Spotlights

Vertex Pharmaceuticals (VRTX): Gene Editing and a Cure for Diabetes

Securities.io maintains rigorous editorial standards and may receive compensation from reviewed links. We are not a registered investment adviser and this is not investment advice. Please view our affiliate disclosure.

Vertex’s Journey: From Cystic Fibrosis to Biotech Leader

Most biotech companies fail, and the ones that succeed usually do so by focusing on a specific disease that was previously incurable, or poorly treated. This is exactly what Vertex Pharmaceuticals did with cystic fibrosis, a rare genetic disease causing damage to the lungs, affecting 109,000 people around the world, most of them in the USA, Europe, Australia, and Canada.

It turned the ambitious biotech startup into a cash-rich pharmaceutical company, able to reinvest its profits into further groundbreaking research.

Today, Vertex is quickly expanding into new medical niches, from gene editing therapies for a wide variety of genetic diseases to a potential permanent cure for type-1 diabetes. As the company managed to retain its ability for disruptive innovation despite its growth, it can be interesting for investors looking for the potential of a biotech company, but without the risks of disruptions and bankruptcy usually common in the sector.

Vertex Pharmaceuticals Incorporated (VRTX +3.48%)

Vertex’s Core: Cystic Fibrosis

Cystic Fibrosis Overview

Cystic fibrosis is caused by a genetic anomaly affecting the cells that make mucus. These secretions are abnormally thick, causing obstructions, especially in the lungs and pancreas, as well as chronic infections due to bacteria proliferating in biofilms in the mucus. Untreated, cystic fibrosis causes worsening health conditions and very poor quality of life, ultimately leading to premature deaths.

For a long time, no treatment was available, and death was unavoidable at an early age. Modern treatments, mostly created by Vertex, have improved the situation.

Today, the average life expectancy is between 42 and 50 years in the developed world with a median of 40.7 years. Lung problems are responsible for death in 70% of people with cystic fibrosis.

Vertex’s Cystic Fibrosis Treatments

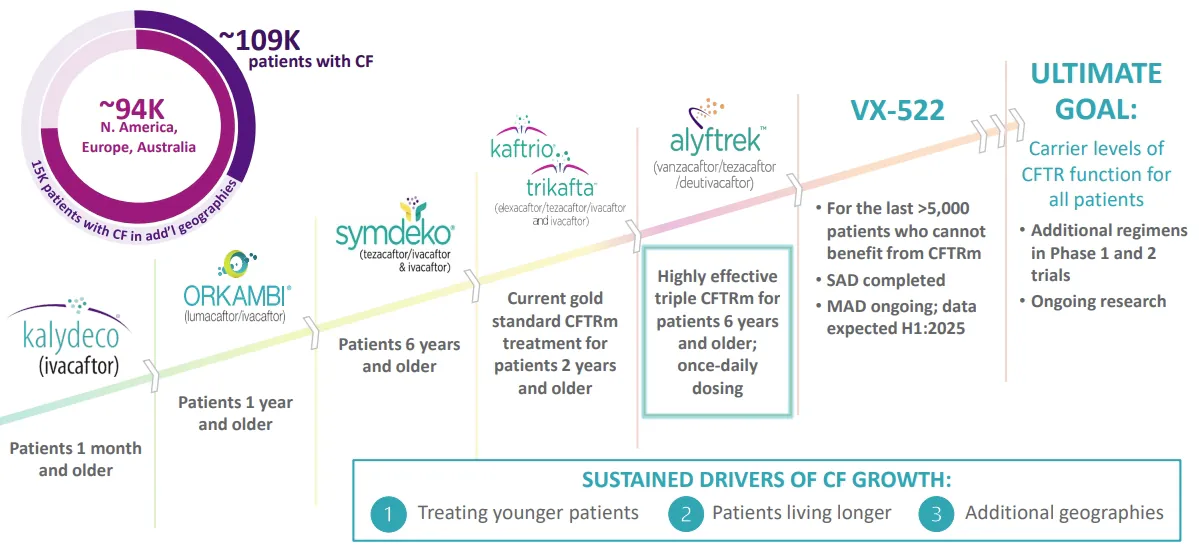

In 2012, the molecule ivacaftor was approved for cystic fibrosis treatment, under the brand name Kalydeco. This was the first drug trying to restore normal mucus production, instead of simply trying to treat the symptoms, like performing mucus removal.

