Energía

Solare vs Fusione — Chi Vince e Perché? Sbposts__content/button_label: Leggi l’Articolo Completo

Securities.io maintains rigorous editorial standards and may receive compensation from reviewed links. We are not a registered investment adviser and this is not investment advice. Please view our affiliate disclosure.

Quando si parla di fonti energetiche, il partigianismo è oggi parte integrante del tema. I conservatori potrebbero preferire i combustibili fossili, i liberali i pannelli solari e i veicoli elettrici, mentre i tecnologi sperano in un rinascimento nucleare (fissione nucleare).

Nel frattempo, gli scienziati utilizzano budget multimiliardari per cercare di sbloccare la fusione nucleare, che potrebbe, in teoria, essere la fonte di energia definitiva, sia pulita che illimitata. Ma non tutti concordano sul fatto che ciò sia probabile a breve.

Per cominciare, gli scettici si sentono piuttosto giustificati dal pessimo storico delle previsioni sulla fusione nucleare che diventa utile e commercialmente valida — un momento che sembra sempre distare 20-30 anni, e così è stato per gli ultimi 80 anni.

Recentemente, il leader tecnologico, miliardario e figura controversa Elon Musk è intervenuto con peso nel dibattito. Ha sostanzialmente affermato che i progetti di ricerca sulla fusione nucleare sono inutili, poiché il miglior e più utile reattore nucleare esiste già: il Sole.

Fonte: Elon Musk / X

E infatti, l’output energetico del Sole probabilmente eclisserà per sempre l’umanità.

Mentre il volume di Giove è ~1.300 volte quello della Terra, il Sole lo fa sembrare minuscolo. Contiene il 99,86% di tutta la massa del nostro sistema solare e brucia costantemente 600 milioni di tonnellate di idrogeno ogni secondo.

Quindi, secondo Musk, l’umanità dovrebbe semplicemente raddoppiare gli sforzi sull’energia solare e dimenticarsi della fusione nucleare.

Ma ha ragione?

Riepilogo

- L’argomento di Elon Musk secondo cui “il Sole è già il reattore a fusione” evidenzia perché il solare sta vincendo oggi: funziona ora e continua a diventare più economico.

- La più grande debolezza del solare è l’affidabilità, con notti, inverni e periodi nuvolosi prolungati che richiedono stoccaggio massiccio o energia di riserva.

- La fusione nucleare promette energia densa, on-demand e a basse emissioni di carbonio, ma non ha ancora dimostrato la produzione netta commerciale di elettricità o costi prevedibili.

- Se la fusione avrà successo, è molto probabile che dominerà le applicazioni che richiedono energia concentrata e costante piuttosto che una generazione diffusa.

- Il futuro più realistico è un sistema ibrido in cui il solare economico si diffonde ampiamente mentre fonti di energia stabili colmano le lacune di affidabilità.

Il Grande Vantaggio dell’Energia Solare: Costo e Velocità

In un precedente articolo intitolato “The Solar Age – A Bright Future To Mankind“, abbiamo discusso di come l’energia solare si stia rapidamente avviando a diventare la principale fonte energetica della nostra civiltà.

In gran parte, ciò è stato guidato da diversi decenni di progresso che hanno visto il prezzo dei pannelli solari scendere di 30 volte.

Fonte: IEA

Parallelamente, i veicoli elettrici e i parchi di batterie abbastanza grandi da alimentare la rete elettrica hanno aumentato l’utilità dell’elettricità rispetto ai combustibili fossili.

Tuttavia, l’energia solare soffre di alcune limitazioni:

- La produzione è molto più bassa in inverno, specialmente alle latitudini settentrionali.

- Il tasso di diminuzione dei prezzi ha iniziato a rallentare.

- La produzione è intermittente e difficile da prevedere, con conseguenti scenari meno che ideali:

- O il solare rimane una piccola parte del mix energetico totale, contribuendo seriamente solo nelle giornate di sole.

- Oppure il solare diventa una parte più grande del mix energetico, ma con un’enorme capacità in eccesso per i giorni senza sole.

- Oppure devono essere costruiti enormi parchi di batterie, impianti a idrogeno o altri sistemi di accumulo di energia — dal costo di trilioni — per integrare il solare durante le giornate nuvolose, le serate e gli inverni.

Allo stesso tempo, l’energia solare funziona ora, mentre i reattori a fusione sono ancora solo una teoria quando si tratta di modelli commercialmente utili.

La Fusione Nucleare Può Diventare Commerciale?

Come abbiamo spiegato in our in-depth report about nuclear fusion, la fusione è, in teoria, la fonte di energia ideale: non produce inquinamento (l’output è elio), consuma il materiale più abbondante nell’Universo (idrogeno) ed è ordini di grandezza più potente anche delle più grandi centrali nucleari a fissione.

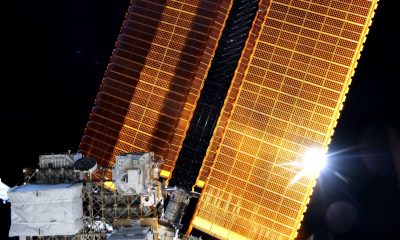

https://www.youtube.com/watch?v=htvxKBdh7Y8

Il problema è che richiede di gestire il materiale in modo sicuro ed economico mentre viene compresso e riscaldato a decine o centinaia di milioni di gradi — e in qualche modo di estrarre energia da esso nel mentre mantenendo unSebbene sappiamo come innescare la fusione nucleare dagli anni ’50, renderla utile per la generazione di energia è stato un obiettivo sfuggente.

Tuttavia, il progetto internazionale ITER sta progredendo. E aziende private come Commonwealth Fusion Systems e Proxima Fusion stanno annunciando i loro modelli commerciali che saranno rilasciati nei prossimi anni.

Quindi, per continuare il paragone innescato da Elon Musk: anche se la fusione commerciale verrà sviluppata, verrà resa obsoleta dal solare?

Confronto Solare Vs Fusione

Panoramica

Gli argomenti chiave dipendono dall’angolazione da cui si guarda a ciascuna fonte energetica.

L’argomento a favore del solare è che è essenzialmente “gratuita”, nel senso che l’energia è già stata generata dal gigantesco reattore a fusione nucleare che è il Sole, e arriva sulla Terra ogni giorno, in attesa di essere raccolta.

I critici diranno che, sebbene la quantità totale che colpisce la Terra sia enorme, è troppo diffusa per piede quadrato per essere veramente efficiente e troppo vulnerabile alle variazioni ambientali.

D’altra parte, i futuri reattori a fusione nucleare produrrebbero energia molto più concentrata, generando energia su richiesta. È anche completamente indipendente dal meteo, dalle stagioni o dall’ora del giorno.

Alla fine, l’argomento non è tanto tecnico quanto concettuale ed economico.

Scorri lateralmente →

| Fattore | Solare (oggi) | Fusione (oggi) | Cosa cambierebbe il vincitore? |

|---|---|---|---|

| Velocità di dispiegamento | Veloce (mesi) | Lenta (anni/decenni) | Se gli impianti a fusione diventano modulari + costruzioni ripetibili |

| Carburante & catena di approvvigionamento | Produzione ad alta intensità di materiali | Componenti complessi; il percorso del trizio è importante | Se la fusione semplifica le parti + risolve la logistica del carburante |

| Affidabilità | Intermittente senza accumulo | Potenziale carico di base/su richiesta | Se l’accumulo diventa estremamente economico su larga scala |

| Uso del suolo | Ampia superficie (ma i tetti aiutano) | Impronta ridotta per MW | Se il solare spaziale diventa economico |

| Prospettiva di costo | In calo, ma in maturazione | Non dimostrata; potrebbe crollare se funziona | Se la fusione raggiunge l’elettricità netta + lunga vita dei componenti |

Come Può Vincere il Solare?

Il Percorso Economico

Ci sono alcuni percorsi affinché il solare abbia senso, indipendentemente da quanto efficiente diventi la fusione nucleare.

Uno è diventare così economico e ubiquo che la generazione di energia diventa un pensiero secondario. Ad esempio, se i pannelli solari diventano abbastanza economici, ha senso coprire ogni tetto, ogni recinzione e forse ogni parete esterna con essi.

I pannelli bifacciali, che producono energia sia dalla parte anteriore che da quella posteriore, sarebbero ideali per molti di questi progetti. Anche i pannelli ultra-durevoli avrebbero grandi benefici economici se potessero produrre per 30 o 50 anni con perdite minime.

Sbposts__content/button_label:

Fonte: Next2Sun

In quel contesto, quello scenario richiede anche costi trascurabili per le batterie, in modo che le serate e l’inverno possano essere interamente integrati da una maggiore produzione solare durante le giornate soleggiate. Anche le connessioni a lunga distanza (migliaia di chilometri o miglia) tra le reti potrebbero aiutare.

Quindi, non importa quanto efficiente diventi la fusione nucleare, sarebbe probabilmente relegata ad applicazioni di nicchia, con la maggior parte della rete alimentata da pannelli solari, probabilmente situati in luoghi soleggiati come deserti o alte montagne.

Il Percorso High-Tech

Un’altra opzione per i pannelli solari per alleviare i loro limiti—principalmente legati al ciclo giorno-notte e al meteo—è spostarsi dove entrambi i problemi scompaiono: nello spazio.

L’energia solare basata sullo spazio, che abbiamo spiegato in un articolo dedicato, si basa sul posizionamento di centrali solari in orbita, dove il Sole splende 24 ore su 24, 7 giorni su 7, e con un’intensità molto più alta che sulla superficie terrestre. L’energia viene poi ritrasmessa sulla Terra utilizzando fasci di microonde e stazioni di ricezione dedicate.

A tal proposito, tali stazioni solari potrebbero, a lungo termine, essere posizionate in orbita attorno a Venere, Mercurio, o anche più vicino al Sole, aumentando ulteriormente la loro produzione.

Sebbene non spiegato nell’argomentazione di Musk, questo potrebbe essere il ragionamento alla base. Mentre il solare terrestre non è ancora perfetto, il crollo dei costi di lancio con razzi come lo Starship di Musk potrebbe rendere il solare spaziale così economico da poter competere direttamente con tutte le altre fonti energetiche.

Come Può Vincere la Fusione?

Naturalmente, il primo passo affinché la fusione nucleare vinca la gara per diventare la principale fonte di energia dell’umanità è riuscire a produrre più energia di quanta ne consumi per l’innesco.

Se ciò accade, allora la questione sarà principalmente una questione economica, con alcune domande chiave che necessitano risposta:

- Qual è il costo per costruire una centrale a fusione nucleare? (Costi di capitale)

- Quanto costa generare un kWh una volta costruita, considerate tutte le spese—non solo il combustibile ma anche le risorse umane, la manutenzione, le riparazioni, i tempi di fermo, l’assicurazione, ecc.? (Costi operativi)

- Per quanto tempo si può operare prima di dover essere dismessa (periodo di ammortamento)?

