Energy

Top 5 Nuclear Stocks To Invest In (October 2024)

Securities.io is not an investment adviser, and this does not constitute investment advice, financial advice, or trading advice. Securities.io does not recommend that any security should be bought, sold, or held by you. Conduct your own due diligence and consult a financial adviser before making any investment decisions.

From Scary to Revolutionary And Back Again

Nuclear energy is a topic that can unleash a lot of passion. Some people see it as an almost miraculous technology and maybe an absolutely needed technology to change our energy mix soon enough to tackle climate change. Others see it as inherently destructive, dangerous, and uncontrollable.

And this division existed early on. The world first became aware of the extraordinary power of nuclear with the atomic bombing of Hiroshima and Nagasaki, soon followed by the invention of the H bomb and the Cold War. From these origins, the destructive potential of our newly acquired mastery of the atom was clear.

But soon, the idea to harness it for peaceful purposes also took hold. First was the “Atom For Peace” initiative, then a massive wave of construction of nuclear power plants worldwide. For a time, it seemed clear that the future was nuclear and that burning coal, oil, and gas would soon be as obsolete as the Netherlands’ picturesque windmills.

And then came a series of nuclear incidents leading to a very negative image of nuclear power. The first blow was Chernobyl, even if some would try to put the blame on poor Soviet design and management. This bruised reputation would completely collapse with the Fukushima meltdown, as Japan could hardly be described as a poorly managed country.

Giving Nuclear A Second Look

First, while there is undeniably a potential for problems with nuclear power, so are any other power production methods. Actually, by very far, the most deadly power sources are coal, oil, and biomass (mostly wood), as they can be deadly from incidents and air pollution. And that is before taking into account climate change consequences.

Nuclear has rare spectacular failures from this angle but is almost the safest possible power source.

Nuclear also has a few key advantages:

- It is carbon neutral, producing small carbon emissions only at construction, mostly from the concrete of the building itself.

- It produces power in all weather conditions, contrary to wind and solar.

- Its production is stable and predictable, making it a great provider of baseload electricity.

- Hence, nuclear is the main contender for replacing winter and peak power stations running on coal or gas.

- Its fuel costs are a neglectable part of the overall cost

- Making its price very stable and predictable, independent of oil price fluctuations.

- It also reduces supply risk, which can matter much, as recently demonstrated by the EU's dependency on Russian gas.

Lastly, nuclear technology is changing. New ideas and concepts are emerging to replace the old massive designs favored by older power stations. These new designs are inherently safer and remove the risk of meltdowns like what happened at Chernobyl and Fukushima.

In the context of a growing need for energy and the push for decarbonization, many countries are reconsidering their attitude toward nuclear. And a few companies are poised to benefit from this change.

On top of the 440 existing nuclear reactors, 60 more are under construction, and a total of 400 are ordered, planned, or being considered, of which 150 are in China.

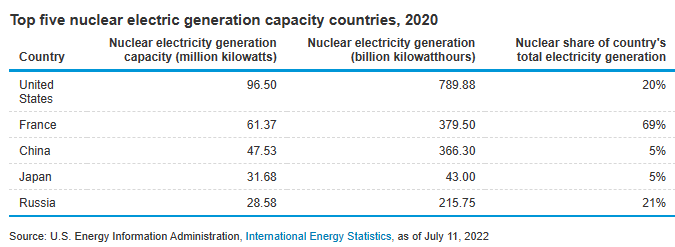

There is a lot of room to grow, as the highest concentration of nuclear energy can be as high as 69% lie in France, while nuclear is still 20% of US electricity and only 5% in China. All while electricity demand is growing from the switch to EVs, heat pumps, and other energy-intensive systems turning away from fossil fuels.

Top 5 Nuclear Stocks

1. NuScale Power Corporation

NuScale Power Corporation (SMR -3.75%)

NuScale Power Corporation (SMR -3.75%)

NuScale is a leader in a new type of nuclear reactor design called Small Modular Reactors (SMRs). It is an American company with the idea of building smaller reactors that can be manufactured in series, like airplanes or ships, instead of the large custom designs favored by the industry until now.

In theory, this should bring down the overall cost, as the production can be done in a normal factory, and parts can be ordered and assembled in batches instead of being custom-made. The smaller size also makes it easier to cool down the reactors, making the risk of accidental meltdown almost non-existent.

NuScale's main design can be transported by trucks and will produce 77 MWe per module, with up to 12 modules per finished power plant for almost 1GW of nominal power.

This design is small enough to be implemented on the site of a decommissioned coal power plant, allowing it to reuse all the security and grid infrastructure already built.

The company has already secured 2 contracts for building its SMRs, one in the US and one in Romania. It also looks at 15+ other potential clients committed to deploying SMRs and 120+ potential customers. On top of this come industrial clients like steel mills looking to decarbonize their operations and secure cheap, reliable power sources.

NuScale was also the first SMR to be certified by the US Nuclear Regulatory Commission (NRC).

While not the only SMR design getting ready to enter the market, NuScale is by far the most advanced technically and from a regulation point of view. It is also strongly supported by the US government, seeing SMRs as a solution to its allies' dependency on fossil fuels imported from adversaries like Russia.

This makes NuScale the stock the most focused on SMRs' promises. Investors in this stock will need nevertheless to be patient, with the delivery of the first reactors to be done no sooner than 2028 to 2030.

2. BWX Technologies, Inc.

BWX Technologies, Inc. (BWXT -0.54%)

BWX Technologies, Inc. (BWXT -0.54%)

Before ambitious startups like NuScale worked on SMRs, nuclear reactors used to be giant buildings. Except for a small niche market that also turned out to be very profitable. Nuclear power for ships like aircraft carriers, submarines, and other military systems.

