Terra News

Terra (LUNA) Price Up 4.50% On the Day, Targeting $60 As Next Key Level

Published

3 years agoon

By

Sam GrantSecurities.io maintains rigorous editorial standards and may receive compensation from reviewed links. We are not a registered investment adviser and this is not investment advice. Please view our affiliate disclosure.

Table Of Contents

Cryptocurrencies have been trading in the green for the better part of the last three days, with the majority posting considerable gains. Terra's native coin LUNA embarked on an ascent run ahead of the weekend, clearing the $55 resistance level on Saturday.

LUNA's attempt to climb over $60 on the same day, however, faced immediate rejection towards $54. The crypto token mounted another challenge before the end of the weekend but was still unsuccessful. LUNA is, as of publishing, trading at $57.31, 44% below its December high.

Elsewhere, Coin Bureau's host, Guy, recently shared his opinion on where the price of LUNA and the UST stablecoin is headed this year. More on this forecast and LUNA's market performance below:

Terra's LUNA could gain 2x to 3x in value, Coin Bureau host predicts

Last Tuesday, Guy, the host of crypto commentary show Coin Bureau, shared a YouTube video in which he set forth his prediction for Terra's LUNA. Guy explained that the crypto asset is poised to gain massively despite current market instability.

He revealed that LUNA/USD could shoot up as much as three times its current value, pointing to the increasing popularity of Terra's algorithmic stablecoin UST as a factor that would spur the hike. Guy told his more than 1.9 million subscribers that LUNA usually prevails in a bearish market, and the increasing demand for UST could do it one better.

LUNA works as a price stability mechanism for UST via the mechanics of supply and demand, which helps maintain the stablecoin's peg at $1. To some degree, LUNA's price is driven by the demand on UST. Basing his prediction on this correlation, Guy noted that a surge in demand for UST could lead to an upturn in the price of the crypto asset.

UST's demand is on the rise – Here's why

One of the reasons the pseudonymous host pointed at as a cause for this spike is TerraUSD's “safe-haven status.” Guy highlighted UST's ability to hold its peg even in an adverse market, qualifying as a better stablecoin over other alternatives.

He additionally pointed to Terra's decentralized savings and yield protocol, Anchor, as another demand driver. With a total value locked of $8.04 billion (excluding borrowed TVL), Anchor is the most popular DeFi project on the Terra chain. The lending protocol accounts for roughly 54 of Terra's DeFi ecosystem.

Terra has established itself as a growing hub for decentralized applications, given that the number of apps on the network has grown exponentially over the last year alone – from a single dApp to currently over 100.

Existent regulatory concern over the role of centralized stablecoins further places UST at an advantage as it is a decentralized stablecoin. Since September, financial watchdogs in the US have indicated increasing disapproval of the said stablecoins, likening them to poker chips. In excess of 10 billion UST have been minted since then, reflecting surging interest.

Guy also referenced Circle and Tether to explain that centralized stablecoin firms can freeze user funds at any time. Tether recently froze holdings in three Ethereum addresses that totaled up to about $160 million worth of USDT.

With all these factors in play, Guy concluded that the only thing holding LUNA back at the moment is its large market cap, but UST's repute and availability could rally a double or triple price surge on the token.

Terra (LUNA) Price Action

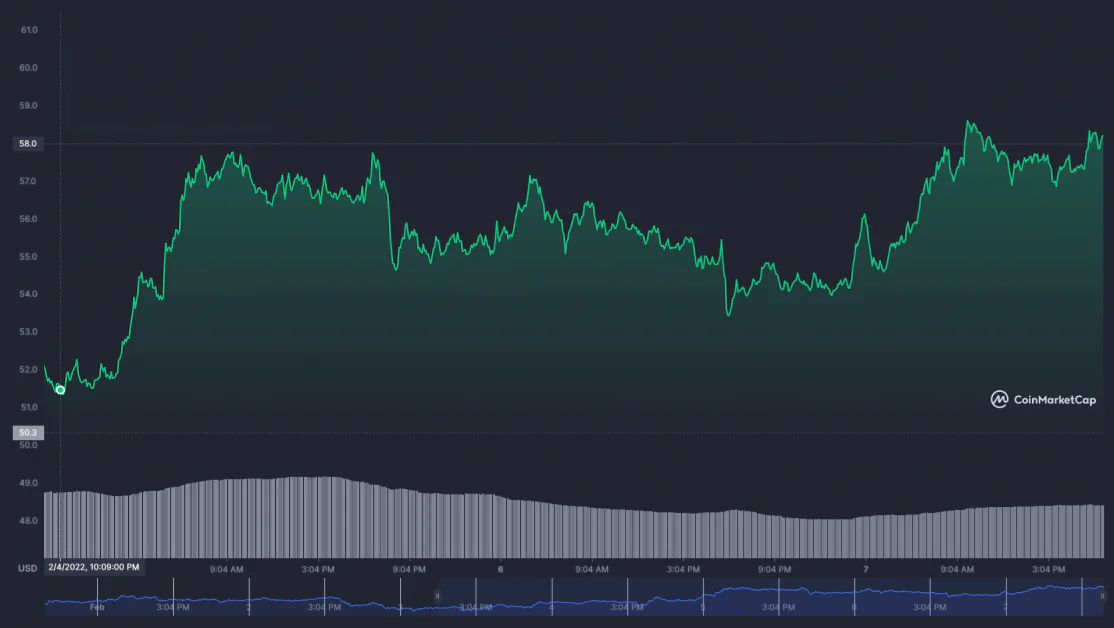

Charts show LUNA/USD has seen 4.50% gains in the last 24 hours. This collectively brings the 7-day gains figure to 21% as per data from CoinMarketCap. LUNA's price spike has seen the market capital swell to $23 billion to put some distance between Terra and eighth-placed Polkadot, which has a market capital of $21 billion.

LUNA/USD trading chart over the weekend

Market sentiment and on-chain signals lean in favor of the price of LUNA rising further. Considering LUNA's path forward doesn't present any significant challenge for bulls, the token is well-positioned to touch $60 soon if it can hold onto the momentum.

To learn more about this token visit our Investing in Terra LUNA guide.

Sam is a financial content specialist with a keen interest in the blockchain space. He has worked with several firms and media outlets in the Finance and Cybersecurity fields.