Sappiamo che potrebbe essere complicato, poiché la fissione nucleare, sebbene una meraviglia della tecnologia, è anche molto costosa da costruire e gestire.

Sebbene alcuni di questi costi siano legati ai rischi intrinseci della fissione nucleare (assenti per la fusione), una tecnologia che ci ha richiesto quasi un secolo per padroneggiarla probabilmente non sarà economica, richiedendo giganteschi magneti superconduttori, elettronica avanzata, supercomputer, nuovi super-materiali e specialisti in fisica del plasma e quantistica.

La fusione vincerà, tuttavia, in qualsiasi applicazione che richieda molta potenza in un’unica posizione, su richiesta. Quindi, in ogni caso, se la fusione nucleare diventerà realtà, diventerà probabilmente la fonte di energia preferita per le grandi navi militari, i veicoli spaziali e alcune industrie pesanti.

Questa sarà anche la fonte di energia favorita per qualsiasi esplorazione dello spazio profondo, poiché la luce solare diminuisce esponenzialmente man mano che ci allontaniamo dal Sole. Ad esempio, Giove riceve solo il 4% della luce solare che riceve la Terra.

Tre Scenari per il Mix Energetico: Solare, Accumulo, Fusione

Nel complesso, il futuro mix energetico dell’umanità dipenderà da alcune variabili, alcune delle quali Elon Musk sta personalmente lavorando duramente per cambiare.

Scenario 1: Il Muro dei Limiti del Solare

Se né pannelli solari più economici né lo stoccaggio di energia ultra-economico si materializzano, la tecnologia inizierà a progredire sempre più lentamente.

In questo caso, il solare diventa incapace di gestire l’intera domanda della rete energetica, e il consumo di base e invernale deve essere coperto da combustibili fossili o da una forma di energia nucleare—con la fusione nucleare che è l’opzione ideale se possibile, grazie ad essere sia a basse emissioni di carbonio che a basso rischio.

Considerando l’attuale popolarità dell’energia solare, ciò probabilmente accadrà se la tecnologia dei pannelli solari e delle batterie raggiungerà limitazioni fondamentali basate sulla fisica che ostacolano ulteriori progressi.

Scenario 2: Ubiquità dell’Energia Solare

In questa opzione, l’energia solare diventa così economica che diventa appena degna di misurarne i costi. La produzione è così abbondante che le giornate soleggiate vedono un enorme surplus “inutile”, mentre i giorni più bui sono comunque coperti dal massiccio parco onnipresente di pannelli solari che copre la maggior parte degli edifici, strade, ecc.

Énergie

Solaire contre Fusion — Qui l’emporte et pourquoi ? Sbposts__content/button_label: Lire l’article complet

Securities.io maintains rigorous editorial standards and may receive compensation from reviewed links. We are not a registered investment adviser and this is not investment advice. Please view our affiliate disclosure.

Lorsqu’il s’agit de discussions sur les sources d’énergie, le partisanisme fait aujourd’hui partie intégrante du sujet. Les conservateurs pourraient préférer les combustibles fossiles, les libéraux les panneaux solaires et les véhicules électriques, et les technologistes espèrent une renaissance du nucléaire (fission nucléaire).

Pendant ce temps, les scientifiques utilisent des budgets de plusieurs milliards de dollars pour tenter de maîtriser la fusion nucléaire, qui pourrait, en théorie, être la source d’énergie ultime, à la fois propre et illimitée. Mais tout le monde n’est pas d’accord pour dire que cela est susceptible de fonctionner dans un avenir proche.

Pour commencer, les sceptiques sont plutôt confortés par le piètre bilan des prédictions concernant l’utilité et la viabilité commerciale de la fusion nucléaire — un point dans le temps qui semble toujours être à 20-30 ans, et ce depuis 80 ans.

Récemment, le leader technologique, milliardaire et figure controversée Elon Musk a pesé de tout son poids dans le débat. Il a essentiellement déclaré que les projets de recherche sur la fusion nucléaire étaient inutiles, car le meilleur et le plus utile réacteur nucléaire existe déjà : le Soleil.

Source: Elon Musk / X

Et en effet, la production d’énergie du Soleil éclipsera probablement l’humanité de façon permanente.

Alors que le volume de Jupiter est ~1 300 fois celui de la Terre, le Soleil le réduit encore à l’état de nain. Il contient 99,86 % de toute la masse de notre système solaire et brûle constamment 600 millions de tonnes d’hydrogène chaque seconde.

Ainsi, selon Musk, l’humanité devrait simplement redoubler d’efforts sur l’énergie solaire et oublier la fusion nucléaire.

Mais a-t-il raison ?

Résumé

- L’argument d’Elon Musk selon lequel “le Soleil est déjà le réacteur à fusion” souligne pourquoi le solaire l’emporte aujourd’hui : il fonctionne maintenant et ne cesse de devenir moins cher.

- La plus grande faiblesse du solaire est sa fiabilité, les nuits, les hivers et les périodes nuageuses prolongées nécessitant un stockage massif ou une alimentation de secours.

- La fusion nucléaire promet une énergie dense, à la demande et à faible émission de carbone, mais elle n’a pas encore prouvé sa capacité à produire une électricité nette commerciale ou des coûts prévisibles.

- Si la fusion réussit, elle est plus susceptible de dominer les applications nécessitant une puissance concentrée et constante plutôt qu’une génération diffuse.

- L’avenir le plus réaliste est un système hybride où le solaire bon marché se déploie largement tandis que des sources d’énergie fermes comblent les lacunes de fiabilité.

Le grand avantage de l’énergie solaire : Coût et rapidité

Dans un article précédent intitulé “The Solar Age – A Bright Future To Mankind“, nous avons discuté de la façon dont l’énergie solaire évolue rapidement pour devenir la source d’énergie primaire de notre civilisation.

En grande partie, cela a été motivé par plusieurs décennies de progrès qui ont vu le prix des panneaux solaires chuter d’un facteur 30.

Source: IEA

Parallèlement, les véhicules électriques et les parcs de batteries suffisamment grands pour alimenter le réseau électrique ont accru l’utilité de l’électricité par rapport aux combustibles fossiles.

Néanmoins, l’énergie solaire souffre de quelques limitations :

- La production est beaucoup plus faible en hiver, surtout sous les latitudes nordiques.

- Le rythme de baisse des prix a commencé à ralentir.

- La production est intermittente et difficile à prévoir, ce qui entraîne des scénarios moins qu’idéaux :

- Soit le solaire reste une petite partie du mix énergétique global, contribuant sérieusement uniquement les jours ensoleillés.

- Soit le solaire devient une part plus importante du mix énergétique, mais avec une capacité excédentaire massive pour les jours sans soleil.

- Soit des parcs de batteries massifs, des installations d’hydrogène ou d’autres systèmes de stockage d’énergie — coûtant des milliers de milliards — doivent être construits pour compléter le solaire pendant les jours nuageux, les soirées et les hivers.

Dans le même temps, l’énergie solaire fonctionne maintenant, tandis que les réacteurs à fusion ne sont encore qu’une théorie lorsqu’il s’agit de modèles commercialement utiles.

La fusion nucléaire peut-elle devenir commerciale ?

Comme nous l’avons expliqué dans notre rapport approfondi sur la fusion nucléaire, la fusion est, en théorie, la source d’énergie idéale : elle ne produit aucune pollution (le résultat est de l’hélium), consomme la matière la plus abondante de l’Univers (l’hydrogène) et est des ordres de grandeur plus puissante que même les plus grandes centrales à fission nucléaire.

https://www.youtube.com/watch?v=htvxKBdh7Y8

Le problème est qu’elle nécessite de manipuler la matière de manière sûre et économique alors qu’elle est comprimée et chauffée à des dizaines ou des centaines de millions de degrés — et d’en extraire l’énergie d’une manière ou d’une autre tout en maintenant une réaction stable.

Bien que nous sachions déclencher la fusion nucléaire depuis les années 1950, la rendre utile pour la production d’énergie est un objectif qui reste insaisissable.

Néanmoins, le projet international ITER progresse. Et des entreprises privées comme Commonwealth Fusion Systems et Proxima Fusion annoncent leurs propres modèles commerciaux pour les prochaines années.

Alors, pour poursuivre la comparaison lancée par Elon Musk : même si la fusion commerciale est développée, sera-t-elle rendue obsolète par le solaire ?

Comparaison Solaire Vs Fusion

Aperçu

Les arguments clés dépendent de l’angle sous lequel on considère chaque source d’énergie.

L’argument en faveur du solaire est qu’il est essentiellement “gratuit”, dans le sens où l’énergie a déjà été générée par le gigantesque réacteur à fusion nucléaire qu’est le Soleil, et qu’elle arrive sur Terre chaque jour, attendant d’être collectée.

Les critiques diront que si la quantité totale atteignant la Terre est énorme, elle est trop diffuse par pied carré pour être vraiment efficace et trop vulnérable aux variations environnementales.

D’un autre côté, les futurs réacteurs à fusion nucléaire produiraient une énergie bien plus concentrée, générant de l’électricité à la demande. Ils sont également totalement indépendants de la météo, des saisons ou de l’heure de la journée.

En fin de compte, l’argument est moins technique que conceptuel et économique.

Glissez pour faire défiler →

| Facteur | Solaire (aujourd’hui) | Fusion (aujourd’hui) | Qu’est-ce qui changerait le gagnant ? |

|---|---|---|---|

| Vitesse de déploiement | Rapide (mois) | Lente (années/décennies) | Si les centrales à fusion deviennent modulaires + constructions reproductibles |

| Combustible & chaîne d’approvisionnement | Fabrication à forte intensité de matériaux | Composants complexes ; la voie du tritium est importante | Si la fusion simplifie les pièces + résout la logistique du combustible |

| Fiabilité | Intermittente sans stockage | Potentiel de charge de base/à la demande | Si le stockage devient extrêmement peu cher à grande échelle |

| Utilisation des terres | Grande superficie (mais les toits aident) | Petite empreinte par MW | Si le solaire spatial devient économique |

| Perspective de coût | En baisse, mais en maturation | Non éprouvée ; pourrait chuter brutalement si elle fonctionne | Si la fusion atteint une électricité nette + longue durée de vie des composants |

Comment le solaire peut-il l’emporter ?

La voie économique

Il existe plusieurs voies pour que le solaire ait du sens, quelle que soit l’efficacité que pourrait atteindre la fusion nucléaire.