Over time, Vertex Pharmaceuticals developed an array of drugs targeting cystic fibrosis along this principle, looking to target as many of the possible mutations causing the disease as possible.

Source: Vertex

Vertex drugs reach up to more than 75,000 patients or 68% of cystic fibrosis patients.

99% of US patients are broadly reimbursed through private and public insurance and 94% of patients in Western countries.

90% of worldwide patients could benefit from the therapies, with most of the untreated ones living in low-income countries. As a result, Vertex is also part of a donation program coordinated by the charity Direct Relief.

Eligible countries currently included in the donation program as of March 2025 are Egypt, El Salvador, Honduras, India, Ivory Coast, Kenya, Lebanon, Nepal, Pakistan, Sri Lanka, Tanzania, Tunisia, Uganda and Ukraine.

For now, cystic fibrosis is the core of Vertex’s revenues, which have grown solidly in the past years as more and more patients are getting treated and moving to more efficient bi- or tri-therapies.

Source: Vertex

What’s Next for Cystic Fibrosis: Vertex’s Latest Innovations

The latest version is the brand name Alyftrek, a tri-therapy using 3 different drugs at once, allowing for only once-per-day dosing and more effective than previous versions. It contains vanzacaftor, a drug able to help patients with mutations that were previously unaffected by other cystic fibrosis drugs.

Alyftrek will potentially receive regulatory approval in most non-US Western countries in 2025.

However, the endpoint of cystic fibrosis therapies would be an actual cure. For this just drugs trying to reactivate defective mucus cells is likely not enough.

This is why Vertex is also developing a gene therapy for cystic fibrosis using mRNA technology, the VX-522 program.

Unfortunately, this program is currently paused, after the announcement in May 2025 of “tolerability issues”, likely meaning the treatment had too many negative side effects.

So for now, the nebulized mRNA-lipid nanoparticle (LNP) therapy, developed in a partnership with Moderna that began in 2020, might not be the miracle cure Vertex hoped.

This is however likely the way forward, with new types of lipid nanoparticle for gene editing of lung cells the type of missing technology that might make it ultimately possible.

Beyond Cystic Fibrosis: Vertex’s Expanding Pipeline

Vertex’s Role in CRISPR and Gene Editing Therapies

Vertex was a key partner of CRISPR Therapeutics (CRSP -2.59%) in the development of the first-ever approved CRISPR gene therapy.

Commercialized under the brand of Casgevy, this therapy treats hemophilia and sickle cell disease. Vertex owns the exclusive right to the commercialization and manufacturing of Casgevy, and will pay a royalty to CRISPR Therapeutics for every dose sold.

Source: Vertex

At $2.2M per patient, this could prove a highly lucrative program, with the hefty price tag in part granted as a reward by regulators for the very innovative approach taken by these companies.

(You can find here a full report on CRISPR Therapeutics)

New Therapeutic Targets: Kidney, Liver, Muscle, and More

Vertex started its success story on the rare disease of cystic fibrosis and is now expanding in multiple new genetic and/or rare diseases besides blood genetic diseases.

Source: Vertex

Vertex is notably developing a new specialty in renal (kidney) diseases, with multiple parallel programs for kidney failures linked to genetic and autoimmune diseases.

Source: Vertex

Other organs targeted are the liver & lung (AATD) and muscles (muscular dystrophies). A small molecule with potential for Huntington’s disease is also under investigation and at the pre-clinical trial stage.

A New Era in Pain Relief: Vertex’s JOURNAVX Therapy

Pain medication is a massive market, with opioids being prescribed to no less than 40 million patients annually. This solution is however also a problem, as opioids are addictive, with 85,000+ patients in acute pain developing addiction (opioid use disorder) every year, and 10% having prolonged opioid use.

Such a level of addiction is immensely costly for society at large, estimated to represent a cost of $180B annually in the USA alone.

Vertex thinks it can help with a new drug, suzetrigine, approved in 2025 and commercialized under the brand JOURNAVX.

JOURNAVX is already available in 33,000 pharmacies and has been prescribed 20,000 times by April 18th, 2025.

How quickly JOURNAVX can take over the pain medication market currently dominated by opioids is yet to be seen.

