The Best Of...

Top 10 Liquid Staking Platforms You Need to Know

Securities.io is committed to rigorous editorial standards. We may receive compensation when you click on links to products we review. Please view our affiliate disclosure. Trading involves risk which may result in the loss of capital.

Learning the top 10 Liquid Staking platforms in operation today is a smart way to improve your low-risk passive income strategy. The DeFi (Decentralized Finance) sector continues to expand thanks to innovative concepts such as Liquid staking, and more platforms offer these services to the public than ever. This demand has led to some confusion when determining your best options.

What is Liquid Staking?

Liquid staking refers to the act of staking your assets in a smart contract in exchange for a receipt token representing its liquidity. Liquid staking protocols enable stakers to access the liquidity of their staked assets without un-staking the original asset. This approach improves liquidity, capital efficiency, and innovation.

This structure is more conducive to market growth than the original staking structure because the staker can still participate in additional DeFi features. Liquid tokens can be traded, used as collateral, staked, farmed, and even restaked. All of these added options have helped drive adoption.

However, you should be aware that not all liquid staking platforms operate in the same manner or with the same level of integrity. As such, it's wise to stick to reputable platforms with experience in the sector. Here are the top 10 liquid staking platforms you need to know (in no particular order).

1. Lido Finance

Lido Finance is an easy-to-use liquid staking option that continues to gain in popularity. The network offers liquid staking support for ETH, MATIC, and SOL. Depositors receive stETH, stMATIC, and stSOL tokens representing their staked liquidity value.

Source – Lido Finance – Liquid Staking Platforms

Lido Finance has some key features that make it stand out. For one, there's no minimum staking amount. This structure means that anyone can use these services to begin earning passive returns today. Additionally, the platform offers a daily payout feature, adding to its overall convenience.

Stakers on Lido Finance need to lock their tokens up to qualify for rewards. During that time, they can use their synthetic derivatives to secure additional returns across DeFi options. Notably, the network charges a 10% staking fee to users, which is higher than some of the competitors on this list. However, there is a toolkit to help optimize your efforts.

Another major reason why Lido Finance has seen great success is its security protocols. The network is open source and has been vetted by the community and auditing firms. Additionally, the network integrates various other enterprise-grade security measures, including 256-bit SSL Encryption to keep you safe. According to company documentation, users can secure rewards on par with operating a validator node on the respective network.

2. Coinbase Prime

Coinbase Prime is another top contender in the liquid staking sector. Coinbase has taken a strategic approach to the market and focused its efforts on enterprise and institutional-level staking. As such, its features require strict KYC/AML compliance.

Coinbase Prime partnered with Liquid Collective as part of its liquid staking strategy. This partnership enabled North America's largest exchange to save time on developing and securing their liquid staking options. Today, Coinbase operates a successful liquid staking protocol under the highest security standards in the region.

As part of this strategy, the exchange leverages multiple validator service providers that integrate multi-cloud and regional operations to improve reliability and cut down time. These strategic liquid staking partners include Figment and Staked. The results are a simplistic and highly secure staking alternative.

You can stake on Coinbase Prime for as little as $1, with reward payouts available daily or quarterly. Additionally, the staking process enables you to start securing rewards immediately after depositing assets. The downside to Coinbase Prime is that the network has a 15% staking fee and doesn't have a large selection of tokens to stake.

Those interested in staking ETH2.0 will need to start with a 0.1 ETH stake. They receive LsETH as a digital receipt and liquidity token. Unlike competitors, Coinbase stakers enjoy validator service provider coverage against slashing incidents through Nexus Mutual's slashing coverage policy.

3. Rocket Pool

Rocket Pool remains one of the largest and most successful liquid staking platforms in operation today. The network offers ETH 2.0 liquid staking features via a decentralized community-centric approach. As such, Rocket Pool stakers gain the added advantage of access to the network’s DAO (Decentralized Autonomous Organization).

Rocket Pool has one of the most vocal communities and remains prevalent on social media channels. The main advantages of the network are its customizable staking pools. These unique smart contracts empower businesses to create pools to drive value.

Rocket Pool is easy to use, and its large community has helped it become one of the most recognizable options on this list. Users receive RPL tokens after the deposit into the Rocket Pool liquidity smart contract. These tokens can be traded, used in other DeFi and LSDfi (Liquid Stacking Derivatives) options, and provide access to the network's DAO.

Notably, Rocket Pool has some of the highest fees on this list and has been known to charge fees around 15-20%. Additionally, the standard lockup on your assets is 3-12 months. Despite these factors, the intuitive interface and proven reliability make Rocket Pool a strong contender you should explore.

4. Frax ETH

Frax Finance is a multipurpose DeFi ecosystem that provides a variety of advanced services to users. The network’s liquid staking protocol, Frax Ether, enables users to leverage these services while still securing staking rewards on the same platform. Depositors receive frETH & sfrxETH as tokenized representations of their staked assets.

Frax Finance is a decentralized community-led project that includes an active DAO that enables stakers to vote on upgrades and alterations. The network has an advanced interface that is appealing to experienced users. Additionally, the network offers other stable assets, making it a dynamic solution for many scenarios.

Frax ETH stakers can leverage the network AMM, lending protocols, and more to improve returns. The platform is open source and has been vetted by the Ethereum community which adds to its security. Additionally, the network integrates a proprietary bridge system called Frax Ferry to facilitate cross-chain transactions.

Frax ETH is a smart option for experienced stakers. However, since the network incorporates self-hosted stablecoins, there is a higher risk of some regulatory concerns rising in the future. As such, Frax Finance is best suited for individual users rather than large institutional stakers.