L’une d’elles est de devenir si bon marché et omniprésent que la production d’énergie devient une considération secondaire. Par exemple, si les panneaux solaires deviennent suffisamment bon marché, il est logique de couvrir chaque toit, chaque clôture, et peut-être chaque mur extérieur avec eux.

Les panneaux bifaciaux, produisant de l’énergie à l’avant et à l’arrière, seraient idéaux pour de nombreuses conceptions de ce type. Les panneaux ultra-durables auraient également de grands avantages économiques s’ils pouvaient produire pendant 30 ou 50 ans avec des pertes minimales.

- L’énergie solaire et la fusion nucléaire sont toutes deux des technologies de rupture qui pourraient fournir une énergie abondante et propre.

- Le solaire est déjà compétitif et se déploie rapidement, tandis que la fusion en est encore aux premiers stades de la recherche.

- Le débat porte sur la question de savoir si les investissements dans la fusion retardent l’adoption d’une technologie solaire déjà viable.

Elon Musk a récemment qualifié la recherche sur la fusion nucléaire de “gaspillage d’argent” par rapport au développement de l’énergie solaire. Il a déclaré : “La fusion est un gaspillage d’argent. La fusion est essentiellement un soleil artificiel sur Terre, ce qui est beaucoup plus difficile qu’un soleil dans le ciel.”

Cette déclaration a relancé un vieux débat : faut-il concentrer nos efforts sur une technologie éprouvée et en amélioration rapide comme le solaire, ou sur une technologie de rupture comme la fusion qui promet une énergie illimitée mais reste incertaine ?

Dans cet article, nous comparons les deux technologies et explorons trois scénarios possibles pour l’avenir du système énergétique mondial.

Le solaire contre la fusion : un bref aperçu

L’énergie solaire photovoltaïque (PV) convertit directement la lumière du soleil en électricité à l’aide de cellules semi-conductrices. La fusion nucléaire, quant à elle, vise à reproduire sur Terre la réaction qui alimente le soleil, en combinant des noyaux atomiques légers pour en former un plus lourd, libérant ainsi une quantité colossale d’énergie.

Le solaire est une technologie mature, déployée à l’échelle du gigawatt, avec des coûts ayant chuté de façon spectaculaire. La fusion en est encore au stade de la recherche, avec pour objectif de démontrer une production nette d’énergie (gain > 1).

Le principal argument de Musk est que le “soleil dans le ciel” est déjà une source de fusion parfaitement fonctionnelle, et que nous devrions nous concentrer sur la capture de cette énergie plutôt que de construire des réacteurs extrêmement complexes sur Terre.

3 scénarios pour l’avenir énergétique

Scénario 1 : Le solaire domine (le plus probable)

Dans ce scénario, les améliorations continues de l’efficacité des panneaux solaires, des technologies de stockage (batteries) et des réseaux électriques intelligents permettent au solaire de devenir la principale source d’énergie mondiale d’ici le milieu du siècle.

Les coûts continuent de baisser, rendant le solaire si bon marché qu’il surpasse non seulement les combustibles fossiles, mais aussi toute nouvelle centrale nucléaire (fission ou fusion) sur la base du coût nivelé de l’électricité (LCOE).

La fusion, bien que potentiellement réalisée scientifiquement, reste une curiosité de niche, trop chère et trop complexe pour concurrencer le solaire omniprésent et le stockage associé.

Scénario 2 : L’énergie solaire orbitale ou planétaire

Ce scénario va encore plus loin. Si le solaire terrestre devient ultra-dominant, il pourrait ouvrir la voie à des concepts encore plus vastes :

- Centrales solaires orbitales (SBSP) : Des satellites géants collectant l’énergie solaire dans l’espace (sans intermittence due à l’atmosphère ou à la nuit) et la renvoyant sur Terre par micro-ondes ou lasers.

- Centrales solaires planétaires : Couvrir de vastes étendues de déserts avec des panneaux solaires, créant une surabondance d’énergie si grande que le coût de l’éclairage artificiel devient négligeable, faisant des fermes verticales notre principale source de nourriture et permettant de réensauvager de grands segments de l’environnement.

Source : One Earth

Le même résultat est produit par le déploiement réussi de fermes solaires orbitales. L’approvisionnement massif en énergie peut non seulement alimenter la Terre, mais aussi les colonies spatiales et les opérations d’extraction d’astéroïdes, conduisant à une abondance similaire en métaux, ressources et énergie.

Scénario 3 : La fusion domine

La plupart des technologies démarrent lentement, entrent dans une phase d’améliorations exponentielles, puis commencent à stagner en raison des limitations inhérentes au concept. C’est quelque chose que nous avons vu avec presque toutes les nouvelles technologies au cours des 200 dernières années.

Ce qui rend la fusion si excitante, c’est que la technologie émerge à peine de la phase conceptuelle pour entrer dans la phase commerciale.

Les coûts et l’efficacité devraient s’améliorer considérablement avec une meilleure compréhension expérimentale, les économies d’échelle et de nouvelles découvertes, un peu comme les premiers moteurs à combustion n’ont que peu de choses en commun avec les moteurs de voiture d’aujourd’hui.

Ainsi, si le solaire a une chance de devenir “trop bon marché pour être mesuré”, la fusion nucléaire a une chance encore plus grande d’atteindre un tel objectif ambitieux.

Ce qui pourrait faire pencher la balance est si la fusion nucléaire est développée assez rapidement. Si une alternative aux combustibles fossiles émergeait et s’intégrait directement dans nos réseaux électriques centralisés et notre système énergétique, elle pourrait surpasser le solaire avant que celui-ci n’ait le temps de devenir omniprésent. Et bien sûr, l’avantage de la fusion pour les applications spatiales et militaires pourrait aussi faire pencher la balance en sa faveur.

À retenir pour les investisseurs

- À court terme, les capitaux continuent d’affluer vers le déploiement du solaire, la modernisation des réseaux et le stockage de l’énergie plutôt que vers des projets de fusion spéculatifs.

- La fabrication solaire reste très cyclique, la surcapacité et les fluctuations des prix créant à la fois des baisses profondes et des rebonds marqués.

- La politique, les tarifs douaniers et la géopolitique peuvent compter autant que la technologie pour les actions solaires, en particulier celles liées aux chaînes d’approvisionnement basées en Chine.

- La fusion doit être considérée comme une option à long terme ; la plupart des expositions aujourd’hui sont privées ou indirectes via des entreprises de défense et de matériaux avancés.

- Pour les investisseurs, les fabricants de matériel solaire sont à traiter comme des trades tactiques, tandis que l’exposition à long terme à la transition énergétique favorise les leaders des réseaux, du stockage et de l’électrification.

Conclusion

Étant donné que l’immense majorité de notre consommation d’énergie primaire provient encore des combustibles fossiles (charbon, pétrole et gaz), il peut sembler un peu étrange de débattre de la pertinence du solaire par rapport à la fusion nucléaire.

À l’heure actuelle, l’une ou l’autre est absolument nécessaire pour moderniser nos systèmes énergétiques vers des sources durables et à faible émission de carbone.

Source : EIA

Mais en pratique, le commentaire de Musk a du sens si l’on considère que les budgets de recherche sur la fusion retardent l’acceptation de l’énergie solaire—surtout si, en fin de compte, le solaire à l’échelle planétaire ou spatial est de toute façon plus logique.

Cela ne veut pas dire qu’il a nécessairement raison, car le solaire (et le stockage de l’énergie) doivent encore prouver qu’ils peuvent fournir 100 % de nos besoins énergétiques—pas seulement la demande du réseau, mais aussi toute l’énergie nécessaire pour les transports, la production chimique et les industries lourdes.

Il pourrait donc aussi être judicieux de ne pas mettre tous nos œufs dans le même panier, mais de travailler simultanément sur de nombreuses sources d’énergie à faible émission de carbone : solaire, géothermie, éolien, fission de 4ème génération, et fusion.

Et de toute façon, on pourrait aussi dire que le potentiel de la fusion nucléaire pour l’exploration et la colonisation spatiales pourrait en soi justifier de travailler à la maîtrise de cette source d’énergie.

Entreprises de fusion à surveiller (principalement privées—pour l’instant)

Actuellement, aucune des entreprises dédiées à la viabilité commerciale de la fusion nucléaire n’est cotée en bourse. Cela inclut Helion, General Fusion, Commonwealth Fusion, TAE Technologies, ZAP Energy, et NEO Fusion.

Vous pouvez trouver une liste extensive de startups dans le domaine de la fusion nucléaire ici.

Les investisseurs publics peuvent obtenir une exposition indirecte via des sociétés cotées qui investissent dans ces startups (comme Chevron et Google), ou via des entreprises de défense et d’aérospatiale qui développent des technologies connexes.

Pour une exposition directe au thème de la transition énergétique, les investisseurs se tournent vers les leaders du solaire, du stockage, des réseaux intelligents et des matériaux avancés.

Pour en savoir plus sur les investissements dans l’énergie, visitez Securities.io.

Une exception est Lockheed Martin. Le constructeur aérospatial de défense travaille depuis le début des années 2010 sur Compact Fusion, un réacteur à fusion nucléaire dont il prévoyait la mise au point pour les années 2020.

Cependant, il a depuis été annoncé que les travaux sur le projet ont été arrêtés en 2021.

La société a été très discrète sur ce projet après une annonce initiale très publique. À ce jour, on ne sait pas exactement ce qui a poussé l’entreprise à abandonner l’idée.

Dans le même temps, il semble qu’elle n’ait pas complètement abandonné le concept, notamment avec des investissements en 2024 dans Helicity, une startup développant un moteur à fusion.

L’idée serait de propulser des engins spatiaux avec de courtes impulsions de fusion. Helicity prévoit d’utiliser un canon à plasma, la même approche que celle adoptée par General Fusion.

Potentiellement, les résultats internes de Lockheed ont montré que leur conception ne pouvait pas maintenir la fusion d’une manière compatible avec la production d’énergie.

Mais peut-être que de courtes impulsions suffisent pour la propulsion dans l’espace, et sont bien plus proches de devenir un produit réel ? Cela correspondrait également mieux au profil global de l’entreprise, axé sur l’aérospatiale et la défense.

Actions Solaires Publiques Mentionnées (Risques Inclus)

1. Daqo New Energy Corp.

Daqo New Energy Corp. (DQ -1.77%)

Cette entreprise chinoise est l’un des leaders mondiaux de la production de polysilicium, le composant central pour la fabrication des panneaux solaires. Cela fait également de Daqo l’un des piliers fondateurs de la domination chinoise sur le secteur de la fabrication solaire.

L’entreprise a développé sa capacité de production très rapidement, l’augmentant de plus de 8 fois depuis 2019.

