Investing In Crypto

Debt, DOGE, and Dilemmas: Can Musk and Trump Solve America’s $1 Trillion Interest Problem?

Securities.io maintains rigorous editorial standards and may receive compensation from reviewed links. We are not a registered investment adviser and this is not investment advice. Please view our affiliate disclosure.

US Debt And Growing Concerns

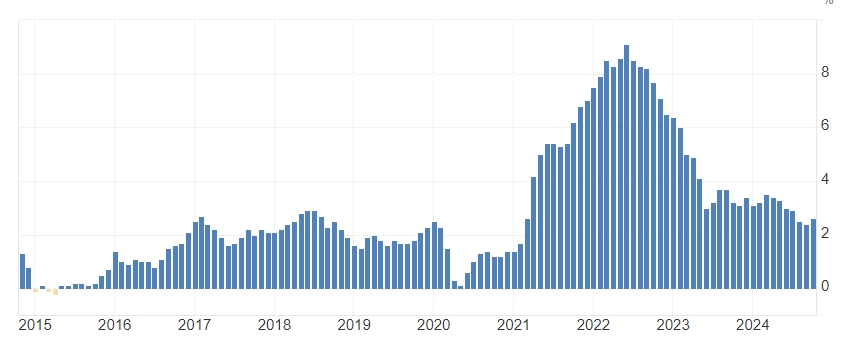

In the past few years, the level of debt accrued by the US government has been extensively discussed in the financial press, mostly due to skyrocketing interest payments.

Source: Federal Reserve Of St Louis

The payment of interest on US debt has passed the trillion dollar mark yearly, rising above the already enormous defense budget (40% of global military spending).

This has become even more relevant as the upcoming Trump administration seemingly will be appointing Elon Musk to “solve the problem” through the to-be-created DOGE (Department of Government Efficiency).

“A significant % of people don’t even know that there is such a thing as a national debt!

Those that do often don’t know how big it is or that our interest payments now exceed what we spend on our military. Only a small % understand that government overspending causes inflation.”

Elon Musk

Often predicted and always postponed, a debt crisis in the world's largest economy and the international reserve currency could be devastating and have wide ramifications, including for assets like Bitcoin and gold.

So, it is important for investors to properly evaluate this risk, and understand how to manage it in their investment strategy.

A Looming Crisis?

With the US stock market, especially AI and tech stocks, reaching all-time highs, it is easy to feel that the US economic situation is solid. However, there are a few problems born during the pandemic that are still lingering.

Inflation

One problem is the persistence of inflation, which remains above 2.5%.

Source: Trading Economics

This could be an issue, as it means that any tentative to reduce interest rates, which would make the US debt more manageable, could reignite 4-6% (or more) inflation.

“If we don't tackle the national debt, all tax revenue will go to paying interest and there will be nothing left for anything else.”

If the issue isn't addressed the dollar will be worth nothing.”

Elon Musk

This is not purely a theoretical issue, as many other external factors could boost inflation in the upcoming 4 years:

- Tariffs on imports from China, Mexico, Canada, etc.

- Labor shortages from curbing immigration and the deportation of illegal immigrants.

- Exogenous energy shocks, like an escalation of the conflict with Iran and/or Russia, uranium fuel shortages, etc.

If inflation stays at higher levels, so will interest rates, keeping the US interest debt payments above the trillion dollar mark.