The high price point of $15.50 per pill might hinder its use at first, although the absence of addiction risk might be worth the price from an insurance and public policy point of view. In any case, this should be an additional very stable revenue stream, with some analysts considering that it could bring as much as $1B annually.

In addition, JOURNAVX could one day be prescribed for chronic pain (Peripheral Neuropathic Pain – PNP) caused by damage to the nervous system, a problem affecting 11 million patients.

Source: Vertex

Stem Cell Therapy for Type-1 Diabetes: Vertex’s Approach

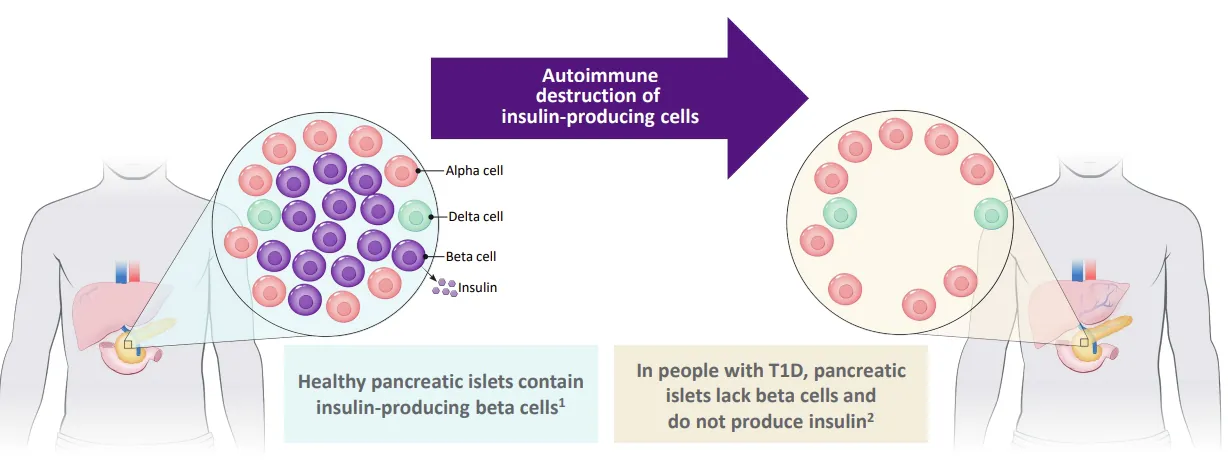

Vertex has for a long time worked on possible type-1 diabetes cure, looking to restore the function of the pancreatic cells destroyed by the body’s immune system in this disease.

Source: Vertex

One path is using zimislecel, a human stem cell-derived islet cell therapy currently in phase III of clinical trials (the last stage), and due to complete dosing in 2025.

Zimislecel is administered along with immunosuppressants to help the cells graft and not be destroyed by the immune system of the patient.

This program is likely going quite well (see here the latest presentation by Vertex on the topic), as the company is already building up capacity for commercialization, ahead of regulatory approval by the FDA.

“We are very pleased with the rapid progress of our zimislecel program, which is on track to complete enrollment and dosing in the phase 3 study this summer, positioning us for global regulatory submissions in 2026.

Consistent with this progress, Vertex is investing in expanding its manufacturing and commercial capabilities to ensure launch readiness.”

With 3.8 million patients in the USA and Europe, the initial 60,000 zimislecel expected first batch of treatment is but a small portion of the overall market.

These 60K patients have the highest unmet need and experience severe hypoglycemic events (SHEs), a serious and potentially life-threatening complication of insulin therapy that can cause seizures, cardiac arrhythmia, coma, and even death.

Strategic Shifts and Setbacks: Vertex’s 2025 Roadmap

Why Vertex Halted Its Diabetes Device Program

Not all is perfect for the prospect of the diabetes treatment program at Vertex, as another promising idea, VX-264, has recently been abandoned. The idea was to use a medical device to shelter the zimislecel-like implant producing insulin from the immune system, but letting insulin and sugar go through the barrier.

“C-peptide increases were not observed at levels necessary to deliver benefit.

While the treatment was safe and well tolerated, the lack of biomarker improvement means that Vertex will not be advancing [VX-264] further in clinical trials.”

