Energy

Update on SMRs (Small Modular Reactor) – Still The Future of Nuclear Power

Nuclear Dreams and Fears

Nuclear energy is a controversial topic.

Firstly, for rational reasons, because of its safety aspect, with the catastrophe of Chernobyl or Fukushima a reminder of what can happen when it fails.

Secondly, for the less rational association with nuclear weapons, as well as a fear of any radiation, often driven by popular pop culture and science fiction.

It has also been seen as a competitor to “true” renewable energies like wind and solar, and a poor alternative to them.

It is nevertheless a very powerful source of energy, in fact, it is the densest available to human civilization with 1 small pellet of uranium able to replace hundreds of liters of oil, a ton of coal, or 17,000 cubic feet of gas.

Source: Energy.gov

It is also a very low-carbon energy source, making some climate activists reconsider their outlook on nuclear. This is especially true as nuclear is able to provide power baseload irrelevant of weather conditions or time of the day, something renewables are only able to do with massive battery parks.

The New Nuclear

Recently, a new breed of nuclear advocates and engineers has emerged, one ready to criticize the path taken by the industry so far. Their complaints about nuclear power as it stands today are two-fold: size and fuel.

Small Is Beautiful?

Nuclear power plants tend to be massive projects. Output is in the gigawatts, investments required in the tens of billions, and construction time in years if not decades. This causes a few problems:

- Difficulty to find money out of government funding, due to the massive time lag between the start of the project and the date of first power production.

- It is not a good match for small countries or remote areas, and requires to some extent the entire power grid to be adapted to the nuclear power plant.

- When something goes wrong, instead of a localized incident, it can become a continent-wide disaster.

- Each massive project is a custom experimental design, blocking the industry from developing any sort of standardization in its production process.

This last point is especially standing out after the failure of large centralized power plants in the last few decades which had the effect of effectively freezing the industry. It even caused its total (and probably permanent) destruction in countries like Germany.

The larger a power plant, the more energy output in just one place there is. This makes the cooling of the reactor extra difficult and extra dangerous if something goes wrong.

So the attention is now turning to small reactors called SMR (Small Modular Reactors). They would be produced in series, like ships or machinery, and trucked to their power plant site. The modular part comes from the fact that an SMR-based nuclear power plant would incorporate 4-20 “modular” power generators, each identical to each other.

There is even a trend of developing micro-reactors for niche applications like industrial heat, military bases, remote communities, or even moon bases.

Source: IAEA

The Wrong Designs & Fuel?

Designs

Another discussion is the design of the plants themselves. Some specialists argue that the water-cooled designs are inherently less safe, as they require a constant stream of water, dependent on a complex system of pumps and piping, exactly what failed in the Fukushima incident.

Different cooling designs are being developed, with a target on passive safety, ensuring that a reactor cools down without any exterior intervention if something goes wrong.

Fuel Choice

Others criticize the focus on uranium as a fuel. For fundamental physics reasons, this fuel was preferred to alternatives because the energy produced with uranium creates plutonium. And plutonium is a key component of nuclear weapons.

In the 1950-1980, when most of the nuclear industry was born, this was seen as a quality. This was after the Cold War, and the need for nuclear weapons materials was considered by many nations as a requirement for their own safety. This is something a lot less accepted by public opinion today, especially with the threat of nuclear proliferation and terrorism.

In addition, uranium is fundamentally a riskier fuel, with more risks of out-of-control chain reactions. So many nuclear enthusiasts and startups are now advocating for exploring thorium reactors instead.

A Hiccup In Innovation

If you had asked any specialists even just 1-2 years ago, most would have said that they felt like SMRs would be the future of the nuclear industry.

“With SMRs, we have opened up a whole spectrum of customers.”

But with the recent cancellation of Nuscale's Carbon Free Power Project, this raised the question if SMRs can be cost-competitive with renewables and conventional nuclear. Or nuclear as a whole, considering the tens of billions of dollars in cost overrun of the most recently opened “traditional” nuclear power plants in Finland and the USA.

This growth in cost could be concerning if it was not an identical situation for the entire energy industry, including renewables.

It is something we investigated in deeper detail in our article “The 2023 Renewable Energy Crash“. To resume shortly, wind turbine and solar panel manufacturers, as well as nuclear power plant builders, have suffered from a conjunction of problems:

- Growing costs of commodities like metal, concrete, and energy, all are required for industrial projects.