Weakened Banking System

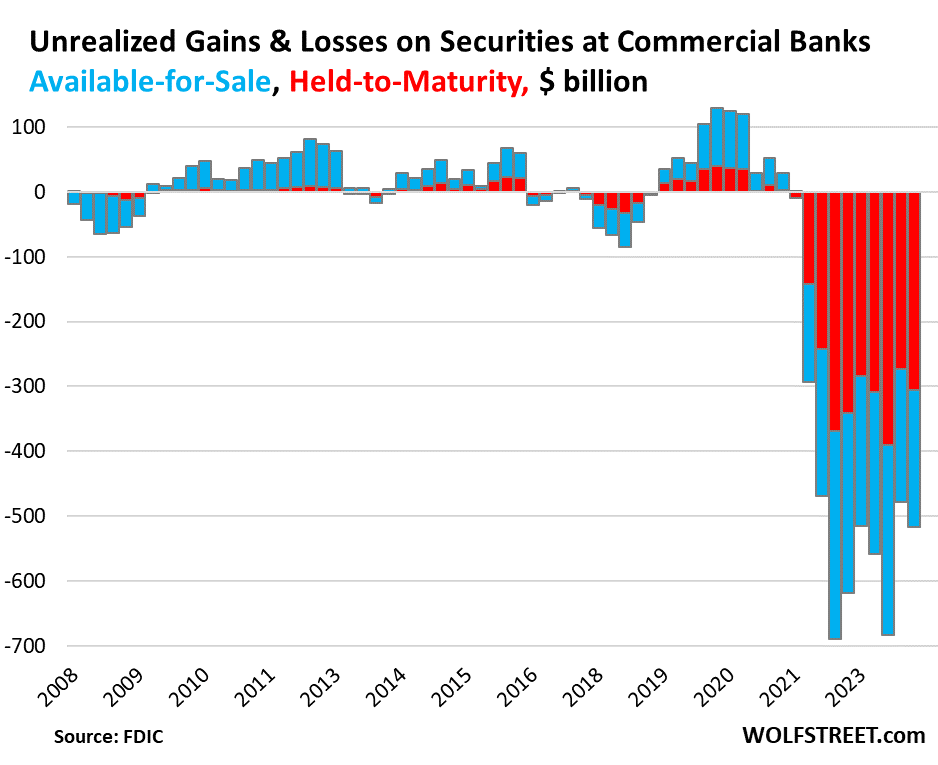

While there was no systematic failure like in 2008, there have been a few close calls in the last 2 years. First, there was the collapse of the Silicon Valley Bank and a few others in Spring 2023, the third-largest bank failure in United States history. Then, there was a mini stock market crash in August 2024 due to the weakening of the Japanese Yen.

While none of these events created a larger crisis, thanks to prompt intervention by central banks, this nonetheless indicates some potential hidden problems and instability in the global financial system.

A big factor behind these sudden weaknesses is massive unrealized losses hidden in the bank balance sheets. Actually, these losses are much larger than any losses during the 2008 Great Financial Crisis.

Source: Wolf Street

Behind these losses are 2 main contributing factors:

- The decline in commercial property values, especially office spaces, with the explosion of Work-From-Home (WFH) during and after the pandemic.

- Decline in government bonds values, due to raising interest rates after decades of declining interest rates.

