Energy

Top 10 EVs Stocks To Invest In (May 2024)

Securities.io is not an investment adviser, and this does not constitute investment advice, financial advice, or trading advice. Securities.io does not recommend that any security should be bought, sold, or held by you. Conduct your own due diligence and consult a financial adviser before making any investment decisions.

Electrifying The World

The last decade has seen a radical departure from the past in our energy system. Concerns about global warming and technological progress drive a trend of electrifying systems previously reliant on fossil fuels. This is true in industrial setups and house equipment like heating systems.

It is equally spectacular with electric vehicles, which a few years ago had the image of “glorified golf carts” and then turned into some of the most discussed and speculated stocks in financial markets.

A Revolution With Strong Regional Differences

The EV revolution is not showing any sign of stopping, led by China, where EVs and plug-in vehicles (which include hybrids) represent 35% of total sales. In fact, China represents 58% of all EVs sold worldwide. This contrasts Western markets, where EVs+hybrids are just getting started and represented only 8.4% of US sales in 2023.

Source: Aljazeera

This dominance of China shows, with the best-selling electric cars being either Teslas or Chinese, with the sole exception of the Volkswagen ID4.

Top 10 EV stocks

(These stocks are ordered by market capitalization at the time of this writing)

1. Tesla, Inc.

The uncontested leader of the EV market is Tesla, which has been at the forefront of the EV revolution.

Maybe the largest contribution of Tesla is not technology but about EVs' image. The Roadster 1.0, with performance comparable to a Porsche (and a quite similar price tag), completely changed the expectations about EVs. Yes, EVs can reduce carbon emissions and be “green.” But suddenly, they were also carrying a “cool” factor. This turned EVs from a “needed sacrifice to save the planet” into “the future of transportation.”

Tesla is a very technology-driven company with a leading position in manufacturing automation and EV design.

It relies heavily for its marketing on CEO Elon Musk's outlandish forecast, as well as his brash and controversial public image. In the long run, Tesla should produce a semi-truck and new models like the famously oddly shaped Cybertruck.

Source: Tesla

Tesla is also looking to become the first company to achieve full self-driving/robotaxi, relying on every Tesla on the road to provide an unmatched influx of data, outmatching all its competitors together.

Lastly, Tesla is active in the energy sector, with a solar panel business and fixed batteries for homes and at the utility-scale level. This is still a nascent business line, but it might, in the long run, turn out to be as big as the vehicle manufacturing part for Tesla.

Tesla is one of the most valuable companies in the world, with a stock price that exploded upward in the last few years. And a lot of its current market capitalization reflects strong optimism about its future. So, investors will want to check if the price they pay can be justified by future growth or if some of that growth is already priced in.

2. Toyota Motor Corporation

Toyota is a “classic” automaker and the world's second-largest car seller, just behind Volkswagen. It is a truly global company, with sales spread equally worldwide. It is also recognized as one of the most efficient manufacturers, with best-in-class automation and just-in-time supply chains and manufacturing systems.

Source: Toyota

For a while, Toyota was lagging in the EV sector, preferring a focus on fossil-fuel-powered cars, hybrid, and hydrogen.

This is changing, with plans for a 900-mile battery. Toyota's change of heart about EVs stems from its achievements in solid-state battery technology, a theoretically game-changer for the industry, allowing for a much more powerful battery with a better safety profile and quick charging. These models should be available in 2027-2028 and challenge the performance of the sector leaders.

Toyota's prudent turn toward electrification can be interesting for investors skeptical of claims of sudden and radical transformation of the transportation sector. With Toyota spending capital on EVs only once solid-state batteries are available and still keeping some fuel cars in its lineup, it makes for a bet on electrification moving forward, but only once the technology is mature enough to replace legacy systems fully.

3. BYD Company Limited

BYD is the leading EV company in China, with 1,860,000 vehicles sold in 2022, €20B of revenues in 2022, and one of the largest private companies in China.

