BioTech

10 Promising Biotech Stocks to Invest in (January 2026)

Securities.io maintains rigorous editorial standards and may receive compensation from reviewed links. We are not a registered investment adviser and this is not investment advice. Please view our affiliate disclosure.

The Birthplace Of Medical Revolution

While biotechnology (BioTech) is a very large field, its largest impact is in medicine. For a long time, medicine has mostly guessed what was wrong in the body of patients. Even when it became more scientifically driven, it still had to rely on assumptions, indirect measures, and partial knowledge to try to bring people back to health.

Another limitation of medicine was treating symptoms, not causes. A doctor could reduce cholesterol levels but not solve why it is high in the first place. Bring extra insulin, but not make the body produce it.

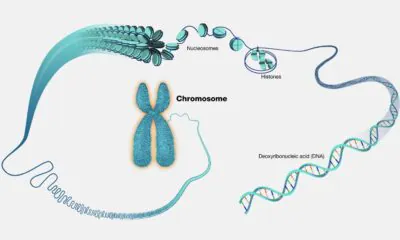

BioTech, and especially the new crops of innovation now reaching the market, is different. By manipulating in a controlled fashion, BioTech can target to regrow damaged tissues or change faulty genetic code.

So, this list will explore the most promising biotech stock, both from an investing and a technological and medical perspective.

10 Promising Biotech Stocks In The Medical Field

(These stocks are ordered by market capitalization at the time of this writing)

1. Vertex Pharmaceuticals Incorporated

Vertex Pharmaceuticals Incorporated (VRTX +0.23%)

Vertex Pharmaceuticals Incorporated (VRTX +0.23%)

Vertex is the leader in Cystic Fibrosis treatment, a deadly genetic disease, with 4 different treatments targeting different patient profiles. Patients who cannot be treated with the current therapy have a drug in phase III of clinical trials, Vanzacaftor.

They are also developing gene therapy for a permanent cure for cystic fibrosis using mRNA technology.

Source: Vertex

But what makes Vertex promising is not only making it manageable or even curing cystic fibrosis. It also seeks approval for a sickle cell disease treatment and Beta-Thalassemia therapy.

Beyond rare diseases, it is also working on curing type-1 diabetes in partnership with CRISPR Therapeutics and its gene editing technology. This relationship deepened after the acquisition of ViaCyte.

And if that was not enough, it also has another program with the same goal to cover possible technical hiccups.

Lastly, their VX-548 treatment for acute pain is in the last stage of development and might be a new alternative to opioids without the risk of addiction and fewer side effects.

Source: Vertex

2. Moderna, Inc.

Moderna, Inc. (MRNA -6.09%)

Moderna, Inc. (MRNA -6.09%)

One of the big winners of the pandemic and the mRNA vaccine technology, Moderna is doubling down on the vaccine applications of mRNA. It has no less than 32 clinical trials for mRNA vaccines, covering 14 pathogens like the RSV, Zika, HIV, Epstein-Barr virus, or cytomegalovirus.

Besides this strong focus on vaccines, Moderna is also exploring the potential of mRNA technology for cancer therapies.

Another promising aspect of Moderna is a flurry of acquisitions of ambitious small startups working on entirely new technology platforms. For example, synthetic genome company OriCiro, metagenomics and AI gene discovery Metagenomi, and macrophage therapies Carisma Therapeutics.

Source: Moderna

The overall strategy seems to be able to grab early new technology similar to how mRNA once was: extremely promising but still far from reaching markets with a usable product. Together with an R&D budget that tripled in 2023 compared to 2023, Moderna is likely to be one of the most innovative companies in the world in the decade to come.

3. BioNTech SE

BioNTech SE (BNTX -2.1%)

BioNTech SE (BNTX -2.1%)

The leader in the Covid-19 mRNA vaccine, BioNTech, is now looking at expanding the potential of mRNA technology.

This starts with vaccines, with candidates for shingles, tuberculosis, malaria, HIV, and herpes virus.

But the more ambitious target is using mRNA to cure cancer. BioNTech currently has 12 different candidates in cancer treatments, covering cancer in the ovaries, prostate, intestines, skin, head, neck, and multiple solid tumors. Most are on phase I clinical trials, with already 3 candidates in phase II. They are either fully owned or in partnership with Sanofi and Genentech.

BioNTech is also working on various other therapeutic methods, including cell and gene therapies, antibodies, and chemical drugs.