This is the Focus of the American company BWXT, which has delivered 400+ reactors for naval nuclear power in its entire 60+ year history. It is also active in segments of the nuclear power supply chain, having delivered 315 steam generators for nuclear power plants.

Source: BWXT

A key part of BWXT's income comes from regular services and maintenance to existing reactors, with a schedule planned until 2053 for various operating nuclear aircraft carriers and submarines.

The company is also the only one accredited to produce high-quality uranium at 20%+. This fuel type is needed for so-called micro-reactors, even smaller than SMRs. They can power many applications, like space systems for NASA and remote military locations. BWXT is also entering the nuclear medicine field, hoping to capture some of the sector's $500M annual revenues.

Finally, BWXT is also working on an SMR design together with GE Energy. With GE as one of the main contenders in the nascent global SMR market, including already agreed contracts with Estonia and Canada, this creates another growth venue for BWXT.

BWXT pioneered miniaturizing nuclear reactors and should benefit greatly from the trend of SMRs picking up. It should also benefit from the military build-up of the US Navy in reaction to increasing challenges from Russia and China. Finally, it is profitable and has predictable revenues, offering a much larger safety than speculative companies with still only designs to show and no installed reactors.

3. Cameco Corporation

Cameco Corporation (CCJ -1.44%)

Cameco Corporation (CCJ -1.44%)

Nuclear power depends on the uranium supply. Uranium is not a very rare resource, although high-concentration deposits are much rarer. The market is dominated by Kazatomprom in Kazakhstan and Cameco in Canada. Other uranium producers exist, but these 2 are by far the largest and the ones with some lower production costs. As a result, Cameco will be at the center of supplying the raw materials required by existing and future nuclear power plants.

Source: Cameco

However, Cameco's mining side is just half of the story. This is because, in 2022, Cameco took the decision to acquire majority control in Westinghouse, the leading builder of nuclear power plants in the US, together with a giant investment firm, Brookfield.

This gives Cameco access to Westinghouse's steady revenues from servicing existing plants and control of a large part of the nuclear supply chain. Due to tight regulations, such parts and equipment will be required for any new power plant, traditional or SMR alike. A good demonstration of Westinghouse's innovation potential is its recently revealed AP300 SMR design, which is likely to be deployed in Slovakia, Finland, and Sweden.

So Cameco is both a bet on uranium prices and Westinghouse keeping a solid control on the nuclear plant building market it used to dominate. It should also be noted that the co-ownership with Brookfield might also help, as the company has a massive renewable/low carbon power generation division in the form of $19B Brookfield Renewable Partners (BEP).

4. Centrus Energy Corp.

Centrus Energy Corp. (LEU -1.58%)

Centrus Energy Corp. (LEU -1.58%)

Currently, Russia produces 14% of the world's uranium, 27% of the conversion, and 39% of the enrichment. This is because many of the massive Kazakh supplies are refined and enriched in Russia, a legacy of the Soviet Union supply chains.

Source: IEA

In the recent geopolitical context, this is seen as a major issue that needs to be rectified, with $4.3B per year paid to Russia to keep US nuclear power plants fueled.

Centers, America's largest uranium enrichment company, is at the center of the effort to relocate nuclear supply.

It is building the only US plant to produce High-Assay Low-Enriched Uranium (HALEU). This type of enriched uranium is very useful, especially for innovative smaller designs and molten salt reactors. The fuel is so energy-dense that 750g of it is enough to cover a person's needs for electricity for a lifetime.

Source: Centrus

Centers is also the only company meeting the US national security requirements for uranium enrichment for HALEU type of fuels, with the company tracing its origins back to the “Atoms for Peace” initiative, as well as the agent in charge of the historical Megatons to Megawatts disarmament program.

The company has grown its revenues by 6.1% CAGR since 2017, deriving 80% of them from fuel supply, and has a long-term order book worth $1B.

With Centrus HALEU fuel the main solution for most SMRs, microreactors, and advanced nuclear designs, the company should enjoy a quasi-monopoly on the enrichment part of the supply chain. As HALEU is more concentrated than normal nuclear fuel, making it more dangerous, it will be very difficult for competitors not involved with the US military to acquire the license to compete with Centrus.

So Centrus is a stock for investors looking to improve nuclear power through new designs while capitalizing on the push to bring the fuel supply away from Russia and Central Asia.

5. Mirion Technologies, Inc.

Mirion Technologies, Inc. (MIR +4.83%)

Mirion Technologies, Inc. (MIR +4.83%)

Aside from the reactors and fuel technologies, nuclear power is highly dependent on many captors, parts, and other “minor” equipment that nevertheless need to work perfectly.

One such category is radiation detection, Mirion's (USA) core business. Nuclear power regulation requires very tight checkups on radiation exposure of personnel, the environment, and the early detection of any potential leak or contamination. The same applies to medical use of radioactive compounds, like cancer treatment and imagery.

Source: Mirion

The company is also active in physical measurements for scientific analyses and research, as well as decommissioning & decontamination devices for the defense industry, cybersecurity, and training services. The company was IPOed in 2020.

Mirion’s revenues have grown steadily by 11.6%, equally carried by its medical segment and its industrial clients.

Source: Mirion

Mirion is a less “glamorous” part of the nuclear supply chain, monitoring and measuring radiation instead of creating new reactor designs, high-density fuel, or military applications. This does not make it less interesting from a financial point of view.

So, Mirion is more of a “pick and shovel” type of stock that will benefit from renewed interest and investments in nuclear. It will also profit from a still high public skepticism about nuclear power, strengthening the requirements for omnipresent, very efficient, and reliable radiation sensors and monitors provided by tried and tested suppliers like Mirion.