- General inflation, which raises the cost of skilled labor.

- Supply chain disruptions, due to the pandemic, troubles in international trade lanes, and trade war and sanctions of the West versus Russia & China.

- Rising interest rates, increasing strongly costs on capital-intensive projects like power generation.

All of these phenomena hurt the ability of energy producers, ALL energy producers, to provide plants at a cost as cheap as previously planned. But except if we plan to not use energy from now on, this is something that will need to be re-priced.

Fossil fuel, renewables, or nuclear, all will cost the most in a high-inflation, high-rate economic environment. So markets' reaction to “pick” renewables and SMR for increasing costs in this context is not really rational.

Just Getting Started

Concerns about cancellation of pilot plants are also likely to be missing the point. The Carbon Free Power Project was by definition a pilot project.

SMRs' cost reductions compared to other nuclear projects are expected to come from 2 sources:

- Amortization of R&D costs over tens and hundreds of identical power plants.

- Steady workflow of the assembly line, allowing for optimization and economy of scale.

So it is likely that any SMR will be somewhat expensive for its first 5 or even 10 power plants. Only once it gets at full speed will the economic benefits form the design manifest. It is the same way that a prototype car will cost more per unit than a well-established and mass-produced model.

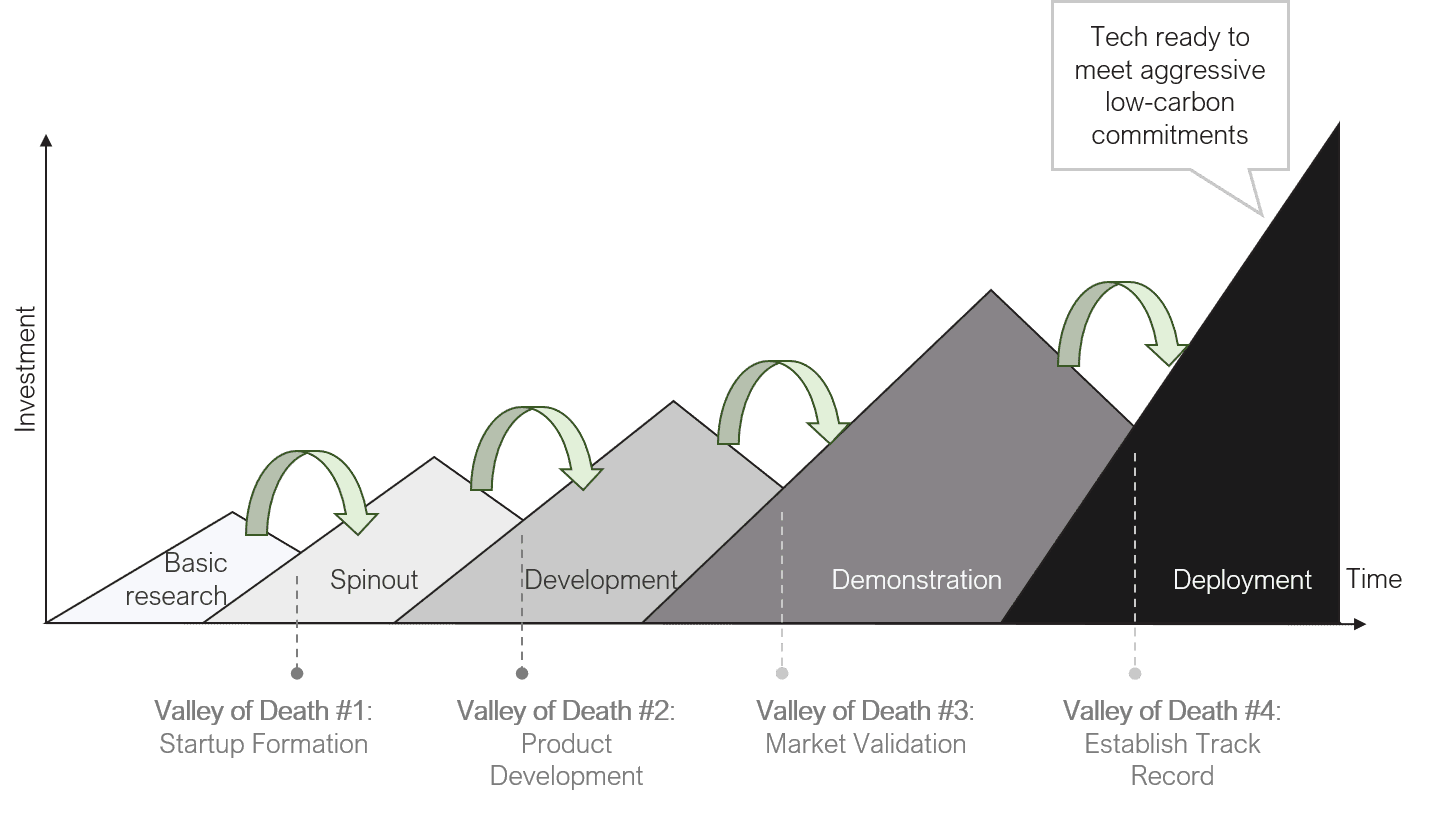

This is also a well-known phenomenon in innovative industries, called the “Valleys of Death”. Between each stage, there is a peak of enthusiasm, followed by a peak of pessimism. Long-term focused investors and public investment carry innovative industries through these negative periods and nurture long-term progress.

Source: ThirdDerivative.org

And even if Nuscale's specific design proves to be too costly, this says a little about molten salt, thorium, HALEU fuels, or nuclear power barges (see more below).

Overall, it seems that the industry has started innovating again, most likely spurred by the energy crisis triggered by the war in Ukraine. With tensions rising in the Middle East, a repeat of the 1970s energy crisis is not unlikely and would replicate its effect on the nuclear industry, making countries like France generate 70% of their electricity with nuclear power.

A Selection Of SMR Innovators

This article is looking at some of the SMR innovating designs, a complete list can be found on the website of the World Nuclear Association.

NuScale Power Corporation (SMR)

NuScale Power Corporation (SMR +1.9%)

NuScale Power Corporation (SMR +1.9%)

NuScale is a leader in a new type of nuclear reactor design called Small Modular Reactors (SMRs).