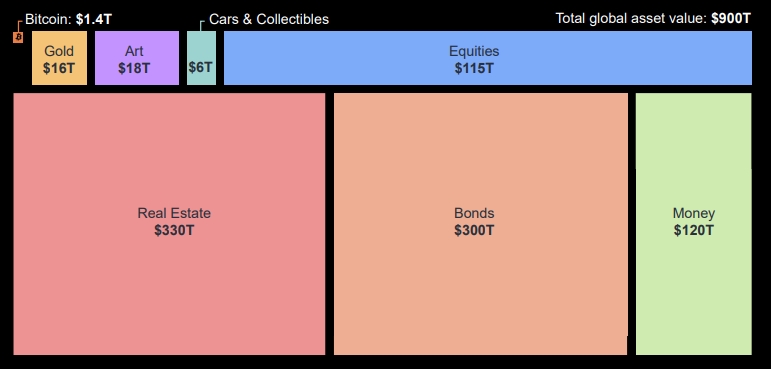

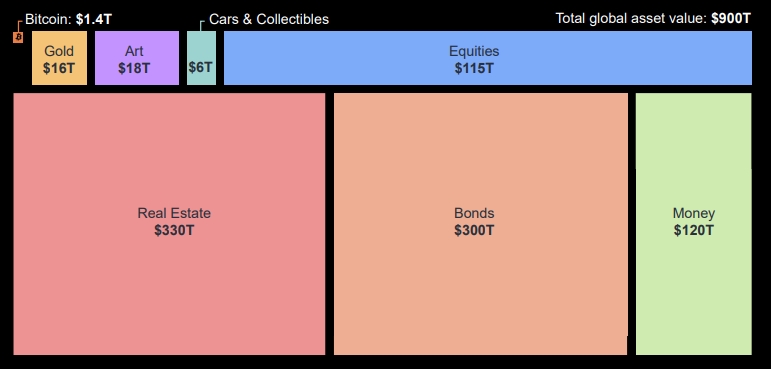

Considering that both bonds and real estate each represent 3x larger asset values than the entire equities markets, any issue in these segments can quickly become a global problem.

Source: MicroStrategy

DOGE Effect?

Historically, successive US administrations, both Democrats and Republicans, failed to address the mounting debt problem: the last budget surplus was in 2001.

So there is more than a little skepticism that the Trump administration will be any different, especially as his first 4 years as a president did not do much on that topic.

Source: DOGE

Still, one possibility is a massive wave of shrinking the federal government under the tutelage of Elon Musk’s DOGE audits:

“DOGE will provide advice and guidance from outside of Government, and will partner with the White House and Office of Management & Budget to drive large scale structural reform, and create an entrepreneurial approach to Government never seen before.”

Donald Trump

And of course, the radical firing of 80% of Twitter's workforce to turn it into X.com was indeed spectacular.

The reforms suggested by DOGE could include:

- Reducing $100B in improper payments in the Medicare and Medicaid programs.

- Removal of 90% of office spaces in Washington DC.

- Forcing the Pentagon to “find” a missing $824B.

- Simplifying radically the 16 million words tax code.

Likely Course Of Actions?

Reforms Are Hard

While radical, these propositions are nothing new and have been discussed by libertarian reformers for decades.

The real challenge is whether any of these will get approved by Congress and actually put into law and enforced.

This will likely be opposed very strongly by a wide array of influential forces, from federal employees and lobbyists, to Democrat & Republican governors and large corporations (including tech companies & defense contractors).

So, mounting debt may not be avoided easily, and inflation may not be tamed anytime soon.

Not Great, Not Terrible

At the same time, doomsday predictions have proven consistently wrong for decades and mostly enriched their writers and impoverished investors listening.

A more likely scenario is one of only partial reforms, that help but do not solve the problem, until a more serious crisis unfolds over many years, forcing more radical actions.

This is how the 1970s stagflation ended, with the Fed suddenly raising interest rates, a policy remembered as the “Volcker Shock”, named after the Fed chairman at the time, Paul Volcker.

That month, the Fed’s interest rate was set at 13.7 percent; by April, it had spiked a full 4 points to 17.6 percent. It would near 20 percent at times in 1981.

When Volcker left office in August 1987, inflation was down to 3.4 percent from its peak of 9.8 percent in 1981

So overall, we can reasonably consider the possibility that inflation could bounce back higher, and interest rates to rise much higher to finally put inflation under control.

Source: Trading Economics

Protections Against Inflation

In any case, investors might want to become a little cautious when the largest economy in the world is considering radical policies and 1-2 trillion-dollar-worth of budget cuts.

On one hand, it could have a politically and socially destabilizing effect.

On the other hand, failing reforms and/or exogenous shocks could lead to an economic & inflation crisis similar to the 1970s stagflation.

Source: MarketWatch

And of course, a context of international tensions at least as high as during the Cuban Missile Crisis is not helping either.

Gold: The “Barbarous Relic”

Historically, the refuge for investors in times of debt, currency, and inflation crises was physical gold. As a “neutral” reserve currency, it was seen as a form of “cash” that was independent of policy failures by individual countries.