Source : Daqo

La position centrale de Daqo dans la chaîne d’approvisionnement des panneaux solaires lui a permis de bénéficier grandement de la croissance du secteur, ses revenus passant de 0,68 milliard de dollars en 2020 à 4,6 milliards de dollars en 2022. Après une flambée en 2022, les prix du polysilicium se sont refroidis, provoquant la chute du cours de l’action par rapport à son pic de 2021.

La communication et le site web de l’entreprise sont un peu ternes, mais cela n’est pas inhabituel pour une entreprise industrielle B2B plus soucieuse de son image au sein du secteur qu’auprès du grand public ou des investisseurs étrangers.

L’action se négocie à une valorisation très faible par rapport à son P/E et à ses flux de trésorerie. Cela est en partie dû à des controverses liant l’entreprise à l’utilisation de travail forcé au Xinjiang et à des discussions à Washington, DC sur des sanctions supplémentaires contre les entreprises opérant dans la région.

Les investisseurs doivent donc être conscients que l’action Daqo comporte un risque géopolitique très réel, parallèlement à un important potentiel de hausse financière en raison de ses faibles multiples de valorisation.

2. JinkoSolar Holding Co., Ltd.

JinkoSolar Holding Co., Ltd. (JKS -0.83%)

Jinko est l’un des plus grands fabricants de panneaux solaires au monde, et il est principalement basé en Chine. Pour éviter les droits de douane, l’entreprise diversifie sa base de fabrication, avec la production de wafers de silicium au Vietnam et la fabrication de cellules solaires en Malaisie et aux États-Unis.

Source : Jinko Solar

Dans tous les cas, l’entreprise n’est pas trop exposée aux marchés occidentaux, la Chine, l’Asie-Pacifique (APAC) et les marchés émergents constituant l’essentiel de son activité.

Source : Jinko Solar

Jinko a livré 85 à 100 GW de cellules solaires rien qu’en 2025, contre seulement 14,5 GW deux ans auparavant. Cela fait de Jinko le numéro 1 de l’industrie photovoltaïque.

La cellule solaire la plus avancée de Jinko, le type N, atteint un rendement énergétique remarquablement élevé de 27,2. Elle propose également des panneaux bifaciaux.

Cherchant à améliorer le profil environnemental de ses produits, Jinko Solar a également lancé NeoGreen, le premier panneau solaire de type N produit entièrement avec des énergies renouvelables (au lieu du charbon couramment utilisé en Chine).

Depuis 2023, les panneaux de type N ont pris le dessus sur la plupart des ventes de Jinko, représentant 80 % des expéditions totales, avec une capacité supplémentaire provenant d’une usine de production de 56 GW nouvellement ouverte. La capacité de production totale devrait atteindre 130 GW en 2025, soit près de la moitié de la production cumulative de l’entreprise sur toute son histoire.

La croissance ultra-agressive de la capacité de production de Jinko reflète la confiance de l’entreprise dans sa technologie de type N et son ambition de s’emparer du

Sbposts__content/button_label:Les marchés d’exportation de l’Asie, de l’Afrique et de l’Amérique du Sud — et la perspective globale de l’énergie solaire prenant le contrôle des systèmes énergétiques mondiaux.

الطاقة

إيلون ماسك: الطاقة الشمسية مقابل الاندماج النووي — أيهما يفوز ولماذا؟ Sbposts__content/button_label: اقرأ المزيد

Securities.io maintains rigorous editorial standards and may receive compensation from reviewed links. We are not a registered investment adviser and this is not investment advice. Please view our affiliate disclosure.

عندما يتعلق الأمر بمناقشات مصادر الطاقة، فإن الانحيازية أصبحت اليوم جزءًا لا يتجزأ من الموضوع. قد يفضل المحافظون الوقود الأحفوري، ويفضل الليبراليون الألواح الشمسية والمركبات الكهربائية، بينما يأمل التقنيون في نهضة نووية (الانشطار النووي).

وفي الوقت نفسه، يستخدم العلماء ميزانيات بمليارات الدولارات لمحاولة فتح أسرار الاندماج النووي، والذي يمكن نظريًا أن يكون مصدر الطاقة النهائي النظيف وغير المحدود. لكن لا يتفق الجميع على أن هذا من المرجح أن ينجح في أي وقت قريب.

في البداية، يشعر المشككون بنوع من التأييد بسبب السجل الكارثي للتنبؤات حول أن يصبح الاندماج النووي مفيدًا وقابلًا للتطبيق تجاريًا — وهي نقطة زمنية تبدو دائمًا بعيدة 20-30 عامًا، وقد ظلت كذلك على مدى السنوات الثمانين الماضية.

مؤخرًا، دخل القائد التقني والملياردير والشخصية المثيرة للجدل إيلون ماسك بقوة في النقاش. وقال بشكل أساسي إن مشاريع أبحاث الاندماج النووي لا طائل من ورائها، لأن أفضل مفاعل نووي وأكثرها فائدة موجود بالفعل: الشمس.

المصدر: إيلون ماسك / X

وبالفعل، من المرجح أن يتفوق إنتاج الشمس للطاقة على البشرية بشكل دائم.

بينما يبلغ حجم كوكب المشتري ~1,300 مرة حجم الأرض، إلا أن الشمس لا تزال تجعله يبدو ضئيلًا. فهي تحتوي على 99.86% من كتلة نظامنا الشمسي وتحرق باستمرار 600 مليون طن من الهيدروجين كل ثانية.

لذلك، وفقًا لماسك، يجب على البشرية أن تضاعف تركيزها على الطاقة الشمسية وتنسى أمر الاندماج النووي.

لكن هل هو محق؟

الخلاصة

- تسلط حجة إيلون ماسك القائلة بأن “الشمس هي بالفعل مفاعل الاندماج” الضوء على سبب فوز الطاقة الشمسية اليوم: فهي تعمل الآن وتستمر في انخفاض تكلفتها.

- أكبر نقطة ضعف للطاقة الشمسية هي الموثوقية، حيث تتطلب الليالي والشتاء والفترات الملبدة بالغيوم الممتدة تخزينًا هائلاً أو طاقة احتياطية.

- يعد الاندماج النووي بتوفير طاقة كثيفة عند الطلب ومنخفضة الكربون، لكنه لم يثبت بعد إنتاجه التجاري الصافي للكهرباء أو تكاليفه المتوقعة.

- إذا نجح الاندماج النووي، فمن المرجح أن يهيمن على التطبيقات التي تحتاج إلى طاقة مركزة ومستمرة بدلاً من التوليد المنتشر.

- المستقبل الأكثر واقعية هو نظام هجين حيث تنتشر الطاقة الشمسية الرخيصة على نطاق واسع بينما تملأ مصادر الطاقة الثابتة فجوات الموثوقية.

الميزة الكبيرة للطاقة الشمسية: التكلفة والسرعة

في مقال سابق بعنوان “عصر الطاقة الشمسية – مستقبل مشرق للبشرية“، ناقشنا كيف تتحرك الطاقة الشمسية بسرعة لتصبح المصدر الأساسي للطاقة في حضارتنا.

إلى حد كبير، كان هذا مدفوعًا بعدة عقود من التقدم شهدت انخفاض سعر الألواح الشمسية بمقدار 30 ضعفًا.

المصدر: IEA

بالتوازي، زادت المركبات الكهربائية ومجمعات البطاريات الكبيرة بما يكفي لتغذية شبكة الكهرباء من فائدة الكهرباء مقارنة بالوقود الأحفوري.

ومع ذلك، تعاني الطاقة الشمسية من بعض القيود:

- الإنتاج أقل بكثير في الشتاء، خاصة في خطوط العرض الشمالية.

- بدأ معدل انخفاض السعر في التباطؤ.

- الإنتاج متقطع ويصعب التنبؤ به، مما يؤدي إلى سيناريوهات أقل من مثالية:

- إما أن تظل الطاقة الشمسية جزءًا صغيرًا من مزيج الطاقة الكلي، وتساهم بشكل جدي فقط في الأيام المشمسة.

- أو تصبح الطاقة الشمسية جزءًا أكبر من مزيج الطاقة، ولكن مع فائض هائل في السعة للأيام غير المشمسة.

- أو يجب بناء مجمعات بطاريات هائلة، أو منشآت هيدروجين، أو أنظمة تخزين طاقة أخرى — بتكلفة تريليونات — لتكملة الطاقة الشمسية خلال الأيام الملبدة بالغيوم والمساء والشتاء.

في نفس الوقت، تعمل الطاقة الشمسية الآن، بينما لا تزال مفاعلات الاندماج مجرد نظرية عندما يتعلق الأمر بنماذج مفيدة تجاريًا.

هل يمكن أن يصبح الاندماج النووي تجاريًا؟

كما أوضحنا في تقريرنا المتعمق حول الاندماج النووي، فإن الاندماج هو نظريًا مصدر الطاقة المثالي: فهو لا ينتج تلوثًا (الناتج هو الهيليوم)، ويستهلك المادة الأكثر وفرة في الكون (الهيدروجين)، وهو أقوى بمقدار أضعاف من حتى أكبر محطات الطاقة النووية الانشطارية.

https://www.youtube.com/watch?v=htvxKBdh7Y8

المشكلة هي أنه يتطلب التعامل مع المادة بأمان وبتكلفة رخيصة بينما يتم ضغطها وتسخينها إلى عشرات أو مئات الملايين من الدرجات — واستخراج الطاقة منها بطريقة ما إلى العربية ترجم إلى العربية.بينما عرفنا كيفية إطلاق الاندماج النووي منذ خمسينيات القرن العشرين، ظل جعله مفيدًا لتوليد الطاقة هدفًا بعيد المنال.

ومع ذلك، فإن مشروع ITER الدولي لا يزال يتقدم. وتعلن شركات خاصة مثل Commonwealth Fusion Systems و Proxima Fusion عن نماذجها التجارية الخاصة التي سيتم إطلاقها في السنوات القليلة القادمة.

لذا، لمواصلة المقارنة التي أثارها إيلون ماسك: حتى لو تم تطوير الاندماج النووي التجاري، فهل ستصبح الطاقة الشمسية تجعله قديمًا؟

مقارنة الطاقة الشمسية مقابل الاندماج النووي

نظرة عامة

تعتمد الحجج الرئيسية على الزاوية التي تنظر منها إلى كل مصدر طاقة.

الحجة لصالح الطاقة الشمسية هي أنها في الأساس “مجانية”، بمعنى أن الطاقة قد تم توليدها بالفعل بواسطة مفاعل الاندماج النووي العملاق الذي هو الشمس، وتصل إلى الأرض كل يوم، في انتظار جمعها.