The company started as the first supplier of Lithium-ion batteries to Motorola in 2000 and entered the automotive business as early as 2003. Today, it is also active in buses, trains, semiconductors, and battery energy storage.

Source: BYD

Size, explosive growth, and world-class achievement are comments that often come up when talking about BYD:

- World's largest battery electric vehicle

- World's top EV maker

- BYD Surpasses LG to Become World’s Second-Largest EV Battery Supplier

- BYD's sales of pure electric and plug-in hybrid cars surged 157 percent from a year earlier to 683,440 units

- BYD's new ‘Seagull' is the cheapest EV in the world

BYD is now expanding overseas, especially in Europe, with €30,000 models and 265-mile ranges. This could put some pressure on local manufacturers and Tesla, with a price tag now in the range of fuel-powered cars. Expansion in the US is more cautious as the US-China rivalry keeps escalating.

With strong growth prospects in Asia and Europe, as well as a dominant position in China, the leading market for EVs, BYD's stock is the less famous and less high-valuation alternative to Tesla.

4. ON Semiconductor Corporation

ON Semi is a semiconductor company specializing in electrification, including in automotive, but also in other sectors like solar energy, batteries, aerospace, telecommunication, data centers, and medical. The automotive sector is making 50% of Q1 2023 revenues and is expected to carry most of the company growth until 2025.

Source: ON Semi

A big part of ON Semi’s technological advantage is based on silicon carbide, a type of silicon compound used for high-energy electric systems. They notably allow for very high power loads required for the fast charging of EVs.

This strategy of doubling down on silicon carbide led to ON Semi experiencing a 26% CAGR for revenues between 2020-2022 and rising free cash flow from $160M in 2019 to $1.6B in 2022. According to management's target, the free cash flow is projected to double by 2027. The growth is carried by a very large and diversifying customer base, including most of the world's largest industrial and technology firms.

With the need for ever more powerful and efficient batteries and electric systems, silicon carbides are becoming increasingly important in the global supply chain. As a leader in the sector, ON Semi will likely benefit greatly from the electrification trend, especially EVs.

5. Li Auto Inc.

Li Auto is a Chinese luxury mid-size automaker. It delivered 52,584 cars in Q1 2023, a massive growth from 31,716 a year earlier.

Li models include features like voice command & 5 screens, autopilot assistance, and “over-the-air” updates.

Source: Li Auto

Besides auto manufacturing, Li is engaging in an aggressive plan to achieve autonomous driving. The company plans to roll out testing in 100 cities in China by the end of 2023. It is also building a fast-charging network, with 300 stations by the end of 2023 and 3,000 stations by 2025.

With its focus exclusively on the Chinese market and a higher price range, Li Auto is a much more “focused/niche” company than automakers like BYD looking to achieve a global footprint.

So, the company's future is much more tied to China's economic performance, especially regarding the income of the upper middle class. And it might be more fair compared to brands like Audi or Aston Martin than larger automakers. Especially with the idea making its way in China that social status markers like luxury cars can be from local brands and not just luxury foreign brands like German automakers.

6. NIO Inc.

Founded as recently as 204, NIO became one of the leading EV makers in China, with 43,854 vehicles delivered year-to-date in 2023, increasing by 15.8% year-over-year. These deliveries are roughly split 40%/60% between SUVs and sedans.

The company's offer is centered around a full package service, aiming to reduce any anxiety about EV technology. This includes a 10-year unlimited warranty, Lifetime Free Roadside Rescue, and “One Click for Worry-Free Service.

It also targets a sustainable luxury brand image going “Beyond the car,” with French, British, Chinese, and Scandinavian designers creating for NIO elegant lifestyle products like clothing, bottles, and even a Mahjong game, as well as a selection of food products and a vineyard in France.

The high-class, high-performance style of the brand is reinforced by products like the NIO EP9, one of the fastest cars in the world. The car has a manufacturing price tag of $1.2M.

Source: NIO

If Li is the Audi of China, NIO would be the Porsche equivalent for the EV world & China, maybe mixed with Maserati. (Those are not one-to-one comparisons, but allow us to give a better idea to people unfamiliar with the Chinese EV market).