NuScale's main design can be transported by trucks and will produce 77 MWe per module, with up to 12 modules per finished power plant for almost 1GW of nominal power.

Source: Nuscale

This design is small enough to be implemented on the site of a decommissioned coal power plant, allowing it to reuse all the security and grid infrastructure already built. NuScale was also the first SMR to be certified by the US Nuclear Regulatory Commission (NRC).

The company has already secured contracts in Romania. It is also looking at 15+ other potential clients committed to deploying SMRs and 120+ potential customers. On top of this come industrial clients like steel mills looking to decarbonize their operations and secure cheap, reliable power sources.

It is however at the center of interrogations about the economic viability of SMRs, after its Carbon Free Power Project with the Utah Associated Municipal Power Systems (UAMPS) got canceled due to cost increases. The company stock price has declined severely on the news, even if it rebounded somewhat since.

General Electric (GE) / Hitachi (HTHIY)

General Electric Company (GE +0.87%)

General Electric Company (GE +0.87%)

GE, in collaboration with Hitachi, is developing the BWRX-300 small modular reactor. It capitalizes on the two companies' experience in nuclear energy to create this 300 MW reactor.

Source: GE

GE has been selected for pilot SMR projects in Canada by Ontario Power Generation and by SaskPower in Saskatchewan.

In the US, it has an agreement with the Tennessee Valley Authority and is in discussion with several other utility companies.

Globally, it has been selected for a fleet of 79 SMRs in Poland, to be deployed by the company Orlen by 2038. It has also been selected in Estonia, Chech Republic, and Sweden, and is in discussion in the UK and the rest of the world for further sales.

The success of GE/Hitachi in promoting the BWRX-300 is impressive and might be the best international success in the SMR industry. It is likely that the popularity of the design is not solely based on its engineering, but the reputation of its parent companies, their influence network, as well as the certitude of available financial backing, compared to small startups.

Rolls-Royce Holdings plc (RYCEY)

Rolls-Royce is not only a manufacturer of luxury cars, but also a leader in aeronautics (notably jet engines) and advanced engineering technology.

The company is looking to become the British leader in SMR technology. Its design provides 470 MW per module.

Source: Rolls Royce

Rolls Royce is discussing the deployment of its SMRs in the Netherlands. It is also in discussions in Sweden and Finland, as well as the Czech Republic (including with car manufacturer Skoda), and Poland.