سيقول النقاد إنه على الرغم من أن الكمية الإجمالية التي تصل إلى الأرض هائلة، إلا أنها منتشرة للغاية لكل قدم مربع لتكون فعالة حقًا وهي عرضة للغاية للتغيرات البيئية.

من ناحية أخرى، ستنتج مفاعلات الاندماج النووي المستقبلية طاقة أكثر تركيزًا بكثير، وتولد الطاقة عند الطلب. وهي أيضًا مستقلة تمامًا عن الطقس أو الفصول أو الوقت من اليوم.

في النهاية، الجدال ليس تقنيًا بقدر ما هو مفاهيمي واقتصادي.

اسحب للمرور →

| العامل | الطاقة الشمسية (اليوم) | الاندماج النووي (اليوم) | ما الذي قد يغير الفائز؟ |

|---|---|---|---|

| سرعة النشر | سريعة (أشهر) | بطيئة (سنوات/عقود) | إذا أصبحت محطات الاندماج نمطية + قابلة للبناء المتكرر |

| الوقود وسلسلة التوريد | تصنيع كثيف المواد | مكونات معقدة؛ مسار التريتيوم مهم | إذا بسط الاندماج الأجزاء + حل مشاكل لوجستيات الوقود |

| الموثوقية | متقطعة بدون تخزين | إمكانية الحمل الأساسي/عند الطلب | إذا أصبح التخزين رخيصًا للغاية على نطاق واسع |

| استخدام الأراضي | مساحة كبيرة (لكن الأسطح تساعد) | بصمة صغيرة لكل ميغاواط | إذا أصبحت الطاقة الشمسية الفضائية اقتصادية |

| التوقعات السعرية | آخذة في الانخفاض، لكنها ناضجة | غير مثبتة؛ قد تنخفض بشدة إذا نجحت | إذا وصل الاندماج إلى صافي كهرباء + عمر طويل للمكونات |

كيف يمكن للطاقة الشمسية أن تفوز؟

المسار الاقتصادي

هناك بعض المسارات التي تجعل الطاقة الشمسية منطقية، بغض النظر عن مدى كفاءة الاندماج النووي.

أحدها هو أن تصبح رخيصة جدًا وشائعة لدرجة أن توليد الطاقة يصبح أمرًا ثانويًا. على سبيل المثال، إذا أصبحت الألواح الشمسية رخيصة بما يكفي، فمن المنطقي تغطية كل سقف، وكل سياج، وربما كل جدار خارجي بها.

ستكون الألواح ثنائية الوجه، التي تنتج الطاقة من الأمام والخلف، مثالية للعديد من هذه التصميمات. كما أن الألواح فائقة المتانة ستحقق فوائد اقتصادية كبيرة إذا تمكنت من الإنتاج لمدة 30 أو 50 عامًا مع خسائر طفيفة في

- تصبح الإضاءة الاصطناعية ضئيلة، مما يجعل المزارع العمودية مصدرنا الغذائي الأساسي، مما يسمح لنا بإعادة إحياء مساحات كبيرة من البيئة.

المصدر: One Earth

يتم إنتاج نفس النتيجة من خلال النشر الناجح لمزارع الطاقة الشمسية المدارية. لا يمكن لإمدادات الطاقة الهائلة أن تزود الأرض فحسب، بل أيضًا المستعمرات الفضائية وعمليات تعدين الكويكبات، مما يؤدي إلى وفرة مماثلة في المعادن والموارد والطاقة.

السيناريو 3: هيمنة الاندماج النووي

تبدأ معظم التقنيات ببطء، وتدخل مرحلة تحسينات أسية، ثم تبدأ في الركود بسبب القيود الكامنة في المفهوم. إنه شيء رأيناه مع كل تقنية جديدة تقريبًا في المائتي عام الماضية.

ما يجعل الاندماج النووي مثيرًا للغاية هو أن هذه التقنية بالكاد تخرج من المرحلة المفاهيمية إلى المرحلة التجارية.

يجب أن تتحسن التكاليف والكفاءة بشكل كبير عندما يدخل المزيد من الفهم التجريبي واقتصادات الحجم والاكتشافات الجديدة حيز التنفيذ، تمامًا كما تشبه محركات الاحتراق المبكرة محركات السيارات اليوم قليلاً.

لذا، بينما تمتلك الطاقة الشمسية فرصة لتصبح “رخيصة جدًا بحيث لا يمكن قياسها”، فإن الاندماج النووي لديه فرصة أكبر لتحقيق مثل هذا الهدف السامي.

ما يمكن أن يرجح الكفة هو إذا تم تطوير الاندماج النووي بسرعة كافية. إذا ظهر بديل للوقود الأحفوري يناسب مباشرة شبكات الطاقة المركزية وأنظمتنا للطاقة، فقد يتفوق على الطاقة الشمسية قبل أن تتاح لها الفرصة لتصبح موجودة في كل مكان. وبالطبع، قد تميل ميزة الاندماج النووي للتطبيقات الفضائية والعسكرية الكفة لصالحه أيضًا.

خلاصة المستثمر

- على المدى القريب، يستمر تدفق رأس المال نحو نشر الطاقة الشمسية وترقية الشبكة وتخزين الطاقة بدلاً من مشاريع الاندماج النووي المضاربة.

- يبقى تصنيع الطاقة الشمسية دوريًا للغاية، حيث يخلق الإفراط في السعة وتقلبات الأسعار انخفاضات حادة وارتدادات حادة.

- يمكن أن تكون السياسات والتعريفات الجمركية والجيو-سياسة بنفس أهمية التكنولوجيا لأسهم الطاقة الشمسية، خاصة تلك المرتبطة بسلاسل التوريد القائمة في الصين.

- يجب النظر إلى الاندماج النووي على أنه خيار طويل الأجل؛ معظم التعرض له اليوم هو خاص أو غير مباشر من خلال شركات الدفاع والمواد المتقدمة.

- للمستثمرين، من الأفضل التعامل مع أسماء أجهزة الطاقة الشمسية على أنها صفقات تكتيكية، بينما يفضل التعرض الطويل الأجل لتحول الطاقة قادة الشبكة والتخزين والكهربة.

الخلاصة

نظرًا لأن الغالبية العظمى من استهلاكنا الأساسي للطاقة لا يزال يأتي من الوقود الأحفوري (الفحم والنفط والغاز)، فقد يبدو من الغريب بعض الشيء مناقشة أهمية الطاقة الشمسية مقابل الاندماج النووي.

في الوقت الحالي، هناك حاجة ماسة لأي منهما لترقية أنظمتنا للطاقة إلى مصادر مستدامة ومنخفضة الكربون.

المصدر: EIA

لكن عمليًا، تعليق ماسك منطقي إذا نظرت إلى ميزانيات أبحاث الاندماج النووي على أنها تؤخر قبول الطاقة الشمسية – خاصة إذا كانت الطاقة الشمسية على نطاق كوكبي أو القائمة في الفضاء أكثر منطقية على أي حال.

هذا لا يعني أنه بالضرورة على حق، حيث إن الطاقة الشمسية (وتخزين الطاقة) لم تثبتا بعد أنهما يمكنهما تلبية 100٪ من احتياجاتنا من الطاقة – ليس فقط طلب الشبكة، ولكن أيضًا كل الطاقة المطلوبة للنقل والإنتاج الكيميائي والصناعات الثقيلة.

لذا قد يكون من المنطقي أيضًا عدم وضع كل بيضنا في سلة واحدة، بل العمل في نفس الوقت على العديد من مصادر الطاقة منخفضة الكربون: الطاقة الشمسية، الطاقة الحرارية الأرضية، طاقة الرياح، الانشطار من الجيل الرابع، و الاندماج النووي.

وعلى أي حال، يمكننا أيضًا القول إن إمكانات الاندماج النووي لاستكشاف الفضاء واستعماره قد تكون في حد ذاتها كافية لتبرير العمل على إتقان هذا المصدر للطاقة.

شركات الاندماج النووي التي يجب مراقبتها (خاصة في الغالب – في الوقت الحالي)

حاليًا، لا توجد أي من الشركات المكرسة لجعل الاندماج النووي مجديًا تجاريًا مدرجة في البورصة. وهذا يشمل Helion، General Fusion، Commonwealth Fusion، TAE Technologies، ZAP Energy، و NEO Fusion.

يمكنك العثور على قائمة شاملة للشركات الناشئة في مجال الاندماج النووي

Sbposts__content/button_label:أسواق التصدير في آسيا وأفريقيا وأمريكا الجنوبية – والآفاق العامة للطاقة الشمسية لتولي زمام أنظمة الطاقة العالمية.

Energía

Solar vs Fusión — ¿Cuál gana y por qué? Sbposts__content/button_label: Ver Guía de Inversión Nuclear

Securities.io maintains rigorous editorial standards and may receive compensation from reviewed links. We are not a registered investment adviser and this is not investment advice. Please view our affiliate disclosure.

Cuando se trata de discusiones sobre fuentes de energía, el partidismo es hoy parte integral del tema. Los conservadores podrían preferir los combustibles fósiles, los liberales los paneles solares y los vehículos eléctricos, y los tecnólogos esperan un renacimiento nuclear (fisión nuclear).

Mientras tanto, los científicos están utilizando presupuestos multimillonarios para intentar desbloquear la fusión nuclear, que podría, en teoría, ser la fuente de energía definitiva, tanto limpia como ilimitada. Pero no todo el mundo está de acuerdo en que esto sea probable que funcione pronto.

Para empezar, los escépticos se sienten bastante reivindicados por el pésimo historial de predicciones sobre la fusión nuclear volviéndose útil y comercialmente viable —un punto en el tiempo que siempre parece estar a 20-30 años de distancia, y lo ha estado durante los últimos 80 años.

Recientemente, el líder tecnológico, multimillonario y figura controvertida Elon Musk ha puesto su peso en el debate. Básicamente dijo que los proyectos de investigación de fusión nuclear no tienen sentido, ya que el mejor y más útil reactor nuclear ya existe: el Sol.

Fuente: Elon Musk / X

Y, de hecho, la producción de energía del Sol probablemente eclipsará permanentemente a la humanidad.

Si bien el volumen de Júpiter es ~1,300 veces el de la Tierra, el Sol aún lo empequeñece. Contiene el 99.86% de toda la masa en nuestro sistema solar y está quemando constantemente 600 millones de toneladas de hidrógeno cada segundo.

Entonces, según Musk, la humanidad debería simplemente redoblar la apuesta por la energía solar y olvidarse de la fusión nuclear.

Pero, ¿tiene razón?

Resumen

- El argumento de Elon Musk de que “el Sol ya es el reactor de fusión” destaca por qué la energía solar está ganando hoy: funciona ahora y sigue abaratándose.