5. Jito Network

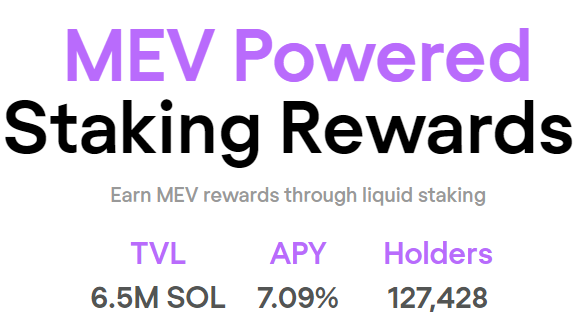

The Jito Network is currently the largest liquid staking platform in the Solana ecosystem. This unique protocol empowers stakers to secure more rewards by integrating Miner Extractable Value (MEV) into their payouts. MEVs are strategies that miners use to drive their rewards higher.

Source – Jito Homepage – Top Liquid Staking Platforms

These actions can include watching transaction pools to see what could affect the price of assets, arbitrage trading, transaction reordering, and much more. In the past, many network users saw MEVs as a problem. However, they are a core component of the market. As such, Jito changed the game by integrating these rewards into their liquid staking rewards.

Jito operates as an open-source liquid staking solution. The network offers high yields and the ability to leverage the same capital across multiple features. Solana stakers receive JitSOL, representing their stake and rewards. These tokens are interoperable within the entire Solana network.

6. Binance

The world's largest exchange by volume also makes the list of best liquid staking options. The network managed to leverage its huge customer base to support highly active liquid staking pools that anyone can leverage. Notably, Binance remains a pioneering force in the LSDfi sector.

Binance first began its Liquid staking features in 2022 after making a strategic investment into the pSTAKE protocol. This partnership enables ETH holders to start depositing into liquid pools on the network. In exchange, they receive WBETH tokens that can be used on the platform's many other services.

Binance continues to invest heavily in liquid staking. The group recently invested $10M into the Helio Protocol to expand its efforts into the market. All of these maneuvers point towards the network's continued desire to remain competitive in nearly all aspects of the blockchain industry.

The advantages of using Binance to liquid stake are familiarity with the network's interface, high liquidity, and proven security. On the downside, the fees will be higher than those of many other liquid staking pool providers.

7. Marinade Finance

Marinade Finance is another Solana liquid staking protocol that is worth checking out. The network offers some flexible features that make it interesting. For example, there are no maturity dates when staking on Marinade Finance. The lack of staking periods means that you can access your tokens if needed without delay.

Additionally, Marinade Finance has some of the lowest staking fees available. The network currently charges around 6% to users. Another major draw is the ability to restake mSOL tokens and achieve even higher returns. In some instances, these returns can go as high as 20% on mSOL tokens.

Marinade Finance is a popular option for Solana users. Another reason why traders like Marinade Finance is the compounding returns feature. This option lets you decide to add your staking rewards continuously to your original stake to improve future returns.

Notably, Marinade Finance is community-driven. All upgrades get approved by votes, and users can put forth their recommendations for users to review. This structure means that Marinade Finance is an effective liquid staking solution all Solana users should know.

8. ANKR

Stakers who want flexibility should check out ANKR. This reliable and established staking option supports some of the biggest networks in operation today. ANKR stakers can select between Ethereum, Avalanche, Binance Smart Chain, Fantom, Gnosis, Polkadot, and Kusama pools.

Some of the main draws for this network include maximum asset flexibility and no minimum staking requirements. Notably, each pool has specific payouts, APYs, and usable assets. These pools can range in payouts from 3-14% APYs currently.

Also, each pool has a separate fee structure varying from 2 – 10% on average, depending on the assets. Notably, ANKR is one of the oldest and most successful liquid staking protocols in operations today. Consequently, it works with some of the biggest names in the market and has earned a reputation as one of the best options for community stakers.

9. Stader Labs

Stader Labs is another multi-chain liquid staking platform that has users excited. Users can stake their tokens and receive Stader Labs liquidity tokens that can be used in +40 different DeFi solutions. This strategy improves ROIs significantly.

Stader Labs has one of the highest security standards on this list. The network has received multiple audits and certifications. CertiK, Peckshield, and Halborn have all looked into the network's features and stability.

Liquid stakers on Stader Labs enjoy more flexibility but at the cost of slightly higher fees than some other options on this list. However, these fees are offset by the integrated DeFi protocols that enable you to leverage your liquid tokens seamlessly to generate more rewards.

10. StakeWise

StakeWise is an open-source ETH staking solution that provides a combination of slashing rewards protections to improve your results and lower penalties. The network doesn’t have minimum staking requirements. However, it charges a 10% fee to stakers that lock up less than 32 ETH. This fee can be reduced to $10 if you stake 32 ETH.

StakeWise eliminates technical requirements for staking which makes liquid staking a viable option for all users. Additionally, the platform operates on a banking-grade cloud infrastructure. This approach includes a unique upgrading procedure that eliminates network downtime. These features ensure that the validator is never penalized and your rewards remain stable.

You decide to stake privately or within a pool. Pool staking options are more affordable as they combine a variety of users to achieve the minimum to operate a validator node. Another major draw for StakeWise is its easy-to-navigate interface that provides real-time monitoring capability without needing technical skills.

Liquid Staking is the Next Big Move

The concept of Liquid Staking isn't new, but it appears that the market has finally become aware of its many benefits. As such, there is now more demand for these features than ever. This demand directly correlates to more platforms offering these services. Stick to the platforms listed here, and you can limit risk exposure while securing passive rewards.

You can learn more about exciting blockchain projects here.