This will be a disappointment for Vertex and long-term investors, as the company had great hope to create a perfect diabetes cure with this method. It also successively bought the smaller biotech companies Semma Therapeutics in 2019, and ViaCyte in 2022 to acquire their insulin devices, respectively for $950M and $320M.

Discontinued: Vertex’s AAV Gene Therapy Program

Another field Vertex is giving up on is AAV gene therapy, using Adeno-Associated Viruses vectors for gene transfer.

It does not mean the company is giving up on the field and declared that its “commitment to cell and genetic therapies remains strong.”, even if it also pulled out of an in vivo gene editing collaboration with Verve Therapeutics in February 2025.

Overall, such a string of abandoned programs in early 2025, with many of them ongoing for years prior, likely indicates a re-focus of the company and a reevaluation of some key technologies like insulin devices and AAV that have failed to prove sufficient efficiency to move forward.

A question still in suspense is if the VX-522 program, the mRNA program to cure cystic fibrosis, will soon join the canceled program, or if an improved version that is better tolerated will be tested in the future.

Overall, while disappointing, these cancellations should also be understood as Vertex capital discipline, with an attention to avoid pouring more money into dead ends, and instead canceling R&D programs early enough to cut losses.

Source: Vertex

Alpine Immune Sciences Acquisition

In April 2024, Vertex acquired Alpine Immune Sciences for $4.9B. The company specializes in autoimmune and inflammatory diseases, as well as cancer.

This notably gave Vertex access to povetacicept, which now became an important part of Vertex’s program for kidney diseases targeting IgAN (IgA Nephropathy).

There are no approved therapies that target the underlying cause of IgAN, which to end-stage renal disease.

IgAN is the most common cause of primary (idiopathic) glomerulonephritis worldwide, affecting approximately 130,000 people in the U.S., another 270,000 in Europe, and 750,000 in China.

“We look forward to welcoming the talented Alpine team to Vertex and believe that together we can bring povetacicept, a potential best-in-class treatment for IgAN to patients faster.”

M.D. Reshma Kewalramani – Chief Executive Officer and President of Vertex

Povetacicept could also find more applications beyond renal failure toward many other autoimmune diseases, and the technical abilities of Alpine could prove important for Vertex’s future.

We also look forward to fully exploring povetacicept’s potential as a ‘pipeline-in-a-product’ and adding Alpine’s protein engineering and immunotherapy capabilities to Vertex’s toolbox.”

M.D. Reshma Kewalramani – Chief Executive Officer and President of Vertex

Revenue, R&D, and Growth: A Look at Vertex’s Financials

Vertex financials are showing growing cash flow, only slowed down by increasing spendings in the finalization of research programs.

Source: Vertex

The company reinvests a lot of its revenues in R&D (26%), with 3 out of 5 employees working in research and development, representing $3.6B in R&D operating cost, out of a total of $5.1B operating expenses in 2024.

Almost all of these revenues are coming exclusively from TRIKAFTA/KAFTRIO, the company’s cystic fibrosis drug.

So the result of the non-addictive pain medicine, blood disease gene therapies, as well as potential diabetes treatment are not showing in the revenues yet, nor is the tri-therapy for cystic fibrosis Alyftrek.

So overall, steady growth of revenues is to be expected in the upcoming years, helping justify Vertex’s relatively high valuation, up x2 since 2021.

Final Thoughts: Is Vertex Still a Top Biotech Investment?

Vertex Pharmaceuticals is a stable and profitable company thanks to its extremely solid leadership in cystic fibrosis, having single-handedly helped make the disease more survivable and increasing the patients’ quality of life.

It is now looking to replicate this success with major public health issues, like type-1 diabetes (3-4 million people in Western countries) and opioid use and addiction risks (an 80 million people market annually). It should also greatly benefit from the deployment at scale of Casgevy, the first ever approved CRISPR gene therapy.

Further programs in kidney and genetic diseases should help bring extra growth to the R&D portfolio.

The company is not always betting on the right strategy, an impossible task in a field as uncertain as biotechnology, as illustrated by several canceled projects having consumed several billions of dollars in R&D and acquisition costs.

However, Vertex is also able to correct course, and control this risk, with the recent major strategic shift in early 2025.

So investors in Vertex can find the safety from stable income streams (cystic fibrosis) mixed with the growth potential of therapies that could change the lives of tens of millions of severely ill patients currently suffering from poor medical options.