- La mayor debilidad de la solar es la fiabilidad, ya que las noches, los inviernos y los períodos prolongados nublados requieren un almacenamiento masivo o energía de respaldo.

- La fusión nuclear promete energía densa, bajo demanda y baja en carbono, pero aún no ha demostrado una producción neta comercial de electricidad ni costos predecibles.

- Si la fusión tiene éxito, es más probable que domine aplicaciones que necesiten energía concentrada y constante en lugar de generación difusa.

- El futuro más realista es un sistema híbrido donde la energía solar barata se expanda ampliamente mientras que las fuentes de energía firme llenen los vacíos de fiabilidad.

La gran ventaja de la energía solar: Costo y velocidad

En un artículo anterior titulado “The Solar Age – A Bright Future To Mankind“, discutimos cómo la energía solar se está moviendo rápidamente para convertirse en la principal fuente de energía de nuestra civilización.

En gran parte, esto fue impulsado por varias décadas de progreso que vieron caer el precio de los paneles solares en un factor de 30.

Fuente: IEA

En paralelo, los vehículos eléctricos y los parques de baterías lo suficientemente grandes como para alimentar la red eléctrica han aumentado la utilidad de la electricidad sobre los combustibles fósiles.

Aún así, la energía solar sufre algunas limitaciones:

- La producción es mucho menor en invierno, especialmente en latitudes norteñas.

- La tasa de disminución de precios ha comenzado a desacelerarse.

- La producción es intermitente y difícil de predecir, lo que resulta en escenarios menos que ideales:

- O la energía solar sigue siendo una pequeña parte de toda la combinación energética, contribuyendo seriamente solo en días soleados.

- O la energía solar se convierte en una parte más grande de la combinación energética, pero con una capacidad excesiva masiva para los días sin sol.

- O se deben construir parques de baterías masivos, instalaciones de hidrógeno u otros sistemas de almacenamiento de energía —que cuestan billones— para complementar la energía solar durante los días nublados, las tardes y los inviernos.

Al mismo tiempo, la energía solar funciona ahora, mientras que los reactores de fusión siguen siendo solo una teoría cuando se trata de modelos comercialmente útiles.

¿Puede la fusión nuclear volverse comercial?

Como explicamos en nuestro informe en profundidad sobre la fusión nuclear, la fusión es, en teoría, la fuente de energía ideal: no produce contaminación (el resultado es helio), consume el material más abundante en el Universo (hidrógeno) y es órdenes de magnitud más potente que incluso las plantas de energía de fisión nuclear más grandes.

https://www.youtube.com/watch?v=htvxKBdh7Y8

El problema es que requiere manejar material de manera segura y económica mientras se comprime y calienta a decenas o cientos de millones de grados —y de alguna manera extraer energía de él mientras se mantiene un tono profesional y optimizado para SEO.Aunque sabemos cómo desencadenar la fusión nuclear desde la década de 1950, hacerla útil para la generación de energía ha sido un objetivo esquivo.

Aun así, el proyecto internacional ITER avanza. Y empresas privadas como Commonwealth Fusion Systems y Proxima Fusion anuncian sus propios modelos comerciales para ser lanzados en los próximos años.

Entonces, para continuar la comparación que desencadenó Elon Musk: incluso si se desarrolla la fusión comercial, ¿queda obsoleta por la solar?

Comparación Solar vs Fusión

Resumen

Los argumentos clave dependen del ángulo desde el cual se vea cada fuente de energía.

El argumento a favor de la solar es que es esencialmente “gratuita”, en el sentido de que la energía ya ha sido generada por el gigantesco reactor de fusión nuclear que es el Sol, y llega a la Tierra todos los días, esperando ser recolectada.

Los críticos dirán que, aunque la cantidad total que llega a la Tierra es enorme, está demasiado difusa por pie cuadrado para ser verdaderamente eficiente y es demasiado vulnerable a la variación ambiental.

Por otro lado, los futuros reactores de fusión nuclear producirían una energía mucho más concentrada, generando energía bajo demanda. También es completamente independiente del clima, las estaciones o la hora del día.

Al final, el argumento no es tanto técnico como conceptual y económico.

Desliza para desplazarte →

| Factor | Solar (hoy) | Fusión (hoy) | ¿Qué cambiaría al ganador? |

|---|---|---|---|

| Velocidad de despliegue | Rápida (meses) | Lenta (años/décadas) | Si las plantas de fusión se vuelven modulares + construcciones repetibles |

| Combustible y cadena de suministro | Fabricación intensiva en materiales | Componentes complejos; la vía del tritio importa | Si la fusión simplifica las partes + resuelve la logística del combustible |

| Fiabilidad | Intermitente sin almacenamiento | Potencial de carga base/bajo demanda | Si el almacenamiento se vuelve extremadamente barato a gran escala |

| Uso del suelo | Área grande (pero los tejados ayudan) | Huella pequeña por MW | Si la solar basada en el espacio se vuelve económica |

| Perspectiva de coste | Bajando, pero madurando | No probada; podría caer bruscamente si funciona | Si la fusión alcanza electricidad neta + larga vida de los componentes |

¿Cómo Puede Ganar la Solar?

El Camino Económico

Hay algunos caminos para que la solar tenga sentido, sin importar cuán eficiente se vuelva la fusión nuclear.

Uno es volverse tan barata y ubicua que la generación de energía se convierta en una idea secundaria. Por ejemplo, si los paneles solares se vuelven lo suficientemente baratos, tiene sentido cubrir cada tejado, cada valla y quizás cada pared exterior con ellos.

Los paneles bifaciales, que producen energía tanto por el frente como por la parte trasera, serían ideales para muchos de esos diseños. Los paneles ultraduraderos también tendrían grandes beneficios económicos si pudieran producir durante 30 o 50 años con pérdidas mínimas.

Sbposts__content/button_label:

Fuente: Next2Sun

En ese contexto, ese escenario también requiere costos insignificantes para las baterías, de modo que las tardes y el invierno puedan ser completamente suplementados por una mayor producción solar durante los días soleados. Las conexiones de larga distancia (miles de kilómetros o millas) entre redes también podrían ayudar.

Entonces, no importa cuán eficiente se vuelva la fusión nuclear, probablemente quedaría relegada a aplicaciones de nicho, con la mayor parte de la red suministrada por paneles solares, probablemente ubicados en lugares soleados como desiertos o altas montañas.

El Camino de Alta Tecnología

Otra opción para que los paneles solares alivien sus limitaciones—principalmente vinculadas al ciclo día-noche y al clima—es trasladarse a donde ambos problemas desaparecen: al espacio.

La energía solar basada en el espacio, que explicamos en un artículo dedicado, consiste en colocar granjas solares en órbita, donde el Sol brilla las 24 horas del día, los 7 días de la semana, y con una intensidad mucho mayor que en la superficie de la Tierra. La energía se retransmite luego a la Tierra utilizando haces de microondas y estaciones de recepción dedicadas.

A este respecto, tales estaciones solares podrían, a largo plazo, ubicarse en órbita alrededor de Venus, Mercurio, o incluso más cerca del Sol, aumentando aún más su producción.

Aunque no se explica en el argumento de Musk, esta podría ser la razón detrás del mismo. Si bien la solar terrestre aún no es perfecta, el colapso de los costos de lanzamiento con cohetes como la Starship de Musk podría hacer que la solar espacial sea tan barata que pueda competir directamente con todas las demás fuentes de energía.

¿Cómo Puede Ganar la Fusión?

Por supuesto, el primer paso para que la fusión nuclear gane la carrera para convertirse en la principal fuente de energía de la humanidad es lograr producir más energía de la que consume para la ignición.

Si esto sucede, entonces la pregunta será principalmente una de economía, con algunas preguntas clave que necesitan respuesta:

- ¿Cuál es el costo de construir una planta de fusión nuclear? (Costos de capital)

- ¿Cuánto cuesta generar un kWh una vez construida, considerando todos los gastos—no solo el combustible sino también los recursos humanos, mantenimiento, reparaciones, tiempo de inactividad, seguros, etc.? (Costos operativos)

- ¿Cuánto tiempo puede operar antes de necesitar ser retirada (período de amortización)?

Sabemos que esto podría ser complicado, ya que la fisión nuclear, aunque una maravilla de la tecnología, también es muy cara de construir y operar.

Si bien algunos de estos costos están vinculados a los riesgos inherentes de la fisión nuclear (que están ausentes para la fusión), una tecnología que nos tomó casi un siglo dominar probablemente no será barata, requiriendo gigantescos imanes superconductores, electrónica avanzada, supercomputadoras, nuevos supermateriales y especialistas en física de plasma y cuántica.

Sin embargo, la fusión ganará en cualquier aplicación que requiera mucha energía en un solo lugar, bajo demanda. Así que, pase lo que pase, si la fusión nuclear se convierte en una realidad, probablemente se convertirá en la fuente de energía preferida para grandes buques militares, naves espaciales y ciertas industrias pesadas.

Esta también será la fuente de energía favorita para cualquier exploración del espacio profundo, ya que la luz solar disminuye exponencialmente a medida que nos alejamos del Sol. Por ejemplo, Júpiter recibe solo el 4% de la luz solar que recibe la Tierra.

Tres Escenarios para la Combinación Energética: Solar, Almacenamiento, Fusión

En general, la combinación energética futura de la humanidad dependerá de algunas variables, algunas de las cuales Elon Musk está trabajando personalmente para cambiar.

Escenario 1: El Muro de las Limitaciones Solares

Si no se materializan ni paneles solares más baratos ni un almacenamiento de energía ultraeconómico, la tecnología comenzará a progresar cada vez más lentamente.

En este caso, la solar se vuelve incapaz de manejar la totalidad de la demanda de la red eléctrica, y el consumo de carga base e invernal debe cubrirse con combustibles fósiles o una forma de energía nuclear—siendo la fusión nuclear la opción ideal si es posible, gracias a ser baja en carbono y de bajo riesgo.

Considerando la popularidad actual de la energía solar, esto probablemente ocurrirá si la tecnología de los paneles solares y las baterías alcanza limitaciones fundamentales basadas en la física que obstaculicen un mayor progreso.

Escenario 2: Ubicuidad de la Energía Solar

En esta opción, la energía solar se vuelve tan barata que apenas vale la pena medir sus costos. La producción es tan abundante que los días soleados ven un enorme excedente “inútil”, mientras que los días más oscuros aún están cubiertos por el enorme parque omnipresente de paneles solares que cubre la mayoría de los edificios, carreteras, etc.

Tal abundancia de energía permite resolver muchos de los problemas de nuestra era:

- La desalinización permite reverdecer desiertos y una abundancia de agua dulce.

- La captura de carbono puede realizarse a gran escala, resolviendo cualquier preocupación sobre las emisiones de carbono.

