SPAC in 2021.

Rocket Lab has launched 203 satellites and manufactured components for over 1,700 satellites in orbit. In 2024, it performed 56 launches of its Electron rocket, making it the second most frequent U.S. rocket and the 3rd globally.

The next step is the Neutron rocket, a much larger model with 13,000 kilos of payload to Low-earth Orbit (LEO)—43x more mass than Electron. Neutron uses LOX/Methane, similar to SpaceX’s Starship.

Source: Rocket Lab

In 2025, the company is finalizing touches for two Neutron launches already booked for 2026 & 2027.

Rocket Lab is also developing a rocket for the Pentagon to test hypersonic missiles (the HASTE program).

While rockets grab attention, Rocket Lab is currently primarily a satellite-building company by revenue, with extensive cleanroom and production facilities. This makes it a “one-stop shop” for companies needing both a satellite and launch provider—an “end-to-end space company.”

In 2025, it will also participate in the “Astroscale Orbital Debris Inspection Demonstration Mission” (ADRAS-J) to observe derelict rocket stages and determine methods for deorbiting them.

(You can read more about Rocket Lab in our dedicated report on the company)

8. Crypto Goes Mainstream (ETFs, Exchanges, Tokenization)

After years of growth, 2025 was the year cryptocurrencies finally went mainstream.

On one hand, this seems contrary to the initial promise of crypto as an anti-establishment alternative. On the other, increased regulation and integration illustrate the growing importance of the asset class.

Investors can now buy Bitcoin and Ethereum ETFs, and VanEck launched a Solana ETF in November 2025. Several exchanges offer cards tied to Visa and MasterCard, and a complex ecosystem of derivative products has grown around cryptos.

Meanwhile, blockchain technology is being adopted in supply chains, payment solutions, and for “tokenized” stocks.

Compliant Crypto Company- Gemini Space Station

Gemini Space Station, Inc. Class A Common Stock (GEMI +0.3%)

As crypto goes mainstream, exchanges with a history of regulatory compliance have a reputational advantage when partnering with large banks and investment firms.

This is the core idea behind Gemini’s strategy to build a “trusted crypto-native finance platform” acting as a bridge between traditional finance and the crypto economy. Their mantra counters the typical tech startup philosophy:

“Ask for permission, not forgiveness.”

This focus on security allowed the company to earn ISO 27001 and SOC 2 Type 2 certifications.

In 2025, Gemini settled all previous regulatory issues with the CFTC and SEC.

This opened the way for the company’s September 2025 IPO, and it received approval from the U.S. to operate as a Designated Contract Market (DCM) and enter prediction markets.

“Prediction markets have the potential to be as big or bigger than traditional capital markets.

For example, “Will 1 bitcoin end this year higher than $200k?” Yes or no. Or, “Will Elon Musk’s X end up paying the full $140 million fine to the European Commission in 2026?” Yes or no.”

This puts Gemini alongside giants like Kalshi and Polymarket.

Progress made by Gemini and companies like Coinbase (COIN -7.9%)—also entering prediction markets at the end of 2025—illustrates that crypto is now an integral part of the financial system.

(You can read more about Gemini in our dedicated article about the company.)