Spotlights

Albemarle (ALB): Digging ‘White Gold’ For The Energy Transition

Securities.io maintains rigorous editorial standards and may receive compensation from reviewed links. We are not a registered investment adviser and this is not investment advice. Please view our affiliate disclosure.

Why Lithium Is Critical to the Energy Transition

For most of human history, lithium was a relatively irrelevant metallic compound with little practical application.

This started to change with the invention by John Goodenough and others of the lithium-ion battery, a work that was rewarded by the Nobel Prize in Chemistry in 2019, which we detailed in a dedicated report.

The technology allowed for the explosion in small portable electronics, from the initial Walkman to today’s omnipresent smartphones, laptops, and tablets.

A key reason is that lithium has unique electrochemical properties, allowing batteries using this metal to be more energy-dense than any before.

Still, small electronics and niche use only consumed so much lithium, and it was not yet considered an important commodity. This changed with the rise of EVs and the global trend of electrification.

What made EVs start to compete technically with ICE (Internal Combustion Engine) cars, like the early BYD or Tesla (TSLA +0.38%) models, was the use of large lithium-ion battery packs.

Because an EV consumes as many batteries as hundreds or thousands of electronic devices, the electrification of transportation has made all the battery production before the EV revolution took off in the mid-2010s look like a footnote of history in comparison.

Source: Statista

To support the trend of electrification, cheap lithium is required. As this means large-scale, ultra-efficient lithium extraction. One company has been among the leaders in answering the world’s exploding hunger for lithium: Albemarle.

Albemarle Corporation (ALB -1.83%)

Lithium Overview

Lithium 101

Before looking into the details of the activity of one of the world’s largest lithium producers, an understanding of lithium chemistry and lithium markets is useful.

Lithium was first discovered in 1817 by Swedish chemists. It is the lightest solid element, with the atomic number 3 (only 3 protons in its nucleus).

Source: Medium

Lithium atoms’ small size means that they have only one electron on their outer charge, and when this electron moves to another atom, this gives them an enormous electric potential change per atom.

In 2024, 2/3rds of lithium production came from ore mining, in large part from spodumene deposits in Australia, the world’s largest producer. This is also the type of lithium production that is predominant in China.

Another 1/3rd comes from brines, mineral-rich waters generally found underground. The largest producers of this type of lithium are the so-called “Lithium Triangle”: Bolivia, Argentina, and Chile.

Source: Lithium Harvest

The largest proven reserves of lithium are located in the lithium triangle, giving the region the largest potential for future production growth. Together, these three countries represent almost 50% of the world’s lithium reserves.

Source: UFine Battery

(You can also read more about the difference in extraction technology of lithium between brine and rock in our report about investing in lithium).

Lithium Markets

Battery-grade level of lithium purity is harder to achieve and requires specialized infrastructure and expertise. Currently, it is a specialty of Chinese producers, with around 67% of global lithium supply processed by China.

Lithium prices have acquired in the past decade a reputation for being extremely volatile, fluctuating widely.

Source: Benchmark Minerals

The 2023 price spike was due to quick growth in demand with not enough supply, as new mines are slow to get started.

This was immediately followed by a dramatic fall in prices, stemming from the combination of massive new production capacity coming online and the EV adoption rate slowing down at the same time.

To this day, the market is still relatively low, despite signs that EV sales are rebounding after the 2024 relative slump.

In the first half of the year, more than 5.9 million battery electric vehicles (BEVs) were registered worldwide, a 37% increase compared to the same period in 2024. For comparison, full-year sales in 2024 had only grown by around 14%.

This rebounding demand is increasingly shaping to become a strategic weak point for Western countries, especially in Europe.

Europe’s growing dependence on Asian suppliers. “Rare earths and materials such as lithium are the building blocks of electric mobility and are increasingly becoming Europe’s strategic Achilles heel.”

Source: Albemarle

The Threat of Alternatives To Lithium

Some alternative battery chemistries try to bypass lithium entirely, like sodium-ion batteries, and might ultimately dent the demand for lithium in the long term (10+ years).

But for now, range anxiety and slow charging are the main objections potential EV buyers bring, especially out of the early adopters who are already with EVs. So high-performance lithium-based batteries are likely to stay in high demand.