- La energía barata ilimitada nos permite extraer metales de minerales de baja ley, creando suministros de materias primas virtualmente ilimitados.

- El costo de ar

Sbposts__content/button_label:

- La energía solar fotovoltaica es la fuente de energía de más rápido crecimiento en el mundo, con costos que han caído más de un 90% en la última década.

- La fusión nuclear promete energía limpia, abundante y casi ilimitada, pero sigue siendo una tecnología experimental y no comercial.

- El debate se centra en si la inversión en fusión está retrasando la adopción masiva de soluciones solares ya viables.

Introducción

En un reciente episodio del podcast de Joe Rogan, Elon Musk hizo una declaración contundente sobre la energía de fusión nuclear, calificándola de “una tontería” y argumentando que es esencialmente “capturar el sol y ponerlo en una caja”, algo que, según él, es innecesario cuando ya tenemos un sol perfectamente funcional en el cielo.

Énergie

Solar vs. Fusion – Wer gewinnt und warum? Sbposts__content/button_label: |||XF_ROW_SEP_6|||Mehr erfahren|||XF_ROW_SEP_6|||Mehr erfahren|||XF_ROW_SEP_6|||Jetzt investieren|||XF_ROW_SEP_6|||Jetzt investieren|||XF_ROW_SEP_6|||Jetzt investieren|||XF_ROW_SEP_6|||Mehr erfahren|||XF_ROW_SEP_6|||

Securities.io maintains rigorous editorial standards and may receive compensation from reviewed links. We are not a registered investment adviser and this is not investment advice. Please view our affiliate disclosure.

Wenn es um Diskussionen über Energiequellen geht, ist Parteilichkeit heute ein fester Bestandteil des Themas. Konservative bevorzugen vielleicht fossile Brennstoffe, Liberale Solarpaneele und Elektroautos, und Technologen hoffen auf eine nukleare Renaissance (Kernspaltung).

Währenddessen nutzen Wissenschaftler Milliardenbudgets, um die Kernfusion zu erschließen, die theoretisch die ultimative, saubere und unbegrenzte Energiequelle sein könnte. Aber nicht alle sind der Meinung, dass dies in absehbarer Zeit funktionieren wird.

Zunächst einmal fühlen sich Skeptiker durch die miserable Erfolgsbilanz von Vorhersagen über die nützliche und kommerzielle Nutzbarkeit der Kernfusion bestätigt – ein Zeitpunkt, der immer 20-30 Jahre entfernt zu sein scheint und das seit 80 Jahren.

Kürzlich hat der Tech-Führer, Milliardär und umstrittene Figur Elon Musk sein Gewicht in die Debatte geworfen. Er sagte im Wesentlichen, dass Forschungsprojekte zur Kernfusion sinnlos seien, da der beste und nützlichste Kernreaktor bereits existiere: die Sonne.

Quelle: Elon Musk / X

Und tatsächlich wird die Energieabgabe der Sonne die Menschheit wahrscheinlich für immer in den Schatten stellen.

Während das Volumen des Jupiter etwa das 1.300-fache der Erde beträgt, wird er von der Sonne immer noch weit übertroffen. Sie enthält 99,86 % der gesamten Masse in unserem Sonnensystem und verbrennt jede Sekunde konstant 600 Millionen Tonnen Wasserstoff.

Laut Musk sollte sich die Menschheit also einfach auf Solarenergie konzentrieren und die Kernfusion vergessen.

Aber hat er recht?

Zusammenfassung

- Elon Musks Argument, dass “die Sonne bereits der Fusionsreaktor ist”, unterstreicht, warum Solarenergie heute gewinnt: Sie funktioniert jetzt und wird immer günstiger.

- Die größte Schwäche der Solarenergie ist ihre Zuverlässigkeit, da Nächte, Winter und längere bewölkte Perioden massive Speicher oder Backup-Strom erfordern.

- Kernfusion verspricht dichte, bedarfsgerechte, kohlenstoffarme Energie, hat aber noch keinen kommerziellen Netto-Strom oder vorhersehbare Kosten nachgewiesen.

- Sollte die Fusion erfolgreich sein, wird sie höchstwahrscheinlich Anwendungen dominieren, die konzentrierte, konstante Energie benötigen, anstatt dezentrale Erzeugung.

- Die realistischste Zukunft ist ein hybrides System, bei dem günstige Solarenergie weit verbreitet skaliert, während zuverlässige Energiequellen die Versorgungslücken schließen.

Der große Vorteil der Solarenergie: Kosten und Geschwindigkeit

In einem früheren Artikel mit dem Titel “The Solar Age – A Bright Future To Mankind” haben wir besprochen, wie Solarenergie schnell dabei ist, die primäre Energiequelle unserer Zivilisation zu werden.

Dies wurde größtenteils durch mehrere Jahrzehnte Fortschritt vorangetrieben, in denen der Preis für Solarpaneele um das 30-fache gesunken ist.

Quelle: IEA

Parallel dazu haben Elektroautos und Batterieparks, die groß genug sind, um das Stromnetz zu speisen, den Nutzen von Strom gegenüber fossilen Brennstoffen erhöht.

Dennoch leidet die Solarenergie unter einigen Einschränkungen:

- Die Produktion ist im Winter, besonders in nördlichen Breitengraden, viel geringer.

- Das Tempo des Preisverfalls hat begonnen, sich zu verlangsamen.

- Die Produktion ist intermittierend und schwer vorherzusagen, was zu weniger als idealen Szenarien führt:

- Entweder bleibt Solarenergie ein kleiner Teil des gesamten Energiemixes und trägt nur an sonnigen Tagen nennenswert bei.

- Oder Solarenergie wird ein größerer Teil des Energiemixes, aber mit massiver Überkapazität für sonnenlose Tage.

- Oder es müssen massive Batterieparks, Wasserstoffanlagen oder andere Energiespeichersysteme – mit Kosten in Billionenhöhe – gebaut werden, um Solarenergie an bewölkten Tagen, abends und im Winter zu ergänzen.

Gleichzeitig funktioniert Solarenergie jetzt, während Fusionsreaktoren in Bezug auf kommerziell nützliche Modelle immer noch nur eine Theorie sind.

Kann Kernfusion kommerziell werden?

Wie wir in unserem ausführlichen Bericht über Kernfusion erklärt haben, ist Fusion theoretisch die ideale Energiequelle: Sie erzeugt keine Umweltverschmutzung (das Produkt ist Helium), verbraucht das häufigste Material im Universum (Wasserstoff) und ist um Größenordnungen leistungsstärker als selbst die größten Kernspaltungskraftwerke.

https://www.youtube.com/watch?v=htvxKBdh7Y8

Das Problem ist, dass sie den sicheren und kostengünstigen Umgang mit Material erfordert, während es auf zehn- oder hundertmillionen Grad komprimiert und erhitzt wird – und dabei irgendwie Energie daraus extrahiert werden muss, während es auf Deutsch übersetzt wird.

Während wir seit den 1950er Jahren wissen, wie man Kernfusion auslöst, war es ein schwer fassbares Ziel, sie für die Energieerzeugung nutzbar zu machen.

Trotzdem schreitet das internationale ITER-Projekt voran. Und private Unternehmen wie Commonwealth Fusion Systems und Proxima Fusion kündigen ihre eigenen kommerziellen Modelle an, die in den nächsten Jahren auf den Markt kommen sollen.

Um also den von Elon Musk angestoßenen Vergleich fortzusetzen: Selbst wenn die kommerzielle Fusion entwickelt wird, wird sie dann durch Solarenergie obsolet?

Solar vs. Fusion Vergleich

Überblick

Die zentralen Argumente hängen davon ab, aus welchem Blickwinkel man jede Energiequelle betrachtet.

Das Argument für Solarenergie ist, dass sie im Grunde “kostenlos” ist, in dem Sinne, dass die Energie bereits von dem riesigen Kernfusionsreaktor, der die Sonne ist, erzeugt wird und jeden Tag auf der Erde ankommt, um gesammelt zu werden.

Kritiker werden sagen, dass die Gesamtmenge, die die Erde trifft, zwar enorm ist, sie aber pro Quadratfuß zu diffus für eine wirklich effiziente Nutzung und zu anfällig für Umweltvariationen ist.

Andererseits würden zukünftige Kernfusionsreaktoren Energie erzeugen, die viel konzentrierter ist und bedarfsgerecht Strom erzeugt. Sie ist zudem völlig unabhängig von Wetter, Jahreszeiten oder Tageszeit.

Am Ende geht es bei der Debatte weniger um technische als vielmehr um konzeptionelle und wirtschaftliche Fragen.

Zum Scrollen wischen →

| Faktor | Solar (heute) | Fusion (heute) | Was würde den Gewinner ändern? |

|---|---|---|---|

| Geschwindigkeit der Bereitstellung | Schnell (Monate) | Langsam (Jahre/Jahrzehnte) | Wenn Fusionskraftwerke modular + wiederholbar gebaut werden |

| Brennstoff & Lieferkette | Materialintensive Fertigung | Komplexe Komponenten; Tritium-Beschaffung ist entscheidend | Wenn Fusion Teile vereinfacht + Brennstofflogistik löst |

| Zuverlässigkeit | Unterbrechungsanfällig ohne Speicher | Potenzielle Grundlast/Bedarfsdeckung | Wenn Speicher im großen Maßstab extrem günstig werden |

| Flächennutzung | Große Fläche (aber Dachflächen helfen) | Kleine Fläche pro MW | Wenn solare Weltraumkraftwerke wirtschaftlich werden |

| Kostenausblick | Fallend, aber ausgereift | Unbewiesen; könnte stark fallen, wenn es funktioniert | Wenn Fusion Netto-Strom erreicht + lange Komponentenlebensdauer |

Wie kann Solar gewinnen?

Der wirtschaftliche Weg

Es gibt einige Wege, auf denen Solarenergie sinnvoll sein kann, egal wie effizient die Kernfusion wird.

Einer ist, so billig und allgegenwärtig zu werden, dass die Energieerzeugung zur Nebensache wird. Wenn Solarpanels beispielsweise billig genug werden, ist es sinnvoll, jedes Dach, jeden Zaun und vielleicht jede Außenwand damit zu bedecken.

Bifaziale Module, die Energie von Vorder- und Rückseite erzeugen, wären für viele solcher Designs ideal. Ultralanglebige Panels hätten ebenfalls große wirtschaftliche Vorteile, wenn sie 30 oder 50 Jahre lang mit minimalen Verlusten produzieren könnten.