Thanks to the company’s culture of innovation and the windfall revenues from the pandemic, BioNTech is well-positioned to stay at the forefront of mRNA innovation. With more clinical trials on mRNA cancer therapy than all its competitors combined, it will likely be the winner in this field if the technology can be successfully used.

4. Exact Sciences Corporation

Exact Sciences Corporation (EXAS -0.11%)

Exact Sciences Corporation (EXAS -0.11%)

Cancer is especially deadly because it is often a silent disease. Most of the time, symptoms get visible only when it is already too late. This is why early detection can radically improve the survival rate of cancer patients.

For successful monitoring, the technology must be non-invasive and cheap enough to run regular testing. This is the idea behind Exact Sciences, which is using both DNA & RNA data to detect early cancer, which “simple” DNA tests might miss.

The company develops solutions for all stages of cancer detection.

Source: Exact Sciences

Such cancer detection is done from a simple blood sample and is also called liquid biopsy. Exact Sciences grew its revenues by 38% CAGR and reached positive EBITDA in 2023.

Source: Exact Sciences

In the long term, it is likely that liquid biopsy will become routine testing, as early cancer detection is a lot cheaper (and safer) than finding it later, making it a very cost-efficient option for insurance and society at large.

5. Neurocrine Biosciences, Inc.

Neurocrine Biosciences, Inc. (NBIX -0.87%)

Neurocrine Biosciences, Inc. (NBIX -0.87%)

Neurocrine is focused on neurology, with 2 approved medicines and 2 others licensed out to AbbVie in exchange for royalty payments.

- 7 potential neuropsychiatry treatments, of which one for schizophrenia is in phase 3.

- 1 potential neuro-endocrinology (brain hormones) treatment in phase 3.

- 5 potential neurology treatments are in phase 3: one for Huntington’s disease and one for cerebral palsy.

Source: Neurocrine

While the approved medicine provides current cash flow, the value of the stock is in the R&D pipeline. Schizophrenia or Huntington’s disease is currently very poorly treated and could represent very large markets to create and capture for Neurocrine.

6. Ionis Pharmaceuticals, Inc.

Ionis Pharmaceuticals, Inc. (IONS -1.84%)

Ionis Pharmaceuticals, Inc. (IONS -1.84%)

While mRNA has been spotlighted in the last 3 years, RNA is a complex molecule with many other sub-types. Among them are micro-RNA (miRNA) & antisense-RNA (asRNA).

They are naturally occurring RNA that do not encode any genes. Instead, they regulate standard mRNA activity, changing the cells’ genetic activity. Both miRNA and asRNA have been discovered to be involved in multiple diseases.

Ionis Pharmaceuticals(IONS) is a leader in antisense-RNA therapies. It currently has 4 commercialized drugs and a rich pipeline of potential new drugs, of which 9 are in phase III of clinical trials:

- 12 neurological therapies.

- 8 cardiovascular therapies.

- 3 rare disease therapies.

- 8 other diseases (Hepatitis B, kidney diseases, etc…)

Ionis has also created a joint venture with RNAi-leader Alnylam (ALNY): Regulus (RGLS). The joint company will use unique patents from both companies to create synergies between the 2 companies’ proprietary technologies.

How far RNAi, miRNA, and asRNA can go as a therapeutic class is yet to be seen. But if the case of mRNA taught us something, it is that we are just at the beginning of application relying on induced or regulated gene expression, and RNA molecules will be at the center of this new field of BioTech and medicine.

7. 10x Genomics, Inc.

10x Genomics, Inc. (TXG -3.49%)

10x Genomics, Inc. (TXG -3.49%)

Modern biotechnology advancements have been directly or indirectly thanks to modern genomics. No modern lab could work without full genome sequencing, RNA analyses, and protein detection.

So when a new segment of biotechnology analysis appears, researchers and investors have good reasons to get excited. 10x Genomics (together with competitors Nanostring) has been doing this by creating “spatial biology.”

Instead of looking at the “mix” of molecules in a sample, spatial biology can determine where in a tissue or a single cell a molecule of interest, like a specific sequence of RNA, is located. And this is either in 2D or 3D. In 2020, Nature Methods branded spatial transcriptomics the “method of the year.”

Some estimates put the Spatial biology total addressable market at $16B, as most of the genetic and molecular biology research is still done using older, less powerful technologies.