Rolls-Royce seems mostly focused on the European markets and industrial applications, probably a smart choice considering the ongoing energy crisis experienced by the continent. A crisis that might get worse with the potential closing of the Suez Canal for energy imports, something we discussed in our article “Fossil Fuel Supplies Troubles – Looming Shipping And Energy Crisis”.

Westinghouse: Cameco (CCJ) and Brookfield Renewable Partners L.P. (BEP)

Brookfield Renewable Partners L.P. (BEP +2.38%)

Brookfield Renewable Partners L.P. (BEP +2.38%)

Westinghouse Nuclear has been a pioneer in US nuclear energy since the beginning of the industry. It has recently been acquired jointly by uranium miner Cameco (49%) and the massive low-carbon utility BEP (51%), part of the even larger Brookfield investing corporation (BN), with $850B under management.

Westinghouse's AP300 SMR design is a downsized version of its conventional AP1000 reactors. Currently, 4 AP1000 are operating in China, with 6 more under construction in China and 2 in Georgia, USA (Georgia's Vogtle project has also become infamous for delays and cost overruns), as well a project for 3-6 reactors in Poland and 6 in India.

With a power capacity of 990MW, this SMR design is threading the line between conventional and “small” reactors.

Source: Westinghouse

As it is not directly listed, to get a part of Westinghouse investors will have to decide if they are more interested in exposure to the renewable energy activity of BEP, or the uranium mining activity of Cameco.

Nevertheless, Westinghouse is a giant in nuclear energy, with a long history of setting the standard for the industry, notably the pressurized water design that would dominate the nuclear industry for decades.

TerraPower

The privately-listed company is notoriously backed by Bill Gates. While larger corporations and Nuscale are mostly looking to improve the conventional design of nuclear power plants through a change of size and production method, TerraPower is looking to change it radically.

Its key innovation is a molten-salt reactor, which the company is leveraging in a partnership with GE-Hitachi to develop the Natrium reactor, a 345MWe reactor. The technology should be deployed at a retiring coal plant in Wyoming. It is also working on the Molten Chloride Fast Reactor (MCFR) design.

Molten salts act as both the fuel, containing the radioactive elements, and the coolant. This might make it inherently safer, as too high temperatures cause the salts to expand, reducing spontaneously the nuclear reaction, and leading to lower temperatures.

It would also allow for continuous refueling instead of having to shut down the reactor every 18-24 months. It could also accept uranium fuel at various degrees of enrichment, making it more flexible.

As the neutrons are not slowed down like in a conventional nuclear reactor, it should make the reaction a lot more efficient.

Source: Terrapower

Even these radical innovations in a very conservative and cautious industry are not enough for TerraPower. It is developing its “long-term goal” of the Traveling Wave Reactor (TWR®) design, which could operate on non-enriched uranium for centuries, and be 30x more efficient than conventional designs.

The nuclear energy industry, cautious to not repeat the blunder of past reactor meltdowns, is currently extremely skeptical of any radical new designs. This might play both in favor and against TerraPower.

On one hand, their radical and innovative approach might create a unique and much safer design. On the other hand, they might face an uphill battle to convince worried nuclear regulatory authorities to even accept the experimental launch of their nuclear reactors.

Terrestrial Energy

Another molten salt company is Terrestrial Energy, with its Integral Molten Salt Reactor.

The company claims to solve a key issue of molten salt reactor designs that is related to the lifespan of the graphite moderator. By making the reactor core a fully integrated unit, it makes it easily replaceable, with a 7-year lifespan.

This design also benefits from the same advantages as other molten salt reactors, like better safety and higher efficiency thanks to higher temperatures.

Moltex Energy

Moltex is a UK-based company developing a nuclear waste burning reactor, a type of reactor also known as Stable Salt Reactor – Wasteburner (SSR-W) in Point Lepreau in Canada.

The design can change its energy output quickly, making it a perfect match to complement intermittent renewables.

“This advanced nuclear technology has the flexibility of gas-fired power stations, but it generates electricity at a lower cost and without carbon emissions,”

The reactor has no moving parts and cools passively, requiring a lot less supervision than a conventional reactor.

Because Moltex relies on nuclear waste, it never could fully replace the standard or SMR designs. However it can fit a unique niche in managing to produce cheap energy while also reducing nuclear wastes and providing a very reactive and flexible source of low-carbon energy on demand.