And recently, gold has been on a winning streak, reaching all-time highs in all currencies, reflecting a return to this role of pressure valve against crises.

Source: Gold Price

This reflects not only American but also global perceptions of risks regarding energy, geopolitics, and economics, as Asian buyers have been a major influence on gold prices.

“Nearly three-quarters of consumer demand for gold over the last ten years has come from emerging markets.”

Mr. John Reade, Chief Market Strategist, World Gold Council.

Another major driver has been central banks, with here too, Asian countries at the forefront.

The largest one has been China, aggressively trying to spend its surplus dollars from trade into gold and infrastructure spending through the Belt and Road Initiative.

“According to the World Gold Council (WGC), central banks led by China purchased 1,037 tonnes (t) (metric tons) of gold in 2023, with the PBoC buying more gold than all other central banks combined. This buying intensity continued well into 2024.”

Digital Gold

What made gold (and to some extent silver) a good neutral reserve currency were a few key features:

- Rare and hard to produce in any significant quantities without massive costs.

- Ultra-durable, contrary to most other metals.

- Easy to split into smaller units for trade and storage.

Since the dawn of civilization, no other alternative managed to fit the bill as well as gold, leaving it uncontested as the safe asset to own in times of crisis, from Ancient Egypt to the Modern Era.

This was until the emergence of cryptocurrency, especially Bitcoin.

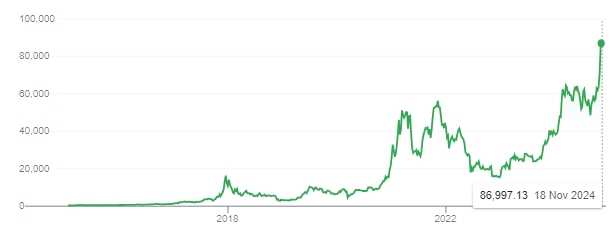

Similarly to gold, Bitcoin prices have been skyrocketing this year.

Source: Google Finance

Bitcoin proponents consider that it has all the advantages of gold, and some extras:

- Not only is it rare, but in the long run, the total amount of Bitcoin will never go above the maximum total quantity.

- Blockchain technology makes Bitcoin “durable”, but also more resistant to tampering due to the immutability of the ledger.

- Its digital nature makes it easier for transactions, while also being easy to divide infinitely, something gold cannot easily pass a minimum of a few grams.

Growing Legitimacy

For many years, what Bitcoin was missing was to be embraced by “big money”: large financial institutions (banks, insurance, pension funds, etc.), billionaires, and central banks.

This has progressively changed:

- Bitcoin Increasingly Used in Treasury Reserves Outside of Digital Asset Sector (Tesla, Square, Meitu, etc.).

- Bitcoin ETFs offer a new way to get exposure to the cryptocurrency, with institutional investors now owning 20% of US-traded spot Bitcoin ETFs.

- Trump is apparently considering a “Bitcoin national stockpile” after making a pledge to create one during his campaign in July 2024.

Even with the recent price rises, Bitcoin is still standing below 10% of the asset value of global gold reserves, with both much smaller than other asset classes.

Source: MicroStrategy

So there is a reasonable case that if Bitcoin becomes a major store of value, it could not only rise due to inflation and a debt crisis, making money flow in defensive assets, but also grow quicker than gold, which was alone in that role historically.

Conclusion

Nothing is certain when it comes to macroeconomics. But so far, the mix of persistent inflation and high US debt levels seems like a recipe for a redo of the 1970s stagflation.

The reaction of market participants to this looming risk is already visible in the strong rise in prices of both gold and Bitcoin.

Which of the two will ultimately outperform the other and prove the best protection against inflation is still debated. Gold has a solid historical track record against debt crises, while Bitcoin has done better returns than gold in the few years it has existed.

In any case, there is a place in most portfolios for inflation hedges and a balanced approach between risk-taking with equities and more defensive assets.