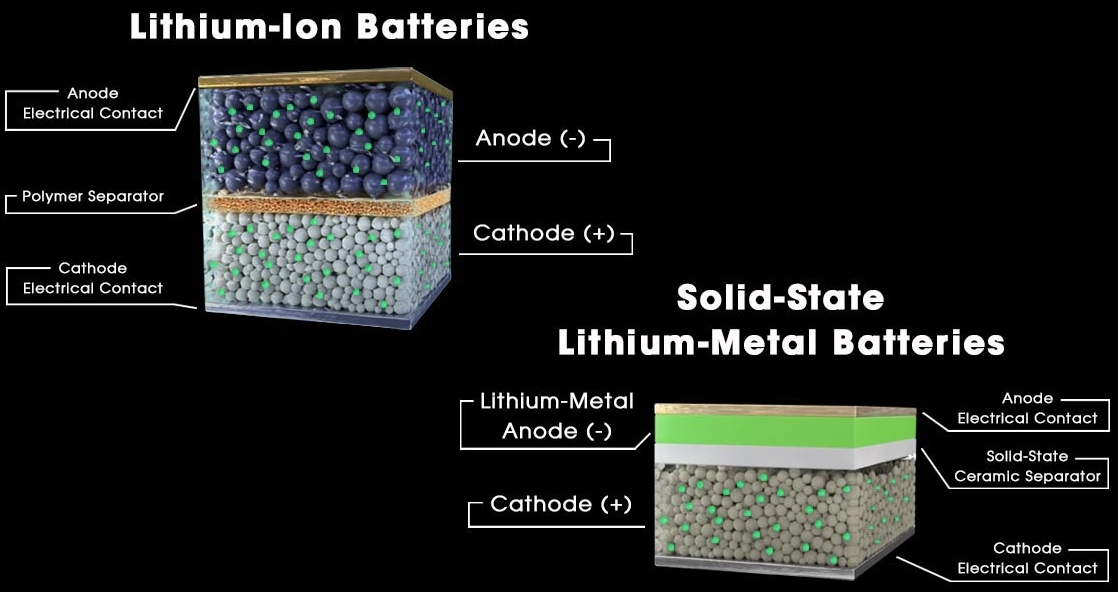

Besides, many of these alternatives to lithium-ion are equally dependent on lithium supply: ultra-durable solid-state lithium metal batteries, laser-printed lithium-sulfur batteries, lithium-CO₂ batteries, lithium-indium batteries, cold-resistant lithium-ion batteries, graphene lithium-ion batteries, etc.

Source: Flash Battery

So, ultimately, even if each potential battery chemistry has its own set of advantages and weaknesses, lithium is still a key component for high-energy-density batteries.

Source: Lithium Harvest

Besides EVs, stationary energy storage, including cheaper and less dense LFP batteries, is expected to be a strong contributor to growing demand in the coming years, with a year-to-year growth of 15%-40% in 2025.

| Year | EV Batteries (Mt LCE) | Stationary Storage (Mt LCE) | Other Uses (Mt LCE) | Total Demand (Mt LCE) |

|---|---|---|---|---|

| 2024 | 0.4 | 0.05 | 0.1 | 0.55 |

| 2025 | 0.55 | 0.08 | 0.11 | 0.74 |

| 2026 | 0.72 | 0.12 | 0.12 | 0.96 |

| 2027 | 0.92 | 0.17 | 0.13 | 1.22 |

| 2030 | 1.6 | 0.4 | 0.14 | 2.14 |

Overall, lithium demand should almost triple from 2024 to 2030, with EV market penetration reaching 42%-54%.

Source: Albemarle

Albemarle Overview

Albemarle is among the world’s top lithium producers, only outmatched by one of the world’s mining companies, Rio Tinto (RIO -1.39%), fellow lithium triangle producer SQM (SQM -0.77%), and Chinese Ganfeng Lithium (GNENY).

The company employs 8,300+ people, has more than 1,650 patents (mostly related to the extraction and purification of lithium and bromine), and sells in more than 70 countries to 1,900 different customers.

Albemarle has mining operations in South America, Australia, and the USA, as well as refineries in the USA, China, and Germany.

Source: Albemarle

It generated $5.4B in revenues in 2024, for an EBITDA of $1.1B.

Albemarle produces lithium through both hard rock mining and brine deposits in the lithium triangle, giving it flexibility on its lithium sources.

The raw material is then shipped to either China (hard rock sources) or to La Negra, Chile (brines).

Source: Albemarle

While lithium makes up the large majority of the company’s revenues, it also produces bromine, used in industrial water treatment, and flame retardants.

Albemarle is also the owner of Ketjen, a provider of advanced catalyst solutions to leading producers in the petrochemical, refining, and specialty chemicals industries.

In 2024, due to record-low lithium prices, these segments were a larger percentage of total revenues than previously.

Source: Albemarle

AlbeMarle’s Future

Innovation

Besides hard rock mining and brine, a third option for lithium production is Direct Lithium Extraction (DLE).

Direct extraction targets the lithium atoms through a selective extraction process. This can be achieved through a few different methods:

- Adsorption-based DLE, where the lithium is physically absorbed by a dedicated material.

- Ion Exchange-Based DLE, where the lithium is exchanged against cations (positive ions).

- Solvent Extraction-Based DLE, where an organic liquid solvent absorbs and dissolves the lithium away from the brine.

- One last method was published recently, EDTA-aided loose nanofiltration (EALNF) to extract lithium.

Source: Lithium Harvest

Overall, direct lithium extraction could be a game-changer for the industry, allowing for extraction without chemicals and requiring much less energy.

Another, still mostly theoretical method could be Electrochemical Lithium Extraction. The idea is to use a powerful electric current to separate the lithium from the other minerals in the brine. A 3-chamber electrochemical reactor developed at Rice University could maybe open the way for that method to become economically and industrially viable.