Rosatom

The Russian nuclear state company has been a leader in the industry for decades. It was one of the first ones to develop something similar to a small reactor. Currently, it does not seem to be really focused on SMR development, except for seaborne nuclear power.

The already deployed idea is to install on a ship a smaller nuclear power plant similar to the one powering nuclear submarines or aircraft carriers. This floating power plant can then be deployed to areas that need it, in the case of Russia mostly cities and industrial sites on the Arctic Ocean.

This design can also be produced in series at dedicated shipyards already experienced in building nuclear-powered warships.

Source: Power Technology.com

With 80% of the world's population living in coastal regions, this design could become popular. For now, the business model envisioned would be for Rosatom to own and operate the power barge, and sell the electricity, including in foreign countries.

It also offers a certain level of flexibility, with the possibility to move a power plant in areas struck by disasters like a hurricane, or to remote regions with little energy infrastructure.

Seaborg

Rosatom's concept of a nuclear barge / floating power station is not unique to Russia, and considering the geopolitical situation, it is unlikely that the Russian design will be popular in Western countries and their allies for the foreseeable future.

This is where the Danish company Seaborg comes in. The company is developing a compact molten salt reactor that is also a floating power plant of up to 800 MW.

Source: Seaborg

The sea-based design of Seaborg reactors makes it a good fit for coastal nations, with discussions engaged with Indonesia and Norway.

Seaborg is also working with the global leader in shipbuilding Samsung Heavy Industries to develop floating Nuclear Power Plants combined with hydrogen and ammonia plants.

So Seaborg could become an integral part of a nuclear-driven Hydrogen and Ammonia economy, as described in our article “The Other Hydrogen Fuel – Top 5 Green Ammonia Stocks”.

X-Energy

X-Energy's innovation in nuclear power is to use a different type of fuel than the conventional enriched uranium, the TRISO-X fuel.

The TRISO-X fuel uses “High Assay Low Enriched Uranium” (HALEU), allowing for longer periods of operation, which should reduce costs. Its design also should incorporate into the fuel itself the containment system, increasing drastically its safety profile.

Its Xe-100 reactor is a High-Temperature Gas-cooled Reactors (HTGR), an 80 MWe design considered as part of the 4th generation of nuclear power plants. Such reactors claim a 400m Safety Perimeter (versus 10 miles for conventional designs).

X-Energy designs might have technical advantages, but might also be vulnerable to geopolitical issues. HALEU fuel is mostly supplied to the US by Russia's Rosatom, and this might be in jeopardy due to the war in Ukraine. Alternative supplies from the US's Centrus or France's Orano might take up to 5-10 years to develop, putting at risk the company's supply of nuclear fuel.

The company announced in October 2023 that it terminated its agreement with SPAC Ares Acquisition Corporation for X-Energy to become publicly listed.

China

For a long time an importer of nuclear technology from Russia and the West, China is quickly becoming a leading innovator in the industry.

The country is host to 55 active nuclear power plants, has 22 under construction and 70 others planned. In total, it announced in 2021 its ambition to build 150 new power plants. It also achieved the world’s first commercial production for a 4th generation nuclear power plant in December 2023.

Besides conventional large power plants, Chinese firms are also developing an air-cooled thorium reactor that would be a great fit for arid areas without enough water for traditional pressurized water designs.

There is also the development of a thorium compact molten-salt design to power container ships without any carbon emissions or need for refueling. This could make a reality the dream of commercial nuclear ships first envisioned in the “atom for Peace” program in the 1960s, the US Savannah. Maybe symbolically, the US Savannah was announced for decommissioning in January 2023

US Savannah – Source: ANS

Copenhagen Atomics

The Danish company is looking to build a thorium-powered molten salt reactor fitting into standardized 40-feet containers.

The company claims the possibility of its reactor being commercially available for $100,000 or for lease while delivering 100 MW of thermal power, with a temperature of 560°C. The first demo product is expected in 2025.

Source: Copenhagen Atomics

By 2028, the company also expects to have built its first waste burner. It will be able to take radioactive wastes that would last 100,000 years and turn the wastes' dangerous period into just 300 years while producing power.

With a focus on all the most advanced nuclear innovations at once (thorium, molten salts, waste burner, container-size reactor), Copenhagen Atomics is probably one of the most ambitious startups in the nuclear industry. So a lot of its future success or failure will likely depend on how quickly the regulatory framework can change to welcome radically new nuclear designs, more than just the technical achievements of the company.