Sbposts__content/button_label:

Quelle: Next2Sun

In diesem Zusammenhang erfordert dieses Szenario auch vernachlässigbare Kosten für Batterien, sodass Abende und Winter vollständig durch eine höhere Solarproduktion an sonnigen Tagen ergänzt werden können. Fernverbindungen (tausende Kilometer oder Meilen) zwischen Netzen könnten ebenfalls helfen.

Dann würde die Kernfusion, egal wie effizient sie wird, wahrscheinlich auf Nischenanwendungen beschränkt bleiben, während der Großteil des Netzes von Solarpanelen versorgt würde, die sich wahrscheinlich an sonnigen Standorten wie Wüsten oder Hochgebirgen befinden.

Der Hightech-Pfad

Eine weitere Möglichkeit für Solarpaneele, ihre Einschränkungen zu mildern – die hauptsächlich mit dem Tag-Nacht-Zyklus und dem Wetter zusammenhängen – besteht darin, dorthin zu gehen, wo beide Probleme nicht existieren: in den Weltraum.

Weltraumgestützte Solarenergie, die wir in einem eigenen Artikel erklärt haben, basiert darauf, Solarfarmen in die Umlaufbahn zu bringen, wo die Sonne 24/7 scheint und mit einer viel höheren Intensität als auf der Erdoberfläche. Der Strom wird dann über Mikrowellenstrahlen und spezielle Empfangsstationen zur Erde zurückgeleitet.

In dieser Hinsicht könnten solche Solarkraftwerke langfristig in der Umlaufbahn der Venus, des Merkurs oder sogar näher an der Sonne positioniert werden, was ihre Produktion noch weiter steigern würde.

Obwohl in Musks Argument nicht erklärt, könnte dies die dahinterstehende Überlegung sein. Während bodengebundene Solarenergie noch nicht perfekt ist, könnten die sinkenden Startkosten durch Raketen wie Musks Starship weltraumgestützte Solarenergie so billig machen, dass sie direkt mit allen anderen Energiequellen konkurrieren kann.

Wie kann Fusion gewinnen?

Natürlich ist der erste Schritt für die Kernfusion, um das Rennen um die wichtigste Energiequelle der Menschheit zu gewinnen, dass sie es schafft, mehr Energie zu erzeugen, als sie für die Zündung verbraucht.

Wenn dies geschieht, wird die Frage hauptsächlich eine wirtschaftliche sein, wobei einige Schlüsselfragen beantwortet werden müssen:

- Wie hoch sind die Kosten für den Bau eines Kernfusionskraftwerks? (Kapitalkosten)

- Wie viel kostet es, eine kWh zu erzeugen, sobald es gebaut ist, alle Ausgaben berücksichtigt – nicht nur Brennstoff, sondern auch Personal, Wartung, Reparaturen, Ausfallzeiten, Versicherung usw.? (Betriebskosten)

- Wie lange kann es betrieben werden, bevor es stillgelegt werden muss (Amortisationszeitraum)?

Wir wissen, dass dies knifflig sein könnte, da die Kernspaltung, obwohl eine technologische Meisterleistung, auch sehr teuer im Bau und Betrieb ist.

Während einige dieser Kosten mit den inhärenten Risiken der Kernspaltung zusammenhängen (die bei der Fusion nicht vorhanden sind), wird eine Technologie, die wir fast ein Jahrhundert beherrschen lernten, wahrscheinlich nicht billig sein. Sie erfordert riesige supraleitende Magnete, fortschrittliche Elektronik, Supercomputer, neue Supermaterialien und Spezialisten für Plasmaphysik und Quantenphysik.

Die Fusion wird jedoch in jeder Anwendung gewinnen, die viel Leistung an einem Ort und nach Bedarf erfordert. Daher wird die Kernfusion, wenn sie Realität wird, unabhängig von allem anderen wahrscheinlich die bevorzugte Energiequelle für große Militärschiffe, Raumfahrzeuge und bestimmte Schwerindustrien sein.

Dies wird auch die bevorzugte Energiequelle für jede Tiefraumforschung sein, da das Sonnenlicht exponentiell abnimmt, je weiter wir uns von der Sonne entfernen. Zum Beispiel erhält Jupiter nur 4% des Sonnenlichts, das die Erde erhält.

Drei Szenarien für den Energiemix: Solar, Speicherung, Fusion

Insgesamt wird der zukünftige Energiemix der Menschheit von einigen Variablen abhängen, an deren Veränderung Elon Musk persönlich hart arbeitet.

Szenario 1: Die Grenzmauer der Solarenergie

Wenn weder billigere Solarpaneele noch ultra-günstige Energiespeicher realisiert werden, wird die Technologie immer langsamer voranschreiten.

In diesem Fall ist die Solarenergie nicht in der Lage, die gesamte Energienachfrage des Netzes zu decken, und die Grundlast- und Winterverbrauch müssen durch fossile Brennstoffe oder eine Form der Kernenergie gedeckt werden – wobei die Kernfusion, wenn möglich, die ideale Option wäre, da sie sowohl kohlenstoffarm als auch risikoarm ist.

Angesichts der derzeitigen Beliebtheit der Solarenergie wird dies wahrscheinlich eintreten, wenn die Technologie sowohl von Solarpanelen als auch von Batterien auf physikalische Grundgrenzen stößt, die einen weiteren Fortschritt behindern.

Szenario 2: Allgegenwart der Solarenergie

Bei dieser Option wird Solarenergie so billig, dass es kaum noch lohnt, ihre Kosten zu messen. Die Produktion ist so reichlich, dass sonnige Tage einen massiven “nutzlosen” Überschuss aufweisen, während dunklere Tage immer noch durch den massiven, allgegenwärtigen Park von Solarpanelen gedeckt werden, der die meisten Gebäude, Straßen usw. bedeckt.

Ein solcher Energieüberfluss ermöglicht es, viele Probleme unserer Zeit zu lösen:

- Entsalzung ermöglicht die Begrünung von Wüsten und einen Überfluss an Süßwasser.

- CO2-Abscheidung kann in großem Maßstab durchgeführt werden, was alle Bedenken bezüglich Kohlenstoffemissionen löst.

- Unbegrenzte billige Energie ermöglicht es uns, Metalle aus minderwertigem Erz zu gewinnen und so praktisch unbegrenzte Rohstoffvorräte zu schaffen.

- Die Kosten für ar

Sbposts__content/button_label:

- künstliche Beleuchtung vernachlässigbar wird, wodurch vertikale Farmen unsere primäre Nahrungsquelle werden und wir große Teile der Umwelt renaturieren können.

Quelle: One Earth

Dasselbe Ergebnis wird durch den erfolgreichen Einsatz orbitaler Solarfarmen erzielt. Das massive Energieangebot kann nicht nur die Erde versorgen, sondern auch Raumkolonien und Asteroiden-Bergbauoperationen, was zu einer ähnlichen Fülle an Metallen, Ressourcen und Energie führt.

Szenario 3: Kernfusion dominiert

Die meisten Technologien beginnen langsam, durchlaufen eine Phase exponentieller Verbesserungen und beginnen dann aufgrund der inhärenten Grenzen des Konzepts zu stagnieren. Dies ist etwas, das wir bei fast jeder neuen Technologie in den letzten 200 Jahren beobachtet haben.

Was die Kernfusion so spannend macht, ist, dass die Technologie gerade erst aus der Konzeptphase in die kommerzielle Stufe übergeht.

Kosten und Effizienz sollten sich drastisch verbessern, wenn mehr experimentelles Verständnis, Skaleneffekte und neue Entdeckungen einsetzen, ähnlich wie frühe Verbrennungsmotoren wenig mit heutigen Automotoren gemeinsam haben.

Während Solarenergie also die Chance hat, “zu billig zum Messen” zu werden, hat die Kernfusion eine noch größere Chance auf dieses hohe Ziel.

Was den Ausschlag geben könnte, ist, ob die Kernfusion schnell genug entwickelt wird. Wenn eine Alternative zu fossilen Brennstoffen auftaucht, die direkt in unsere zentralisierten Stromnetze und Energiesysteme passt, könnte sie die Solarenergie ausstechen, bevor diese allgegenwärtig wird. Und natürlich könnte der Vorteil der Fusion für Raumfahrt- und Militäranwendungen die Waage ebenfalls zu ihren Gunsten neigen lassen.

Erkenntnis für Investoren

- Kurzfristig fließt Kapital weiterhin in den Ausbau von Solarenergie, Netzmodernisierungen und Energiespeicherung eher als in spekulative Fusionsprojekte.

- Die Solarproduktion bleibt hochgradig zyklisch, wobei Überkapazitäten und Preisschwankungen sowohl tiefe Einbrüche als auch scharfe Erholungen verursachen.

- Politik, Zölle und Geopolitik können für Solaraktien genauso wichtig sein wie die Technologie, insbesondere für solche, die mit chinesischen Lieferketten verbunden sind.

- Kernfusion sollte als langfristige Option betrachtet werden; die meisten Engagements sind heute privat oder indirekt über Verteidigungs- und Hochleistungswerkstoffunternehmen.

- Für Investoren sollten Solar-Hardware-Unternehmen am besten als taktische Trades behandelt werden, während langfristige Engagements im Energieumbau eher bei Netz-, Speicher- und Elektrifizierungsführern liegen.

Fazit

Da die überwiegende Mehrheit unseres Primärenergieverbrauchs immer noch aus fossilen Brennstoffen (Kohle, Öl und Gas) stammt, mag es etwas seltsam erscheinen, die Relevanz von Solarenergie gegenüber Kernfusion zu diskutieren.

Derzeit wird dringend eine von beiden benötigt, um unsere Energiesysteme auf nachhaltige, kohlenstoffarme Quellen umzustellen.

Quelle: EIA

In der Praxis macht Musks Kommentar jedoch Sinn, wenn man Fusionsforschungsbudgets als Verzögerung der Akzeptanz von Solarenergie betrachtet – insbesondere wenn letztendlich planetare oder weltraumgestützte Solarenergie ohnehin sinnvoller ist.

Das soll nicht heißen, dass er unbedingt recht hat, da Solarenergie (und Energiespeicherung) noch beweisen müssen, dass sie 100 % unseres Energiebedarfs decken können – nicht nur die Nachfrage des Stromnetzes, sondern auch die gesamte Energie für Transport, chemische Produktion und Schwerindustrie.

Es könnte also auch sinnvoll sein, nicht alles auf eine Karte zu setzen, sondern gleichzeitig an vielen kohlenstoffarmen Energiequellen zu arbeiten: Solarenergie, Geothermie, Wind, Fusion der 4. Generation und Kernfusion.

Und auf jeden Fall könnte man auch sagen, dass das Potenzial der Kernfusion für die Weltraumforschung und -kolonisierung an sich Grund genug sein könnte, an der Beherrschung dieser Energiequelle zu arbeiten.