Funds

Blockchain Capital’s BCAP Token Q1, 2021 Results

Blockchain Capital launched the first security token back in April 2017, this was to be the first tokenized venture fund. This STO event raised $10M USD with each token selling for $1.00.

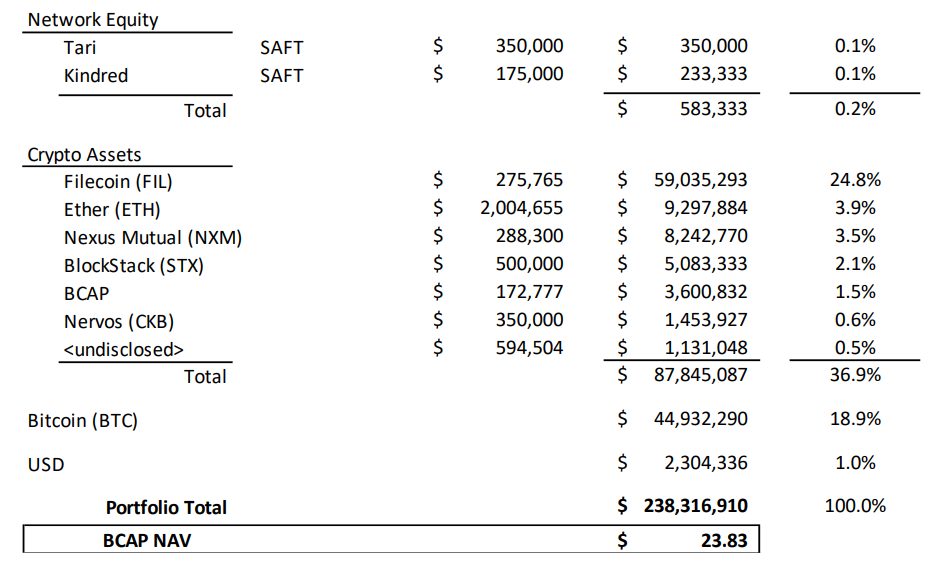

Today they announced that the net asset value (“NAV”) of each BCAP token as of March 31st, 2021, is $23.83, based on the NAV of the underlying venture capital fund, Blockchain Capital III Digital Liquid Venture Fund, LP. Weekly NAV updates can be found here.

The BCAP NAV finished up 273.5% for the first quarter of 2021. The Q1 increase was driven by multiple major moves across the fund’s portfolio, both from equity and token holdings.

In aggregate, the equity book increased 337% in the quarter, driven by the following:

- Anchorage raised $80M in its Series C led by GIC.

- Bison Trails was acquired by Coinbase, increasing the value of the investment by 14.1x.

- Coinbase started trading on the Nasdaq Private Markets and reached a market cap of over $100B, increasing the value of the position by 9.5x.

- Kraken shares followed suit in the secondary market, trading from $4B up to $15B, increasing the value of the position by 3.6x

- OpenSea raised a $23M round from a16z, marking up the two seed-led rounds by 2.6x

The token portfolio also had great gains during the quarter, increasing by 204%. Filecoin was the largest contributor, increasing by 750% during the quarter. Bitcoin doubled during the quarter, while STX and NXM also posted gains of 180%.

The BCAP portfolio is up 2,283.2% since inception, post-STO from April 2017, and has a Net IRR of 122.0%. Performance figures are net of all fees and carry.

The composition of the portfolio as of March 31st, 2021 is as follows:

On an additional note there are two holdings that have extreme potential. Cryptocurrency exchange Kraken is considering going public through a direct listing in 2022, after seeing record trading volumes and new clients amid a surge in the price of bitcoin.

Should security Tokens (also known as digital securities) take off, the Securitize holdings have the potential to be a gamechanger, as Securitize is a leader in this space.

About Blockchain Capital

Blockchain Capital was founded in 2013 with the mission of helping entrepreneurs build world-class companies and projects based on blockchain technology – providing founders with the tools they need to succeed: capital, domain expertise, partnerships, recruiting and strategy.

Blockchain Capital is one of the earliest and most active venture investors in the blockchain industry and has financed 100+ companies and projects since its inception. The company invests in both equity and crypto assets and is a multi-stage investor. Blockchain Capital also pioneered the world's first ever tokenized investment fund and by extension the blockchain industry's very first security token, the BCAP, which the company sold through a security token offering in April of 2017.

Blockchain Capital believes that blockchain technology holds the promise to disrupt legacy businesses and create whole new markets and business models, and invests in founders who want to leverage blockchain technology to change the world in profound ways.