On the technology side, NIO offers a full power solution for the home, including chargers and mobile applications.

On the road, it offers a battery swap solution and very high-power chargers, bypassing the issue of slow charging, which other EV automakers are working hard to solve with better battery chemistry.

If that is still not enough, the company also offers that “NIO’s service specialist will come to pick up the car at your doorstep for valet charging.” Another alternative is Power Mobile when an NIO van comes and recharges your car for another 100km without wasting the user's time.

In Q1 2023, NIO delivered 31,041 cars, up from 25,768 a year before but down from Q4 2022, when the company had reached an all-time-high quarterly delivery of 40,052.

Overall, NIO is shaping to be a true “lifestyle” car brand, focusing on elegance and practicality, ensuring the EV technology's current limitations do not inconvenience its buyers. The company is also looking to expand overseas, with a different branding and a more “budget” approach for Europe, even if, in this case, “budget” means a price tag from €50k to €91k.

7. Lucid Group, Inc.

With Tesla moving into the mass consumer market following repeated price cuts, it might look like the EV market is moving away from a luxury item out of China. Still, there might be space for premium brands in the West, which is Lucid's idea.

A central idea of Lucid branding is best-in-the-world performances, with the Lucid Air the longest range, fastest charging EV in the world, for a price tag ranging from $87,400 to $138,000. The company also plans to launch a new model, Gravity, an SUV that should be commercialized in 2024.

In Q1 2023, Lucid delivered 1,406 cars and produced 2,314. While the car number is smaller than most of its Chinese competitors' (and much smaller than Tesla's), the company has solid financial backing and liquidity access in the form of Saudi Arabia's Public Investment Fund (PIF), which owns 60.5% of the company.

The company technology is also recognized internationally, with Aston Martin having signed in June 2023 an agreement to integrate Lucid's powertrains and battery systems.

Source: Lucid Motors

Lucid is a latecomer in the EV luxury market, but its deal with Aston Martin shows it is far from an under-performer from a technical point of view. It still has plenty of growth potential, and contrary to a smaller company, like the recently failed Lordstown Motors, Lucid benefits from backing by investors with very deep pockets, paradoxically powered by oil money.

8. XPeng Inc.

Xpeng is another Chinese EV manufacturer that used to have a relatively high price tag. From January to June 2023, XPeng delivered 32,815 units, down 38.9 percent from the same period in 2022.

This trend of sales going down might be stopped by the launch of the G6 Ultra Smart Coupe SUV at the end of June, with more than 25,000 orders within 72 hours of the presale period starting. It is even possible that quite a few customers of Xpeng were waiting for the release of the new model.

Source: XPeng

Nevertheless, due to this slowdown in growth, XPeng's stock price suffered, which might be equally a warning sign or an opportunity to buy the stock at a discount.

Xpeng is working on autonomous driving, with some of Xpeng’s models will be able to drive autonomously in Beijing in the summer of 2023 and targeting dozens more Chinese cities by the end of the year.

Finally, XPeng is streamlining its future development process with the launch of the Next-Gen Technology Architecture – SEPA2.0. This innovation should allow XPeng to reuse the same drive train design and components for all vehicle types, significantly reducing R&D costs and time.

9. ChargePoint Holdings, Inc.

While most of the attention about EVs has been given to automakers, the technology needs a reliable network of public charging stations to be practical, especially as larger battery packs and better battery chemistry increase the total power per car.

ChargePoint is the leader in charging station companies in North America, with 7x more market share than the closest competitors, thanks to more than 240,000 ports in North America and Europe.

The company's growth has been directly in line with the EV adoption curve, with 2023 promising to be a banner year and the path to 2026 being exponential growth.

Source: ChargePoint

ChargePoint also provides charging services to other companies, with 76% of the Fortune 50 being ChargePoint customers.

Despite these achievements, ChargePoint stock prices have come under pressure with the recent announcements of GM and Ford integrating Tesla’s North American Charging Standard (NACS) charging connections into their vehicles, later followed by Volvo.