Source: Nanostring

10x Genomic grew using a mix of R&D ($1B+ investing in R&D so far) and acquisitions. Notably, its Visium platform was obtained through the acquisition of Spatial Transcriptomics in 2018.

For now, Spatial biology and 10x Genomics machines are exclusively used by researchers. This was also true for genetic sequencers and PCR machines in the early 2000s, and they are now present in every hospital and medical lab. The same might happen for spatial biology tools, with a wider adoption by the research community in the meantime.

8. CRISPR Therapeutics AG

CRISPR Therapeutics AG (CRSP -8.68%)

CRISPR Therapeutics AG (CRSP -8.68%)

CRISPR is a revolutionary technology that allows the editing of a cell’s genes or even the whole organism with high precision. This could be used to solve countless genetic diseases that were until now incurable.

CRISPR Therapeutics was founded by CRISPR Cas9 co-discoverer and 2020’s Nobel Prize winner Emmanuel Charpentier. The company focuses on applying to human medicine the Cas9 system.

Source: CRISPR Therapeutics

CRISPR Therapeutics is working in close collaboration with larger biotech Vertex to develop therapies for blood diseases and a potential cure for Type-1 diabetes.

Besides diabetes, the CRISPR Therapeutic R&D pipeline’s 2 flagship programs are blood therapies for Beta-thalassemia and sickle cell diseases (SCD). Both are developed in partnership with Vertex.

CRISPR Therapeutics is also developing a modified immune system cell that can be manufactured in advance and made to fit all cancer patients. The company currently has 8 candidates in the pipeline, of which 2 already in clinical trials.

CRISPR has been one of the most promising biotechnology companies in the last decade, offering to make gene therapies a reality after many false starts.

With CRISPR able to help cure genetic diseases and cancer, two of the most poorly treated health issues, the leading company in the sector has a lot of potential, as identified by the deepening partnership with older and larger biotech and rare disease leader Vertex.

9. Sangamo Therapeutics, Inc.

Sangamo Therapeutics, Inc. (SGMO -4.79%)

Sangamo Therapeutics, Inc. (SGMO -4.79%)

Sangamo is a gene therapy and stem cell biotech company. Its flagship program is a hemophilia A gene therapy, in partnership with Pfizer, in clinical trial phase 3. The Biologics License Applications (BLA) is anticipated for the end of 2024.

Its other important pipeline stem cell therapies in development are:

- Gene therapy for Fabry disease, in phase 1

- A stem cell therapy to remove the risk of kidney transplant rejection in phase 1

- A stem cell therapy for sickle cell disease, in phase 1 of clinical trials

Sangamo’s genome engineering could be used to solve neurological issues like prions disease (like mad cow disease), Huntington’s, etc. These programs are developed in partnership with Pfizer, Novartis, Biogen, and Takeda.

Sangamo relies on the more established “zinc-finger” technology for its gene editing. While at times more complex, it also allows for a genome-wide effect, compared to the more narrow effect of CRISPR-based methods.

As the leader in zinc-finger technology for medical applications, Sangamo has much potential to work on diseases where single gene editing could not provide sufficient results.

10. Evofem Biosciences, Inc.

(As a side note, Evofem did a 1-125 reverse stock split, which explains the somewhat strange stock price chart.)

Evofem is the seller of Phexxi, a revolutionary hormone-free contraception method approved in the summer of 2020. It was developed with the support of the University of Illinois Chicago. This makes it adopted mostly by women who previously did not want or could not use other forms of contraception (often for medical reasons).

The method uses a combination of lactic acid, citric acid, and potassium bitartrate and provides protection against chlamydia and gonorrhea. It is also a rather simple and cheap product to manufacture.

Phexxi sales have increased rapidly since approval, reflecting women’s growing awareness and adoption of this solution. The growth continued in 2023, with February 2023 seeing 15% more units sold than February 2022.

Source: Evofem

The company is targeting to reach cash flow break-even in 2023 and to relaunch on major stock exchanges (the stock is currently trading in the OTC- Over The Counter exchanges).

With the Phexxi patent running at least until 2033, this is an interesting niche single-product company with a long runway for its IP. Extra growth could come from additional applications as well as international licensing.

Very few biotech companies focus on women’s health, making it an under-treated and under-monetized market. Evofem’s simple but efficient product demonstrates this sector’s potential to bring outsized results from R&D efforts. With its approved drug potentially useful for more applications, Evofem is a very promising biotech company trading at a very low valuation (below $2M at the time of writing this article).