Among the leaders of DLE are Arcadium, now part of Rio Tinto, and Albemarle. Albemarle has commissioned in 2024 a DLE pilot plant at its La Negra site in Chile.

It has the potential to increase lithium recovery rates by up to 85%, scale production, and accelerate the time needed to bring lithium to market.

Another pilot DLE process is being launched at the facility in Magnolia, Arkansas, using a different brine source and a different extraction technology, expanding further the breadth of DLE applicability.

Overall, this could bring Albemarle into producing a much less energy-intensive and cheaper lithium than most of its competitors.

Mastering A Low Price Environment

In commodity markets, being able to sustain activity even during downturns, especially low prices lasting several years, is what distinguishes the successful giant mining companies from the smaller ones, doomed to a cycle of boom and bust.

As lithium prices have been going lower in the past 2 years, this is the elephant in the room that can cause legitimate concern for potential shareholders of Albemarle.

A key part of handling this type of situation is enough flexibility to cut costs when the commodity prices are low.

This is exactly what Albemarle did in 2024, with a cut to capex of $450M year-to-year, and more than $1.3B since 2023, with more cuts for 2025.

Source: Albemarle

In parallel, the company has saved up to $400M from improvements in its cost structure (energy efficiency, fewer management layers, etc.) and increased productivity (yield improvements, plant ramp-ups, common ERP platform, etc.).

Source: Albemarle

This resulted in quickly improving operating cash flow margins, with free cash flow expected to be positive in 2025.

Source: Albemarle

Besides the need for positive free cash flow, liquidity, and cash available can be the death of a company during a sector downturn. Albemarle has at the end of Q2 2025 more than $1.8B in cash, and almost as much in other forms of liquidity.

Source: Albemarle

Meanwhile, the debt held is at a low fixed rate (3.6%), for a total of $3.5B, with enough cash on hand to cover repayment until 2032.

Source: Albemarle

This overall means that Albemarle is not in any danger from a financial point of view, which is more than many small lithium producers can say.

In contrast, the company is already looking at improving EV sales, and could likely grow quickly through a mix of restarting capex and acquisitions of distressed smaller producers in the upcoming years.

As a result, it can invest in growth moderately and look for now at a production growth of 15% CAGR (in volume), which should help stabilize cash flows, and potential for higher growth if market conditions improve.

This would replicate the recent rapid entry of Rio Tinto in the lithium market with the acquisition of Arcadium Lithium, itself the result of the merger in 2023 of large lithium producers Allkem & Livent, making it pre-acquisition the 3rd largest lithium producer in the world.

Improving Green Profile

As lithium is a commodity valued for its role in electrification and decarbonizing the economy, its carbon and environmental profile matters a lot.

In that respect, Albemarle production coming from brine (60% of total production) is more energy efficient, as a lot of the energy is provided “for free” by the Sun in the drying ponds of the lithium triangle.

Source: American Solar Energy Society

However, for the rest of Albemarle’s electricity consumption, some progress has still to be made, with, for example, 24% of total purchased electricity coming from renewable energies in 2024, up from 16% in 2023.

Salar de Atacama, La Negra, Kings Mountain, and Silver Peak operate on 100% renewable electricity, but the refining facilities, especially in China, are still to be powered solely by renewable power.

However, these emissions should not be understood out of context, as lithium represents only 4% of the total emissions created by the production of a battery-powered car. As EVs avoid around 26 tons of emissions compared to an ICE vehicle, lithium’s potential “emission problem” is not a serious one.

Source: Albemarle

Besides carbon emissions, Albemarle is also optimizing its operations to reduce the consumption of water, with a goal to reduce water usage by 25% by 2030, with the program ahead of schedule in Chile.

Source: Albemarle

The company has also reduced its air pollution, notably reducing its sulfur emissions by 80% from 2022 to 2024. It also uses Bischofite, one of the co-products from lithium extraction, which acts as a dust suppressant. This solution uses approximately 95% less water than the use of water alone and is 30% more effective in the control of dust on dirt roads.

In 2024, Albemarle sold enough bischofite as a dust suppressant in Chile to save approximately 51 billion liters of water and prevent over 6,000 tons of airborne particulate matter.

Lastly, Albemarle continued to help its customers comply with the EU battery passport regulation, which will take effect in 2027. It will create a unique product identifier in the form of a QR code, which will record the battery’s raw materials, manufacturing history, carbon footprint, human rights record, circularity, and other factors.

Conclusion

The green transition is highly reliant on a few key commodities, some of which have become significantly more important than at any point in history prior. Lithium is one of them, and also a lot harder to replace than minerals linked to a specific battery design, like cobalt.

This makes lithium miners a potentially attractive investment, especially for value investors, as the sector is far from the highs of 2023.

However, a highly volatile and cyclical sector like lithium is also a very risky one. This is why large producers, with lower production costs, more financial resources, and the ability to rebound and deploy capital at scale quickly, are less risky than smaller, less capitalized lithium mining companies.

Albemarle is more diversified geographically than its arch-rival SQM (centered on Chile and the lithium triangle) and more focused on lithium than Rio Tinto, which is also an iron, gold, copper, and aluminum miner.