This could have given an advantage to Tesla and its own charging network over independent suppliers. As a response, ChargePoint was prompt to admit the need for harmonization in the industry and the adoption of NACS in its own charging stations.

So the question about charging networks is still hanging, with manufacturers like Tesla pushing for their own while companies like ChargePoint adopt Tesla's standards.

Overall, there is likely still a market for a widespread and dominant charging station that is not dependent on the whims and decisions of Tesla, with other car manufacturers probably keen not to become dependent on the charging network of their direct competitors.

So, investors in ChargePoint will need to carefully assess the competitive situation and judge if the June 2023 news about NACS impacts ChargePoint’s long-term prospects.

10. Aehr Test Systems

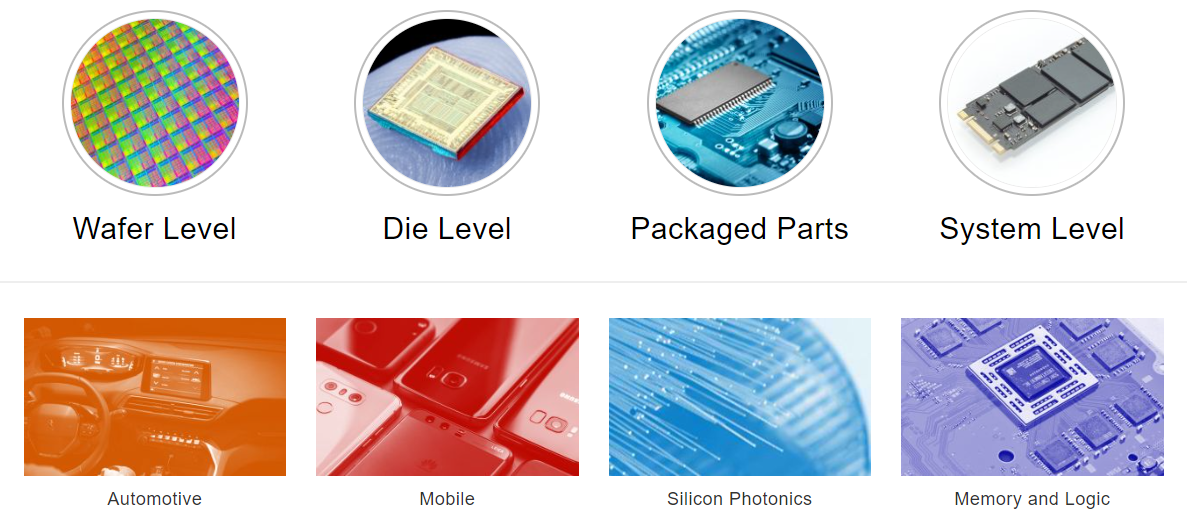

Aehr is a semiconductor company with a specialization in silicon carbide. More precisely, the company produces equipment for testing the silicon carbide wafer. This gives it a presence in the EV automotive sector and smartphones, computer chips, and photonics/telecommunication.

Source: Aehr

This makes Aehr a very niche and technical company, as well as a crucial component of the supply chain and “on the way to becoming the industry standard for a critical

manufacturing step for silicon carbide power semiconductors”.

Aehr is also actively developing new markets, notably the Gallium Nitride burn-in market, used in high-power applications like photovoltaic inverters.

This gives Aehr a very diversified customer base, looking like the who’s-who of the semiconductor industry, including TSMC, Texas Instruments, Seagate, and Bosch.

By occupying a small and important niche (silicon carbide testing) inside another niche in the EV supply chain (silicon carbide power electronics), Aehr is well positioned to benefit from the growth in EV production volume, irrespective of the latest battery technology, car model or change in charging plugs standards.

The downside to this unique position is that markets seem already well aware of it, with the stock price having skyrocketed 20x since March 2021. So, investors must carefully assess what growth is already priced in. And the potential of new markets, like Gallium Nitride testing, to utilize Aehr’s unique technology for new applications.